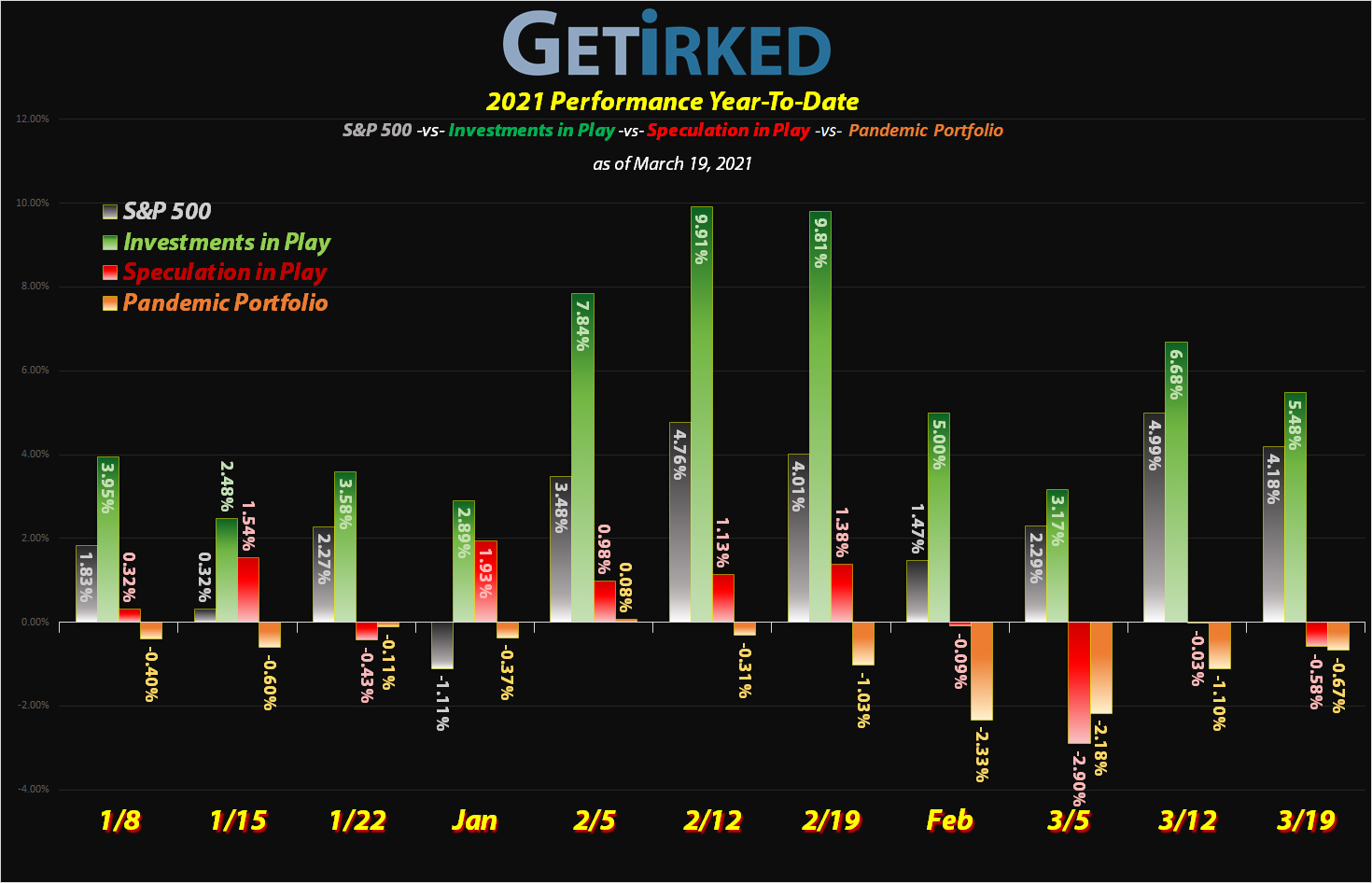

March 19, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

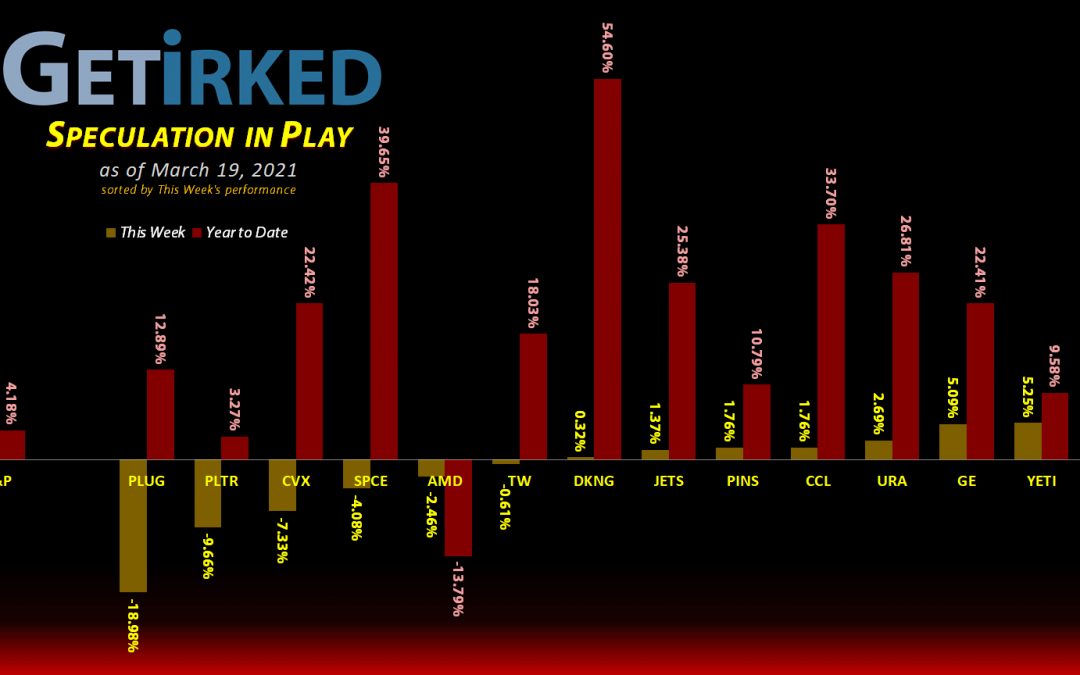

The Week’s Biggest Winner & Loser

Grow Generation (GROW)

As the potential for legalized recreational use of marijuana becomes more real, Grow Generation (GROW) saw a growth spurt with the rest of the cannabis sector this week, jumping +11.91% and winning the spot of the Week’s Biggest Winner.

Plug Power (PLUG)

Plug Power (PLUG) was unplugged when it reported financial irregularities in earnings for 2018, 2019 and a few quarters in 2020. The stock fizzled -18.98%, easily earning itself the spot of the Week’s Biggest Loser (and getting kicked out of the portfolio – see below).

