December 4, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

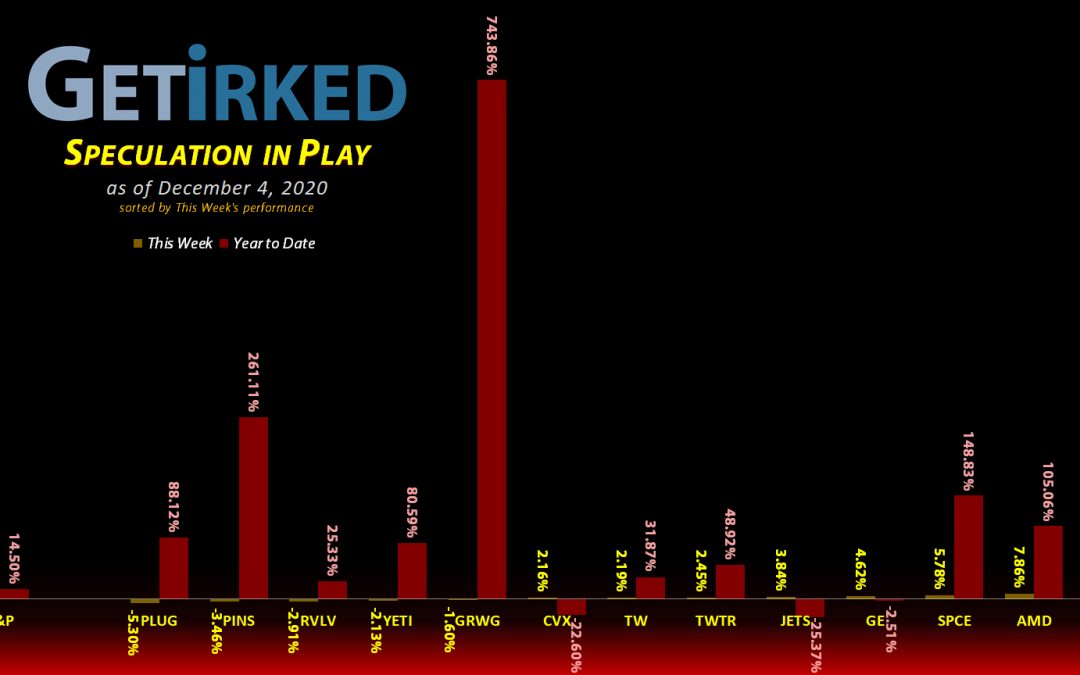

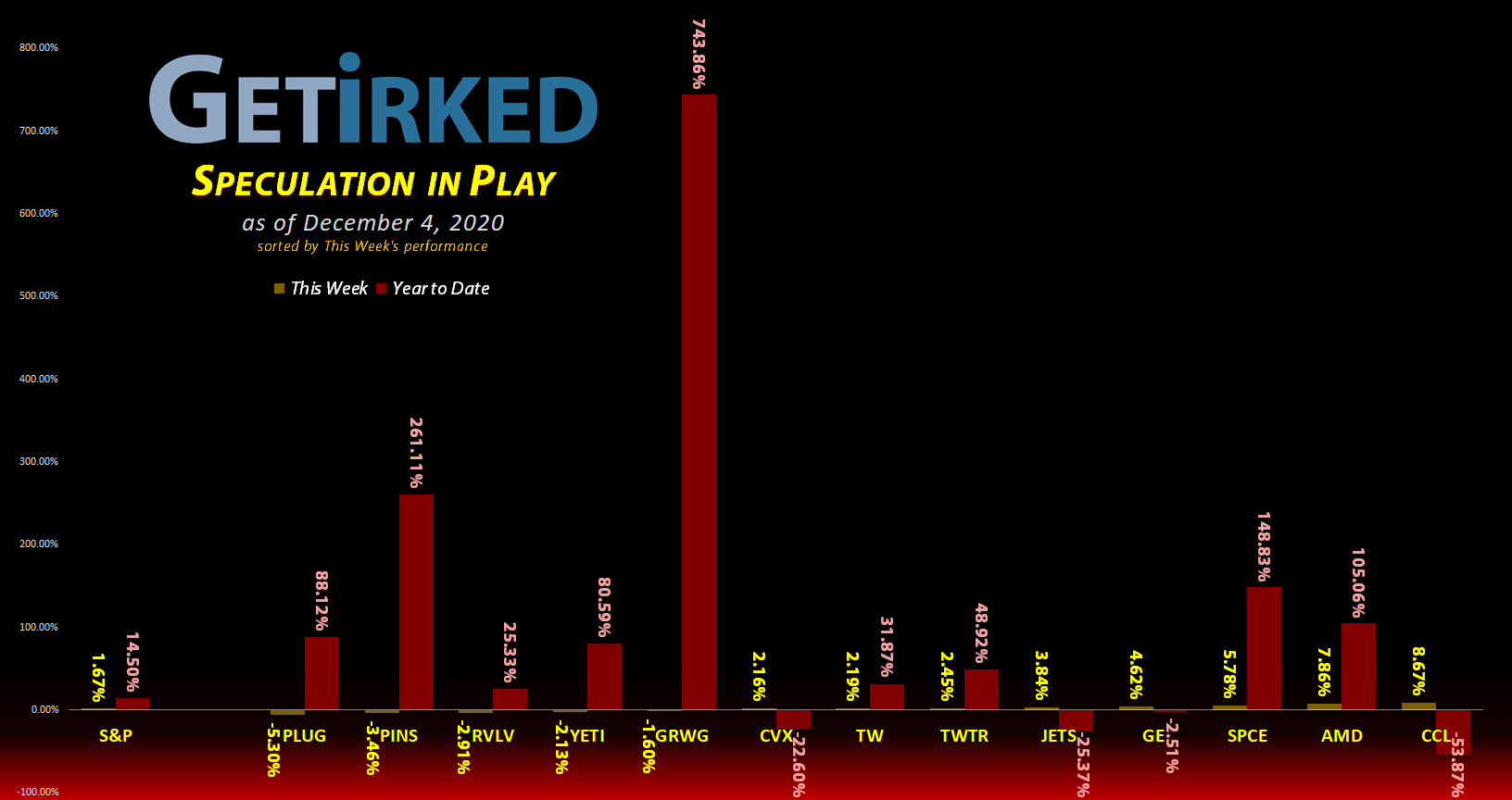

The Week’s Biggest Winner & Loser

Carnival Cruise Lines (CCL)

Carnival Cruise Lines (CCL) makes it a double, winning two weeks in a row as the surprise ultimate recovery play. CCL popped +8.67% earning itself the top spot as the Week’s Biggest Winner.

Plug Power (PLUG)

The entire Electric Vehicle (EV) space got slammed this week with everyone taking profits so it was no surprise that Plug Power (PLUG), the hydrogen fuel cell manufacturer, took it on the chin with the rest of the sector, dropping -5.30% to earn itself the Week’s Biggest Loser spot.

