Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #50

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Two New Contenders Enter the Ring…

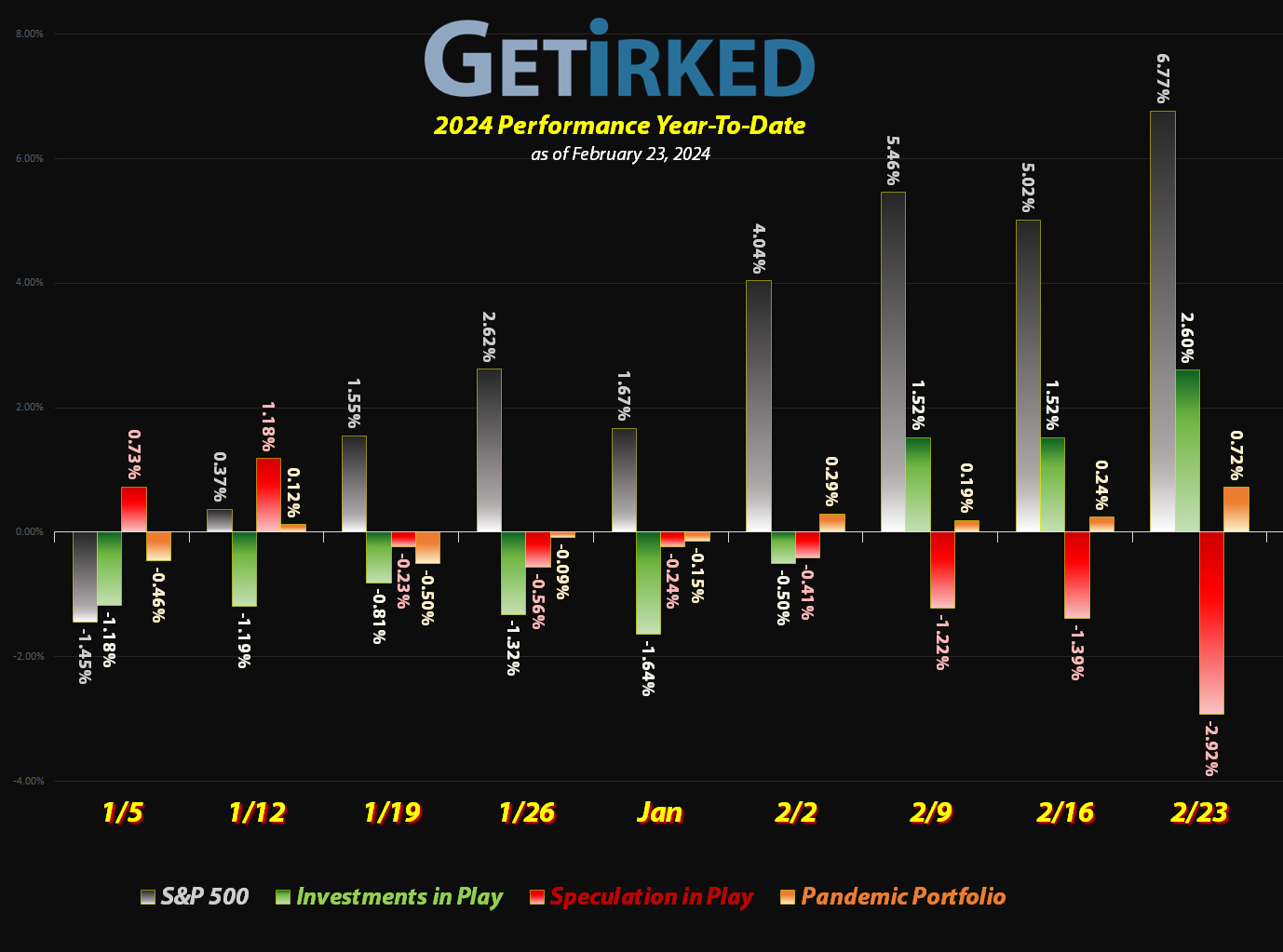

The past month since the last update has been quite a busy one for the Pandemic Portfolio. In addition to receiving dividends and adding to existing positions, I decided it was time to add two monsters to the portfolio: Caterpillar (CAT) and Union Pacific (UNP), both best-of-breed in their respective sectors and both carrying excellent dividends.

