February 19, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

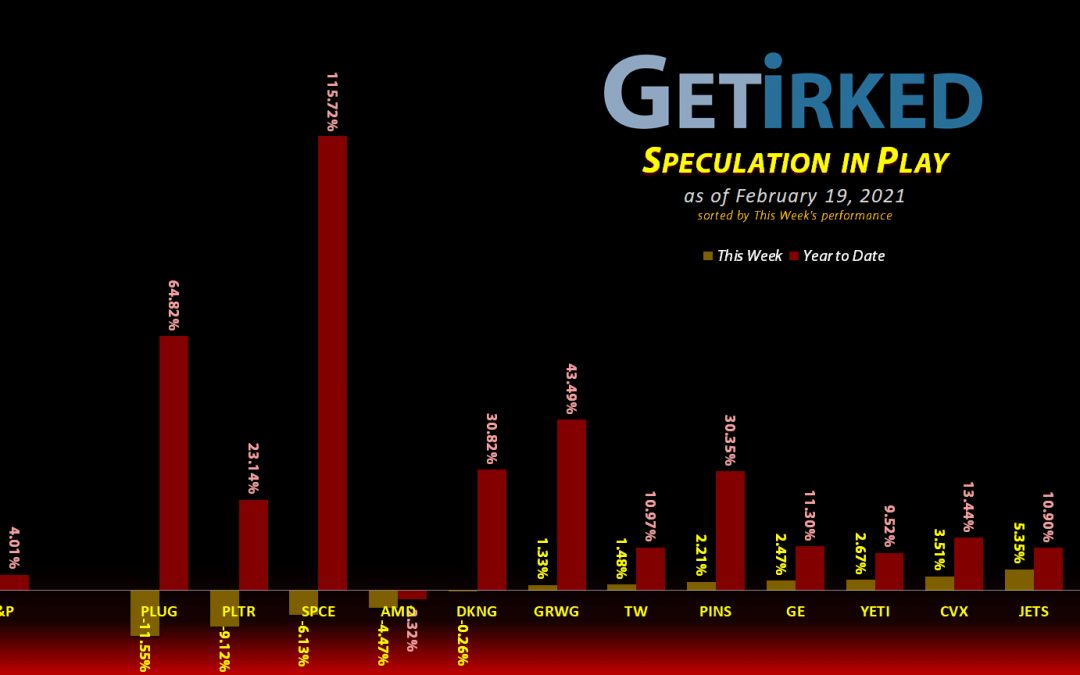

The Week’s Biggest Winner & Loser

Carnival Cruise Lines (CCL)

The reopening of the economy must be right around the corner because Carnival Cruise Lines (CCL) cruised +19.37% during a relatively flat week to earn itself the spot of the Week’s Biggest Winner.

Plug Power (PLUG)

Many investors must have pulled the plug and taken profits in hydrogen energy play Plug Power (PLUG) this week, as the stock suffered a -11.55% discharge, earning itself the Week’s Biggest Loser spot.