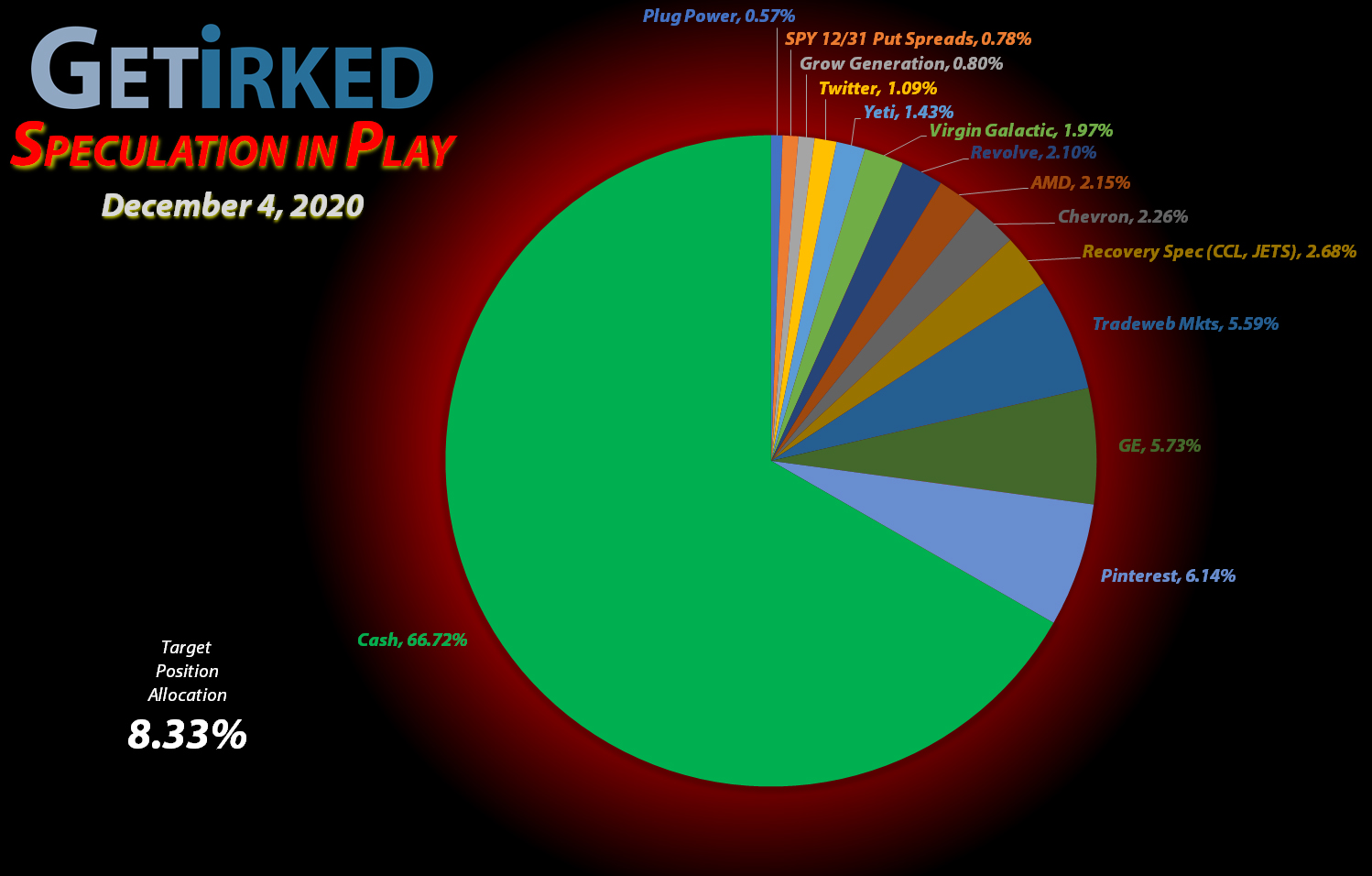

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+771.15%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($58.79)*

AMD (AMD)

+602.48%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$107.72)*

Yeti (YETI)

+534.17%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Virgin Galactic (SPCE)

+256.03%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Chevron (CVX)

+228.75%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-0.07)*

Grow Gen. (GRWG)

+209.79%*

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: (-$0.19)*

Carnival Cruise (CCL)

+206.35%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-1.01)*

Twitter (TWTR)

+203.20%*

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: (-$45.02)*

Airlines ETF (JETS)

+196.35%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$3.72)*

Plug Power (PLUG)

+188.86%*

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: (-$0.28)*

Tradeweb Mkts (TW)

+184.70%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $21.47

General Electric (GE)

+94.41%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $5.60

Revolve Group (RVLV)

+26.51%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $18.19

12/31 SPY Put Spreads

-86.40%

Cost: $2.4993

Current Value: $0.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCLWhat is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Super-Spec to Recovery-Spec: Change in Strategy

This week, I decided to make a change to the Super Speculative Basket, pulling out Virgin Galactic (SPCE) to make it a position on its own. This leaves two specific recovery-oriented stocks in the basket: the Airlines ETF (JETS) and Carnival Cruise Lines (CCL).