Without further adieu, let’s get down to it and see what’s been happening in the portfolio since the last update…

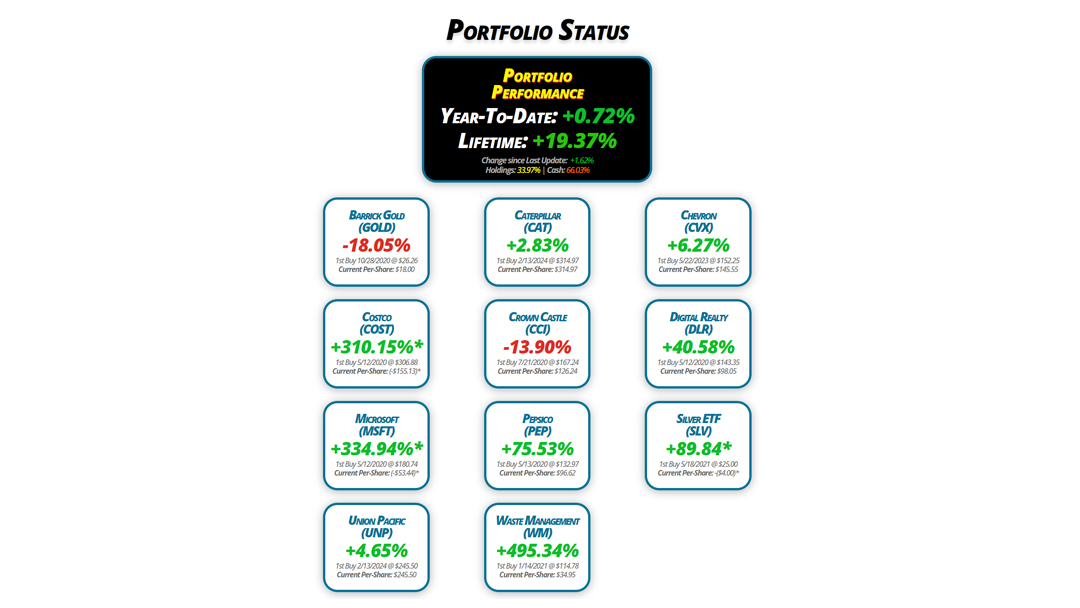

Portfolio Status

Portfolio

Performance

Year-To-Date: +0.72%

Lifetime: +19.37%

Change since Last Update: +1.62%

Holdings: 33.97% | Cash: 66.03%

Barrick Gold

(GOLD)

-18.05%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.00

Costco

(COST)

+310.15%*

1st Buy 5/12/2020 @ $306.88

Current Per-Share: (-$155.13)*

Microsoft

(MSFT)

+334.94%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$53.44)*

Union Pacific

(UNP)

+4.65%

1st Buy 2/13/2024 @ $245.50

Current Per-Share: $245.50

Caterpillar

(CAT)

+2.83%

1st Buy 2/13/2024 @ $314.97

Current Per-Share: $314.97

Crown Castle

(CCI)

-13.90%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $126.24

Pepsico

(PEP)

+75.53%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $96.62

Waste Management

(WM)

+495.34%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $34.95

Chevron

(CVX)

+6.27%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $145.55

Digital Realty

(DLR)

+40.58%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $98.05

Silver ETF

(SLV)

