March 26, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

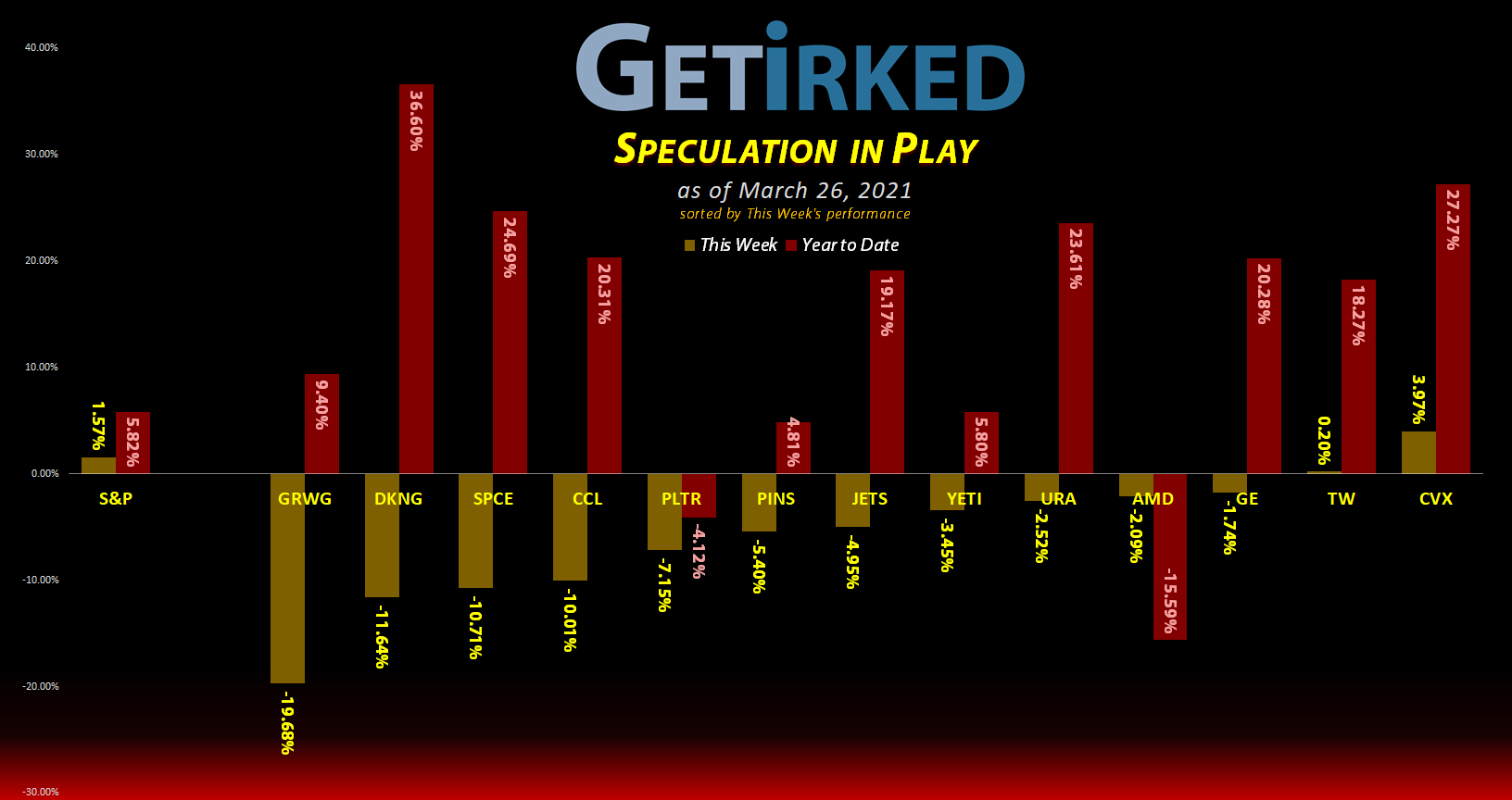

The Week’s Biggest Winner & Loser

Chevron (CVX)

When high-flying growth stocks and speculative names see a market rotation, it becomes very obvious in this portfolio as Chevron (CVX), an oil company, brought home the Week’s Biggest Winner with a relatively minor +3.97% gain.

Grow Generation (GRWG)

Grow Generation (GRWG), the picks-and-shovels play on the cannabis sector, did anything but grow this week, dropping -19.68% and earnings itself the spot of the Week’s Biggest Loser.

