Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #49

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Some will win, some will lose…

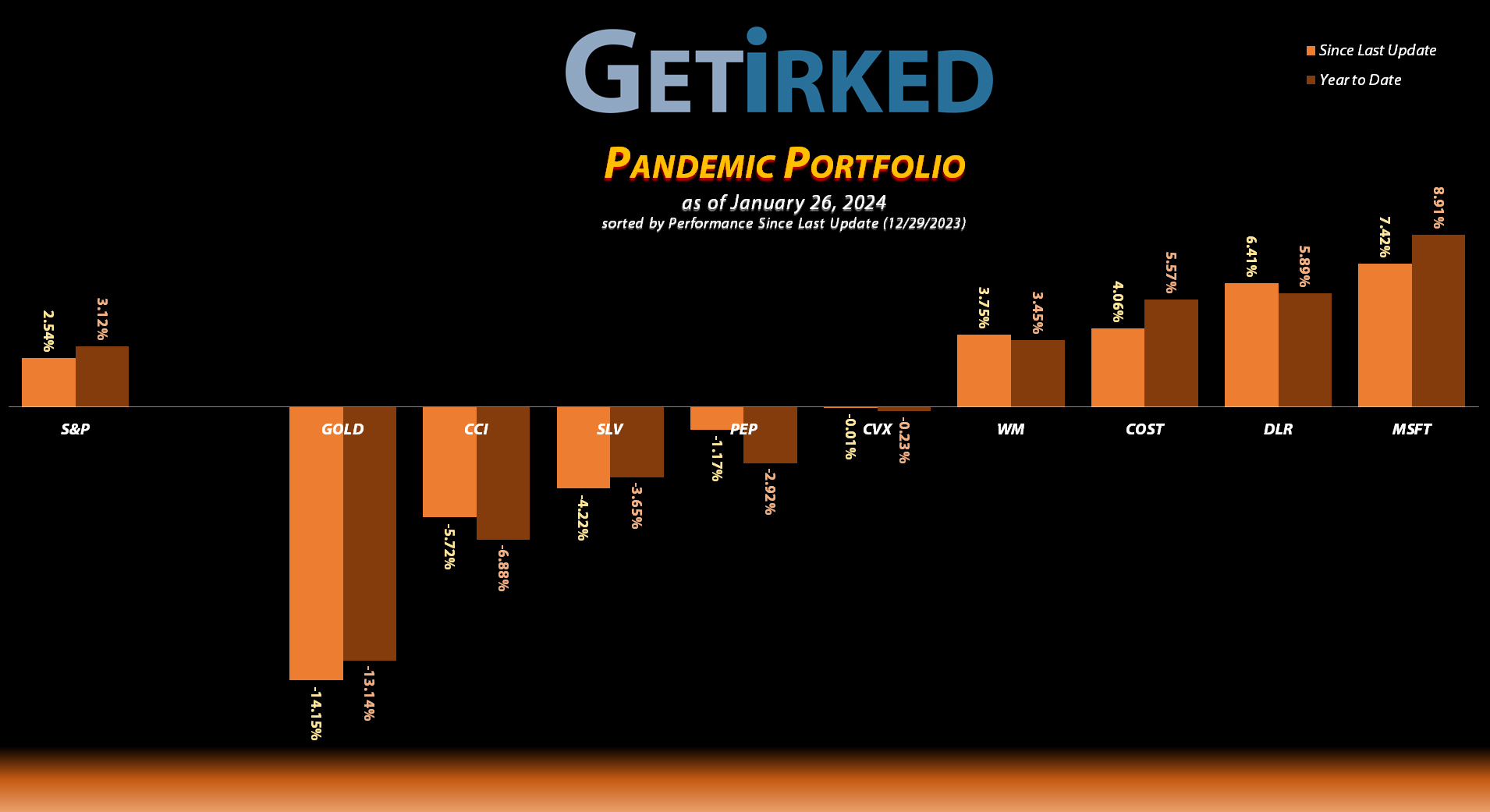

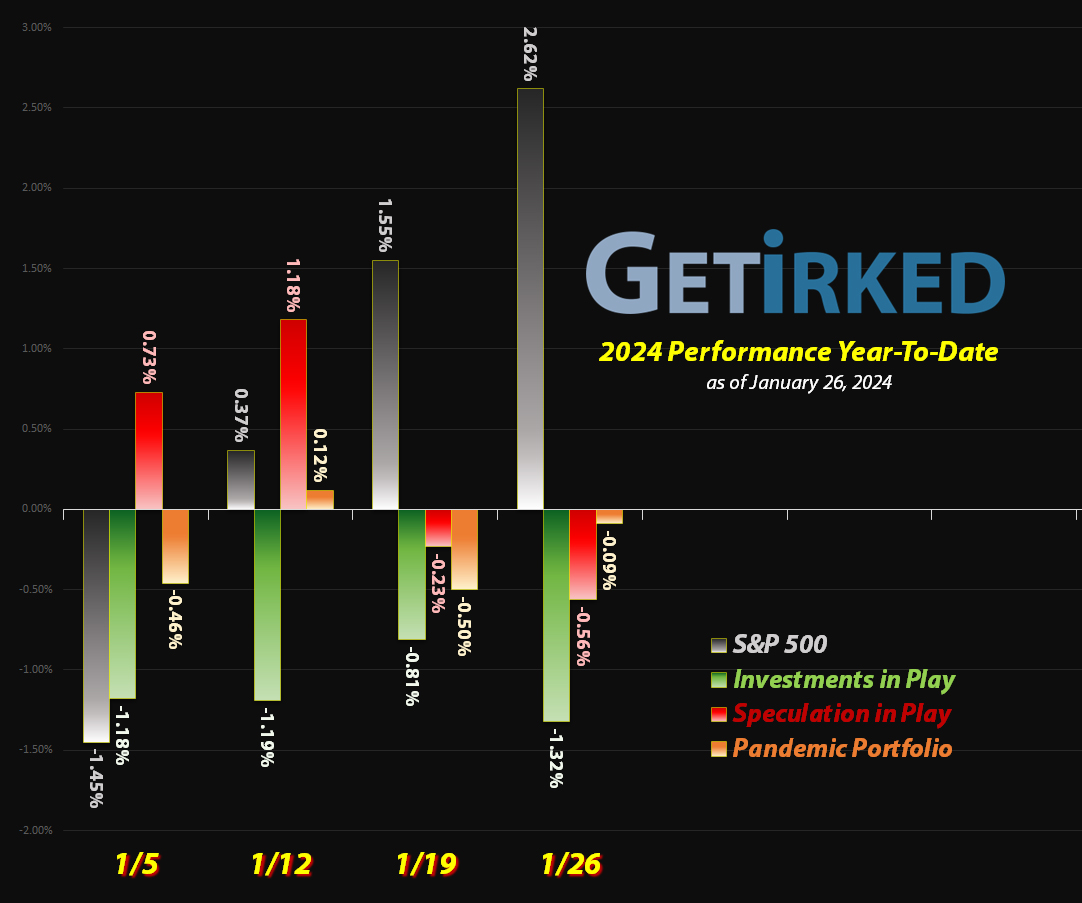

The Pandemic Portfolio’s done relatively well so far in 2024 despite having some real stinkers in the form of its precious metals exposure to Barrick Gold (GOLD) and the Silver ETF (SLV). However, others, such as obvious winner Microsoft (MSFT) and subtle outperformer Waste Management (WM) have really taken off.

Let’s take a look at the moves made since the last update.

