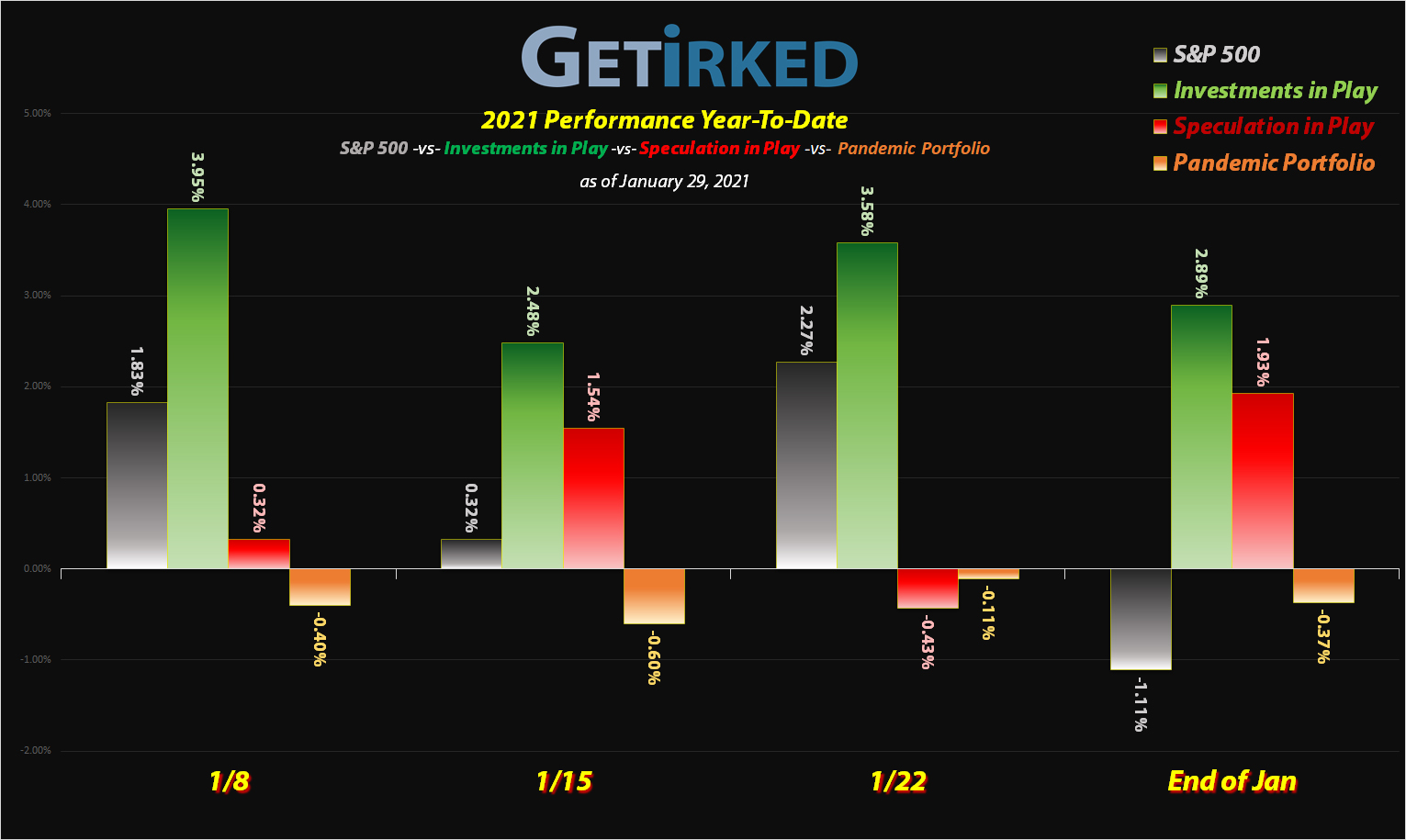

January 29, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

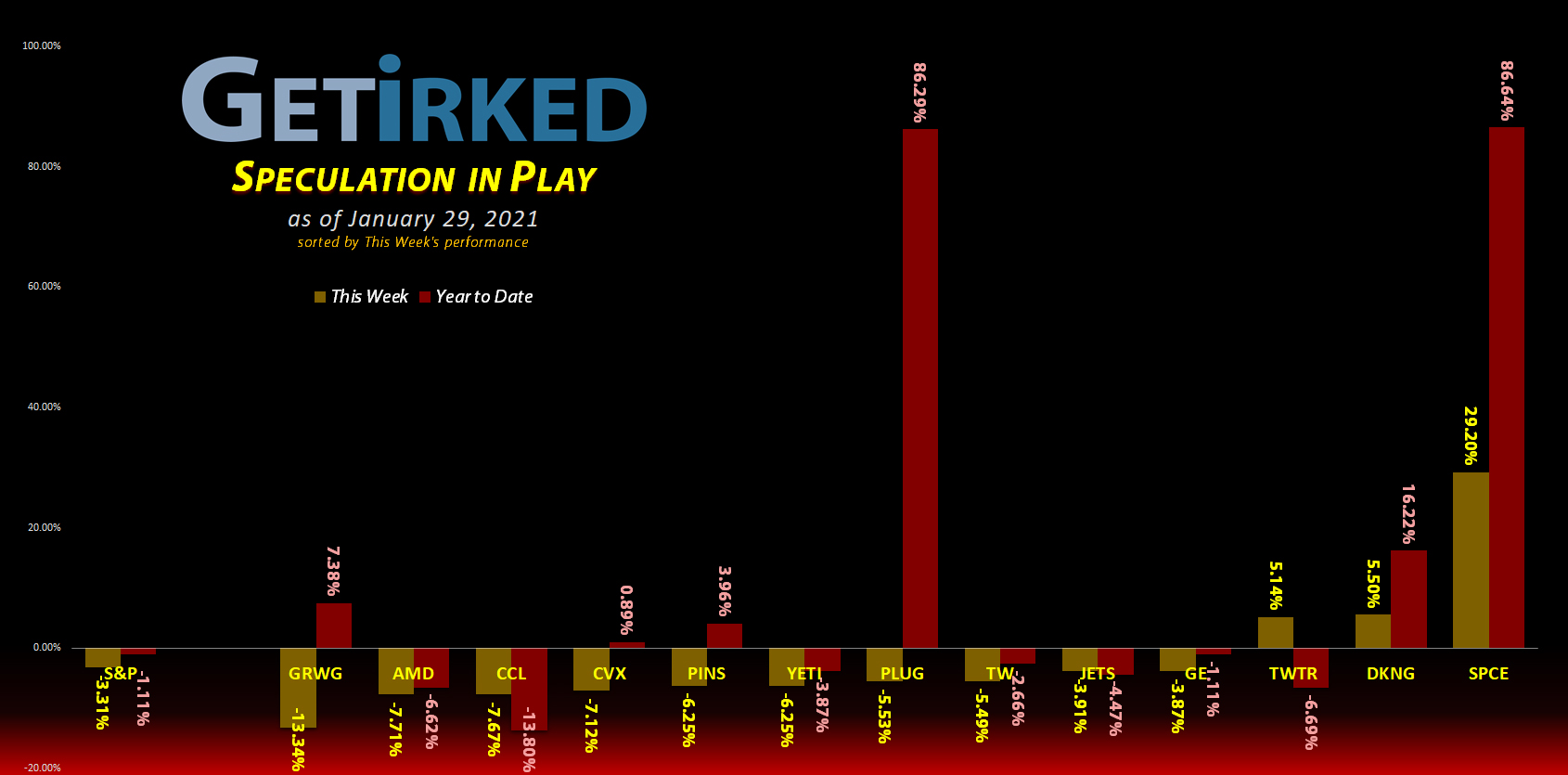

The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

Virgin Galactic (SPCE) wins a hat trick – three weeks-in-a-row as the Week’s Biggest Winner with a +29.20% gain. If you think that gain was amazing, SPCE actually hit outer space mid-week with a +73.28% weekly gain hitting a new all-time high of $59.40 before pulling back dramatically. Now, that’s a rocket ship!

