Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #6

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Buying Season is Here…

Winter may still be coming, but Buying Season is here for the Pandemic Portfolio. While the selloff hasn’t been extreme enough to see additions across the board, I did pick up a few choice positions thanks to the lower levels presented over the past week.

Oh, and I added a hedge to the portfolio in the form of Barrick Gold (GOLD), the premier goldminer and Best-of-Breed in the sector.

Read on to learn more…

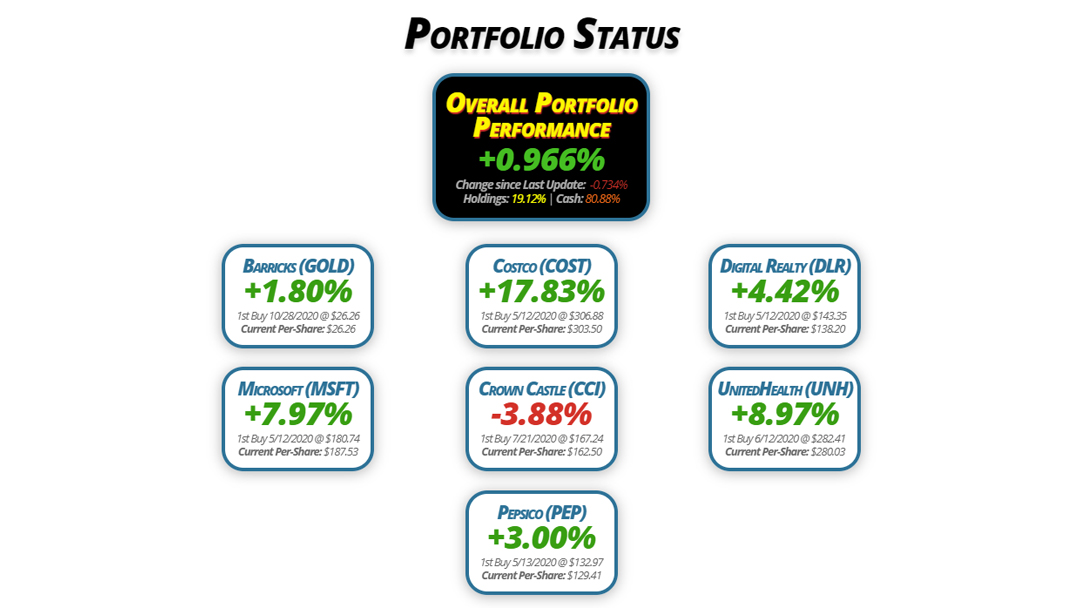

Portfolio Status

Overall Portfolio

Performance

+0.966%

Change since Last Update: -0.734%

Holdings: 19.12% | Cash: 80.88%

Barrick (GOLD)

+1.80%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $26.26

Microsoft (MSFT)

+7.97%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $187.53

Costco (COST)

+17.83%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $303.50

Crown Castle (CCI)

-3.88%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $162.50

Pepsico (PEP)

+3.00%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $129.41

Digital Realty (DLR)

+4.42%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $138.20

UnitedHealth (UNH)

+8.97%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $280.03

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): *New Position*

Current Price: $26.73

Per-Share Cost: $26.26

Profit/Loss: +1.80%

Allocation: 1.588%*

Next Buy Target: $24.90

With reserve banks printing fiat currencies by the trillion globally, I felt it was time to add a hedge into the Pandemic Portfolio in the form of gold.

Why a gold miner and not a gold ETF?

Many analysts will suggest holding gold in a portfolio using Exchange Traded Funds (ETFs) that specifically track the price of gold such as GLD or IAU. However, there are many in the investment community that question whether the gold ETFs carry enough physical gold to account for the shares they’re selling. In other words, thanks to derivatives markets like futures and options, it’s possible the ETFs “claim” to have enough gold, but, in reality, have written more paper than they have corresponding gold.

Accordingly, professionals will advise investing in the gold miners over the gold ETFs. The miners are exposed to a great deal more volatility meaning the price of their stocks will rise and fall in a greater amount comparative to the price of gold. While this offers greater upside, it does open the downside risk.

However, another benefit to miners over ETFs is the yield. Many goldminers pay out a dividend yield, something the gold-tracking ETFs naturally cannot do.

While in my retirement ETF accounts, I choose to use GDX (the goldminer ETF) to one specific company, my portfolios are all-about picking the best individual plays for the space.

