Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #9

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

What’s Hot is What’s Not

This week, some of the more popular stocks like Costco (COST) got slammed hard while others like Microsoft (MSFT) continue to demonstrate stability (almost boringly-so).

I bit the bullet and added some COST before the deadline for its $10 special dividend paying out later this month, and also scooped up a bit more Digital Realty Trust (DLR) when it showed weakness.

For more details as well as updates on the rest of the portfolio, read on!

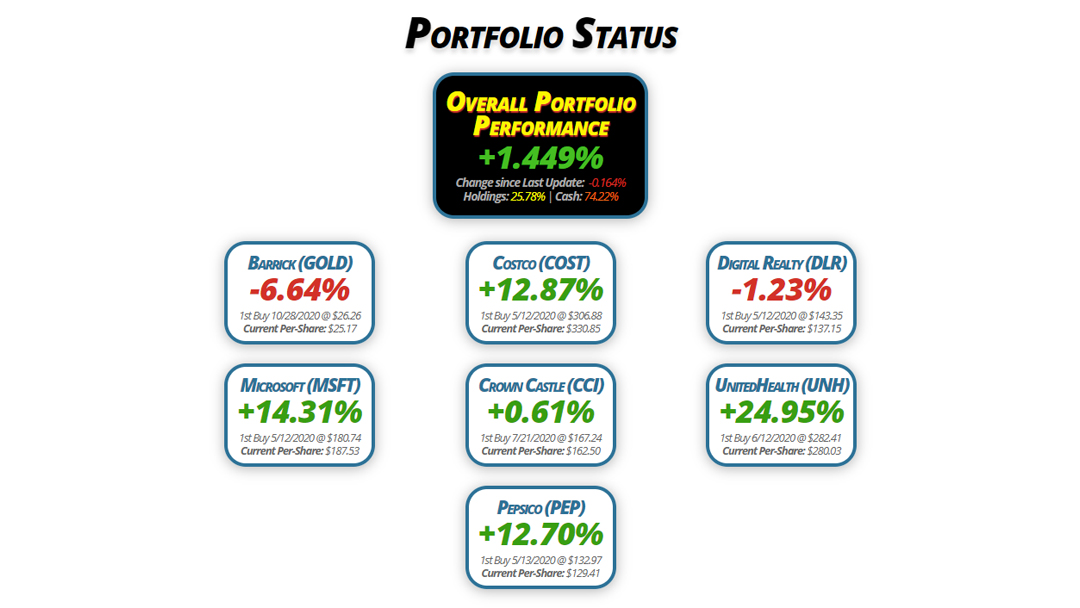

Portfolio Status

Overall Portfolio

Performance

+1.449%

Change since Last Update: -0.164%

Holdings: 25.78% | Cash: 74.22%

Barrick (GOLD)

-6.64%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $25.17

Digital Realty (DLR)

-1.23%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $137.15

Costco (COST)

+12.87%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $330.85

Microsoft (MSFT)

+14.31%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $187.53

UnitedHealth (UNH)

+24.95%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $280.03

Crown Castle (CCI)

+0.61%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $162.50

Pepsico (PEP)

+12.70%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $129.41

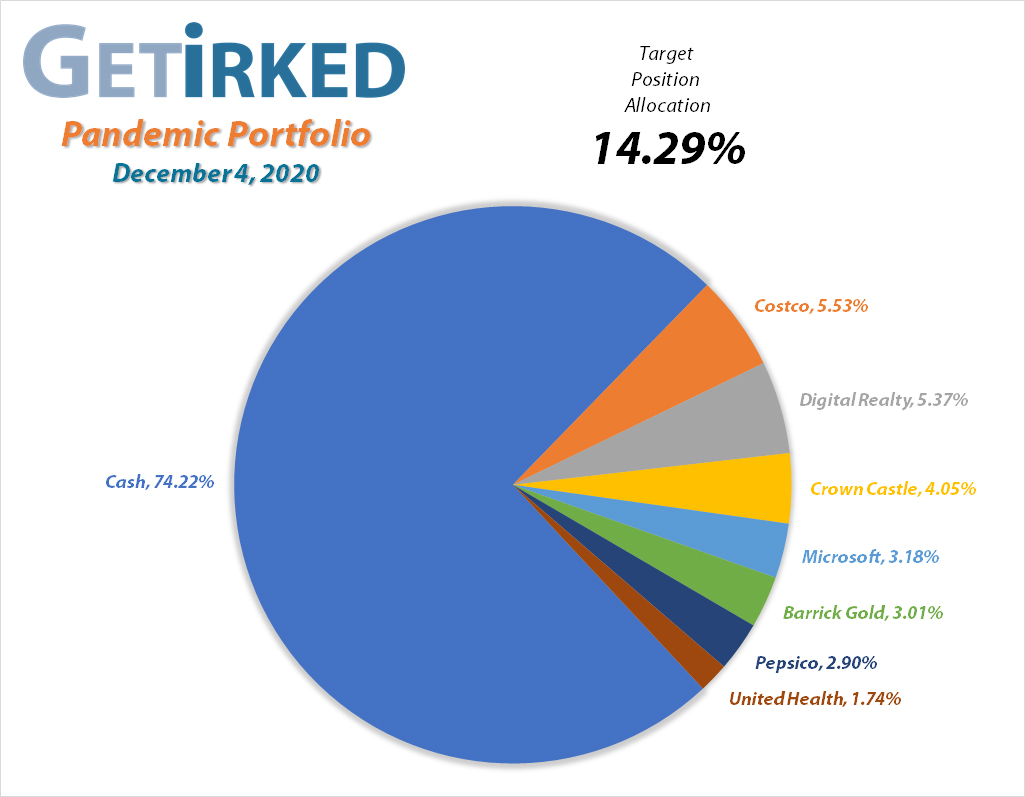

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $23.50

Per-Share Cost: $25.17 (Unchanged from last update)

