Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #45

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Long term investors: Embrace the selloff!

Many long-term investors and traders dread pullbacks and corrections. In more than 25 years in the market, I’ve learned to embrace and actually enjoy systemic selloffs. With a time horizon of more than 20 years, systemic selloffs cause even the best-quality stocks to sell off, some times dramatically.

In most cases, these selloffs allow investors to pick stocks that have no inherent single-company risk. There isn’t a negative catalyst affecting any single stock, the catalyst is system-wide, causing every stock to sell off, regardless of whether or not that’s reasonable.

As a result, there are buying opportunities everywhere during a systemic selloff. Of course, since we don’t know how much lower stocks will go, I always buy in stages using small quantities so I can buy more if the stock goes lower.

I think of it this way – if my favorite clothing store had a 35% storewide sale today, would I wait because it wasn’t a 50% off sale? No. I’d go in and buy some clothes. If tomorrow, that same store had a 50% sale, would I sell the clothes I bought today at a 15% loss? No! I’d go back and buy more!

The key to being a long-term investor is picking quality stocks of quality companies. If you believe in the company for the long term, buying more when a stock’s price is cut by 30%, 50%, or more is a no-brainer.

However, I didn’t always feel this way. When I started investing, selloffs scared the heck out of me. I had to train myself to think this way.

If the fear still gets to you, make sure you create buying plans for all of your positions in advance and then place limit orders. This way, you don’t have to watch the market sell off – you can trust the work you did when you were objective and unemotional.

Do the work, trust yourself, and, remember, this too shall pass.

Let’s take a look at the moves made in the portfolio since the last update…

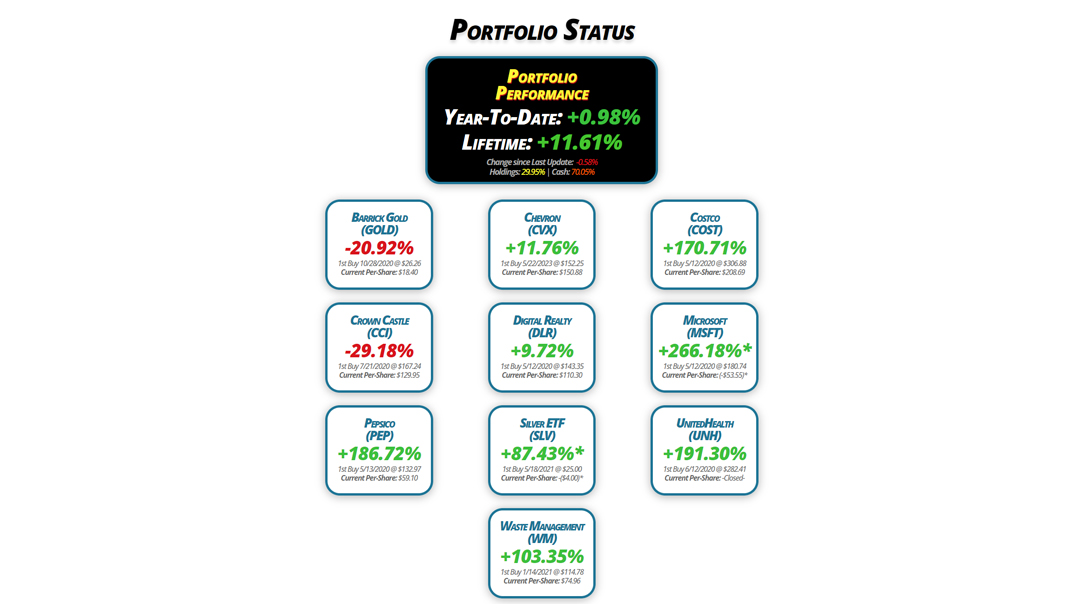

Portfolio Status

Portfolio

Performance

Year-To-Date: +0.98%

Lifetime: +11.61%

Change since Last Update: -0.58%

Holdings: 29.95% | Cash: 70.05%

Barrick Gold

(GOLD)