GrowGeneration (GRWG)

The systemic market-wide selloff took down a whole lot of stocks, but, in this portfolio, GrowGeneration (GRWG), the picks-and-shovels cannabis play, took the selloff the hardest, dropping -13.34% on the week to earn the Week’s Biggest Loser spot.

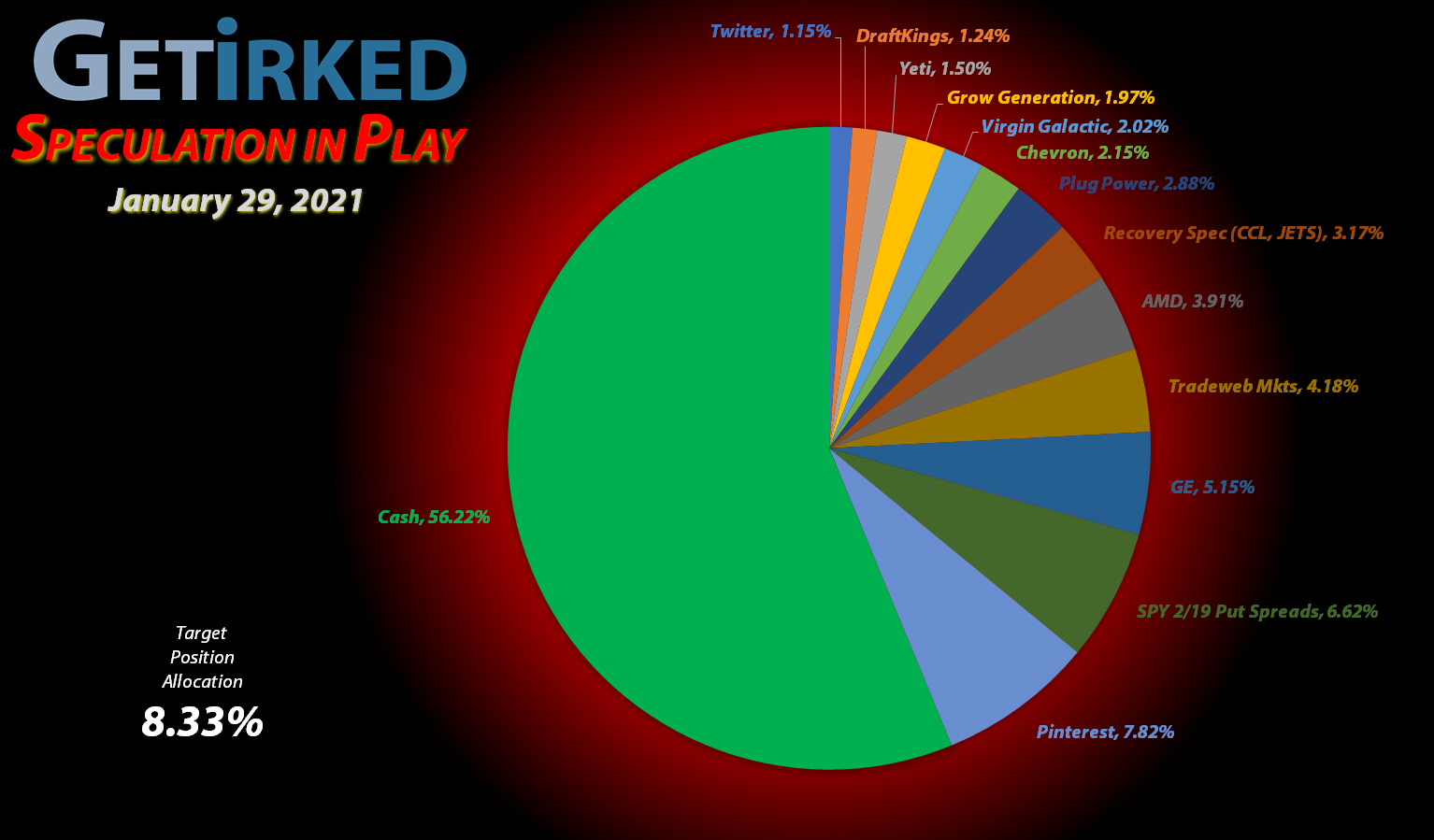

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Tradeweb Mkts (TW)

+763.99%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $7.04

Pinterest (PINS)

+679.95%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

AMD (AMD)

+471.91%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$6.69)*

Yeti (YETI)

+440.54%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Airlines ETF (JETS)

+439.45%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

Carnival Cruise (CCL)

+334.44%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: 4.30

Virgin Galactic (SPCE)

+232.95%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$20.40)*

Chevron (CVX)

+122.32%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-0.07)*

General Electric (GE)

+111.10%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $5.06

Twitter (TWTR)

+106.32%*

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: (-$45.02)*

Plug Power (PLUG)

+102.63%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $31.18

Grow Gen. (GRWG)

+95.78%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $22.06

DraftKings (DKNG)

+2.15%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $52.97

2/19 SPY Put Spreads

-51.60%

Cost: $5.9914

Current Value: $2.90

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCL

What is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

AMD (AMD): Added to Position

I added to Advanced Micro Devices (AMD) during Wednesday’s selloff, when it fell through a buy price target with an order filling at $89.20. The order locks in a meager +3.36% in gains on the shares I sold back on December 1, 2020 for $92.30, however, AMD has shown remarkable strength in the space which caused me to want more exposure.

Should AMD actually pull back to $76.60 from these levels, I’ll add capital back into the position, but, for the moment, I’ll let the position ride from here with no designated selling price targets.

