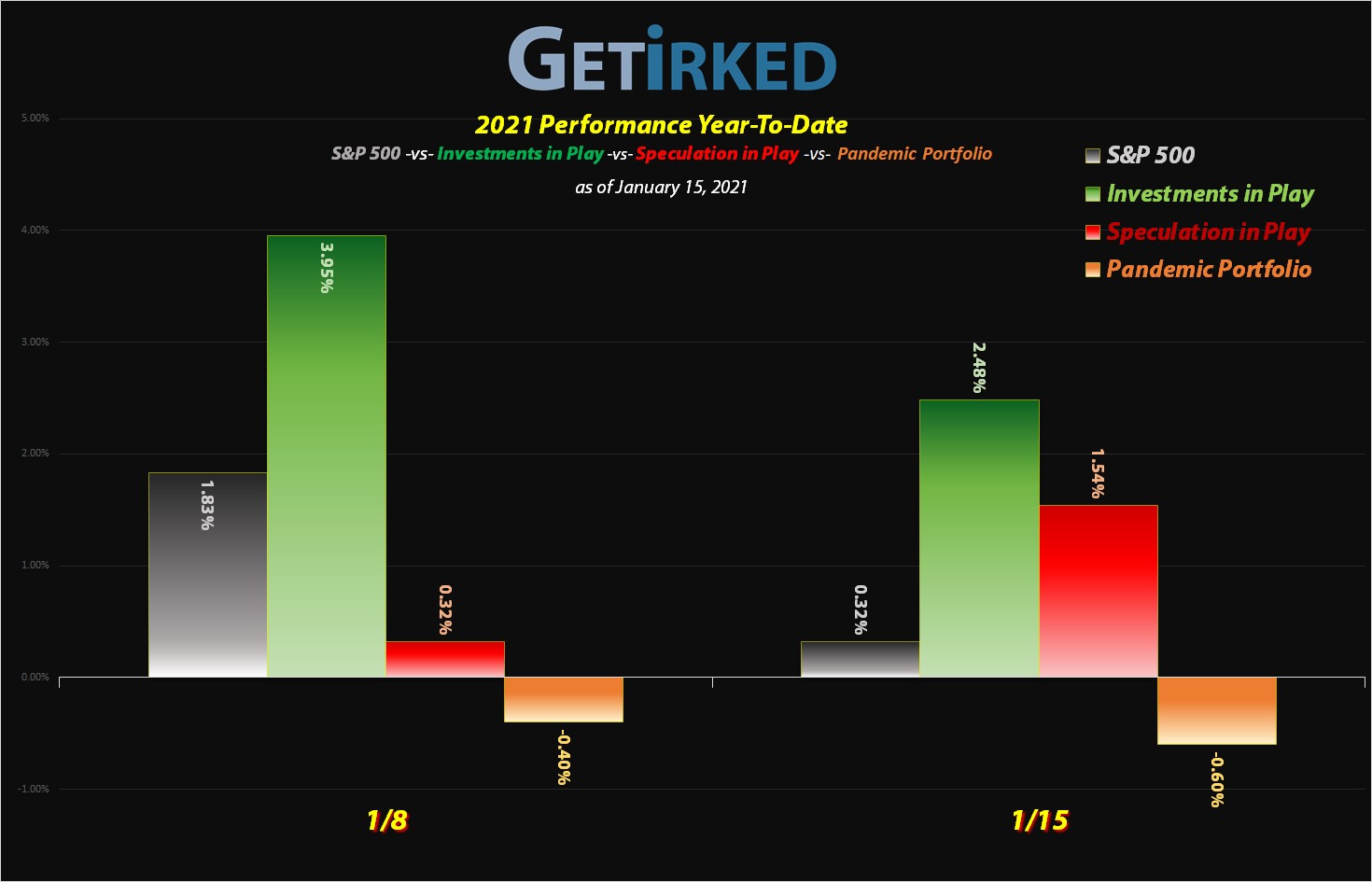

January 15, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

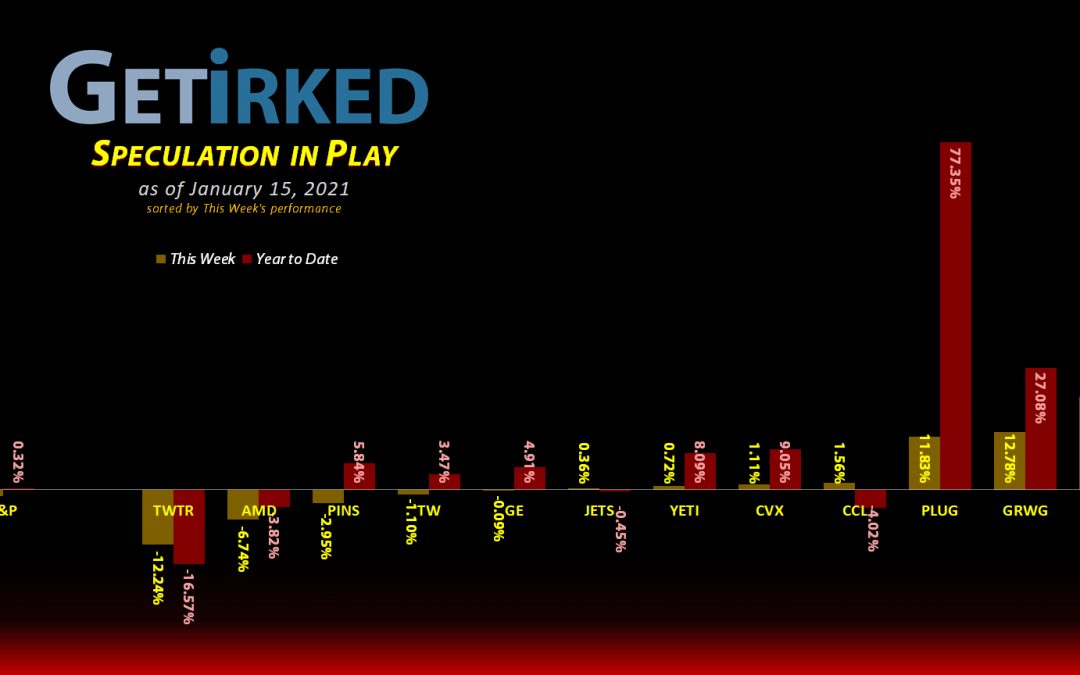

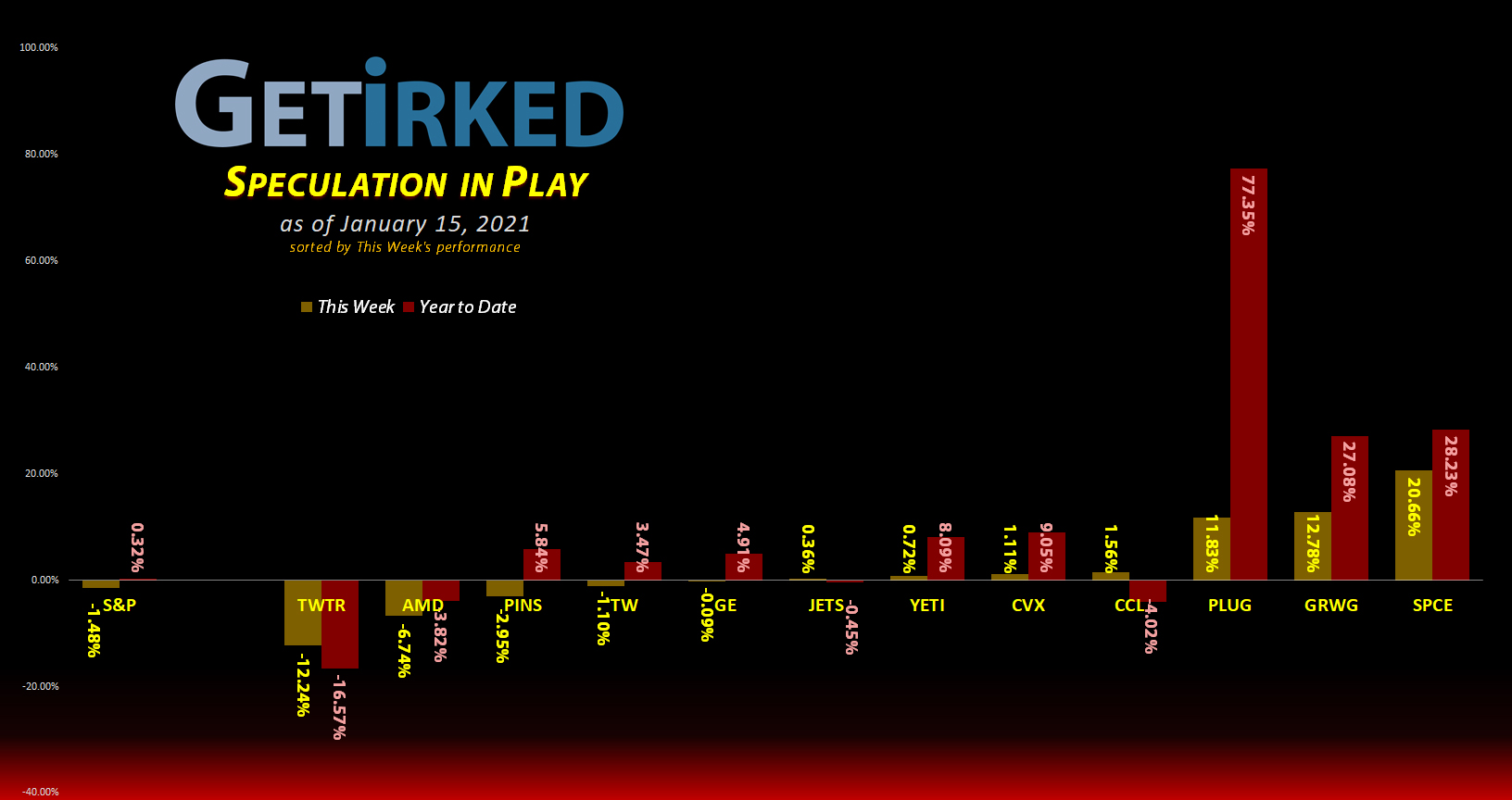

The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

Virgin Galactic (SPCE) took off once more after the announcement that a New Edge Tech Exchange Traded Fund (ETF) would be assembled which would, of course, include SPCE (how could it not?!).

SPCE gained +20.66% this week to earn itself the spot of the week’s Biggest Winner.

Twitter (TWTR)

After banning Donald Trump’s Twitter (TWTR) account for, well, attempting to rebel against the U.S. government, Twitter fell under hard times this week as it appears government regulation of the platform is virtually inevitable.

The stock dropped -12.24% this week, also making it the biggest loser so far this year at -16.57% YTD, but it definitely locked in the week’s Biggest Loser spot.