-20.92%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.40

Crown Castle

(CCI)

-29.18%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $129.95

Pepsico

(PEP)

+186.72%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $59.10

Chevron

(CVX)

+11.76%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $150.88

Digital Realty

(DLR)

+9.72%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $110.30

Silver ETF

(SLV)

+87.43%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Waste Management

(WM)

+103.35%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $74.96

Costco

(COST)

+170.71%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $208.69

Microsoft

(MSFT)

+266.18%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$53.55)*

UnitedHealth

(UNH)

+191.30%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: -Closed-

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

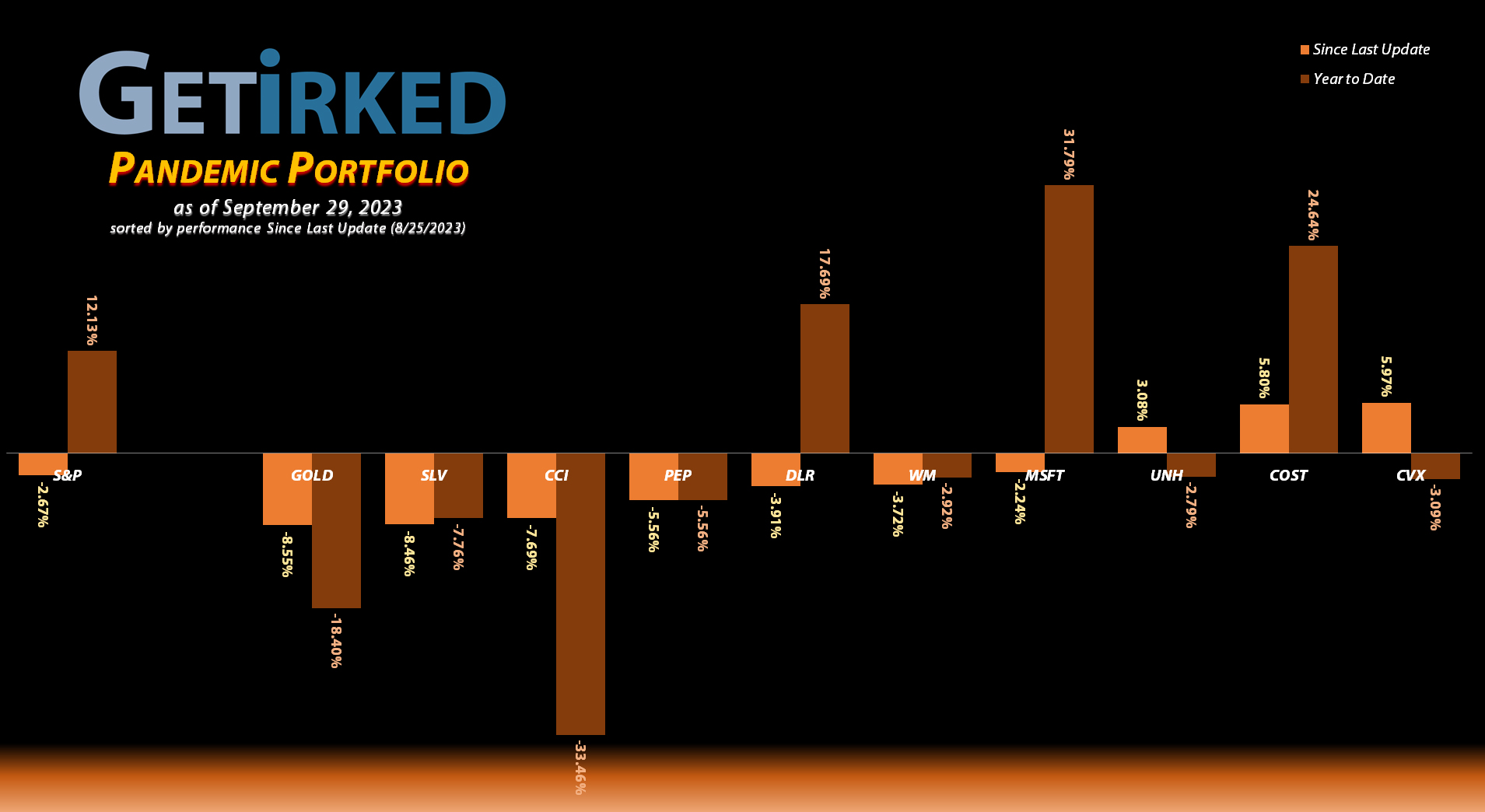

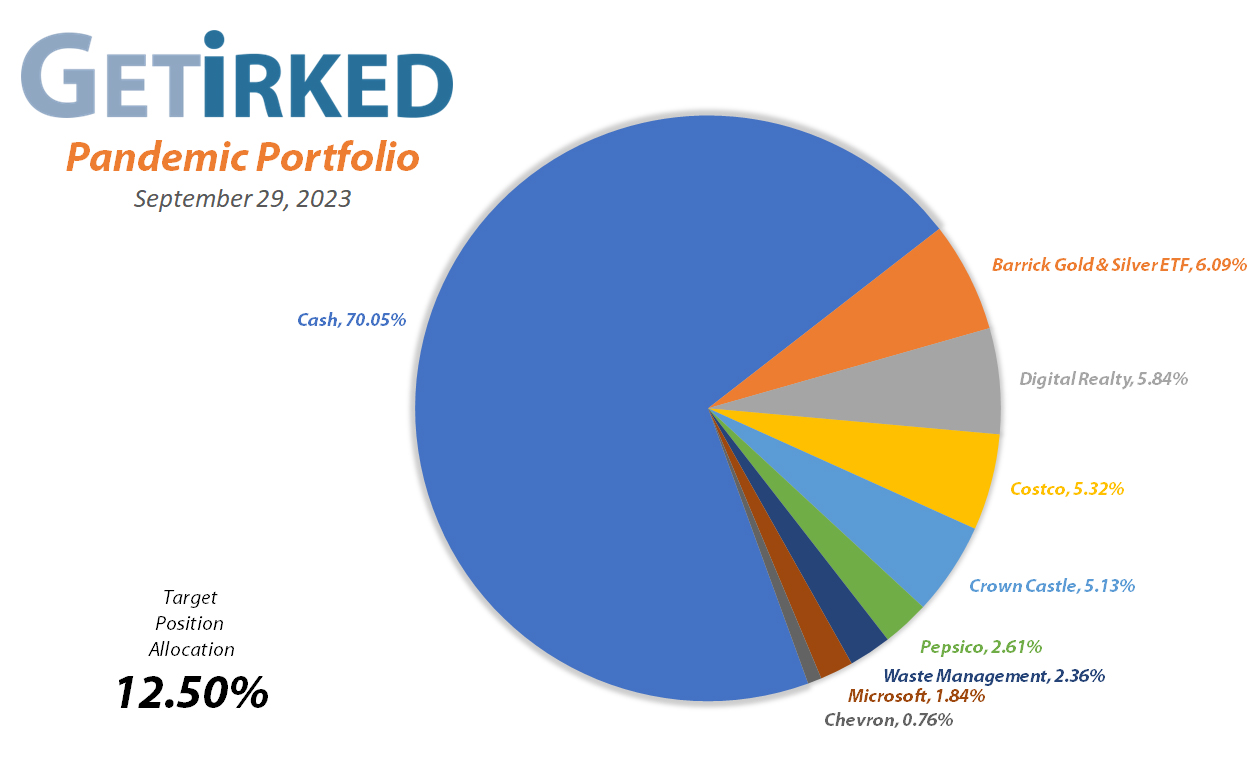

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added & Dividend Payout

Current Price: $14.55

Per-Share Cost: $18.40 (-0.92% since last update)

Profit/Loss: -20.92%

Allocation: 5.54%* (-0.34% since last update)

Next Buy Target: $13.14

Barrick Gold (GOLD) paid out its quarterly dividend on Friday, September 125 which lowered my per-share cost -0.48% from $18.57 down to $18.48. Unfortunately, since Barrick is headquartered in Canada, my broker doesn’t permit reinvesting, but that the payout still serves to lower my cost basis.