+89.84*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

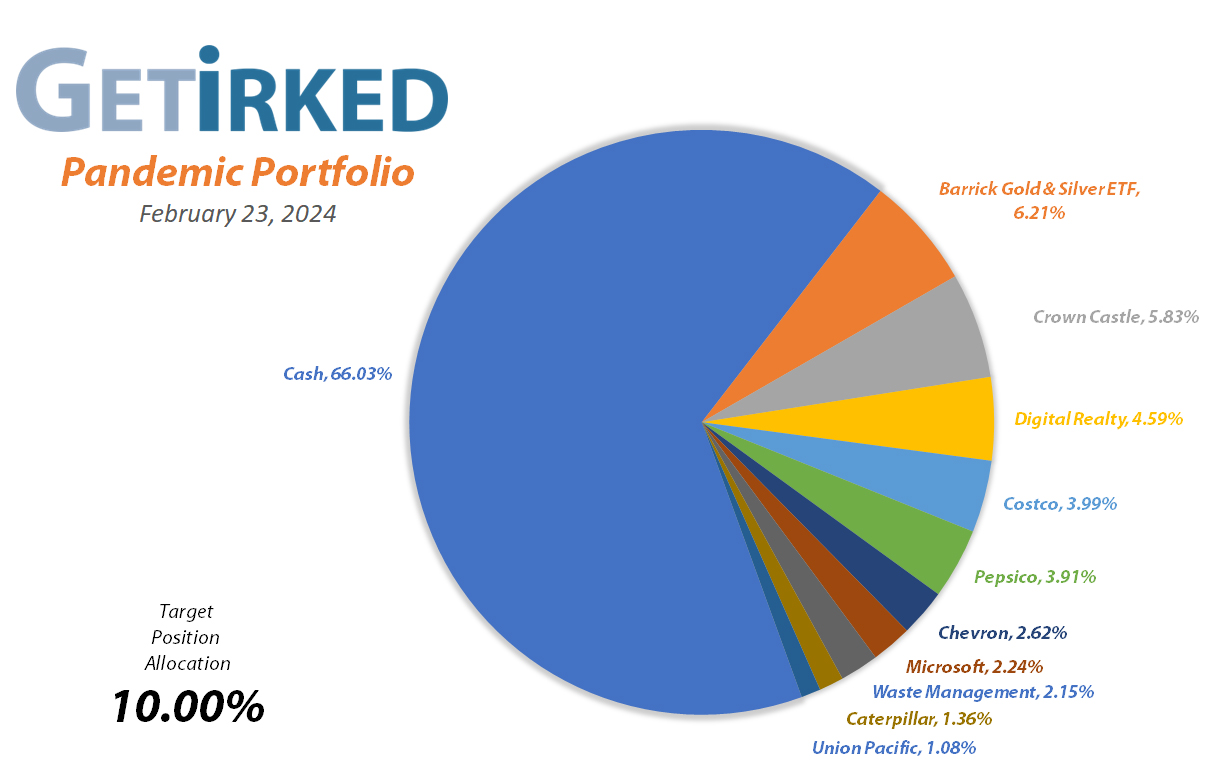

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

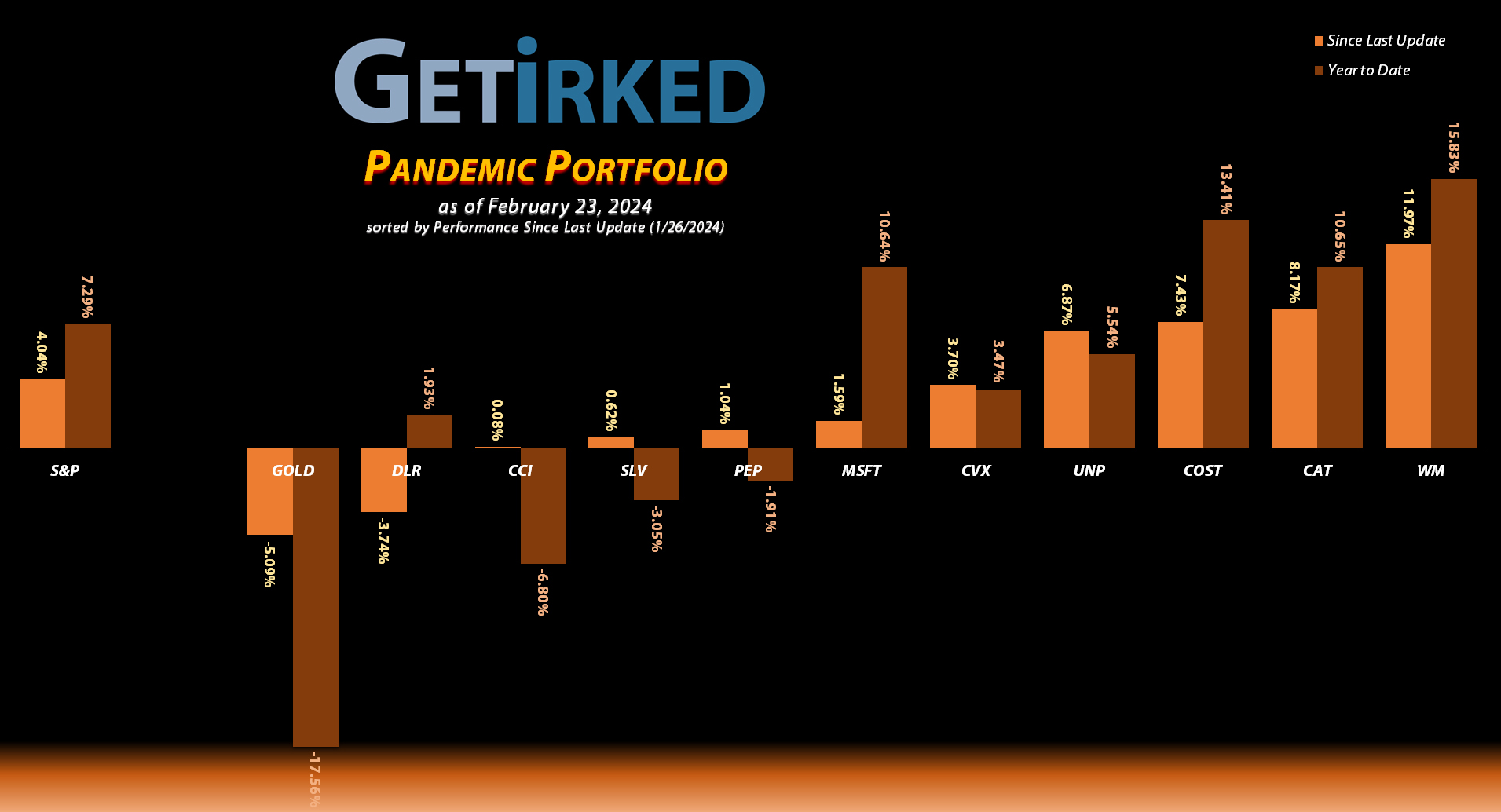

Barrick Gold (GOLD): Added to Position

Current Price: $14.75

Per-Share Cost: $18.00 (-1.75% since last update)

Profit/Loss: -18.05%

Allocation: 5.68%* (+0.1% since last update)

Next Buy Target: $13.00

Despite gold, the precious yellow metal, performing well over the past few years, the gold miners have been downright hated, and rightfully so. Every time the goldbugs come out saying “This is it, gold is finally going to moon!” the pet rock hits a new high only slightly above the previous high, finds extreme resistance, and sells off, plummeting to Earth like the rock it is.

Accordingly, no one has faith in the gold mining stocks. They’ve come under extreme selling pressure and it seems like that won’t be going anywhere after the Consumer Price Index (CPI) shows inflation might not be as dead as we hoped.

On Tuesday, February 13, Barrick Gold (GOLD) collapsed a day before reporting earnings, filling my next buy order, adding 4.20% to my position at $14.17. The buy lowered my per-share cost -1.75% from $18.32 to $18.00. From here, my next buy target is $13.00, above a past point of support, and my next sell target is $20.24, just under the high GOLD saw in 2023.

GOLD is $14.75 as of this update, up +4.09% from where I added.

Caterpillar (CAT): *New Position*

Current Price: $323.87

Per-Share Cost: $314.97 (New since last update)

Profit/Loss: +2.83%

Allocation: 1.36%* (New since last update)

Next Buy Target: $284.03

When the markets sold off as a result of the unexpected rise in inflation from the Consumer Price Index (CPI) on Tuesday, February 13, I opened a new position in Caterpillar (CAT), the venerable industrial, buying 14.75% of my desired allocation at $314.97.

