Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #47

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Whipsaw Volatility roars across the Portfolio!

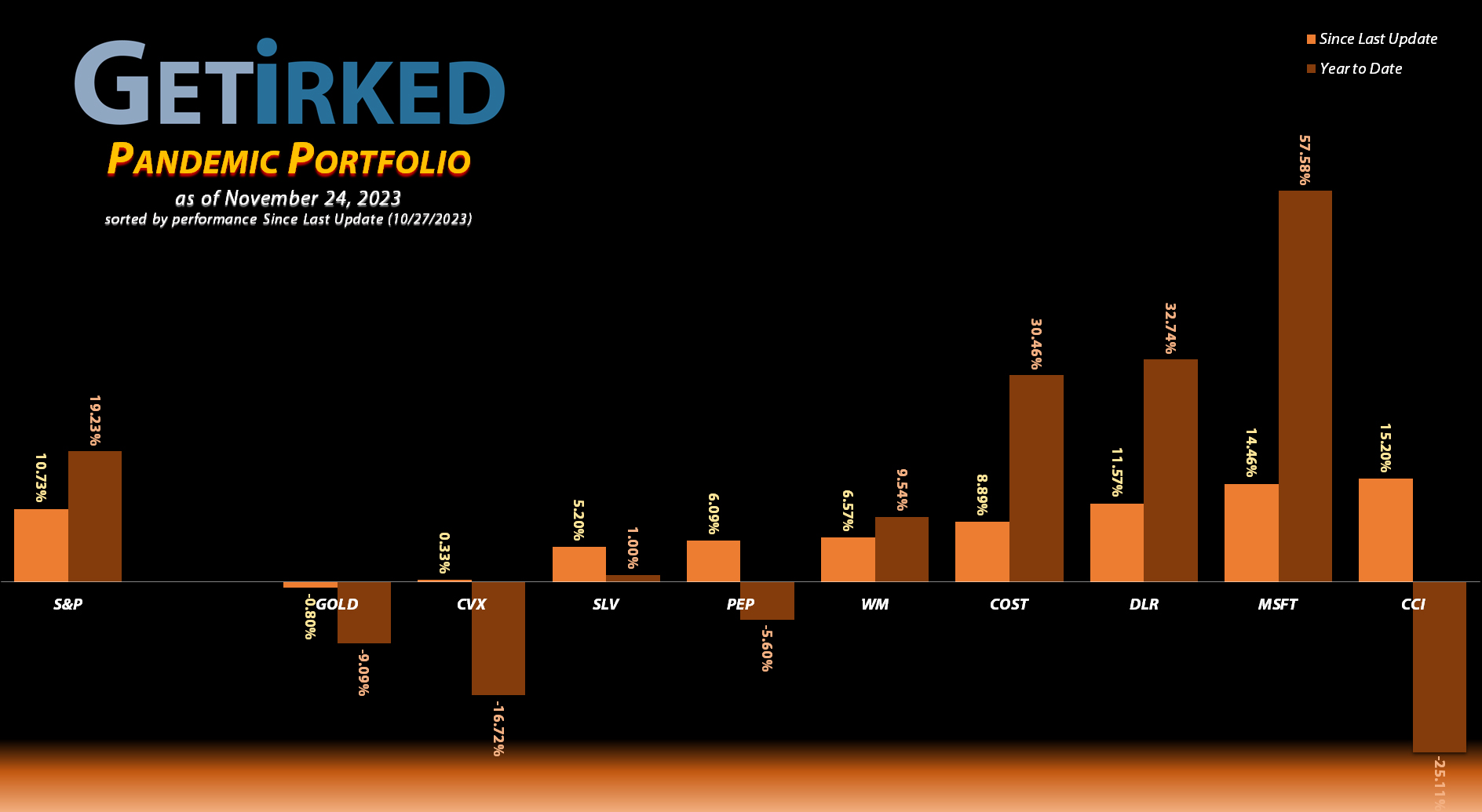

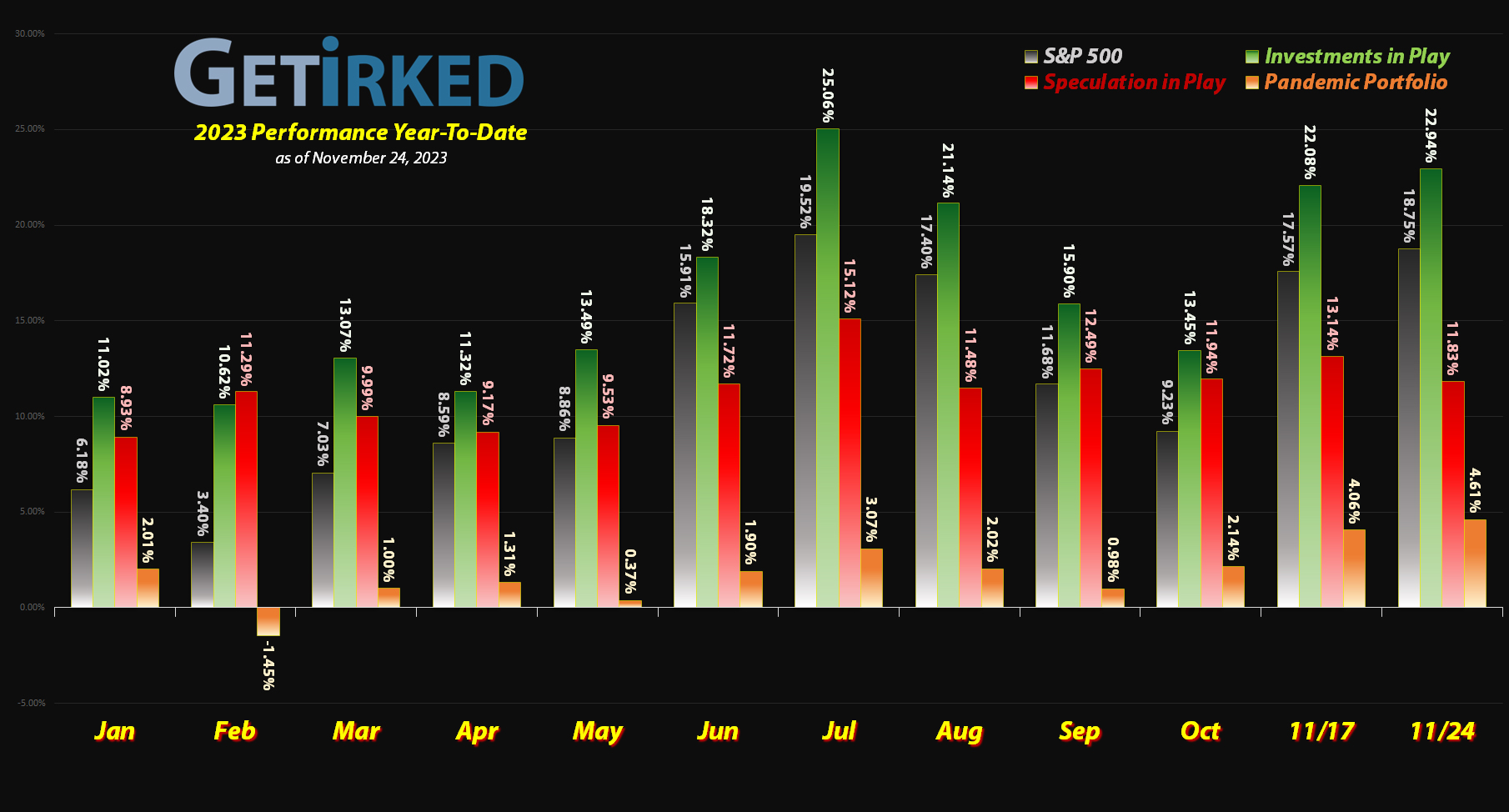

While September and October are seasonally volatile for the stock market, the bulls took control in November when the Consumer Price Index (CPI) came in slightly cooler than expected, perhaps indicating that inflation has peaked. The markets particularly roared to life, impacting every element of the Pandemic Portfolio as the yield on the 10-Year U.S. Treasury crashed from its 5.00% danger level to under 4.5%.

This caused Real Estate Investment Trusts (REITs) like Crown Castle (CCI) and Digital Realty (DLR), both held in this portfolio, to rally substantially, while causing precious metals to sell off. Accordingly, both Barrick Gold (GOLD) and the iShares Silver ETF (SLV), pulled back quite a bit on the result of the action in precious metals.

With Bulls predicting a rally into year-end and Bears predicting a Black Swan Event such as a credit event before the end of 2023, the stock market’s getting very exciting for everyone involved!