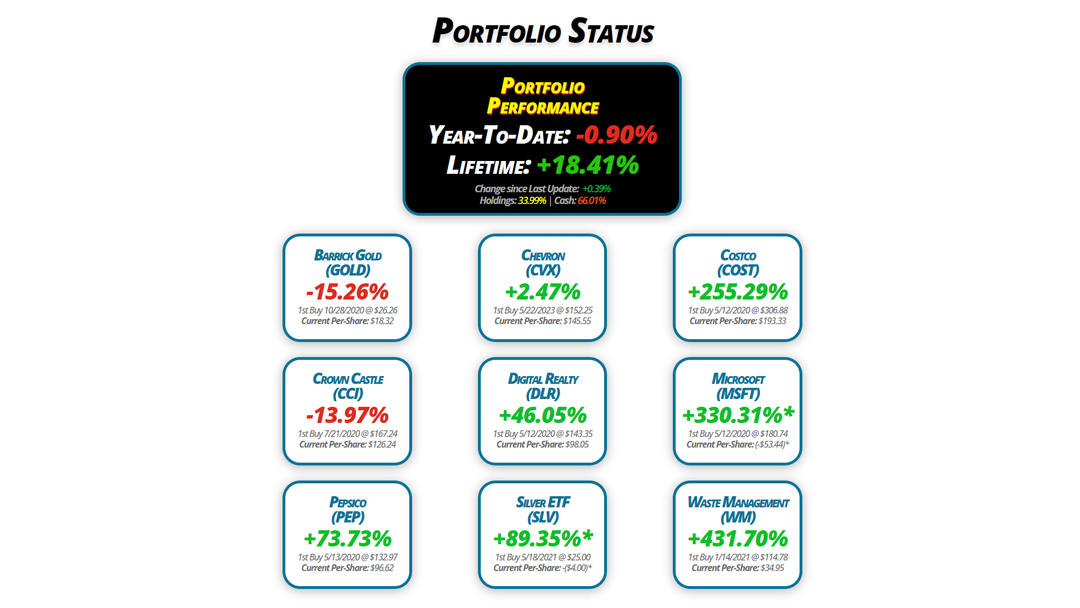

Portfolio Status

Portfolio

Performance

Year-To-Date: -0.90%

Lifetime: +18.41%

Change since Last Update: +0.39%

Holdings: 33.99% | Cash: 66.01%

Barrick Gold

(GOLD)

-15.26%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.32

Crown Castle

(CCI)

-13.97%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $126.24

Pepsico

(PEP)

+73.73%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $96.62

Chevron

(CVX)

+2.47%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $145.55

Digital Realty

(DLR)

+46.05%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $98.05

Silver ETF

(SLV)

+89.35%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Costco

(COST)

+255.29%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $193.33

Microsoft

(MSFT)

+330.31%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$53.44)*

Waste Management

(WM)

+431.70%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $34.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