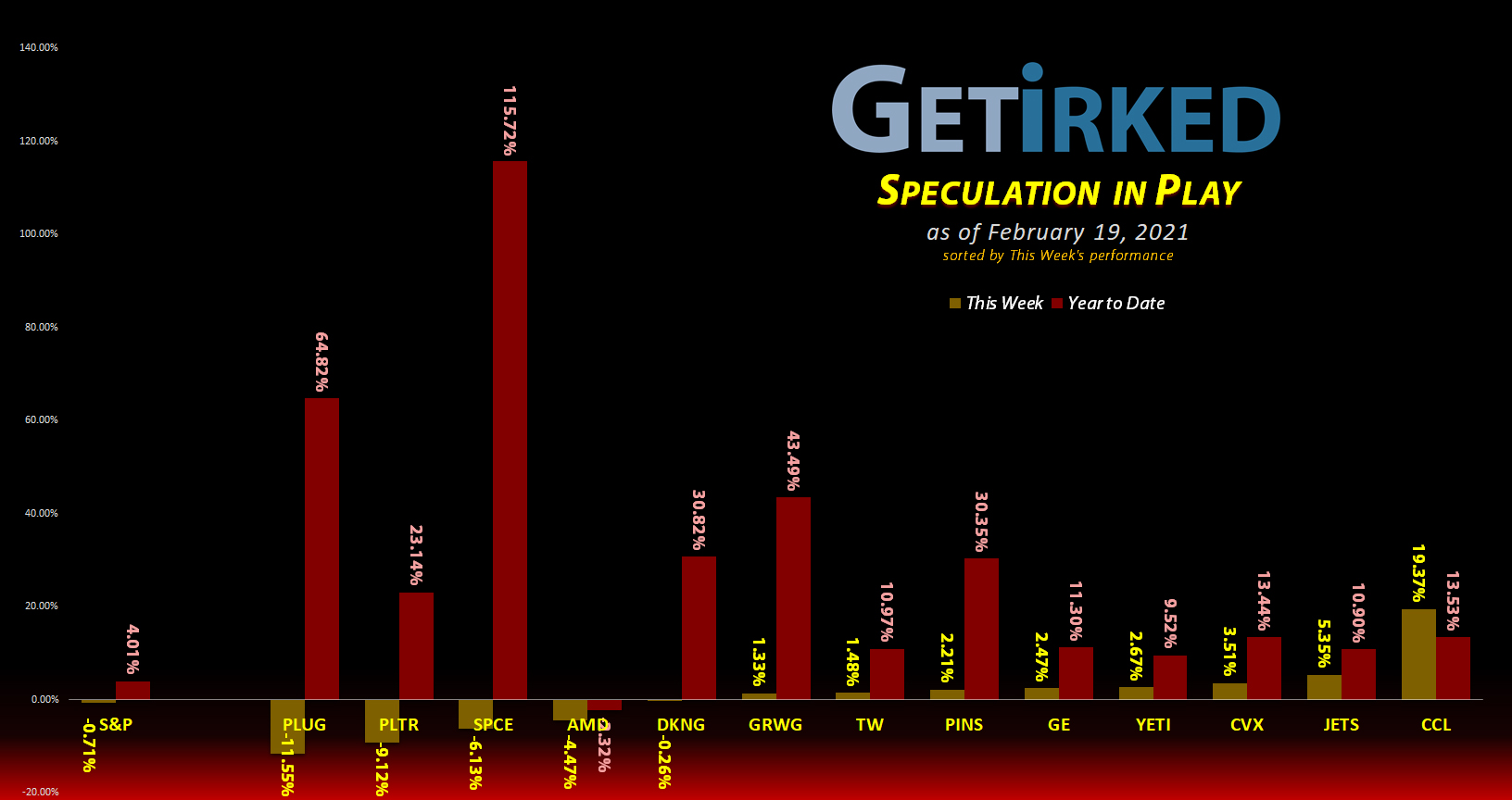

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+795.65%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Airlines ETF (JETS)

+510.15%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

AMD (AMD)

+492.05%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$6.69)*

Carnival Cruise (CCL)

+472.19%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

Yeti (YETI)

+459.97%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Virgin Galactic (SPCE)

+272.22%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$100.00)*

Grow Gen. (GRWG)

+161.60%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $22.06

Tradeweb Mkts (TW)

+157.14%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.20)*

General Electric (GE)

+137.59%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $5.06

Chevron (CVX)

+137.53%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

Plug Power (PLUG)

+79.28%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $31.18

DraftKings (DKNG)

+14.99%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $52.97

Palantir (PLTR)

-1.69%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $29.50

2/19 SPY Put Spreads

-100.00%

Cost: $5.9914

Current Value: $0.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCLWhat is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Palantir Tech (PLTR): Added to Position

Palantir Tech (PLTR) continued to demonstrate weakness following its disappointing earnings guidance and the deadline on pre-IPO investors’ lockup period looming and triggered a buy order on Wednesday that filled at $27.50.

The buy lowered my per-share cost -6.35% from $31.50 to $29.50. From here, my next buy target is $25.00 and I have no sell targets, yet, although PLTR’s all-time high in the mid-$40s is certainly tempting.

PLTR closed the week at $29.00, up +5.45% from where I added Wednesday.

