July 23, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

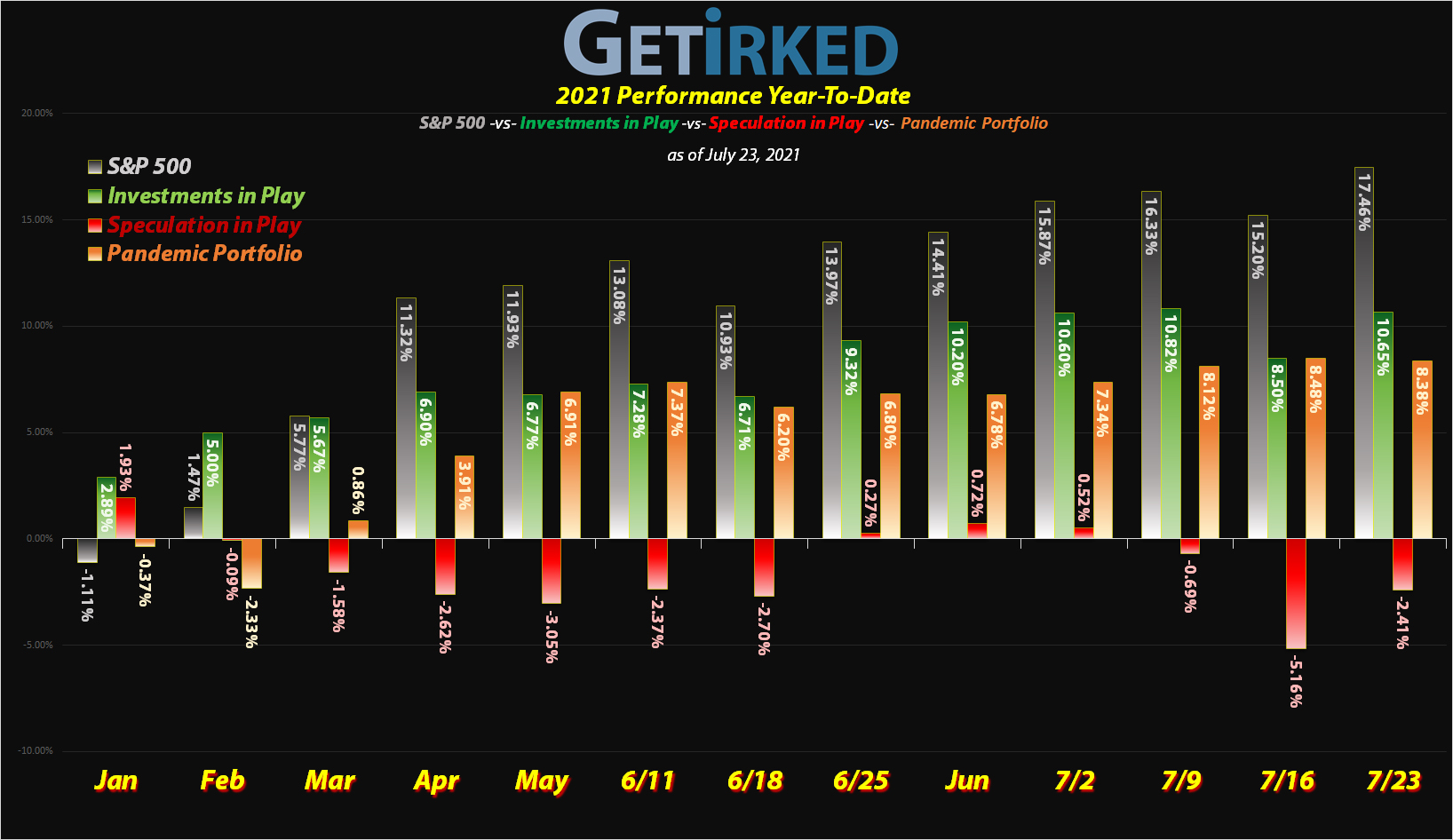

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Draft Kings (DKNG)

After announcing its foray into the newest crypto hotness, Nonfungible Tokens (NFTs) and the expected increase in betting on the upcoming summer Olympics, Draft Kings popped +12.65% to earn itself the spot of the Week’s Biggest Winner.

