February 12, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

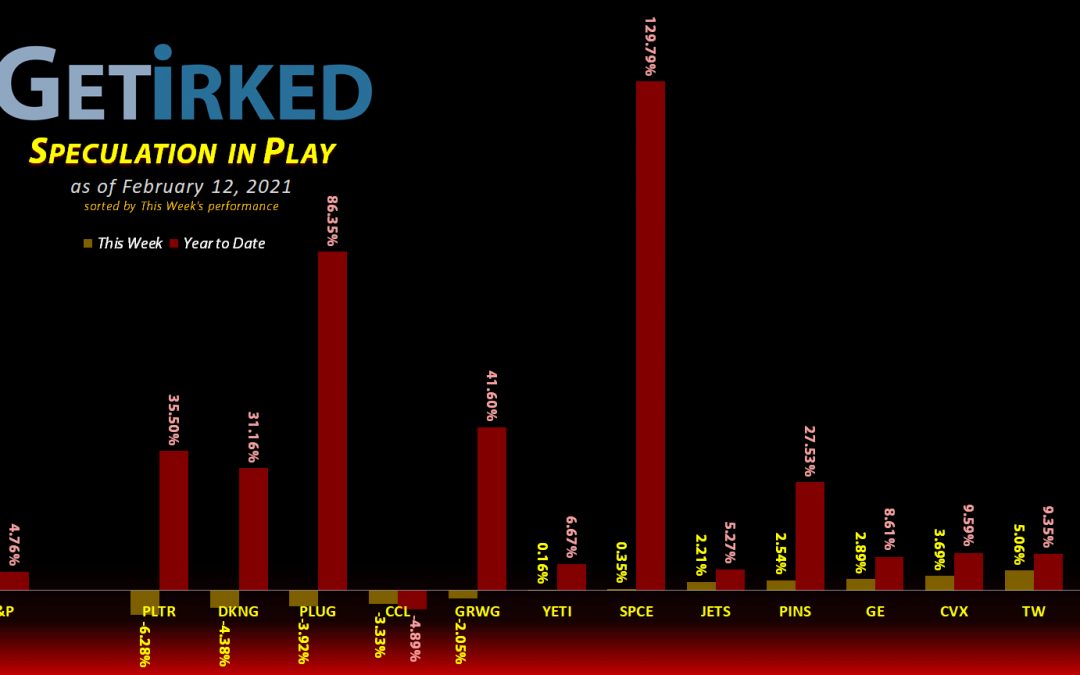

The Week’s Biggest Winner & Loser

AMD (AMD)

AMD (AMD) continues to impress and while the Xilinx (XLNX) acquisition is putting a drag on the stock, AMD still popped +6.68% to earn itself the spot of the Week’s Biggest Winner.

Palantir Tech (PLTR)

Palantir Tech (PLTR) is a new position in the portfolio this week, and its -6.28% pullback is exactly the reason why. After this high-flying relatively new IPO (launched in Oct 2020) skyrocketed to $45 a share, it’s been pulling back consistently and lost -6.28% this week to make its first appearance in the portfolio as the Week’s Biggest Loser.

