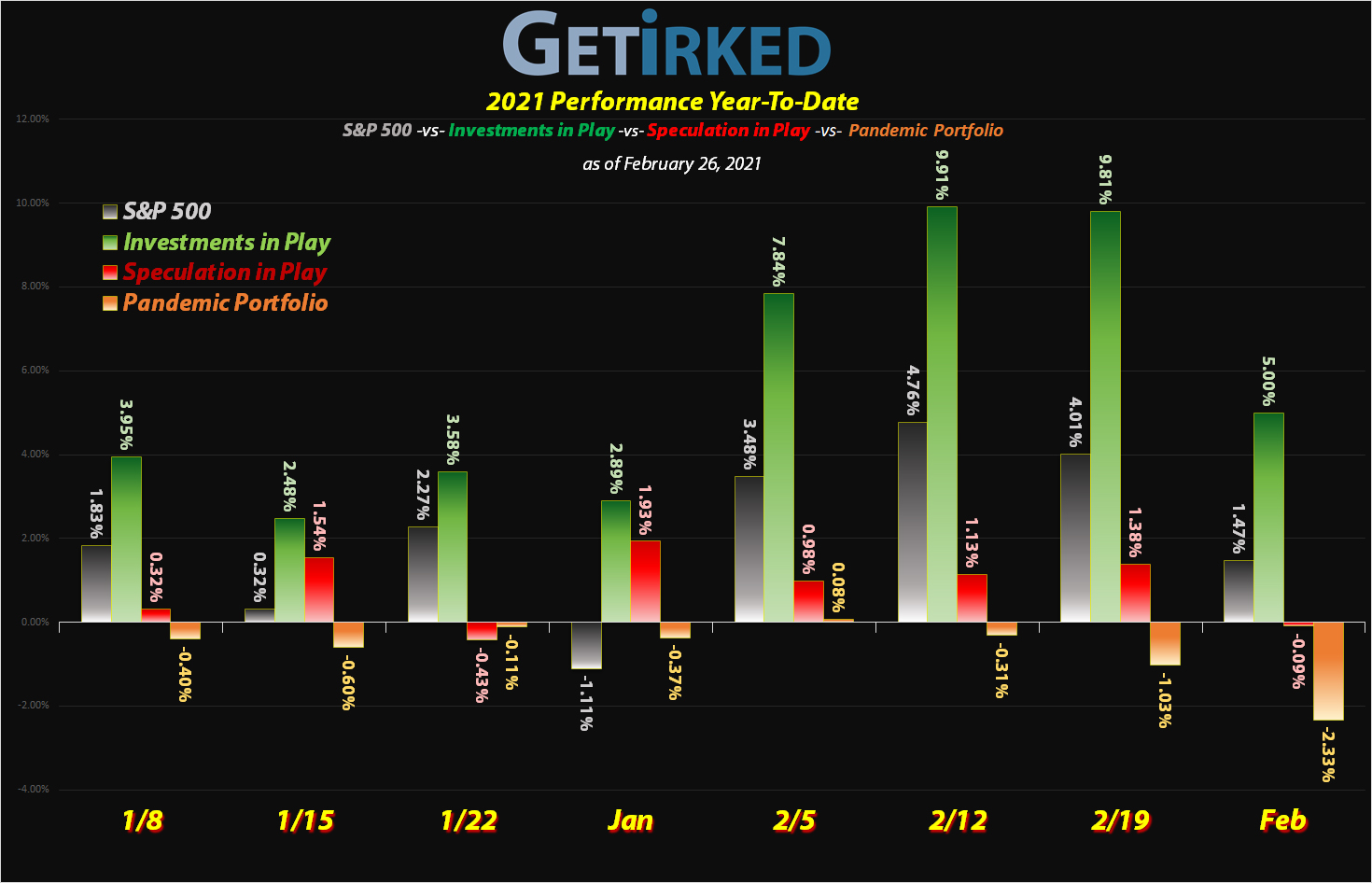

February 26, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

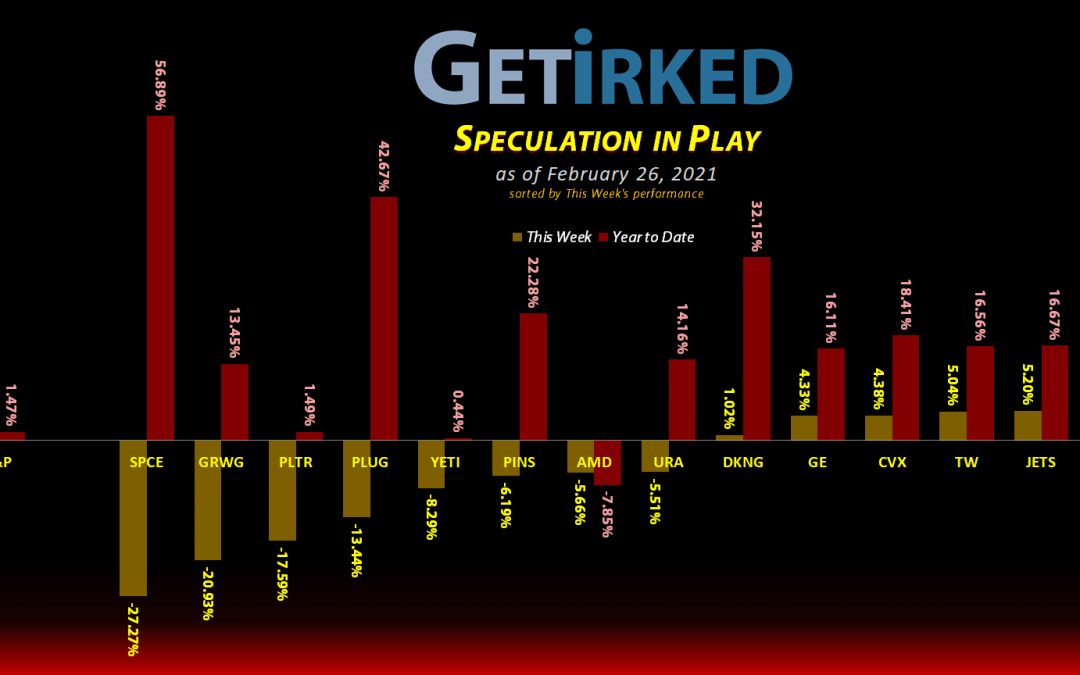

The Week’s Biggest Winner & Loser

Carnival Cruise Lines (CCL)

Cruise lines be cruisin’, am I right? The reopening trade continues to dominate, even in a week where the market flipped out about interest rates with CCL locking in a very solid +8.78% gain and earning itself the spot of the Week’s Biggest Winner.

Virgin Galactic (SPCE)

A one-two combo smackdown of disappointing earnings and a spaceflight test delayed to May positively crashed Virgin Galactic (SPCE) this week, dropping -27.27% and definitely parachuting in as the Week’s Biggest Loser.