Let’s take a look at the moves made in the portfolio since my last update…

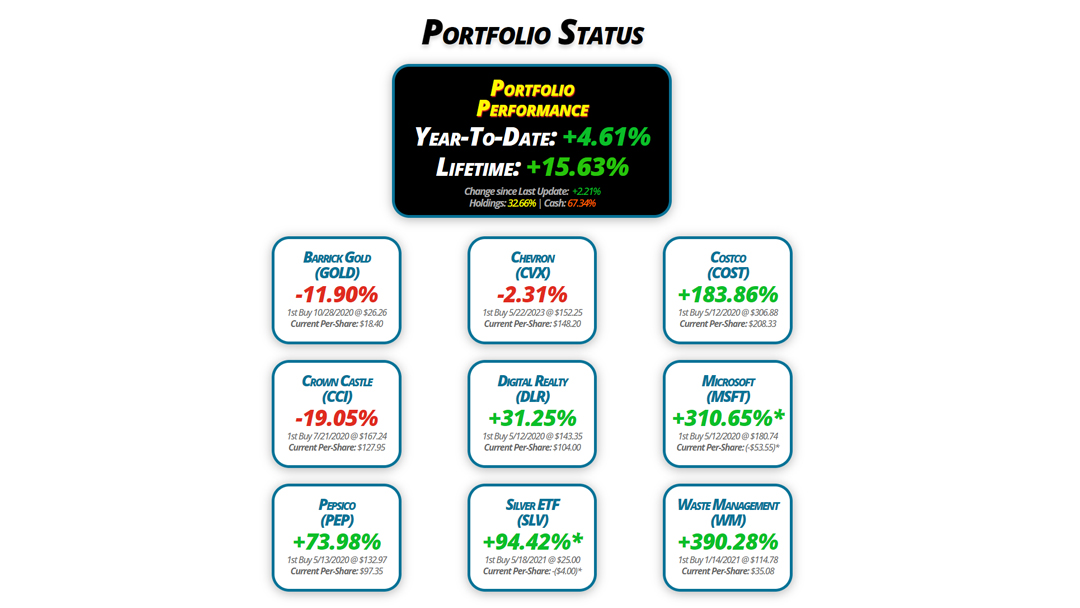

Portfolio Status

Portfolio

Performance

Year-To-Date: +4.61%

Lifetime: +15.63%

Change since Last Update: +2.21%

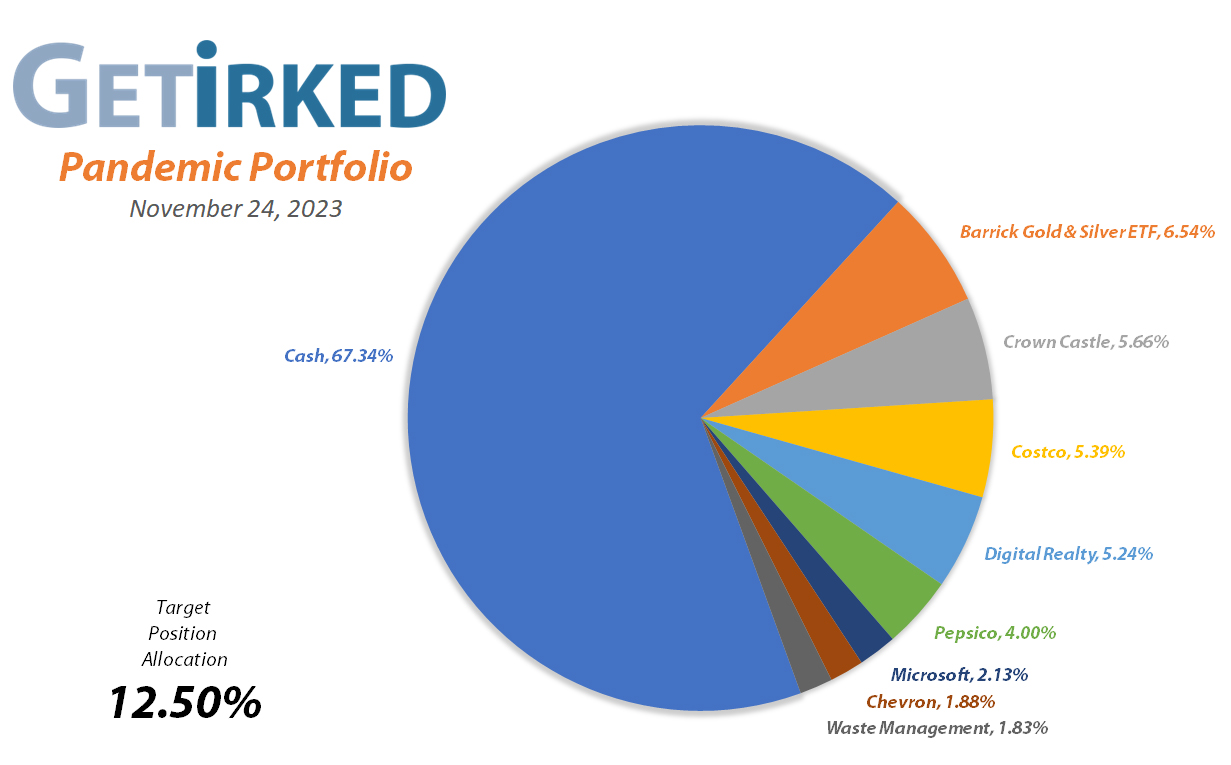

Holdings: 32.66% | Cash: 67.34%

Barrick Gold

(GOLD)

-11.90%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.40

Crown Castle

(CCI)

-19.05%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $127.95

Pepsico

(PEP)

+73.98%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $97.35

Chevron

(CVX)

-2.31%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $148.20

Digital Realty

(DLR)

+31.25%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $104.00

Silver ETF

(SLV)

+94.42%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Costco

(COST)

+183.86%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $208.33

Microsoft

(MSFT)

+310.65%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$53.55)*

Waste Management

(WM)

+390.28%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $35.08

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $16.21

Per-Share Cost: $18.40 (Unchanged since last update)

Profit/Loss: -11.90%

Allocation: 5.96%* (-0.21% since last update)

Next Buy Target: $14.00

The precious yellow metal has whipsawed quite a bit since the last update as it struggles against a strong U.S. dollar and weakening 10-year U.S. Treasury yield. This has caused the gold mining stocks to take a true pounding as skeptics believe gold won’t be able to hold its recent gains.

Accordingly, Barrick Gold (GOLD has remained in a range which means I just sit on my hands until something happens. My next buy target remains at $14.00 and my next sell target is $19.77

Chevron (CVX): Added to Position

Current Price: $144.78

Per-Share Cost: $148.20 (-1.65% since last update)

Profit/Loss: -2.31%

Allocation: 1.88%* (+0.59% since last update)

Next Buy Target: $137.38