Profit/Loss: -6.64%

Allocation: 3.010%*

Next Buy Target: $22.60

Despite the U.S. dollar losing value in the global currency markets, gold also demonstrates a bit of weakness, particularly in the goldminer space where Best-of-Breed Barrick Gold (GOLD) is still under pressure. I’m aiming to add a bit more to the position if it retests areas near its previous low.

Costco (COST): Added to Position

Current Price: $373.43

Per-Share Cost: $330.85 (+9.213% from last update)

Profit/Loss: +12.87%

Allocation: 5.533%*

Next Buy Target: $323.70

As I discussed in the last update, Costco (COST) announced a special dividend payout of $10 per share with an ex-dividend date of December 1. In layman’s terms – every shareholder will receive a one-time payout of $10 for each share they hold in their portfolio at the close of the market on December 1.

So, when the market sold off on Monday, November 30, I decided to add some more to my position with a buy order that filled at $386.89. The order raised my per-share cost a whopping +9.213% from $302.94 to $330.85. However, given that Costco also made a new high on Monday of $393.15 before pulling back to my buying price in the middle of a down market, this is a stock with staying power.

Plus, the special dividend (when it’s paid out later in December) will reduce my per-share cost nearly -4.75% to somewhere around $321, by my calculations. My next buy target for the stock is $323.70.

Costco reported its quarterly earnings this week, and while their numbers were stellar, they weren’t good enough for investors who sold off the stock likely from a combination of the earnings and the special dividend date passing.

COST closed the week at $373.43, down -3.48% from where I bought Monday.

Crown Castle (CCI): Strategy Update

Current Price: $163.50

Per-Share Cost: $162.50 (Unchanged from last update)

Profit/Loss: +0.61%

Allocation: 4.050%*

Next Buy Target: $155.40

Crown Castle Incorporated (CCI) continues to bounce between the mid-$150s and the upper-$160s, pulling back slightly this week and nearing my per-share cost.

At this point, I’m being patient and I’ll wait to add more if it drops down to $155.40 near the low of its last selloff.

Digital Realty Trust (DLR): Added to Position

Current Price: $135.47

Per-Share Cost: $137.15 (-0.414% from last update)

Profit/Loss: -1.23%

Allocation: 5.370%*

Next Buy Target: $129.90

Digital Realty Trust (DLR) continued to exhibit weakness since the last update, dropping to a trigger price which prompted a buy order to fill at $133.15 on Wednesday, December 2. The buy lowered my per-share cost -0.414% from $137.72 to $137.15.

With its $4.48 annual dividend, DLR provides a very nice 3.36% annual yield, much better than the 0.85% 10-year treasury. From here, my next buy target is slightly under $130 at $129.90, slightly above a past point of support.

DLR closed the week at $135.47, up +1.71% from where I added Wednesday.

Microsoft (MSFT): Strategy Update

Current Price: $214.36

Per-Share Cost: $187.53 (Unchanged from last update)

Profit/Loss: +14.31%

Allocation: 3.176%*

Next Buy Target: $197.90

Not much has changed in the land of Mr. Softy (Microsoft (MSFT)). The tech behemoth remains an unwavering stalwart as it consolidates around the $215 mark, even during this week’s rally but also in previous selloffs.

Given the amount of negative catalysts ahead and the likelihood that technology and growth names will get hit hard if we see a selloff, I continue to be patient, aiming to add more at $197.90, a past point of support.

Pepsico (PEP): Strategy Update

Current Price: $145.85

Per-Share Cost: $129.41 (Unchanged from last update)

Profit/Loss: +12.70%

Allocation: 2.901%*

Next Buy Target: $130.60

Pepsico (PEP) might be making a run at its all-time high, exhibiting a lot of strength over the past few weeks as it works its way higher and higher into the $140-$150 range.

That being said, I prefer to be patient with this one as it has sold off pretty strong during the past few down markets, often testing the low-$130s which is where I’ve got my buy target.

UnitedHealth (UNH): Strategy Update

Current Price: $349.89

Per-Share Cost: $280.03 (Unchanged from last update)

Profit/Loss: +24.95%

Allocation: 1.738%*

Next Buy Target: $301.90

UnitedHealth (UNH) continues to hold up strong, refusing to give me an opening to add more to my position. This is a high-quality problem as it just means I continue to be pretty profitable in this, my portfolio’s smallest position.

Whereas previously, I was hoping I’d see UnitedHealth drop under $300, I’ve raised my price target in hopes of catching it if it tests the $301-$302 mark, a past point of support for the stock.

* Target allocation for each position in the portfolio is 14.29% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.