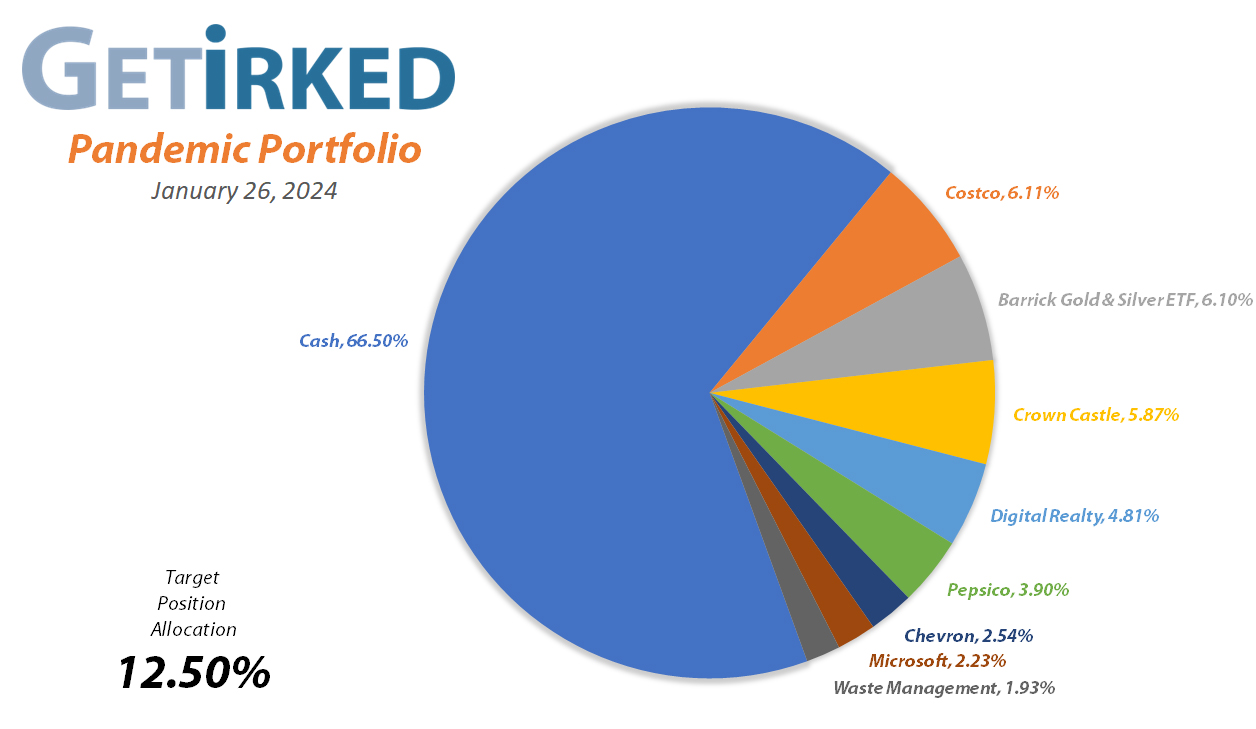

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $15.53

Per-Share Cost: $18.32 (Unchanged since last update)

Profit/Loss: -15.26%

Allocation: 5.57%* (-0.94% since last update)

Next Buy Target: $14.17

Goldbugs have been wrong so many times that it’s hard to take any of them seriously, anymore. After hitting a high toward the end of December, January has been an absolute disaster for both precious metal, but also the miners whose stocks have been positively decimated.

Barrick Gold (GOLD) sold off nearly 15% from the beginning of the year in an epic show of weakness. In fact, GOLD may actually hit my next buying target of $14.17 before the next update… it’s been that bad.

Chevron (CVX): Added to Position

Current Price: $149.15

Per-Share Cost: $145.55 (-0.75% since last update)

Profit/Loss: +2.47%

Allocation: 2.54%*(+0.62% since last update)

Next Buy Target: $137.49

Chevron (CVX) and the rest of the oil sector pulled back when oil prices started to get weak mid-January. This caused Chevron to trigger my next buy order, adding 8.40% to my position at $142.19 on Thursday, January 18.

While this buy only lowered my per-share cost -0.75% from $146.65 to $145.55, Chevron has seen so much support around these levels that I wanted to add more to the position in case CVX’s resilience holds and it heads higher from here. Additionally, Chevron’s dividend yield is nearly 4.25% at these prices, making it a very nice place to add to bring in more juicy income.

That being said, my next buy order is, of course, lower, down at $137.49 a price calculated using the Fibonacci Method and a point of support Chevron has seen before. My next sell target is $187.81, a bit below Chevron’s all-time high of $189.68 as well as below a key point of resistance CVX has seen in the past.

CVX is $149.15 as of this update, up +4.89% from where I added.

Costco (COST): *Special Dividend*

Current Price: $686.88

Per-Share Cost: $193.33 (-7.20% since last update)

Profit/Loss: +255.29%

Allocation: 6.11%* (+0.22% since last update)

Next Buy Target: $546.89

Costco (COST) paid out its long-awaited, bountiful $15/shr special dividend on Friday, January 12. Unfortunately, Schwab doesn’t allow special dividends to automatically reinvest for some reason, however the effect remains the same. The dividend lowered my per-share cost -7.20% from $208.33 to $193.33.

From here, my next buy target is $546.89, above a key level of support, and my next sell target is $739.59, a price calculated using Fibonacci Method where I will remove the remaining investment capital from the position.

Crown Castle (CCI): Dividend Reinvestment

Current Price: $108.60

Per-Share Cost: $126.24 (-1.34% since last update)

Profit/Loss: -15.26%

Allocation: 5.87%* (-0.30% since last update)

Next Buy Target: $85.64

Crown Castle (CCI) paid out its substantial dividend on Tuesday, January 2, which, after reinvesting, lowered my per-share cost -1.34% from $127.95 down to $126.24. From here, I remain steadfast with my next buying target at $85.64, slightly above the low CCI saw in 2023, and my next sell target is $129.68.