Considered the Best-in-Breed gold miner, Barrick Gold (GOLD) was the logical choice. With its 1.23% dividend yield ($0.32 per share annually), GOLD was in my sights when the markets were hit on European concerns; I opened a position in Barrick at $26.26 on Wednesday, October 28. My next price target is $24.90.

GOLD closed the week at $26.73, up +1.80% from Wednesday.

Costco (COST): Strategy Update

Current Price: $357.62

Per-Share Cost: $303.50 (Unchanged from last update)

Profit/Loss: +17.83%

Allocation: 3.548%*

Next Buy Target: $322.90

While it can be difficult to be patient when it comes to adding to a position, it’s important to stick to the discipline. The markets sold off quite a bit since the last update, however, Costco is resilient, still nearly 10% from my next buying target. Given that I’m already intending to add to the position above my per-share basis, I’m keeping with the buy target for the time being.

Crown Castle (CCI): Strategy Update

Current Price: $156.20

Per-Share Cost: $162.50 (Unchanged from last update)

Profit/Loss: -3.88%

Allocation: 3.889%*

Next Buy Target: $147.90

The biggest position in the Pandemic Portfolio at this point, I’m sticking to the plan when it comes to Crown Castle (CCI). While it did pull back during the market-wide selloff, it demonstrated outperformance in the face of a negative market. I’m waiting to add to this position until it drops further.

Digital Realty Trust (DLR): Added to Position

Current Price: $144.30

Per-Share Cost: $138.20 (+1.416% from last update)

Profit/Loss: +4.42%

Allocation: 2.891%*

Next Buy Target: $134.30

After Digital Realty Trust (DLR) exhibited surprising resilience during the last selloff, I raised my buy target above my per-share cost to ensure I’d snag a few more shares should we see another selloff. Friday’s selloff was key with a buy order filling at $144.06.

The order only raised my per-share cost by +1.416% to $138.20, still -3.59% lower than my initial buy at $143.35 back on May 12. With a $4.48 annual dividend, DLR pays out a yield in excess of 3% at these levels. Combined with its exposure to enterprise cloud play as a Real Estate Investment Trust (REIT), I’m definitely looking at adding more to this position on the way down.

DLR closed the week at $144.30, up +0.17% from where I added.

Microsoft (MSFT): Added to Position

Current Price: $202.47

Per-Share Cost: $187.53 (+5.112% from last update)

Profit/Loss: +7.97%

Allocation: 3.015%*

Next Buy Target: $190.40

After reporting decent earnings but giving an pessimistic forward expectations during their quarterly report, Microsoft (MSFT) was slammed with the rest of the markets on Wednesday, October 28, triggering a buy order I had in place which filled at $205.83.

The order raised my per-share cost +5.112% from $178.41 to $187.53 but also captures a -11.61% discount from Microsoft’s $232.86 all-time high set back on September 2. My next buy target is $190.40, slightly above its 200-Day Simple Moving Average (SMA).

MSFT closed the week at $202.47, down -1.63% from Wednesday.

Pepsico (PEP): Strategy Update

Current Price: $133.29

Per-Share Cost: $129.41 (Unchanged from last update)

Profit/Loss: +3.00%

Allocation: 2.664%*

Next Buy Target: $126.90

Pepsico (PEP) has definitely locked itself into a trading range between $129-$145, bouncing between the two points. While it did drop as low as $131.71 during this week’s selloff, my discipline dictates that I continue to wait as November’s volatility could likely push Pepsico much lower.

In fact, I believe PEP may break through its trading range before finding support around $126.50-$127.00, a past point of support.

UnitedHealth (UNH): Strategy Update

Current Price: $305.14

Per-Share Cost: $280.03 (Unchanged from last update)

Profit/Loss: +8.97%

Allocation: 1.523%*

Next Buy Target: $259.70

UnitedHealth (UNH) has been getting slammed in the past few weeks as investors fear a Biden victory could mean punishment for the managed healthcare space.

That being said, UNH still hasn’t sold off enough to be interesting to me. While analysts like Jim Cramer of CNBC’s Mad Money suggest adding to UnitedHealth if it pulls back to $290, I believe my price target of $259.70 representing slightly less than a 15% pullback is very possible in the coming weeks, particularly if Biden wins or if the election’s contested.

* Target allocation for each position in the portfolio is 14.29% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.