AMD closed the week at $85.64, down -3.99% from where I added Wednesday.

DraftKings (DKNG): *New Position*

I’ve been eyeing DraftKings (DKNG) for some time and took this week’s volatility as the opportunity to start a position on Friday when DKNG dropped to below $53, buying at $52.97.

DraftKings is a play on legalized sports gambling, providing users of its website with daily sports betting and iGaming opportunities. The company has developed an online and retail sportsbook as well as a casino gaming platform, distributing its offerings through a variety of channels including app downloads and websites.

With the pandemic decimating the economy of individual states throughout the U.S., I’m betting (pun intended) that more and more states will legalize sports betting to generate tax revenue, a hugely positive catalyst for DraftKings.

DKNGS has already rocketed 505.57% from its March 2020 low of $10.60 to its all-time high of $64.19 made in September, so I’m entering this one slowly. My next buy price target is $45.85, slightly above its recent selloff in December.

DKNGS closed the week at $54.11, up +2.15% from where I opened it Friday.

Grow Generation (GROW): Added to Position

Grow Generation (GROW), the picks-and-shovels play that sells grow equipment to cannabis companies, was one of my two fastest positions to a double (the other being Plug Power (PLUG)).

Due to my trading discipline, I had to take half off the table when it doubled within three weeks of my buying it, selling half at $32.26 on November 23. From there, GROW grew to an all-time high of $53.86. Insane upside.

Now that this stock has established some key levels, I added capital back in during Wednesday’s selloff with a buy order at $44.31. I want more exposure to this space so I don’t mind buying up my cost basis, now $22.06 a share.

From here, I plan to add more if GROW drops to $30.90 and don’t currently have any selling price targets.

GROW closed the week at $43.19, down -2.53% from where I added Wednesday.

Pinterest (PINS): Added to Position

I added to Pinterest (PINS) during Wednesday’s selloff with an order that filled at $66.70, just $0.43 below where I sold shares on November 20, 2020 for $67.13.