On Wednesday, September 27, GOLD dipped below $15 and triggered my next buy order which filled at $14.99 adding just 1.48% to my allocation. The buy locked in a 24.10% discount replacing some of the shares I sold for $19.75 on May 3, 2023 and lowered my per-share cost -0.43% down from $18.48 to $18.40. Since I feel gold could continue to sell off, I’m using very small quantities.

From here, my next buy target is $13.14, slightly above GOLD’s 2022 low. My next sell target is $19.77, below a point of resistance Barrick has seen many times over the past few years.

As of this update, GOLD is $14.55, down -2.94% from where I added.

Chevron (CVX): Dividend Reinvestment

Current Price: $168.62

Per-Share Cost: $150.88 (-0.90% since last update)

Profit/Loss: +11.76%

Allocation: 0.76%* (+0.05% since last update)

Next Buy Target: $150.82

Chevron (CVX) paid out its quarterly dividend on Tuesday, September 12, which, after reinvesting, lowered my per-share cost -0.90% from $152.25 down to $150.88.

From here, my next buy target is $150.82, above a past point of support, and I have no sell targets at this time as I continue to build my allocation in this long-term holding.

Costco (COST): Dividend Reinvestment

Current Price: $564.96

Per-Share Cost: $208.69 (-0.18% since last update)

Profit/Loss: +170.71%

Allocation: 5.32%* (+0.33% since last update)

Next Buy Target: $480.39

Costco (COST) paid out its quarterly dividend on Monday, September 11, which, after reinvesting, lowered my per-share cost -0.18% from $209.07 down to $208.69.

From here, my next buy target is $480.39, above a past point of support, and I have no sell targets at this time as I continue to build my allocation in this long-term holding.

Crown Castle (CCI): Added to Position

Current Price: $92.03

Per-Share Cost: $129.95 (-2.40% since last update)

Profit/Loss: -29.18%

Allocation: 5.13%*(+0.05% since last update)

Next Buy Target: $80.89

Crown Castle (CCI) came under serious selling pressure shortly after the FOMC meeting, filling my next buy order on Thursday, September 21 with a 4.56% buy at $93.37. The buy lowered my per-share cost -2.40% from $133.15 to $129.95.

From here, my next buy target is $80.89, above a point of support CCI saw back in November 2016. My next sell target is $132.81, below a key point of resistance Crown has come up against many times over the years.

As of this update, CCI is $92.03, down -1.46% from where I added.

Digital Realty Trust (DLR): Strategy Update

Current Price: $121.02

Per-Share Cost: $110.30 (Unchanged since last update)

Profit/Loss: +9.72%

Allocation: 5.84%* (-0.20% since last update)

Next Buy Target: $87.35

After performing admirably throughout the end of August and into the beginning of September, Digital Realty Trust (DLR) got hit particularly hard during the selloff with the rest of the markets.

As other Artificial Intelligence-related (AI) companies reported earnings that revealed investors may have to wait much longer for AI profits than was initially hoped, the hype behind AI began to fade. As a result, a lot of the stocks with any relationship to AI – Digital Realty Trust included – took the brunt of the selloff as investors lost interest.

After seeing how incredibly weak Digital Realty was during the selloff in 2022 and the fact that it remains one of the larger positions in the portfolio, I’m not planning to add to DLR unless it nears its 2022 lows down around $86.00. This one has been a wild ride, so the best way to tame it is with patience and big spreads between buying and selling price targets.

