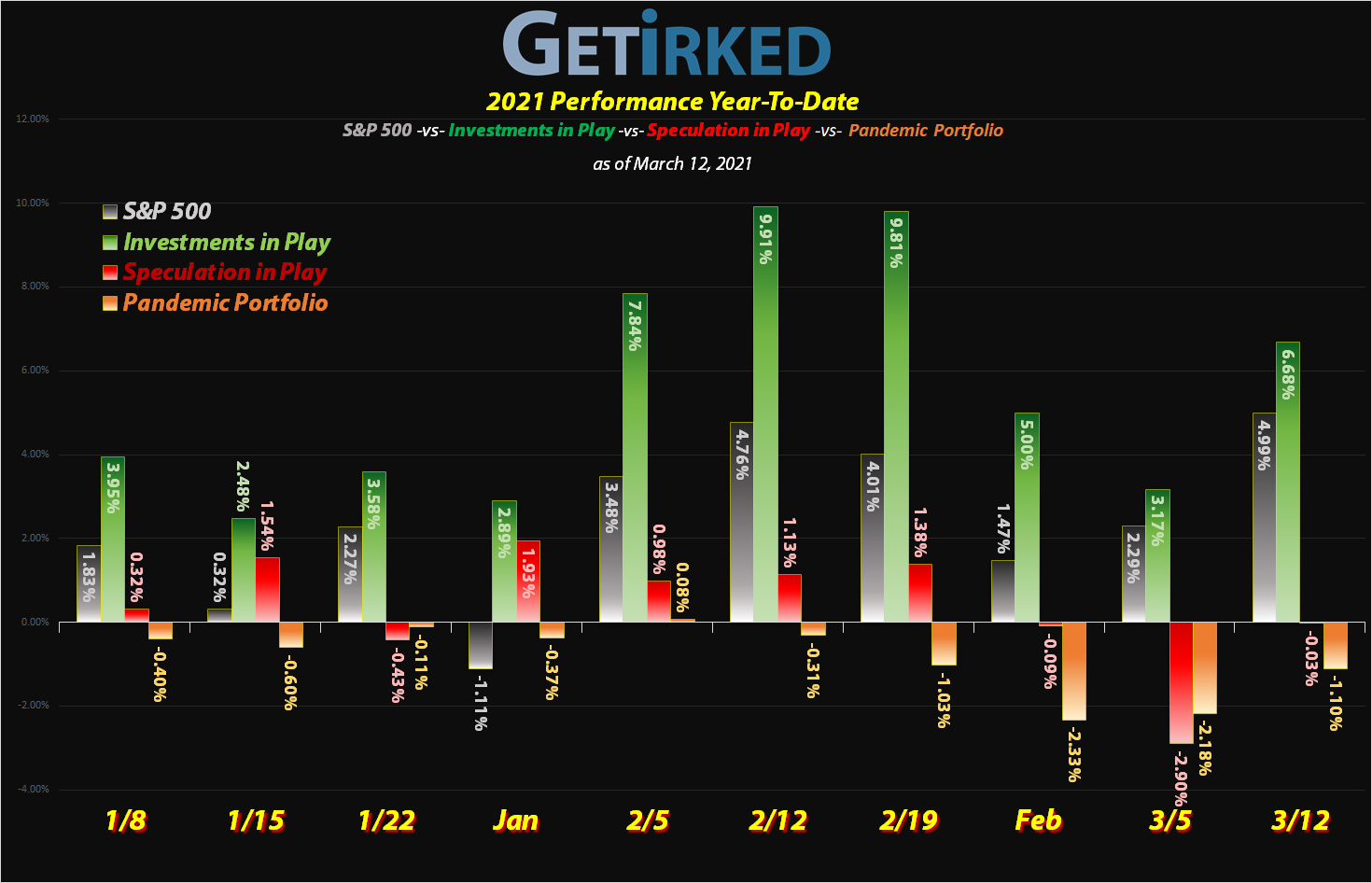

March 12, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

After a pretty rapid re-entry last week, Virgin Galactic (SPCE) was able to turn it around and re-launch this week, earning +26.60% and locking in its spot as the Week’s Biggest Winner.

General Electric (GE)

Despite good news about General Electric (GE) divulging some of its assets to pay down its debt, GE dropped -7.50% this week. Many analysts believe investors aren’t happy with GE’s Board of Directors announcing a reverse 8:1 stock split which would effectively raise the stock’s share price to more than $100 but also divide all exist holdings by 8 (i.e. shareholders will hold 1 share for every 8 they held before the reverse split). GE definitely earned itself the Week’s Biggest Loser spot.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+701.50%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Airlines ETF (JETS)

+568.94%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

Carnival Cruise (CCL)

+562.25%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

Yeti (YETI)

+452.13%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

AMD (AMD)

+448.45%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$6.69)*

Virgin Galactic (SPCE)

+252.07%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$35.45)*

Tradeweb Mkts (TW)

+165.39%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.20)*

Chevron (CVX)

+161.96%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

Grow Gen. (GRWG)

+121.89%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $22.06

General Electric (GE)

+80.39%*

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: -($1.01)*

DraftKings (DKNG)

+35.45%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $52.97

Plug Power (PLUG)

+25.17%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $37.75

Uranium ETF (URA)

+5.34%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.97

Palantir (PLTR)

+0.82%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $26.70

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCLWhat is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Strategy Update: Getting More Aggressive…

It was a weird week as I made a few purchases in my typically more conservative Investments in Play portfolio, but made absolutely no moves in my Speculation in Play portfolio.

Now, don’t get me wrong, I always have buy and sell targets for all of my positions, but even with the Tech Wreck selloff, it became readily apparent to me that I was being far too bearish with almost all of my speculative positions.

While I typically don’t post my price targets for my speculative plays for two reasons 1) they’re incredibly volatile and will likely lose money, and 2) I typically change my targets so quickly that they’ll become outdated.

That being said, readers have reached out for an update so here we go, these are the next buy price target for all of my positions (keep in mind – these are the next buy price targets, not the last… I always have powder on the side to add at much, much lower levels):

- AMD (AMD): $67.83 (down -16.311% from current levels)

- Carnival Cruiselines (CCL): $18.56 (down -34.786% from current levels)

- Chevron (CVX): $66.65 (down -40.256% from current levels)

- Draft Kings (DKNG): $55.03 (down -23.303% from current levels)

- General Electric (GE): $5.56 (down -55.803% from current levels)

- Airlines ETF (JETS): $19.60 (down -29.191% from current levels)

- Pinterest (PINS): $42.73 (down -40.446% from current levels)

- Palantir (PLTR): $21.20 (down -21.248% from current levels)

- Plug Power (PLUG): $33.55 (down -28.995% from current levels)

- Virgin Galactic (SPCE): $17.65 (down -48.915% from current levels)

- Tradeweb Markets (TW): $46.70 (down -37.028% from current levels)

- Uranium ETF (URA): $17.31 (down -8.558% from current levels)

- Yeti (YETI): $43.46 (down -39.038% from current levels)

Now, looking over those price targets, it might seem like I’m still not aggressive enough, however, given the extreme volatility of the market and the edginess of traders, most of these positions were within these targets just last week.

Crazy.

At any rate, if you want to learn more, check out my article How to Make a Trading Plan which discusses strategies and techniques to ensure you’re ready both on the way up and the way down.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.