Caterpillar is the best-in-breed when it comes to construction equipment, and, strangely enough, is now a play on artificial intelligence. How? CAT announced in its recent earnings call that the company’s seeing a huge rise in sales to build data centers where the majority of A.I. computer equipment will be housed.

As with all the companies I hold in this portfolio, Caterpillar (CAT) has a dividend. While not huge at 1.66% annually, Caterpillar is a serial dividend-raiser which means this yield will likely increase as time moves on.

From here, my next buy target is $284.03, above a key level of support CAT has seen since in the past, and, since this is a brand-new position, I have no plans to take profits as this time.

CAT is $323.87 as of this update, up +2.83% from where I opened it.

Chevron (CVX): Strategy Update

Current Price: $154.68

Per-Share Cost: $145.55 (Unchanged since last update)

Profit/Loss: +6.27%

Allocation: 2.62%* (+0.08% since last update)

Next Buy Target: $139.76

Chevron (CVX) saw a significant bounce off of January’s low, particularly when the company reported an excellent quarter with good forward guidance. The bounce was so hard that I’ve raised my next buy target to $139.76, slightly above Chevron’s January low where I will add even more to the position.

Costco (COST): Dividend & Profit-Taking

Current Price: $737.93

Per-Share Cost: -$155.13* (-$348.19 since last update)

Profit/Loss: +310.15%

Allocation: 3.99%* (-2.12% since last update)

Next Buy Target: $680.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Costco (COST) paid out its quarterly dividend on Tuesday, February 20, which, after reinvesting, lowered my per-share cost -0.14% from $193.33 to $193.06.

Thanks to the company preferring special dividends to quarterly dividend raises and the huge capital gains the stock price has seen lately, Costco’s yield is currently 0.56% annually… definitely not great, but I’m not complaining.

I know this sounds counterintuitive, but after Nvidia (NVDA) reported a blowout quarter and instigated a massive rally across the board, Costco (COST) made new all-time highs so I decided it was time to get the remaining capital out of the position with a sale which filled at 740.46, selling 38.88% of my position and locking in +145.71% in gains on shares I bought for $301.36 back on June 12, 2020.

The sale lowered my per-share cost -$348.19 from $193.06 down to -$155.13 (a negative per-share cost indicates all capital has been removed in addition to $155.13 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I have no intention to sell any more of the position until Costco develops significantly more price action, however I will start adding back to the position if it pulls back to $680.89, a past point of support.

COST is $737.93 as of this update, down -0.34% from where I took profits.

Crown Castle (CCI): Strategy Update

Current Price: $108.72

Per-Share Cost: $126.24 (Unchanged since last update)

Profit/Loss: -13.88%

Allocation: 5.83%* (-0.04% since last update)

Next Buy Target: $95.99

When the Consumer Price Index (CPI) came in slightly hotter than expected mid-February, all of the Real Estate Investment Trusts (REITs) got hit pretty hard as the market had to reset expectations for when the Federal Reserve might start cutting interest rates. This included both Crown Castle (CCI) and Digital Realty Trust (DLR).

Crown reported decent earnings which helped stem the selloff, but I’m not super-confident that the selling pressure is done. Accordingly my next buy target is $95.99, above a level of support that CCI saw in the fourth quarter of 2023.

Digital Realty Trust (DLR): Strategy Update

Current Price: $137.84

Per-Share Cost: $98.05 (Unchanged since last update)

Profit/Loss: +40.58%

Allocation: 4.59%* (-0.22% since last update)

Next Buy Target: $103.43

Digital Realty Trust (DLR) seemed to recover from the CPI selloff that knocked down all of the REITs until it reported earnings and missed on Thursday, February 15. As a result, DLR sold off pretty substantially as investors were disappointed in pretty much every possible way.

I do still plan to buy above my cost basis (as much as I hate doing so) as I’ve taken a lot off the table in Digital Realty. My next buy target is $103.43, slightly above a point of support that DLR tested several times throughout 2022 and 2023.

