Originally posted February 4, 2019. Last Updated June 29, 2020.

TLDR: Roboadvisers don’t outperform

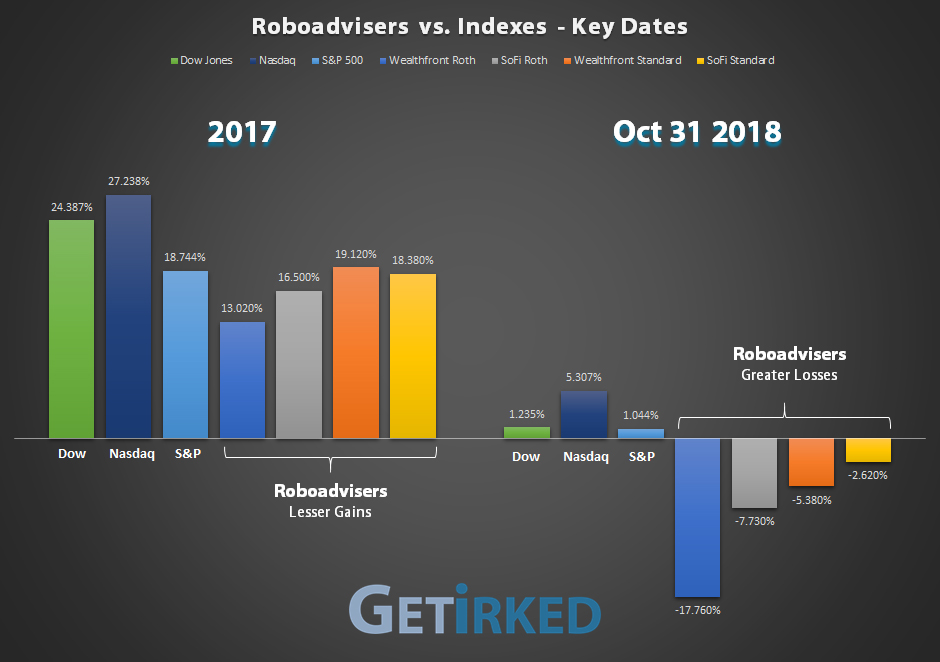

In order to test roboadviser performance, Get Irked opened IRAs and standard wealth accounts at both SoFi and Wealthfront, two of the leading roboadvisers in the space. All accounts were set to an investment profile of moderately-aggressive (or the institution’s equivalent of one setting below fully-aggressive) resulting in diversified portfolios with assets in a variety of different investment sectors typically utilizing Exchange Traded Funds (ETFs).

Over the past two years, SoFi performed comparably to the indexes with our test accounts. Wealthfront’s performance was often downright disastrous during downtrends with its algorithm seeing significantly greater losses than the averages without the corresponding gains during uptrends, as if the algorithm was weighted to perform on the downside.

Although SoFi’s performance during downtrends is admirable when compared to Wealthfront’s dismal performance, SoFi did not compete with the indexes. When accounting for the roboadviser standard account management fee of 0.25% annually, SoFi’s performance was markedly less than the indexes.

Comparatively, roboadviser maintenance fees of 0.25% annually are more than many index tracking funds charge. For example, VTI, the Vanguard Total Stock Market Index tracking fund, carries a fee of 0.04% annually, 84% less than roboadvisers charging 0.25%.

To make matters worse, both SoFi and Wealthfront used Vanguard’s own ETFs as the bulk of their investment strategy which means investors pay 0.25% to the roboadviser plus the ETF maintenance fees charged by the ETF managers resulting in an actual annual fee of 0.29% or more (depending on the expense ratio of each ETF used) versus the 0.04% fees charged by Vanguard if an investor simply purchased VTI (Total Stock Market ETF) or VOO (S&P 500 ETF).

2-28-2019 Update

Bloomberg confirms Get Irked’s Findings

Bloomberg released a report on February 28, 2019 entitled “One of Wall Street’s Most Popular Trading Strategies Is Now Failing” where Bloomberg confirmed Get Irked’s analysis.

“Hedge funds learned … the hard way last year [2018] when data-crunching computers that invest $220 billion based on historical price trends did worse than most other managers, robot or human,” the article reads.

The article goes on to say that Get Irked is far from the only investor to pull out of roboadvisers: “The losses were so bad that investors pulled billions of dollars out of an investment strategy that for years had, paradoxically, been regarded as a great way to protect portfolios from downside risks.”

Passive Investing Over Time

How to invest without fees

Many online brokerages offer the ability to buy Vanguard Funds including VOO, the Exchange Traded Fund (ETF) tracking the S&P 500, or VTI, the ETF tracking the entire U.S. stock market, through their platforms, investors can also go straight to the source.

Vanguard Funds

Go Straight to the Source

After researching a variety of approaches, Get Irked opened an account with Vanguard Funds, the creators of the popular Vanguard Total Stock Market Index Fund (Ticker symbol: VTI) and S&P 500 tracking fund VOO.

Vanguard offers investors the ability to buy and sell shares in Vanguard’s entire line of Exchange Traded Funds (ETFs), index funds and mutual funds with no trading costs (i.e. it costs the investor nothing to buy and sell shares of Vanguard’s funds). Vanguard also offers no account maintenance fees if investors elect to have statements delivered through e-delivery rather than paper, saving $20 annually.

In addition, Vanguard offers an interest rate on any uninvested funds in an account when funds are held in their Money Market account, on par with the market-leading interest rates offered by online savings accounts.

Get Irked sees great value in Vanguard Funds. Investors can select from a myriad of funds appealing to all levels of risk profiles. For those interested in passive investing, Vanguard provides a number of intriguing solutions.

As with all investments, interested investors should discuss the option of using Vanguard Funds with their financial adviser as all investments carry risk.

To learn more about Vanguard and explore their fund offerings, visit their website at Vanguard.com.

Learn more from Get Irked!

Want to learn more about Index Funds and Exchange Traded Funds (ETFs)? Click here to learn the different ways to build a portfolio of diversified funds!

Disclaimer

Get Irked receives no referral bonus from Vanguard for the above links and we are not receiving any sponsorship from Vanguard for this feature. We are simply impressed with Vanguard’s services and offerings for passive investors as an alternative to roboadvisers or traditional brokerages.

Please Note: After testing roboadviser performance, Get Irked is retracting our prior recommendation of roboadvisers, instead recommending passive investors stick with Exchange Traded Funds (ETFs), index funds or mutual funds.