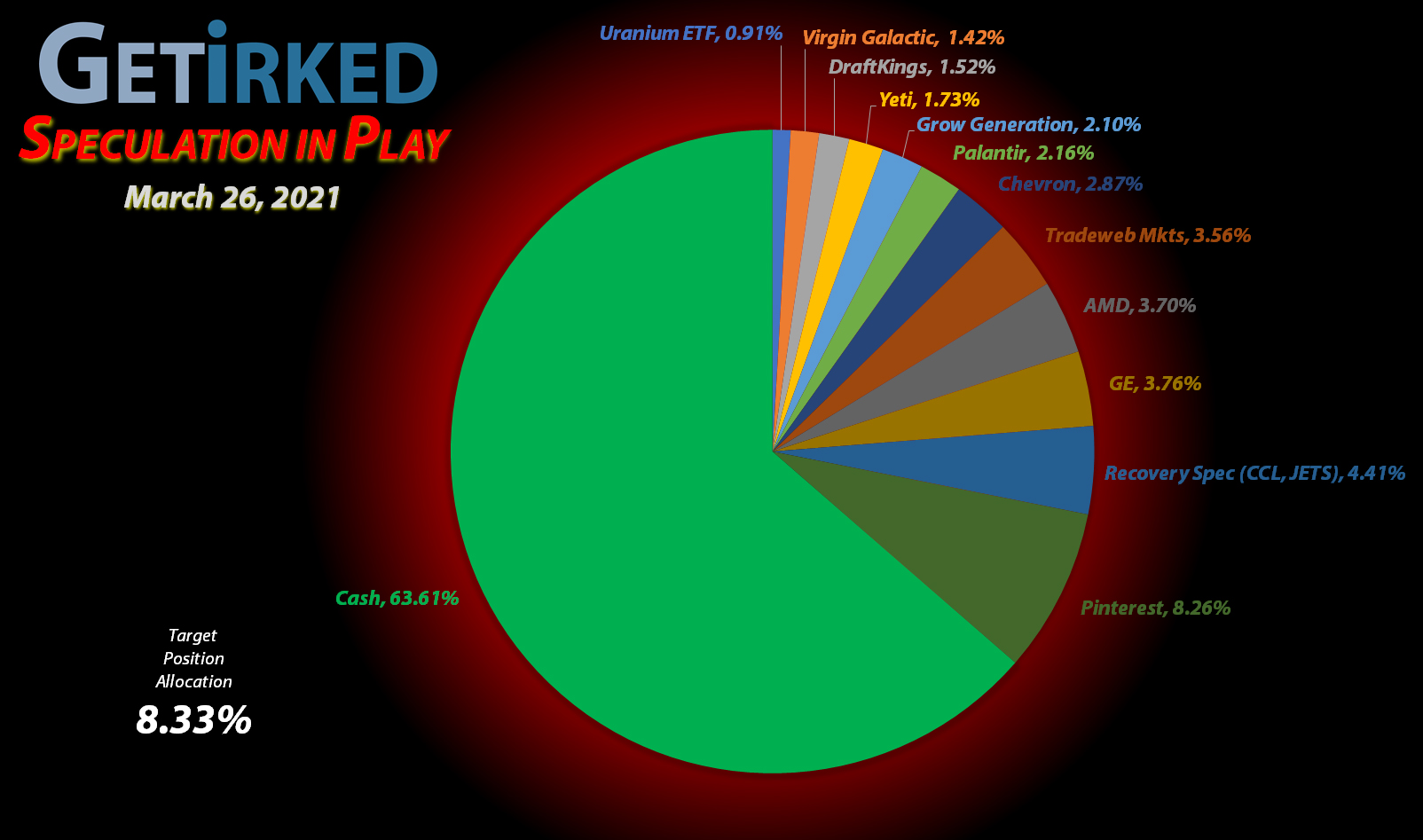

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+683.67%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Airlines ETF (JETS)

+548.18%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

Carnival Cruise (CCL)

+506.40%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

Yeti (YETI)

+454.56%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

AMD (AMD)

+429.85%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$6.69)*

Virgin Galactic (SPCE)

+234.21%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$35.45)*

Tradeweb Mkts (TW)

+165.01%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.18)*

Chevron (CVX)

+156.04%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

Grow Gen. (GRWG)

+99.46%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $22.06

General Electric (GE)

+82.82%*

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: -($1.01)*

DraftKings (DKNG)

+20.07%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $52.97

Uranium ETF (URA)

+5.45%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.97

Palantir (PLTR)

-15.43%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $26.70

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCL

What is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Why Patience is Priority #1 in Speculation