Microsoft (MSFT): Strategy Update

Current Price: $410.34

Per-Share Cost: -$53.44* (Unchanged since last update)

Profit/Loss: +334.94

Allocation: 2.24%* (+0.01% since last update)

Next Buy Target: $368.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Microsoft (MSFT) was flying high – even making new all-time highs – until reviews of its Copilot offering, its generative AI assistant, were, let’s say, far less than stellar. As a result, Microsoft really started to sell off as investors started to question whether or not AI will add as much to Microsoft’s bottom line as quickly as everyone was thinking.

From here, I do still intend to add to the position, putting some of my profits back in, with my next buy target at $368.89, above a distinct floor of support that Microsoft built from mid-October to mid-December in 2023.

Pepsico (PEP): Strategy Update

Current Price: $169.60

Per-Share Cost: $96.62 (Unchanged since last update)

Profit/Loss: +75.53%

Allocation: 3.91%* (+0.01% since last update)

Next Buy Target: $155.97

Pepsico (PEP) has been trading in a pretty tight range since recovering from the GLP-1 weight loss drug scare from last October. There’s a lot of support just above $165 and a lot of resistance around $170-175. However, I’m not doing anything in either range until we either see Pepsi break out to the upside or break down to lower levels.

My next buy target is $155.97, just above the low PEP saw in October, and my next sell target is $196.21, just under Pepsi’s all-time high. If it continues to chop around here, I’ll continue to sit on my hands and remain patient.

iShares Silver ETF (SLV): Strategy Update

Current Price: $21.01

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +89.84%*

Allocation: 0.53%* (Unchanged since last update)

Next Buy Target: $19.10

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Initially, the precious metals took it on the chin when it looked like inflation might be coming back. No one wants to pile into gold and silver when there are high yields coming from Treasurys. However, both silver and gold caught a bid in the last week of February going into this update, and bounced a bit off their lows.

All that being said, I’m in no hurry to add to this position since I am still playing with the house’s money, so my next buy target remains at $19.10, a bit above the low SLV saw back in 4th quarter 2023.

Union Pacific (UNP): *New Position*

Current Price: $256.91

Per-Share Cost: $245.50 (New since last update)

Profit/Loss: +4.65%

Allocation: 1.08%* (New since last update)

Next Buy Target: $235.50

When the markets sold off as a result of the unexpected rise in inflation from the Consumer Price Index (CPI) on Tuesday, February 13, I opened a new position in Union Pacific (UNP), the locomotive transport, buying 11.43% of my desired allocation at $245.50.

Union Pacific is one of a handful of train companies, responsible for the vast majority of heavy transport throughout the United States. Additionally, their incredibly efficient diesel locomotive engines make this tranport also an Environmental/Social/Governance (ESG) play, strangely enough.

As with all the companies I hold in this portfolio, Union Pacific (UNP) has a dividend, currently sporting a very respectable 2.13% annual yield. From here, my next buy target is $235.50, above a key level of support UNP has seen in its past, and, since this is a brand-new position, I have no plans to take profits as this time.

UNP is $256.91 as of this update, up +4.65% from where I opened it.

Waste Management (WM): Strategy Update

Current Price: $208.05

Per-Share Cost: $34.95 (Unchanged since last update)

Profit/Loss: +495.34%

Allocation: 2.15%* (+0.22% since last update)

Next Buy Target: $155.48

Waste Management (WM) has spent all of 2024 doing nothing but heading higher and higher. Going into earnings, I fully anticipated that expectations were far too high for the company, however it surprised everyone including me by reporting an absolute blowout quarter.

Afterward, Waste Management even went on to set a new all-time high just under $205 before pulling back and settling down a bit. Despite all this bullish price action, I will continue to remain patient with this one as I’ve seen it sell off spectacularly several times in the years I’ve held it.

My next buy target has been raised to $155.48, substantially lower than current levels but quite a bit above a key level of support that WM has tested several times in 2023.

* Target allocation for each position in the portfolio is 10.00% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.