Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #46

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

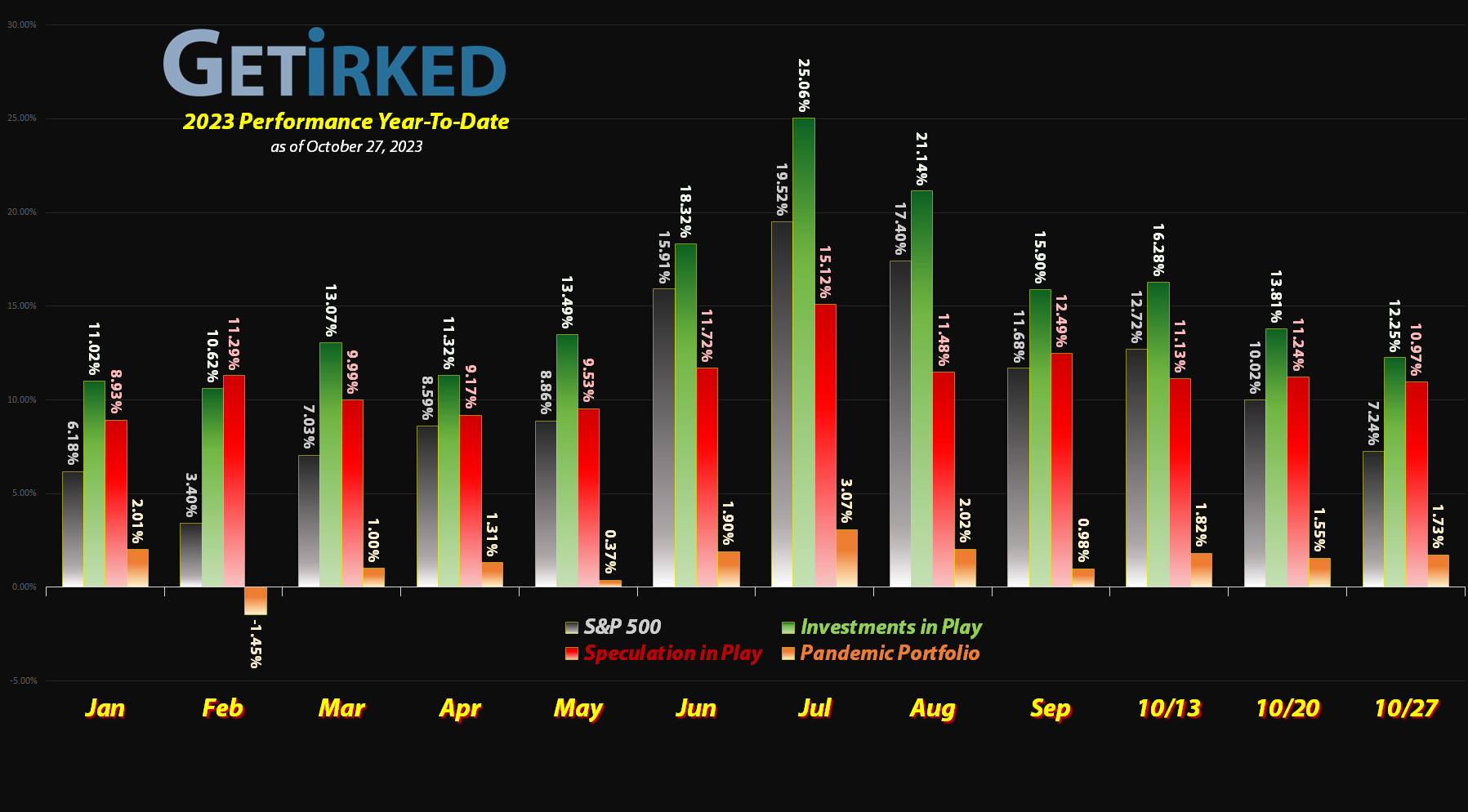

Will Market Volatility continue into November?

Anyone who tries to dispute the volatility we typically see during September and October every year simply isn’t paying attention. The selling starts as a result of institutions and hedge funds whose fiscal years end in September locking in gains to impress their clients.

This selling typically begets more selling as the professionals who didn’t lock in gains early enough start to jump on the band wagon before those gains turn to losses. Of course, it doesn’t take much to create a bit of a market panic as weak hands decide to “shoot first and ask questions later.” Then, October hits and a lot of firms add back in which causes whipsaw action.