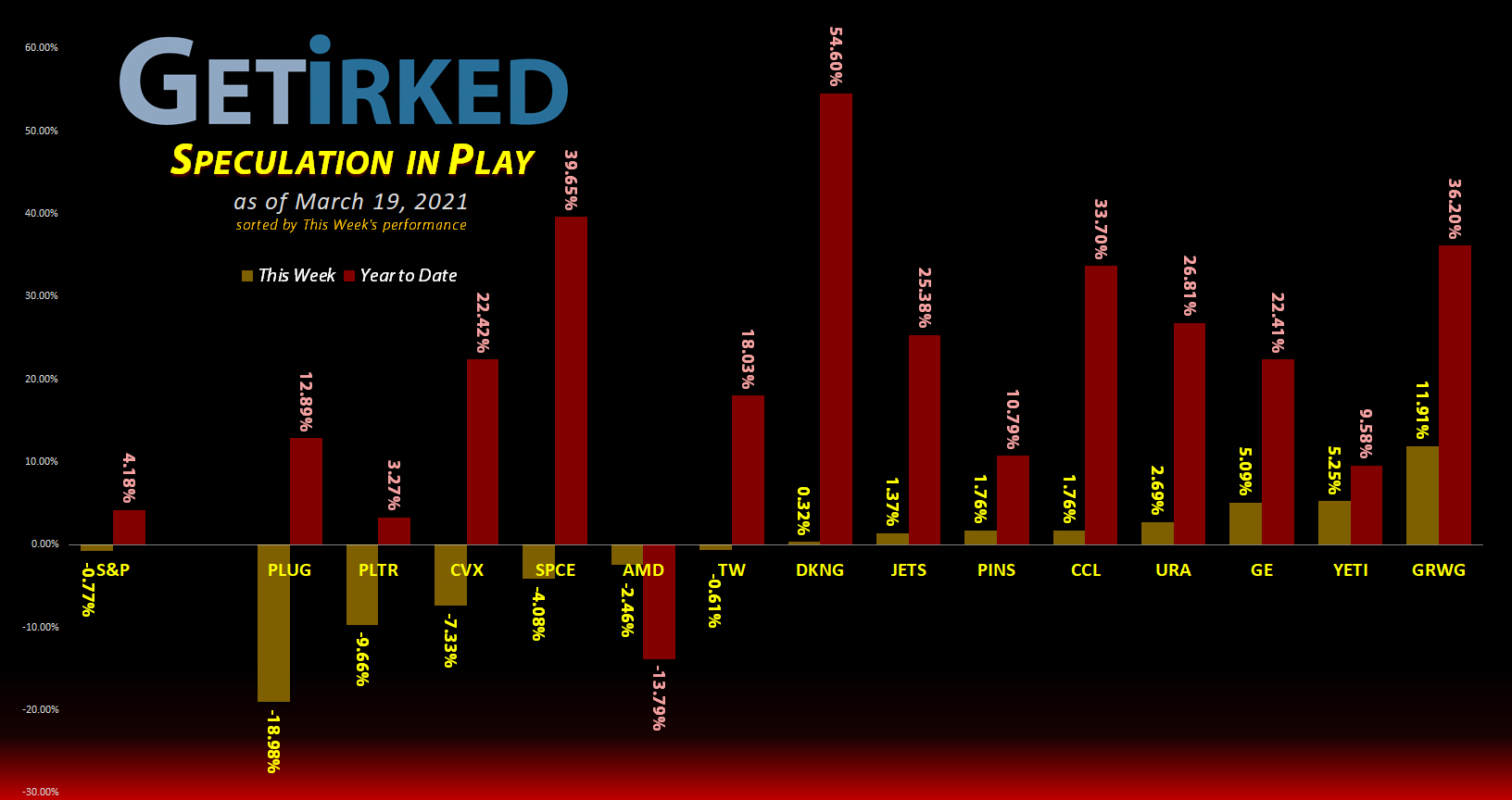

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+709.89%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Airlines ETF (JETS)

+576.75%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

Carnival Cruise (CCL)

+573.88%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

Yeti (YETI)

+460.05%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

AMD (AMD)

+438.28%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$6.69)*

Virgin Galactic (SPCE)

+246.99%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$35.45)*

Tradeweb Mkts (TW)

+164.76%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.18)*

Chevron (CVX)

+150.10%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

Grow Gen. (GRWG)

+148.32%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $22.06

General Electric (GE)

+84.18%*

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: -($1.01)*

DraftKings (DKNG)

+35.89%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $52.97

Uranium ETF (URA)

+8.18%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.97

Plug Power (PLUG)

0.00%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $0.00

Palantir (PLTR)