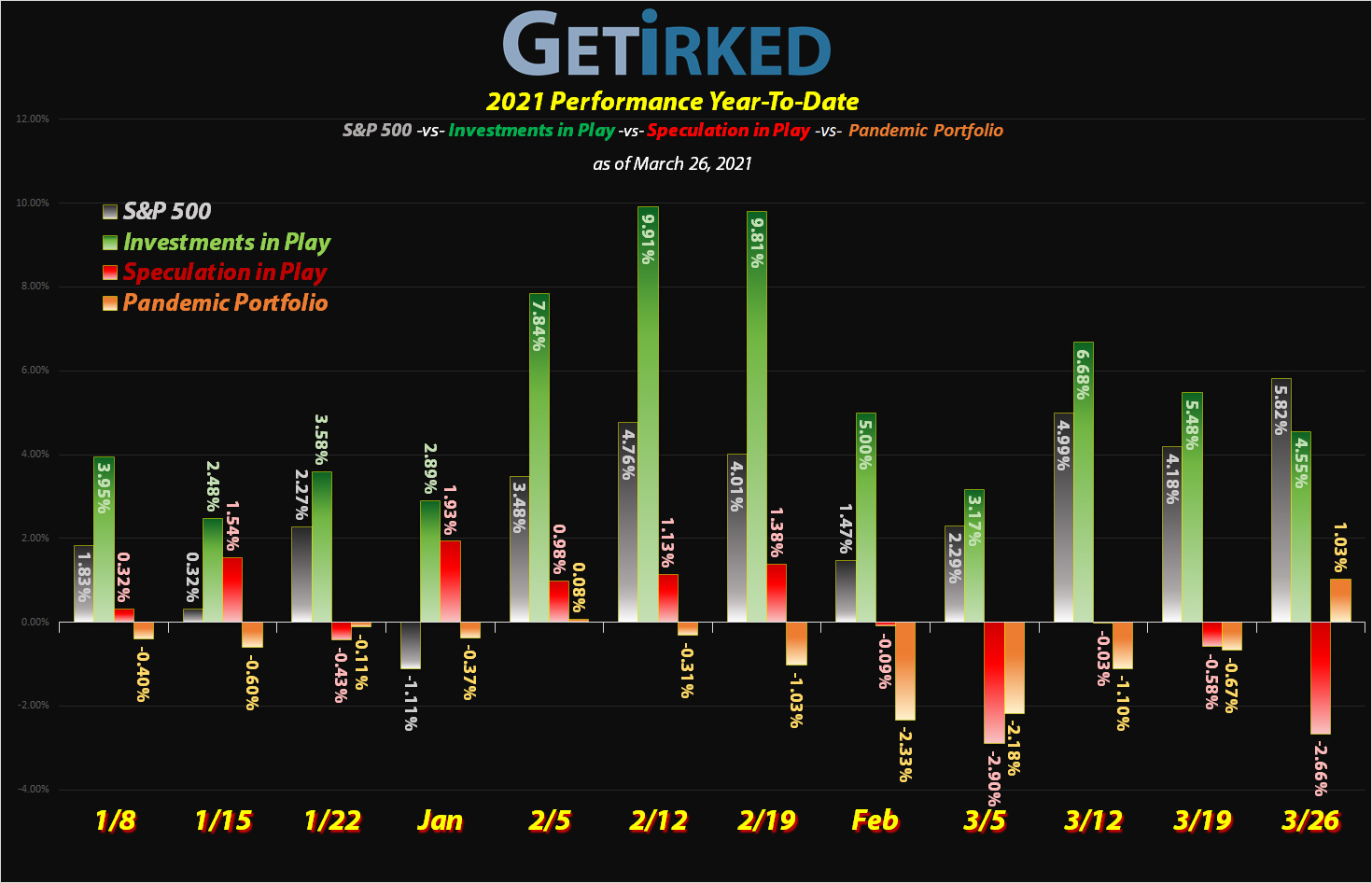

Once again, I made no moves this week.

Even with all of the market rotation and the majority of the Speculation in Play portfolio taking it on the chin for the past several weeks, I sat on my hands.

Why?

Because there weren’t any moves to make. Even with the positions seeing their stock prices wither, they still aren’t sold off to the point that adding to them makes sense to me.

Whether I’m speculating or investing, patience is the top priority. Warren Buffett, the famous investor and founder of Berkshire-Hathaway (BRK), has a saying about investing and speculating, “Investing isn’t baseball – there are no ‘called strikes’ in this game; just keep your bat on the shoulder until the pitch is perfect.”

Over the years that I’ve been running this dedicated Speculation in Play portfolio, I’ve learned that I have the tendency to be early. I’ll jump in and add to a position after a selloff only to have the position get cut in half once more.

While I do intend to be aggressive in 2021 with this portfolio, it’s also important to know levels. The market’s rotating out of the majority of the names in this portfolio, and the pain is not overwhelming enough to the shareholders of these high-flying stocks.

There’s more pain ahead, and when it happens, I’ll have my bat at the ready.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.