Why am I buying back in at such a close level? Well, since November, PINS shot to a high of $76.88. With that kind of upward strength and given I had taken all of my capital out of this position (and a lot of profits, to boot), I realized I wanted to be more aggressive with the position.

From here, I’ll add more if PINS sells down to $44.85. I have no upside buying targets, as I want to see how much higher it may be able to go then its current all-time high of $76.88.

PINS closed the week at $68.51, up +2.71% from where I added Wednesday.

Plug Power (PLUG): Added to Position

Like GrowGeneration (GRWG) above, Plug Power (PLUG) was one of my fastest-growing positions… ever. After initially opening the position on October 30, 2020 at $14.14, PLUG powered its way to a double in less than three weeks where my discipline required I take profits at $28.56 to remove my initial investment.

Well, PLUG was far from done, nearly tripling from where I took profits to hit an all-time high of $75.49! During this week’s selloff, PLUG pulled back and I decided to add some capital back in at $62.63 on Friday, down -17.04% off its all-time high, giving me a $31.18 per share cost basis.

Given that PLUG is a volatile stock, I’m moving slowly with my next price target to add more to my position at $43.65.

PLUG closed the week at $63.17, up +0.86% from where I added Friday.

SPY Put Insurance: Rollover to 2/19

In what may turn out to be a “good money after bad” situation, I decided to roll over my SPY 1/29 367-359 put spreads into SPY 2/19 370-360 put spreads when the market frothiness caused the difference to cost about $1.14 more to the position on Tuesday.

The result is a position with a total cost of $5.9914 for each put spread with a maximum profit of $10.00 (the difference between the puts I bought at $370 and the ones I sold for $360).

The market simply feels far too overheated to me. Now, a trader can go broke trying to time when a market will crash, but the intent of this portfolio is speculation, and the total risk I’m taking extending this position was only 2.86% of the portfolio thanks to how badly these spreads have treated me since inception back in November.

With less than -3% to the downside and potentially +23.47% to the portfolio’s upside, I decided it was worth the risk. However, that being said, if the market’s still higher by expiration on February 19, it will be time to pull my shorting dollars off the table and revert to the stock plays that have gotten me here.

However, after the week’s volatility, the put spreads, which were worth basically $1.14 on Tuesday, skyrocketed to $2.90 on Friday, a +154.39% gain in three days.

Status as of Friday, January 29:

Put Spreads Cost: $5.9914

Current Value: $2.90

Profit/Loss: -51.60%

Gain/Loss since Tuesday: +154.39%

Virgin Galactic (SPCE): Profit-Taking

Virgin Galactic (SPCE) rocketed to the moon once more on Tuesday, making a try for its all-time high at $42.49 last made in February 2020 before its epic -78.68% collapse to $9.09 at the pit of the March selloff.

Last time, I just waved at the high, hanging on to the remaining position I held at the time, having taken the last of my capital out in the mid-$20s. This time, I’m not making that mistake again, and took some profits with a trailing-stop sell order that filled at $40.36 on Tuesday.

The sale locked in +308.92% in gains on some of the original shares I bought at $9.87 back when SPCE first made its entre into the U.S. markets on Halloween 2019, taking my per-share cost down to -$20.40 per share (my remaining shares have no capital in them and, in fact, add $20.40 in gains to my portfolio’s value).

On Wednesday, Virgin Galactic continued its stratospheric climb, tagging a new all-time high of $59.40 before pulling back -33.55% on Thursday before finding support at $39.47 and bouncing to finish the week at $44.29. Whew… what a ride!

If SPCE crash-lands as it has in the past, I’ll add half of my profits back in at $20.40, $10.20, $5.10, and so on – a strategy that guarantees against losing any capital as I will only put my profits to work, never adding real capital back into the position.

SPCE closed the week at $44.29, up +9.74% from where I sold Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.