And, that’s during a year with no positive or negative catalysts muddying up the waters! As you might imagine, take a year with a lot going on between a the U.S. 10-Year Treasury yield crossing 5% for the first time in more than 16 years, a House of Representatives in disarray, and not one but two wars going on in the world, and you’ve got a recipe for volatility.

The big question is – will the volatility continue into November or will we see a rally into the year end that many analysts are predicting?

Let’s look at the moves I made in the portfolio since the last update…

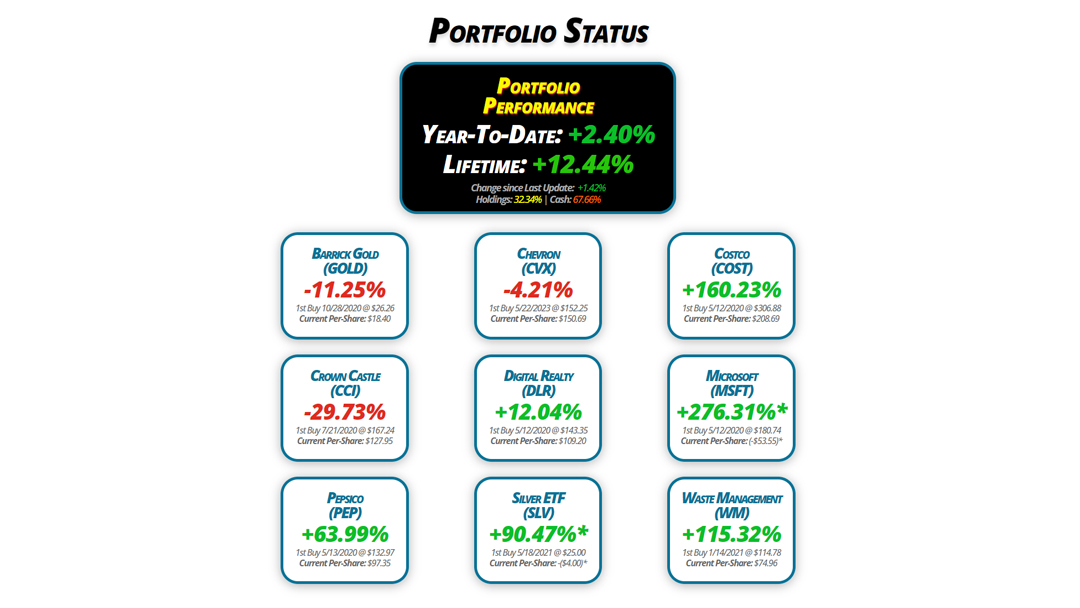

Portfolio Status

Portfolio

Performance

Year-To-Date: +2.40%

Lifetime: +12.44%

Change since Last Update: +1.42%

Holdings: 32.34% | Cash: 67.66%

Barrick Gold

(GOLD)

-11.25%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.40

Crown Castle

(CCI)

-29.73%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $127.95

Pepsico

(PEP)

+63.99%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $97.35

Chevron

(CVX)

-4.21%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $150.69

Digital Realty

(DLR)

+12.04%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $109.20

Silver ETF

(SLV)

+90.47%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Costco

(COST)

+160.23%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $208.69

Microsoft

(MSFT)

+276.31%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$53.55)*

Waste Management

(WM)