Feb 19 370-360 Put Spreads: *Total Loss: -100%*

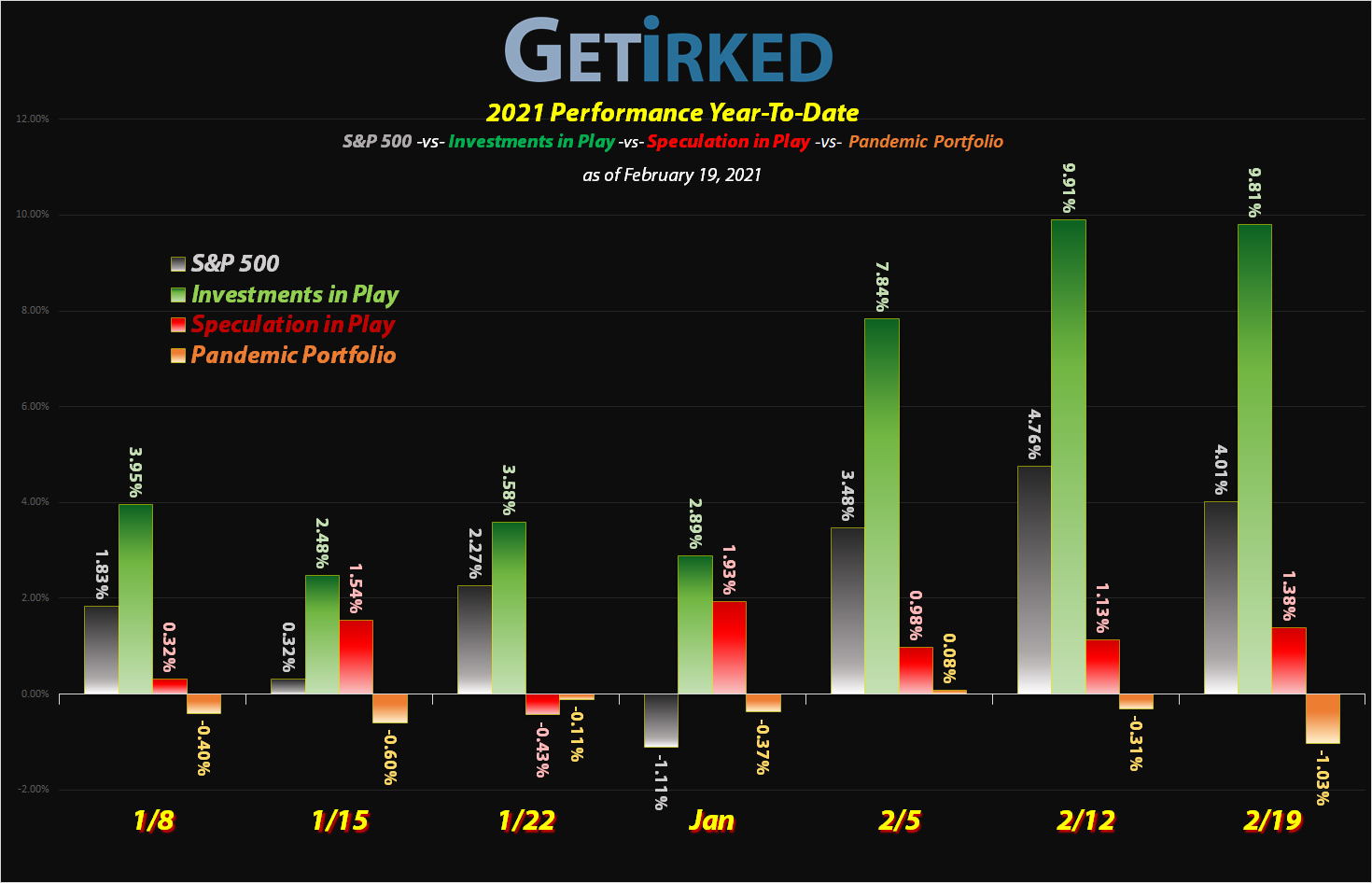

I finally gave in to defeat with the SPY Put Spreads I had been rolling over since I first opened the position at the beginning of November 2020, embracing an epic complete and total loss of -$5.9914 on each of the spreads.

The time decay of the spreads had been causing a dark cloud to form over the entire portfolio, detracting from the gains in positions this year while the put spreads slowly lost more value with each passing day.

Although I do believe what many analysts say – that the market is due for a pullback – I’m going to take a little time to lick my wounds and stick to my knitting of trading around stock positions rather than playing with options.

What’s the moral to this trade?

You can’t time the markets.

Despite many professionals pointing to the overbought conditions of the market, low interest rates combined with incoming stimulus and nowhere else to invest money means money seems to be pouring into the markets.

Do I believe we’re going to rally forever with no pullback?

Absolutely not, but my efforts to try and time the market cost my Speculation in Play portfolio to the tune of an astounding -13.76% from November to now, a true testament to how well the stock positions in this portfolio have performed seeing as the portfolio has somehow managed to stay green Year-to-Date.

YOWTCH!

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.