Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #7

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Let’s do the time warp… again…

The markets entered their regular rotation this week once Pfizer (PFE) announced its vaccine candidate has a 90%+ efficacy rating. Investors dropped the growth and tech stocks like they were hot in favor of industrials and travel/leisure plays.

However, the trick to investing is to remain contrary. The best time to buy the growth/tech plays is when they’re on sale, not when everyone wants them, so it was time to eye some of the portfolio’s positions for good spots to add on.

Plus, as always, it’s never a bad time to take a moment to review the plan and see if we can’t make some updates here and there…

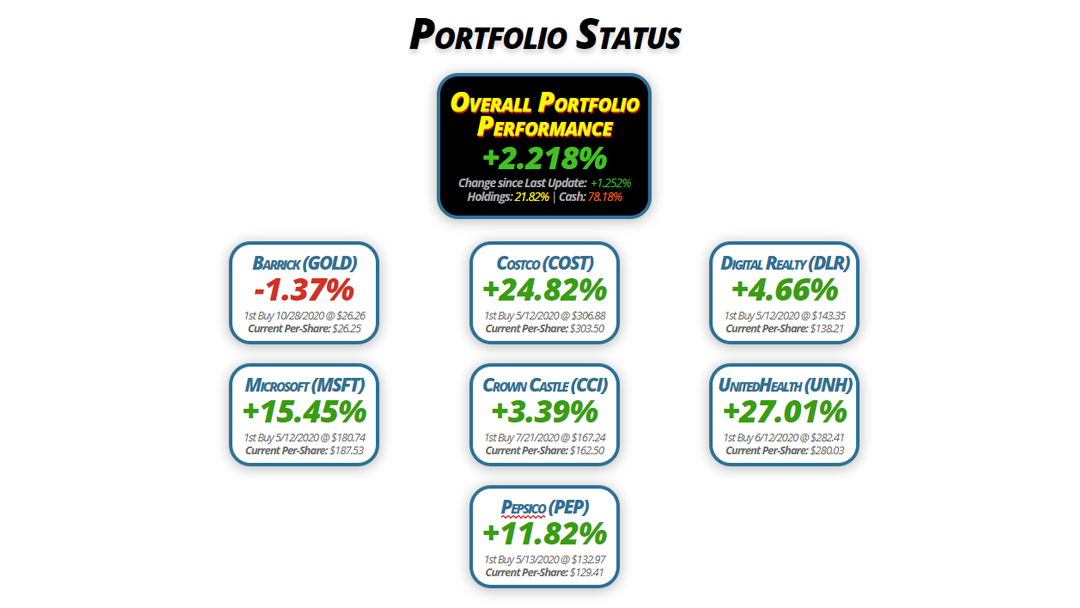

Portfolio Status

Overall Portfolio

Performance

+2.218%

Change since Last Update: +1.252%

Holdings: 21.82% | Cash: 78.18%

Barrick (GOLD)

-1.37%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $26.25

Microsoft (MSFT)

+15.45%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $187.53

Costco (COST)

+24.82%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $303.50

Crown Castle (CCI)

+3.39%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $162.50

Pepsico (PEP)

+11.82%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $129.41

Digital Realty (DLR)

+4.66%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $138.21

UnitedHealth (UNH)