Fabled Co. (FBSGF)

New foray in the portfolio, Fabled Silver-Gold Corporation (FBSGF), a penny stock and a play on commodities, dropped -3.85% this week to earn its first recognition as the Week’s Biggest Loser. Given that it dropped and bounced more than 50% in one minute of trading on Friday, I’d say a -3.85% drop for the week is child’s play for this volatile monstrosity.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+735.83%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Yeti (YETI)

+507.31%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Carnival Cruise (CCL)

+410.99%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

AMD (AMD)

+318.86%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $22.00

Virgin Galactic (SPCE)

+308.79%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$56.17)*

Airlines ETF (JETS)

+233.07%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $9.87

Tradeweb Mkts (TW)

+185.13%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($128.08)*

Chevron (CVX)

+145.31%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

General Electric (GE)

+81.22%*

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: -($1.00)*

Grow Gen. (GRWG)

+47.16%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $27.12

Uranium ETF (URA)

+20.32%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $16.11

Fabled Co. (FBSGF)

+15.83%

1st Buy: 7/19/2021 @ $0.1036

Current Per-Share: $0.1036

Can. Palladium (DCNNF)

+4.20%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.1000

DraftKings (DKNG)

-4.21%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $51.50

Palantir (PLTR)

-10.68%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.42

Wendy’s (WEN)

-14.21%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $26.60

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCLWhat is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Canadian Palladium (DCNNF): *New Position*

This week, I decided to enter a decidedly super-speculative sector – penny stock commodities. After doing some significant research, I found three companies, all commodity stocks with share prices under $1, and decided to split a single position among the three.

The three stocks are Canadian Palladium Resources Inc. (DCNNF), Fabled Silver Gold Corp (FBSGF), and Golden Minerals Company (AUMN). I must emphasize exactly how stupidly speculative these three stocks are – bad news could, quite literally, zero out the stocks overnight; I’m viewing them as lottery tickets and only attributing the amount of money I’d be willing to lose on the lottery as such.

The first of the three to hit my price target was Canadian Palladium (DCNNF) on Monday, with an order filling at $0.1000 (yes, these stocks price out to ten-thousandth of a penny). From here, my next price target to add more is $0.0800, 20% lower than here.

DCNNF closed the week at $0.1042, up +4.20% from where I opened Monday.

Fabled Silver Gold Corp (FBSGF): *New Position*

As I mentioned above, Fabled Silver Gold Corp (FBSGF) represents a jump into the crazy-speculative penny stock commodity sector along with Canadian Palladium (DCNNF) and, eventually if it hits my price target, Golden Minerals Company (AUMN).

FBSGF triggered a buy order with extremely strange price action on Friday with my order filling at $0.1036. Despite FBSGF going on to the finish the day at $0.1200, the charts show that it dropped precariously to $0.0765 suddenly in ONE minute before bouncing +56.86% the next minute!

Now, strange things regularly happen in the penny stocks, however, I had a second limit order at $0.0766 which did not fill, so I’m chalking this one up to a system glitch at the exchange. If it was something more nefarious, we’ll find out next week, eh?

FBSGF closed the week at $0.1200, up +15.83% from where I opened Friday.

Uranium ETF (URA): Added to Position

The Uranium ETF (URA) sold off on Monday along with the rest of the markets, triggering a buy order I had in place which filled at $19.00. The order locks in a -16.34% discount on shares I sold on June 1 for $22.71 and raises my per-share cost to $16.11, -10.35% below my initial 17.97 purchase price.

Since I think this commodities selloff may have legs, my next buy target for URA is at $14.58, slightly above a past low. I have no current sell orders at the given time.

URA closed the week at $19.36, up +1.89% from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.