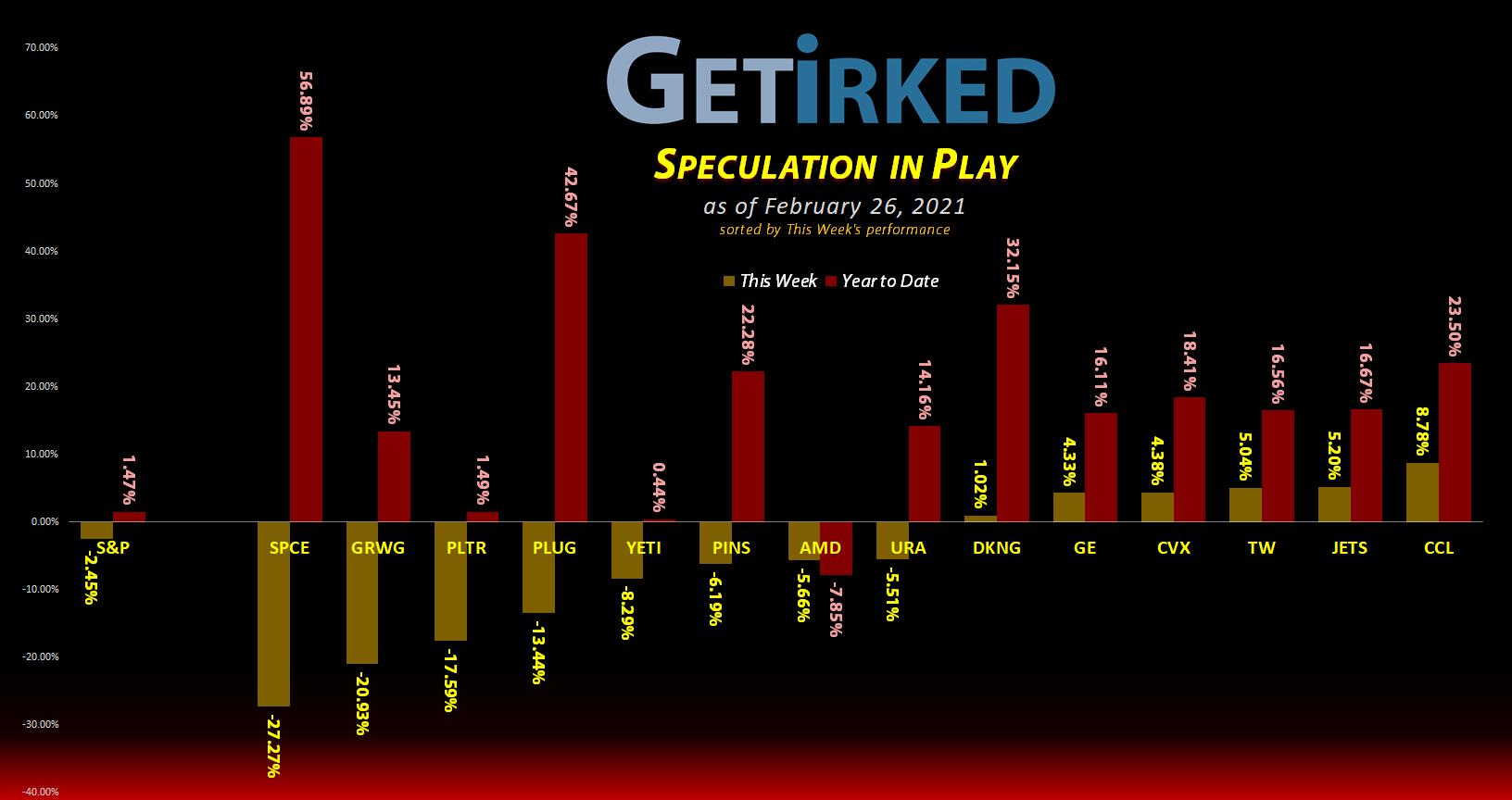

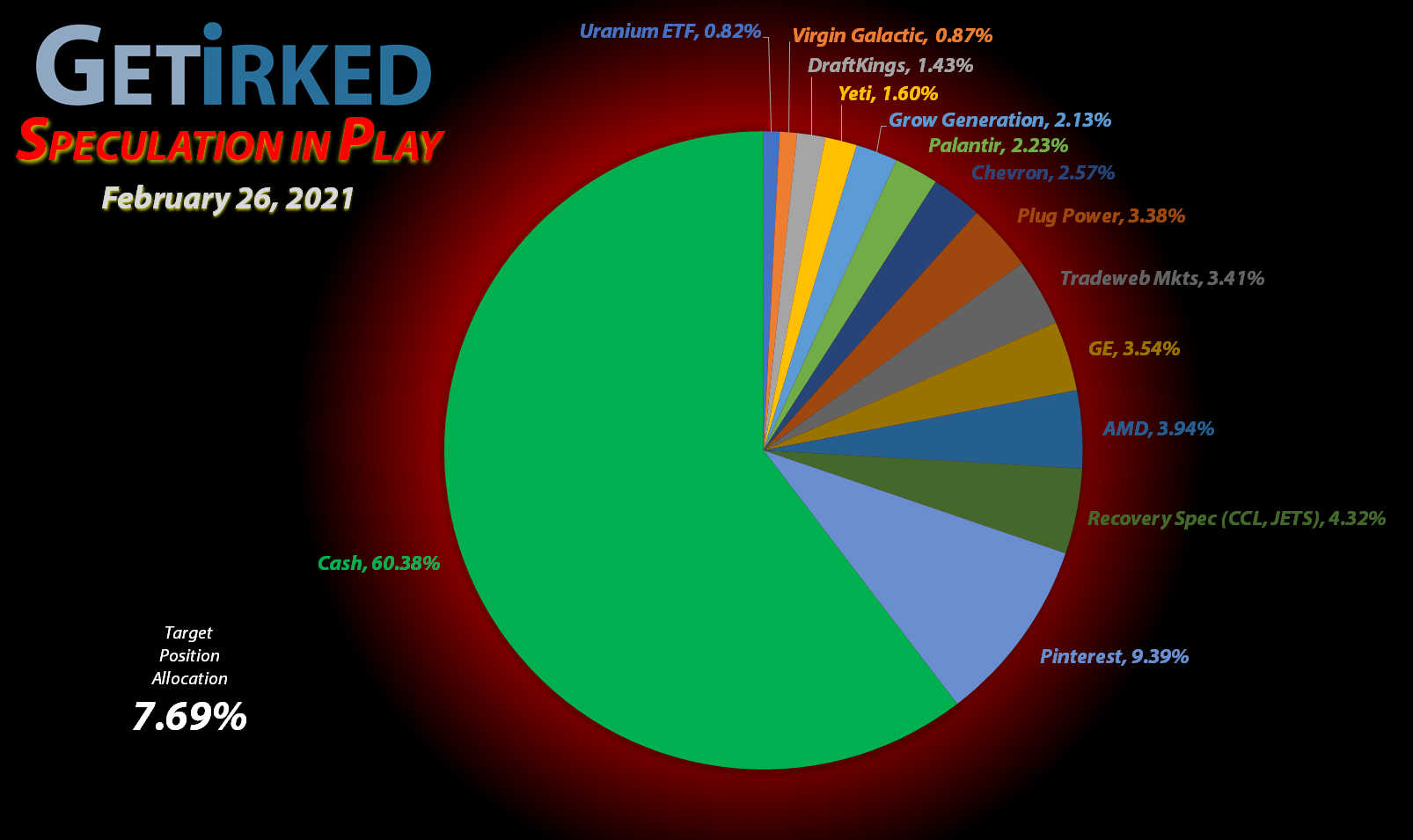

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+760.25%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Airlines ETF (JETS)