+115.32%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $74.96

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

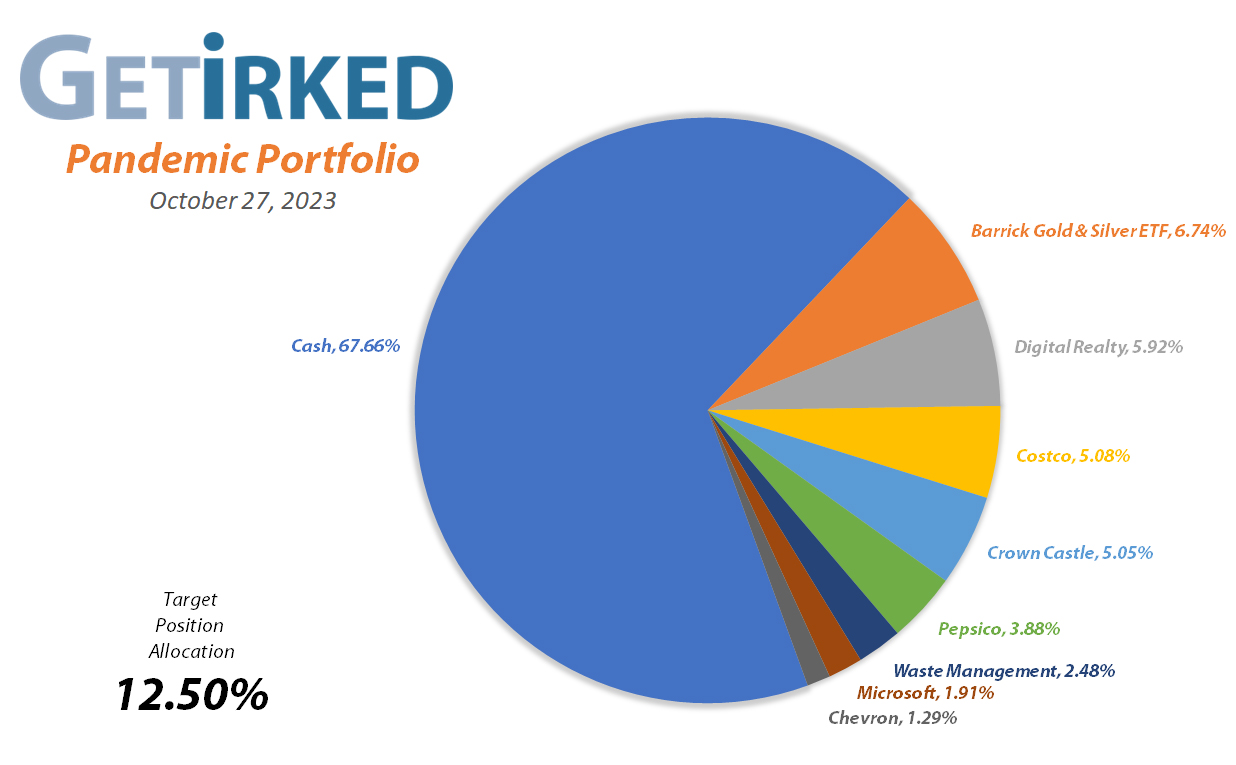

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

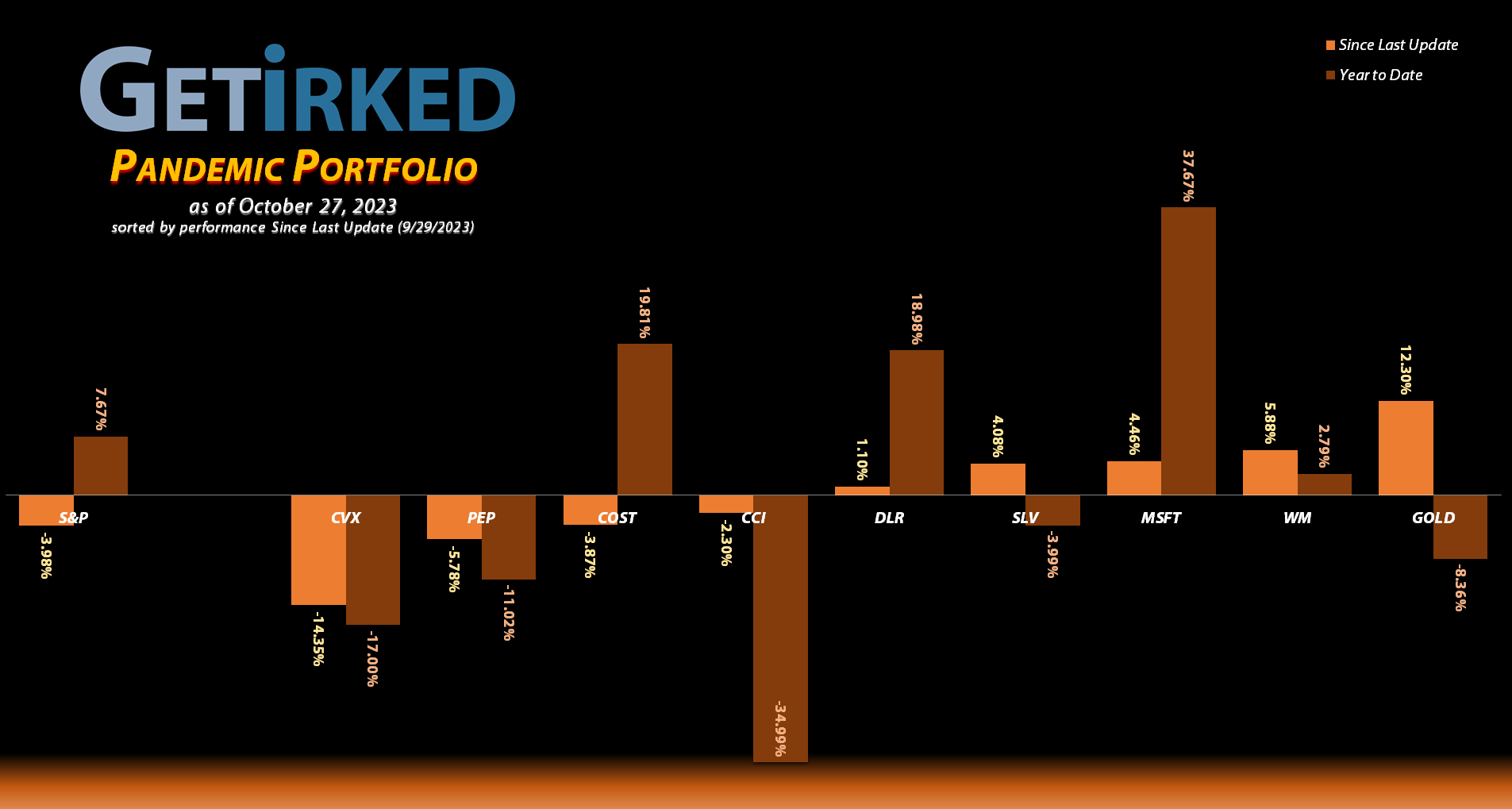

Barrick Gold (GOLD): Strategy Update

Current Price: $16.33

Per-Share Cost: $18.40 (Unchanged since last update)

Profit/Loss: -11.25%

Allocation: 6.17%* (+0.63% since last update)

Next Buy Target: $13.90

After selling off substantially even from last update, the precious yellow metal final got a massive bid and bottomed at the beginning of September and rallied spectacularly, bringing up all of the goldminers with it.

At this point, Barrick Gold (GOLD) is in a no man’s land for me, quite a bit under my next sell target at $19.77 and quite a bit above my next buy target at $13.90.

Chevron (CVX): Added to Position

Current Price: $144.35

Per-Share Cost: $150.69 (-0.13% since last update)

Profit/Loss: -4.21%

Allocation: 1.29%* (+0.53% since last update)

Next Buy Target: $141.08

I added to my Chevron (CVX) when it disappointed on earnings on Friday, October 27, and flew through my next buy target with the order filling at $150.51. The buy added 7.94% to my position and lowered my per-share cost -0.13% down from $150.88 to $150.69.

From here, my next buy target is $141.08, above a past point of support that Chevron saw in September 2022, and I continue to hold off taking profits in this position as I’m still in the early building stages.

As of this update, CVX is $144.35, down -4.09% from where I added.

Costco (COST): Strategy Update

Current Price: $543.08

Per-Share Cost: $208.69 (Unchanged since last update)

Profit/Loss: +160.23%

Allocation: 5.08%*(-0.24% since last update)

Next Buy Target: $480.39

After beating on earnings at the end of September, Costco (COST) continued its rally until the market started pulling back mid-month in October. However, COST still needs to pull back substantially more in order to hit my next buy target at $480.39, above a past point of support.

Additionally, since this position continues to perform well for me, I have no plans to take any profits for the moment, even if it reaches its all-time high at $612.27.

Crown Castle (CCI): Dividend Reinvestment

Current Price: $89.91

Per-Share Cost: $127.95 (-1.54% since last update)

Profit/Loss: -29.73%

Allocation: 5.05%*(-0.08% since last update)

Next Buy Target: $80.91

Crown Castle (CCI) paid out its quarterly dividend on Monday, October 2, which, after reinvestment, lowered my per-share cost -1.54% down from $129.95 to $127.95.