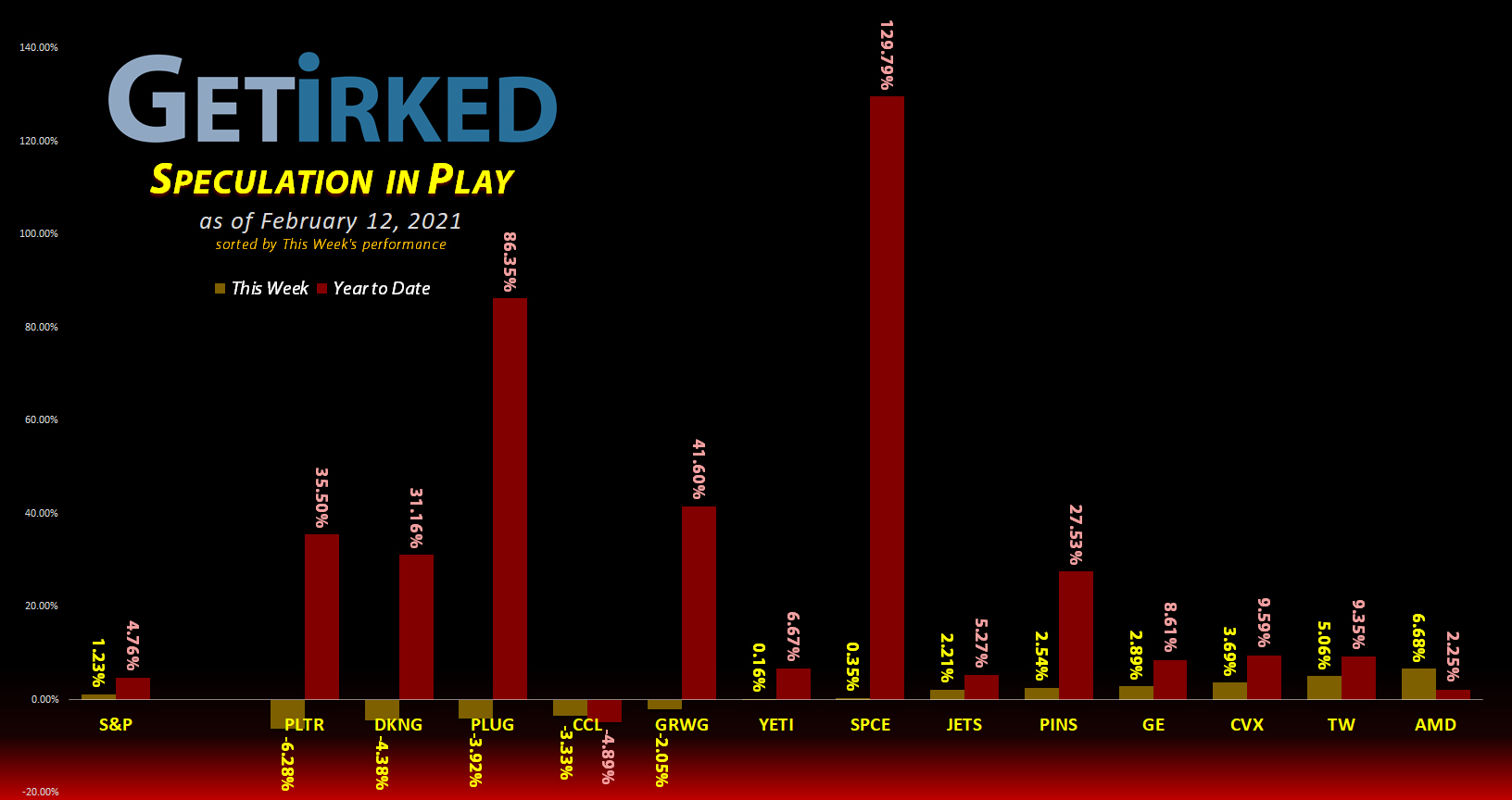

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+783.27%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

AMD (AMD)

+513.47%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$6.69)*

Airlines ETF (JETS)

+484.25%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

Yeti (YETI)

+455.84%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Carnival Cruise (CCL)

+379.35%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

Virgin Galactic (SPCE)

+278.23%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$100.00)*

Grow Gen. (GRWG)

+158.16%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $22.06

Tradeweb Mkts (TW)

+155.42%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.20)*

Chevron (CVX)

+132.87%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

General Electric (GE)

+131.86%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $5.06

Plug Power (PLUG)

+102.69%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $31.18

DraftKings (DKNG)

+15.29%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $52.97

Palantir (PLTR)

+1.30%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $31.50

2/19 SPY Put Spreads

-99.00%

Cost: $5.9914

Current Value: $0.06

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCLWhat is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