+536.67%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

Carnival Cruise (CCL)

+522.45%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

AMD (AMD)

+466.14%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$6.69)*

Yeti (YETI)

+446.79%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Virgin Galactic (SPCE)

+247.08%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$100.00)*

Tradeweb Mkts (TW)

+163.07%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.20)*

Chevron (CVX)

+143.55%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

General Electric (GE)

+80.16%*

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: -($1.01)*

Grow Gen. (GRWG)

+80.16%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $22.06

Plug Power (PLUG)

+28.16%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $37.75

DraftKings (DKNG)

+16.16%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $52.97

Palantir (PLTR)

-10.49%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $26.70

Uranium ETF (URA)

-2.62%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.97

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCL

What is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

General Electric (GE): Profit-Taking

General Electric (GE) made a stab for a past high on Wednesday, triggering a sell order I had in place to remove the remaining capital and some profits from the position which filled at $13.21.

The sale locked in +115.85% in gains on shares I bought during the March 2020 selloff at an average price of $6.12 per share and gives the position a new per-share “cost” of -$1.01 per share (each share in the portfolio cost no capital and actually adds $1.01 in profits to the bottom line).

From here, I’m going to let the remainder of the position run – it’s the house’s money, and with GE in the middle of a long-stretching turnaround, who knows how high it may be able to go? After all, GE’s previous all-time high was in the $60s…

If GE drops back to the $5.50-$5.60 range, I’ll stock up, putting my newfound gains to work as well as some capital, too.

GE closed the week at $12.54, down -5.07% from where I sold Wednesday.

Global X Uranium ETF (URA): *New Position*

I know what you’re thinking – “Irk, have you gone full Doc Brown on us?! Are you building a time machine out of a Miata?!?!”

Hear me out…

In the current market conditions, all commodities – think fossil fuels, steel, copper, wood, and, yes, even uranium – are in a raging bull market. The argument for uranium, however, is even more intriguing based on the fact that the world’s going to need a lot more green energy if we want to get off fossil fuels, and, believe it or not, outside of the renewables, nuclear power is as green as it gets.

In fact, compared to all other sources of energy, fewer people have died from nuclear power plant accidents than any of the other sources, and that’s without a new plant having been built in 50 years.

Add to this thesis that new nuclear power plants are a very big part of President Joe Biden’s Green Energy plan, and you’ve got a hell of a story for uranium.

Why the URA ETF and not Cameco Corp (CCJ), Best-in-Breed in the space?

Uranium is notoriously volatile both as an atomic particle but also as an industry. While Cameco (CCJ) is the most successful refiner of uranium and is likely to see the biggest gains, I want to hedge my bets with the safe way to play the entire space, an Exchange Traded Fund (ETF): Global X Uranium ETF (URA).

While I was a little late to this party, the Global X Uranium ETF (URA) was as low as $6.95 last March, I decided to wait until URA pulled back from its $19.85 all-time high to open a position. That happened with an order that filled at $17.97 when URA dropped on Tuesday.

From here, my next price target to add more is $14.80 and I currently have no sell targets as we wait to see what happens in this space.

URA closed the week at $17.50, down -2.69% from where I opened it Tuesday.

Palantir Tech (PLT): Added to Position

Palantir Tech (PLT) sold off in a big with the rest of the technology sector this week, dropping through a buy order I had in place which filled at $25.00 on Tuesday, followed by another buy order which filled on Friday at $22.80.

The combined orders gave me an average $23.90 buying price and reduced the per-share cost for my position by -9.49% from $29.50 to $26.80.

From here, my next price target to add more is $18.20, slightly above a past point of support for the stock. Once again, I intend to hold this stock for a long time as I believe its prospects are excellent for the long-term… $45 is the sell target.

PLT closed the week at $23.90, spot-on at my average buy price.

Plug Power (PLUG): Added to Position

Plug Power (PLUG) continued to sell off this week, triggering a buy order I had in place at $50.90 on Monday before dropping under $50 a share. The purchase raised my per-share cost +21.07% from $31.18 to $37.75.

Unfortunately, PLUG lost out on the Wall Street Fashion Show, collapsing through the $40s and even below my new per-share cost at one point during the week.

From here, I’m going to be a bit more cautious, eyeing $26.75 as my next buy point as the $30 mark provided a lot of prior support. I’m also looking at taking profits around PLUG’s all-time high of $75.49 if it attempts to test it.

PLUG closed the week at $48.38, down -4.95% from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.