Digital Realty Trust (DLR): Profit-Taking & Dividend

Current Price: $143.20

Per-Share Cost: $98.05 (-5.72% since last update)

Profit/Loss: +46.05%

Allocation: 4.81%* (-0.25% since last update)

Next Buy Target: $86.41

Digital Realty Trust (DLR) paid out its forth-quarter dividend on Monday, January 22, which, after reinvestment, lowered my per-share cost -0.86% down from $104.00 to $103.12.

On Friday, January 26, Digital Realty broke through my next sell target which filled at $143.43, selling 11.17% of the position. The sale locked in +6.42% in gains on shares I bought for $134.78 on November 24, 2020 and lowered my per-share cost -4.92% from $103.12 to $98.05.

I do believe in Digital Realty Trust for the long term, however its volatility over the past couple of years has taught me to have wider spreads between my buys and sells. Accordingly, my next buy target remains slightly above the low that DLR saw in May 2023 at $86.41, and my next sell target is just slightly higher than current levels at $158.21, below a past point of resistance.

DLR closed at $143.20, down +0.16% from where I took profits.

Microsoft (MSFT): Strategy Update

Current Price: $403.93

Per-Share Cost: -$53.44* (Unchanged since last update)

Profit/Loss: +330.31%

Allocation: 2.23%* (+0.15% since last update)

Next Buy Target: $342.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Any company with artificial intelligence (AI) exposure saw huge gains since the last update, and they don’t come any bigger than Microsoft (MSFT)… literally. During its January rally, Microsoft actually grew bigger than Apple (AAPL) – the biggest company in the U.S. stock market – in terms of market cap, making Mr. Softy the biggest in the land.

Even though Microsoft hit new all-time highs in the last week of January, I’m remaining steadfast with my next buying target at $342.89, a point of support I believe we’ll see in before 2024 is over. With Microsoft demonstrating such incredible strength, however, I do not have any plans to take additional profits; I’m curious to see how high the markets want to take this one.

Pepsico (PEP): Dividend Reinvestment

Current Price: $167.86

Per-Share Cost: $96.62 (-0.75% since last update)

Profit/Loss: +73.73%

Allocation: 3.90%* (-0.03% since last update)

Next Buy Target: $155.97

Pepsico (PEP) paid out its ample quarterly dividend on Monday, January 8, which, after reinvesting, lowered my per-share cost -0.75% from $97.35 to $96.62. While that yield may seem meager on a quarterly basis, it adds up to 3% annually, which is not shabby at all when you consider Pepsico has been growing substantially over the years.

From here, my next buy target is $155.97, above PEP’s 2023 low, and my next sell target is $196.21, just below Pepsico’s all-time high.

iShares Silver ETF (SLV): Strategy Update

Current Price: $20.87

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +89.35%*

Allocation: 0.53%* (-0.02% since last update)

Next Buy Target: $19.10

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Where gold goes, so does silver, and that was the case since the last update. Like its big, yellow brother, silver (SLV) sold off substantially from its highs seen at the very beginning of December. While it did rally into the year-end, it didn’t get near the relative performance of gold in January.

From its December 1st high to its low in January, silver sold off more than -14% before seeing an anemic bounce before the end of the month. Because of the weakness across the sector, I will not be raising my buy target from $19.10.

Waste Management (WM): Strategy Update

Current Price: $185.81

Per-Share Cost: $34.95 (Unchanged since last update)

Profit/Loss: +431.70%

Allocation: 1.93%* (+0.06% since last update)

Next Buy Target: $150.46

Waste Management (WM) has been on an absolute tear since bottoming in October last year, rallying +24.90% from its October 3 lows to its new all-time high hit on January 25. That’s an incredible performance for any stock, but it’s downright astounding when you consider Waste Management is more or less considered a utility company.

Despite its strong performance, I’m not raising my buying price target, yet, choosing to stay at $150.46 until we see where WM heads next. However, I will take profits if WM keeps up this near-parabolic move, with a sell target right before the round-number psychological support of $200 at $199.52.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.