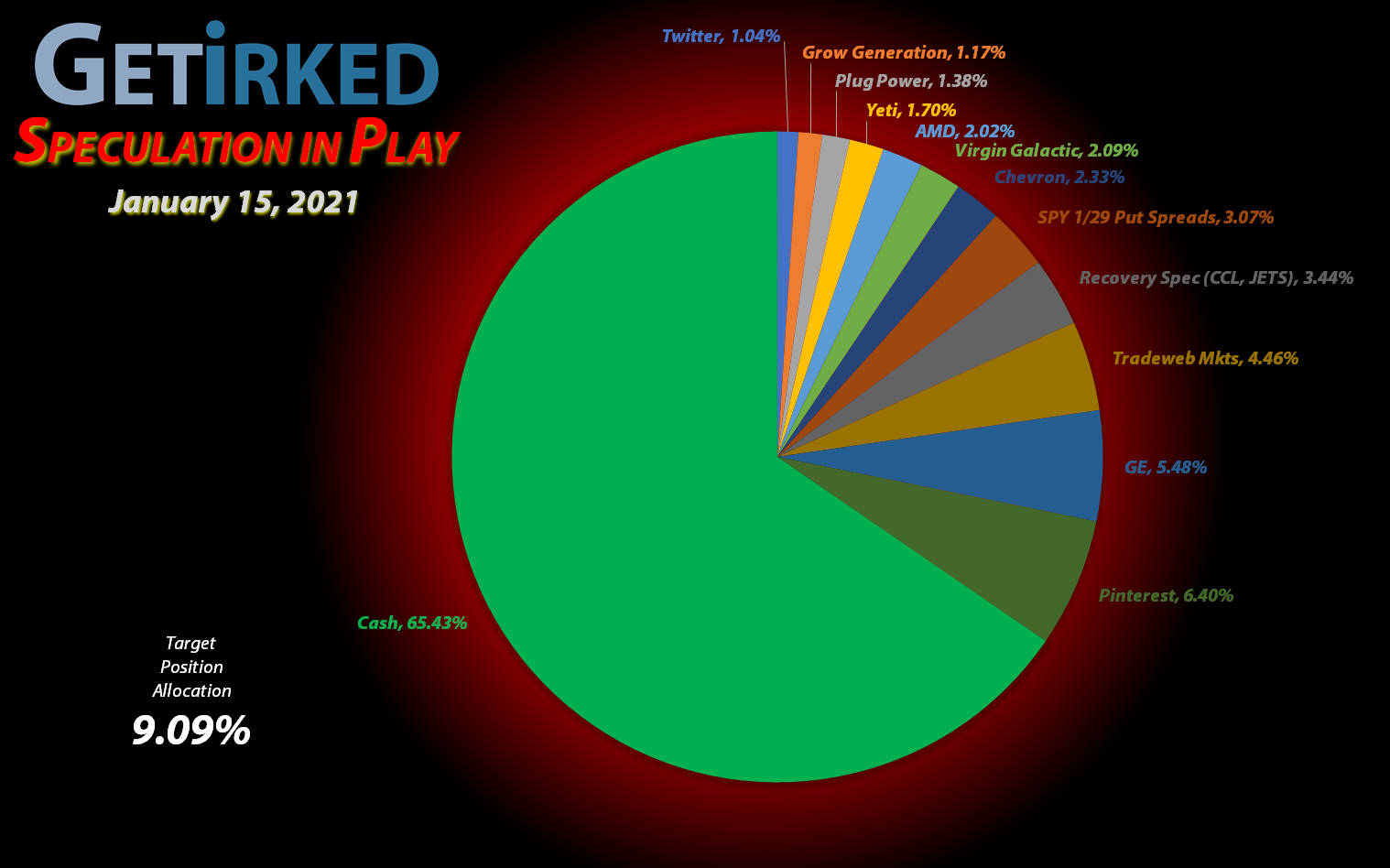

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Tradeweb Mkts (TW)

+818.43%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $7.04

Pinterest (PINS)

+784.19%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($58.79)*

AMD (AMD)

+587.58%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$107.72)*

Yeti (YETI)

+557.72%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Airlines ETF (JETS)

+457.95%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

Carnival Cruise (CCL)

+383.89%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: 4.30

Plug Power (PLUG)

+313.65%*

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: (-$0.28)*

Virgin Galactic (SPCE)

+265.54%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Grow Gen. (GRWG)

+259.96%*

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: (-$0.19)*

Chevron (CVX)

+232.23%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-0.07)*

Twitter (TWTR)

+200.37%*

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: (-$45.02)*

General Electric (GE)

+123.56%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $5.07

1/29 SPY Put Spreads

-72.23%

Cost: $4.8254

Current Value: $1.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCL

What is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Airlines ETF (JETS): Added to Position

The Airlines ETF demonstrated continued support this week, maintaining its price action around the $21.70-$22.25 range, so I added back in on Tuesday at $22.03. The purchase puts some capital back into the position, giving me a new per-share cost of $4.87.

From here, my next price target to add is $17.90, right above JETS’ 200-Day Simple Moving Average (SMA). I currently have no sell targets for the stock since I believe this year’s economic reopening may lead to a surge in air travel, lifting all airline stocks and, consequently, the JETS ETF.

JETS closed the week at $22.28, up +1.13% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.