+27.01%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $280.03

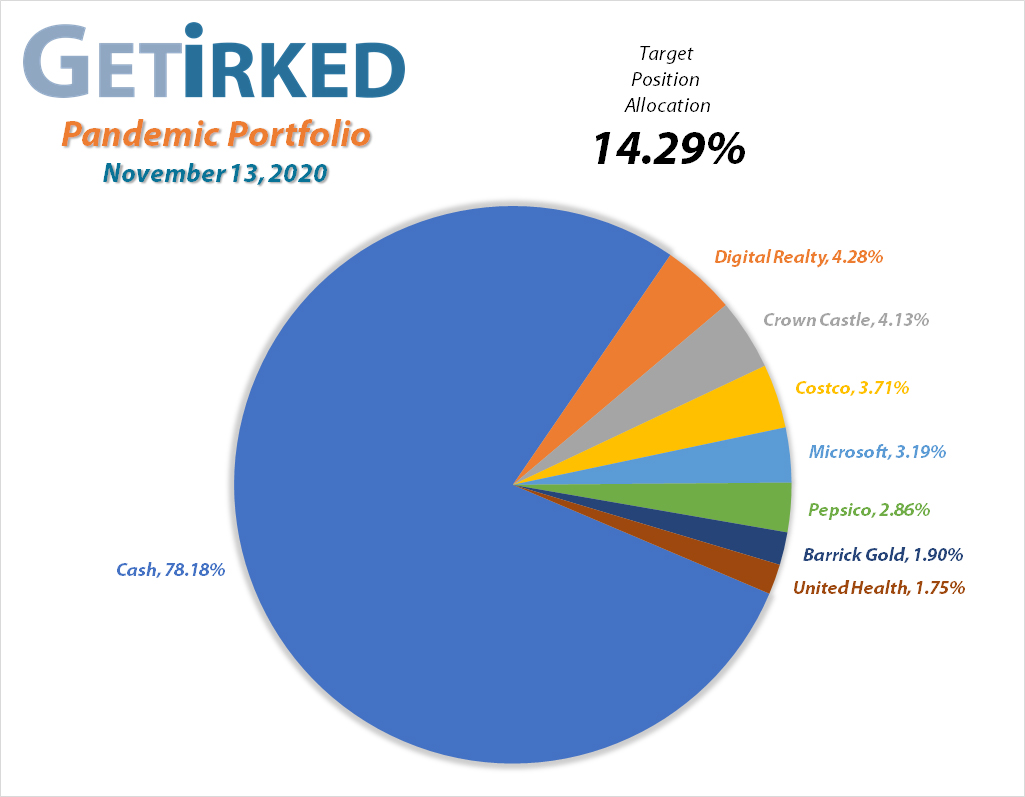

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position

Current Price: $25.89

Per-Share Cost: $26.25 (-$0.01 from last update)

Profit/Loss: -1.37%

Allocation: 1.900%*

Next Buy Target: $24.20

When the markets went bonkers following the election of President-Elect Joe Biden and the COVID vaccine news from Pfizer (PFE), the precious yellow metal gold sold off in a big way. On Tuesday, I added some more to my Barrick Gold (GOLD) position when it tried for Monday’s low with an order filling at $26.23.

The order reduced my per-share cost by a negligible -$0.01, but, more importantly, increased my allocation. With federal stimulus virtually guaranteed in the coming weeks or months, the potential for further weakness in the U.S. dollar is high, so GOLD remains a hedge against that risk.

GOLD closed the week at $25.89, down -1.30% from where I bought Tuesday.

Costco (COST): Strategy Update

Current Price: $378.84

Per-Share Cost: $303.50 (Unchanged from last update)

Profit/Loss: +24.82%

Allocation: 3.714%*

Next Buy Target: $336.90

Even during a week where investors sold off all of the stay-at-home plays, Costco (COST) remained vigilant. No messing around – if I’m going to want to add to this position, I’m going to have to get aggressive. I’ve raised my next buy target to a support point above Costco’s 200-day Simple Moving Average (SMA) in order to ensure I can add some to this amazing retailer that performs no matter the circumstances.

Crown Castle (CCI): Strategy Update

Current Price: $168.01

Per-Share Cost: $162.50 (Unchanged from last update)

Profit/Loss: +3.39%

Allocation: 4.133%*

Next Buy Target: $155.30

Crown Castle (CCI) bounced hard this week taking my position into the profitable territory. Since this one’s a notoriously volatile position, I’m sticking with my next buy price target around $155.00.

Digital Realty Trust (DLR): Added to Position

Current Price: $144.65

Per-Share Cost: $138.21 (+$0.01 from last update)

Profit/Loss: +4.66%

Allocation: 4.278%*

Next Buy Target: $133.30

Digital Realty Trust (DLR) sold off substantially throughout week, filling a few orders I had in place at lower levels giving me an average buying price $138.23. The orders raised my per-share cost a negligible +$0.01 and increased my position in DLR with its $4.48 per share annual dividend giving my purchases a 3.24% annual yield.

DLR closed the week at $144.65, up +4.64% from my average buying price.

Microsoft (MSFT): Strategy Update

Current Price: $216.51

Per-Share Cost: $187.53 (Unchanged from last update)

Profit/Loss: +15.45%

Allocation: 3.185%*

Next Buy Target: $197.90

Much like Costco (COST) above, Microsoft (MSFT) remains a stalwart against all selloffs. Even while competitors in the FANG makeup like Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google (Alphabet – GOOG) got hit hard, Microsoft ignored the selloff. Its ongoing strength is why I have once again raised my next buy target to $197.90, a past point of support.

Pepsico (PEP): Strategy Update

Current Price: $144.71

Per-Share Cost: $129.41 (Unchanged from last update)

Profit/Loss: +11.82%

Allocation: 2.858%*

Next Buy Target: $131.90

Pepsico (PEP) has finally come into its own. Despite being a stay-at-home pandemic play (which all saw the business end of the selling-stick this week), Pepsico (PEP) thrived and rocketed higher with the rest of the market. Accordingly, I’ve made my next buy target higher than my current per-share cost at $131.90, a past point of support.

UnitedHealth (UNH): Strategy Update

Current Price: $355.67

Per-Share Cost: $280.03 (Unchanged from last update)

Profit/Loss: +27.01%

Allocation: 1.755%*

Next Buy Target: $297.90

Alright, there’s being patient and there’s being patient. UnitedHealth (UNH) couldn’t be taken down even with the election of a Democratic president, holding up strong this week in light of a failed “Blue Sweep” of Congress, effectively guaranteeing that UnitedHealth will continue making huge profits.

I give in. While UnitedHealth is notoriously volatile, I’ve significantly raised my buy target above my per-share cost in an effort to add more to this position should it sell off to just under $300, a past point of support.

* Target allocation for each position in the portfolio is 14.29% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.