-8.91%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $26.70

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

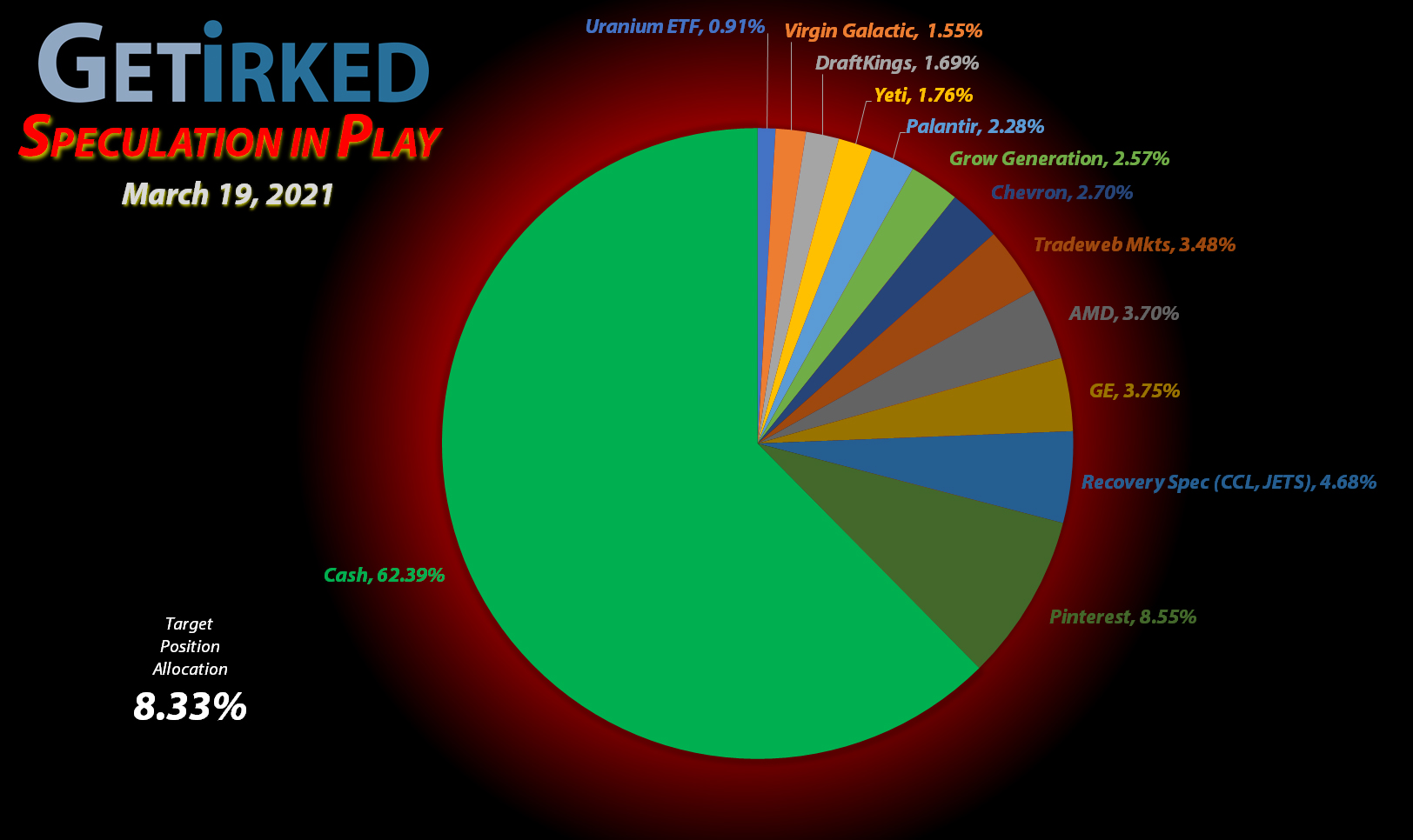

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCLWhat is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Plug Power (PLUG): *Closed – Break-Even*

On Tuesday night, Plug Power (PLUG) announced that it found accounting errors in its results for 2018, 2019, and the first three quarters of 2020 resulting in the stock’s price plunging on Wednesday.

Jim Cramer offers a hard rule: “Financial irregularities equals sell.” Since there’s no way of knowing how this could settle out and there’s plenty of room to the downside following PLUG’s 1,400% run over the past year, that rule is one I follow.

So, on Wednesday, with the stock slightly below my per-share cost, I decided I’d give it a day to try to reach break-even and placed a limit order to sell the entire position if the price reach $37.75, my per-share cost.

In the afternoon, the stock bounced and triggered my sell order which filled. PLUG’s been a disappointing story for me since I first bought in at $14.14 in October 2020. I sold half my shares after they doubled three weeks later at $28.56 and then the stock rocketed to $70+.

Given its story, I felt safe getting back in, buying at $62.63 on January 29, 2021 and again at $50.90 on February 22, but it turns out I was far too eager as PLUG plummeted below my then $37.75 price to hit nearly $30 during the interest rate scare a few weeks ago.

Combine its volatility with this financial news, and I count myself lucky to get out with no loss, even though I had significant profits at one point.

PLUG closed the week at $38.28, up +1.40% from where I closed Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.