When crude oil sold off early in November, it caused the entire energy sector to sell off with it. Chevron (CVX) triggered my next buy order on Wednesday, November 8 with a fill at $143.18 adding 8.11% to my allocation and lowering my per-share cost -1.65% from $150.69 to $148.20.

From here, my next buy target is $137.38, above a key level of support Chevron has tested in the past as well as a key Fibonacci Retracement level, and my next sell target is CVX’s all-time high at $189.68.

As of this update, CVX is $144.78, up +1.12% from where I added.

Costco (COST): Dividend Reinvestment

Current Price: $591.36

Per-Share Cost: $208.33 (-0.17% since last update)

Profit/Loss: +183.86%

Allocation: 5.39%*(+0.31% since last update)

Next Buy Target: $480.39

Costco (COST) paid out its quarterly dividend on Friday, November 17, which, after reinvesting, lowered my per-share cost -0.17% from $208.69 to $208.33.

Costco’s quarterly dividend is notoriously small because the company has historically paid out an ample special dividend from time-to-time, although it hasn’t paid out a special dividend in nearly three years, the last time being a $10.00/shr dividend paid on December 1, 2020. Many analysts believe a special dividend will be coming very soon, however these analysts have been saying that for more than a year now.

My next buying target for COST is $480.39, a level of support Costco has tested many times over the past two years, and my next sell target is $699.46, below the psychological $700 point of resistance and much greater than Costco’s current all-time of $612.27.

Crown Castle (CCI): Strategy Update

Current Price: $103.58

Per-Share Cost: $127.95 (Unchanged since last update)

Profit/Loss: -19.05%

Allocation: 5.66%* (+0.61% since last update)

Next Buy Target: $85.00

When the yield on the 10-Year U.S. Treasury pulled back substantially from the near-magical 5.00% level, the Real Estate Investment Trusts (REITs) like Crown Castle (CCI) and Digital Realty Trust (DLR) really caught a bid as investors looked for decent yields higher than a potentially-peaked 10-Year bond.