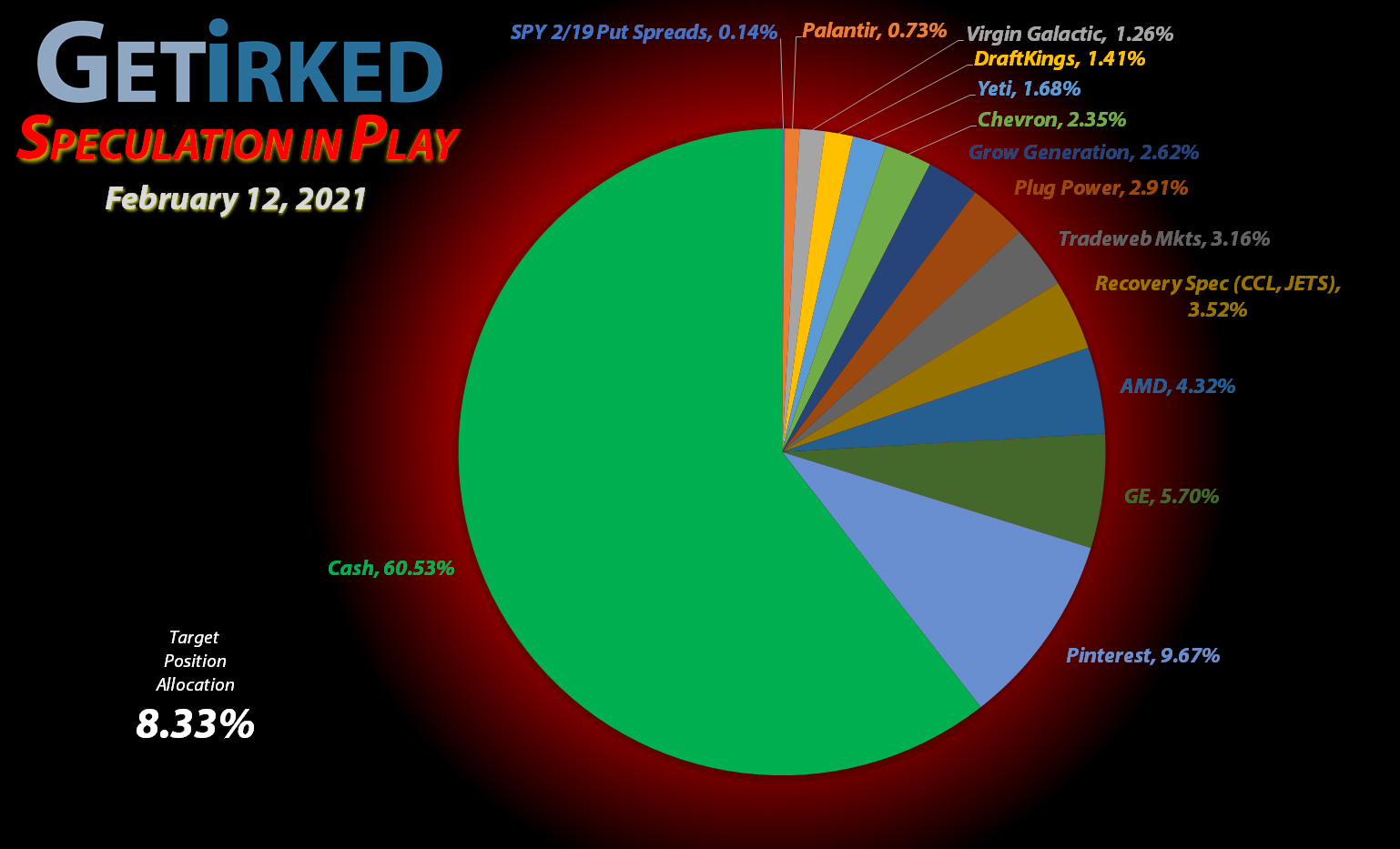

This Week’s Moves

Palantir Technologies (PLTR): *New Position*

You may have heard of Palantir Technologies (PLTR), the somewhat sketchy military intelligence data analysis company that builds and deploys software platforms to assist in counterterroism investigations and operations. Its artificial intelligence (AI) software is truly something to behold, and investors agreed as the stock rocketed 500% from its IPO price in October.

PLTR has been under significant selling pressure for some time now following its IPO near $9 a share last October and a rocketship move to a high of $45.00 in January of this year. I decided to open a small position at $31.50 on Friday, -30% off PLTR’s all-time highs.

From here, my next price target is around $26.00, near the start of the last big move made and nearly -20% lower from here. Of course, I have no sell targets at this time as I’m waiting for PLTR to develop more price discovery as we move forward.

PLTR closed the week at $31.91, up +1.30% from where I opened it Friday.

Tradeweb Markets (TW): Profit-Taking

When Tradeweb Markets (TW) made another stab at its all-time high on Thursday, it was time to take profits and pull my capital (and some additional profit) out of the position with an order that filled at $67.90, reducing my per-share “cost” to -$23.20 (meaning the remaining shares cost the portfolio nothing and, instead, add $23.20 each to the portfolio’s bottom line in addition to the share price).

The sale locked in +24.36% in profit on shares I bought for $54.60 in the middle of last summer on July 10, 2020. From here, my next buy target is $46.70, a past point of support, and I have no sell targets as I wait to see if TW will make for new all-time highs from here.

TW closed the week at $68.29, up +0.57% from where I sold Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.