Microsoft (MSFT): Dividend Reinvestment

Current Price: $315.75

Per-Share Cost: -$53.55* (+0.20% since last update)

Profit/Loss: +266.18%

Allocation: 1.84%* (-0.03% since last update)

Next Buy Target: $295.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Microsoft (MSFT) paid out its quarterly dividend on Thursday, September 14, which, after reinvesting, raised my per-share cost +0.20% from -$53.66 up to $53.55 (a negative per-share cost indicates all capital has been removed in addition to $53.55 per share added to the portfolio’s bottom line in addition to each share’s current value).

The reason my per-share cost was raised is because there are now more shares splitting the same amount of profit. The position has become more profitable because of the additional shares, but the per-share “cost” is higher because of the additional shares.

From here, my next buy target is $295.89, above a past point of support, and I have no sell targets at this time as I continue to build my allocation in this long-term holding.

Pepsico (PEP): Strategy Update

Current Price: $169.44

Per-Share Cost: $59.10 (Unchanged since last update)

Profit/Loss: +186.72%

Allocation: 2.61%* (-0.13% since last update)

Next Buy Target: $167.54

Investors pulled a surprise move over the last month, dumping consumer staples stocks like Pepsico (PEP) which are typically considered defensive in potential recessionary-environments.

Pepsico was hit hard throughout August and September. At one point, PEP did see a rally in the first week or two, but that turned out to be a dead cat bounce of sorts as Pepsico reversed and broke down to new lower lows.

All that being said, I’m maintaining my buy price target at $167.54, slightly above the low Pepsico saw earlier in 2023, as I’d like to increase my position in this stable company with an excellent dividend.

iShares Silver ETF (SLV): Strategy Update

Current Price: $20.34

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +87.43%

Allocation: 0.55%* (-0.04% since last update)

Next Buy Target: $18.75

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Even though the price action for the precious metals has been particularly volatile as of late, the irony is that silver ended September roughly around the same price point as where it started the month.

If yields continue to rise, the precious metals will continue to suffer selling pressure, so I have no interest in raising my SLV price target from where it currently stands – slightly above the low the Silver ETF saw in March 2023’s selloff during the regional banking crisis.

UnitedHealth (UNH): Closed w/+191.30% Gain

Closing Price: $510.00

Profit/Loss: +191.30% | 40.88% annualized since June 2020

UnitedHealth (UNH) paid out its quarterly dividend on Tuesday, September 19, but since I’m trying to close the position, I take the dividend as a cash payout and don’t reinvest it. Regardless, the dividend lowered my per-share cost -0.72% from $260.77 to $258.89.

On Monday, September 25, UNH crossed over the $510 mark, and while I was trying to be patient and wait for a full 200% lifetime gain, given the volatility and uncertainty in the markets, I decided not to look a gift horse in the mouth and closed the position with a trailing stop order.

My sell order filled at $510.00 on the dot, closing out my UnitedHealth position with a lifetime gain of $191.30% over the time since I initially opened it on

June 12, 2020, an annualized gain of 40.88% per-year.

For newer readers, I decided to close UNH in January of this year after several colleagues of mine in the healthcare industry shared with me unsavory anecdotes of how UnitedHealth treats both its patients and providers. As a result, UNH’s closure seemed prudent out of respect to my associates.

And, yes, it’s taken me eight months to get out of this investment. Often, being a long-term investor means waiting a long time to make a move.

UNH is $504.19 as of this update, down -1.14% from where I closed it.

Waste Management (WM): Dividend Reinvestment

Current Price: $152.44

Per-Share Cost: $74.96 (-0.45% since last update)

Profit/Loss: +103.35%

Allocation: 2.36%* (-0.06% since last update)

Next Buy Target: $149.28

Waste Management (WM) paid out its quarterly dividend on Monday, September 25, which, after reinvestment, lowered my per-share cost -0.45% from $75.30 to $74.96.

Just like the rest of the market, WM has come under significant selling pressure throughout September and is rapidly approaching my next buy target at $149.28, slightly above the lows it made in March. My next sell target is $173.52, just under the highs Waste Management just saw in July.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.