The past few months have been particularly rough on CCI, so I’m maintaining my buy target at $80.91, despite that point of support being significantly below CCI’s pandemic bottom. Additionally, I’ll start pulling profits out of this position if it tests the recent highs it saw in March with my next sell target at $131.44.

Digital Realty Trust (DLR): Dividend Reinvestment

Current Price: $122.35

Per-Share Cost: $109.20 (-1.00% since last update)

Profit/Loss: +12.04%

Allocation: 5.92%* (+0.08% since last update)

Next Buy Target: $87.24

Digital Realty Trust (DLR) paid out its ample quarterly dividend on Monday, October 2, which, after reinvestment, lowered my per-share cost -1.00%, down from $110.30 to $109.20.

From here, my next buy target is $87.24, above DLR’s lows from both May of this year as well as October of 2022, and my next sell target is $133.39, right at Digital Realty’s recent high.

Microsoft (MSFT): Strategy Update

Current Price: $329.81

Per-Share Cost: -$53.55* (Unchanged since last update)

Profit/Loss: +276.31%

Allocation: 1.91%* (+0.07% since last update)

Next Buy Target: $311.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Despite the weakness in the markets in October, Microsoft (MSFT) has held up exceptionally well, not even getting close to testing the lows it saw in September.

My next buy target had been around $294.18, a point of support below September’s lows, but after seeing the resilience Microsoft has been demonstrating, I’ve raised my next buy target to $311.89, right above the lows MSFT saw in September.

Additionally, since I’ve already taken all of the capital (and some profits) out of this position, I’m going to hold fast with no additional sell targets for the time being.

Pepsico (PEP): Added x 2 & Dividend Reinvestment

Current Price: $159.64

Per-Share Cost: $97.35 (+$38.25 since last update)

Profit/Loss: +63.99%

Allocation: 3.88%* (+1.27% since last update)

Next Buy Target: $153.89

Pepsico (PEP) continued to struggle along with the rest of consumer staples right off the bat at the beginning of October, triggering my next buy order which added 10.16% to my allocation at $167.54 on Monday, October 2, locking in a -9.62% discount replacing shares I sold for $185.38 back on April 20, 2023. Since I was purchasing above my cost basis, the buy raised my per-share cost +$24.45 from $59.10 to $83.55.

Also on October 2, PEP paid out its quarterly dividend which, after reinvestment, lowered my per-share cost -0.57% from $83.55 to $83.07.

On Thursday, October 5, the selling returned in earnest, sending Pepsico through my next buy target which filled at $161.06, adding +9.60% to the allocation and giving me an average buy price of $164.30. The buy also locked in a -10.91% discount on shares I sold for $180.78 on October 26, 2022. This buy raised my per-share cost an additional +17.19% up to $97.35.

From here, my next buy target is $153.89, above a past point of support, and my next sell target is $196.37, slightly under PEP’s all-time high

PEP is $159.64 as of this update, down -2.84% from my $164.30 average buy.

iShares Silver ETF (SLV): Strategy Update

Current Price: $21.18

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +90.47%

Allocation: 0.57%* (+0.02% since last update)

Next Buy Target: $19.10

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Just like gold, silver pulled back quite a bit at the beginning of the month before finding a bottom and rallying pretty incredibly. Accordingly, I’ve raised my next buy target for my Silver ETF (SLV) position to $19.10, slightly above the low silver saw at the beginning of October.

My next sell target remains right at $24.00, just a bit above the highs silver saw earlier in 2023. Since this position is entirely the “House’s Money,” I’m in no hurry to take additional profits until SLV hits my targets.

Waste Management (WM): Strategy Update

Current Price: $161.41

Per-Share Cost: $74.96 (Unchanged since last update)

Profit/Loss: +115.32%

Allocation: 2.48%* (+0.12% since last update)

Next Buy Target: $150.39

At the beginning of October, Waste Management (WM) got within a whisper of my buy target right around $149.00 before making a bottom, finding support, and rebounding throughout the month.

During the last week of October, Waste Management gave a blowout earnings report. Accordingly, I’ve raised my target to $159.39, slightly above the bottom Waste Management saw several weeks ago so I can add back to this position if it decides to retest that area once more.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.