Crown Castle rallied nearly +25% off its low set in October. Accordingly, I have raised my next buy target to $85.00, above its October low. My next sell target is $129.69, above my cost basis and below the next level of resistance.

Digital Realty Trust (DLR): Profit-Taking x 2

Current Price: $136.50

Per-Share Cost: $104.00 (-4.76% since last update)

Profit/Loss: +31.25%

Allocation: 5.24%* (-0.68% since last update)

Next Buy Target: $86.71

Digital Realty Trust (DLR) saw a significant pop following the Federal Reserve meeting on Tuesday, November 1, where the Fed decided to pause rate hikes once more. On Wednesday, November 2, DLR triggered my next sell order which filled at $129.44, selling 9.19% of my allocation.

On Friday, November 3, DLR continued to rally, triggering my next sell order which sold another 10.12% of my position and filled at $135.12, giving me an average selling price of $132.28.

The combined sales locked in an +21.14% gain over my cost basis and lowered my per-share cost -4.76% down from $109.20 to $104.00. From here, my next sell target is $143.39, slightly below the next point of resistance, and my next buy target is $86.71, a bit above the low DLR saw in June.

DLR is $136.50 as of this update, up +3.19% from my $132.28 average sale.

Microsoft (MSFT): Strategy Update

Current Price: $377.45

Per-Share Cost: -$53.55* (Unchanged since last update)

Profit/Loss: +310.65%

Allocation: 2.13%* (+0.23% since last update)

Next Buy Target: $311.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Microsoft (MSFT) rallied substantially off its October lows thanks to its artificial intelligence exposure. Over the last weekend before this update, it looked like things could get rocky for the AI sector as OpenAI suddenly terminated Sam Altman, its CEO and noted AI spokesperson, on the evening of Friday, November 17.

However, by Sunday night, Microsoft announced that it had scooped up Altman and some of his colleagues who left OpenAI following their sudden announcement, and that Altman would be leading Microsoft’s internal AI division which caused the stock to rally even more when markets reopened Monday.

My next buy target is $311.89, above a key level of support that Microsoft tested several times in 2023, and I still have no sell targets in MSFT since I’m playing with the House’s Money and this stock has been incredibly volatile.

Pepsico (PEP): Strategy Update

Current Price: $169.37

Per-Share Cost: $97.35 (Unchanged since last update)

Profit/Loss: +73.98%

Allocation: 4.00%* (+0.12% since last update)

Next Buy Target: $156.15

Pepsico (PEP) has recovered a bit from its selloff in early October following Wal-Mart’s (WMT) illogical claims that GLP-1 weight loss drugs were impacting consumers’ eating habits (as opposed to inflation, which was the far more likely cause for consumers pulling back on spending).

Given that PEP held its low so well in October, I have raised my next buy target to $156.15, slightly above that low, where I will add more to this stalwart. As for my next sell target, I’m eyeing $195.48, slightly below Pepsico’s all-time high at $196.88 which it set in May.

iShares Silver ETF (SLV): Strategy Update

Current Price: $22.28

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +94.42%

Allocation: 0.58%* (+0.01% since last update)

Next Buy Target: $19.10

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Just like gold, silver has also been whipsawing quite a bit since my last update. However, since it held a pretty strong low at the beginning of September, I have raised my next buy target to $19.10, slightly above that precise low.

Waste Management (WM): Profit-Taking

Current Price: $172.01

Per-Share Cost: $35.08 (-53.20% since last update)

Profit/Loss: +390.28%

Allocation: 1.83%* (-0.65% since last update)

Next Buy Target: $150.32

Waste Management (WM) made an incredible recovery off its low under $150.00 set in October, rallying more than +15% before finding resistance just under $173.00.

When it made another try to break higher on Friday, November 24, I decided it was time to trim profits as WM is dangerously close to its all-time high and is quite overbought in just a few weeks.

My sale cut 28.92% of my allocation filling at $172.82 and locking in +54.15% in gains on shares I bought for $112.11 back on January 27, 2021. The sale lowered my per-share cost -53.20% from $74.96 to $35.08. From here, my next buy target is $150.32, just above the low WM saw in early October, and my next sell target is $199.49, just under that key psychological resistance at $200.

WM is $172.01 as of this update, down -0.47% from where I took profits.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.