Since both these positions will need a quick distribution of vaccines and herd immunity to thrive and may collapse substantially if the virus continues to rage out of control, I’m choosing to make them share a single position and they will be listed as “Recovery-Spec” on the portfolio composition charts each week.

Virgin Galactic (SPCE), on the other hand, is such a crazy, volatile, and potentially lucrative medium- to long-term play, I’ve chosen to let it once again hold its own position as the only pure play on consumer space travel in the stock market.

Accordingly, I’ve set my buy price target to add more to SPCE at $19.40, slightly above its 200-day Simple Moving Average (SMA) and a historical point of support.

This change raises the number of positions in the portfolio to 12 and reduces the target allocation size to 8.33% per position.

AMD (AMD): Profit-Taking

AMD (AMD) made another attempt for its all-time highs on Tuesday, triggering a sell order I had in place which filled at $92.30.

The order locked in +84.86% in gains on some shares I bought back on May 27 for $49.93. It pulled even more profits out of the position, lowering my per-share “cost” from -$5.14 to -$107.72 (meaning that each share in the position cost no capital and adds $107.72 in profits on top of the current share price to the portfolio’s overall performance.)

From here, I have no additional sell targets in place as I wait to see where AMD heads next. If it sells off, my next buy target $79.30, slightly higher than its last selloff low.

AMD closed the week at $94.04, up +1.89% from where I sold Tuesday.

Chevron (CVX): Capital Investment Removed

When negative reports about job losses and rising case numbers of COVID started rolling in throughout the week, I decided not to push my luck with Chevron (CVX) and sold enough shares to pull out my capital investment using sell orders on Thursday and Friday which filled with an average selling price of $90.92.

The sales locked in +32.61% in gains on shares I bought for an average of $68.56 on March 17 and October 27 for $67.24 and $69.87, respectively. The sales also lowered my per-share cost for the position from $59.38 to -$0.07 (each of the remaining shares carry their share price plus $0.07 in profit as they cost nothing with the capital removed).

From here, I’m letting the rest of my position ride for awhile, but I’m keeping my eyes open for another selloff with my next buy target at $66.90.

CVX closed the week at $93.28, up +2.60% from my average selling price.

General Electric (GE): Profit-Taking

General Electric (GE) made another try for $11 this week, crossing over $10.50 and triggering a sell order I had in place which filled at $10.65 on Friday.

The sale locked in +92.24% in gains on some of the shares I bought for $5.54 back on May 13 and lowered my per-share cost -6.67% from $6.00 to $5.60. From here my next sell price is around $12.50, a past point of resistance, where I intend to pull out my remaining capital seeing as GE’s highest recent high is only slightly above that around $13.25. My next buy target is now my per-share cost of $5.60, near GE’s all-time low.

GE closed the week at $10.88, up +2.16% from where I sold Friday.

Revolve Group (RVLV): Profit-Taking

Revolve Group (RVLV) saw a big pop during a down market on Monday. The strange behavior triggered a sell order I had in place which filled at $23.73. The sale lowered my per-share cost -5.7% from $19.29 to $18.19.

My next sale target is $26.60, near a past point of resistance, and my next buy target is $16.40, slightly above RVLV’s 200-day Simple Moving Average (SMA) and above the low of the last selloff.

RVLV closed the week at $23.01, down -3.03% from where I sold Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.