Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #44

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

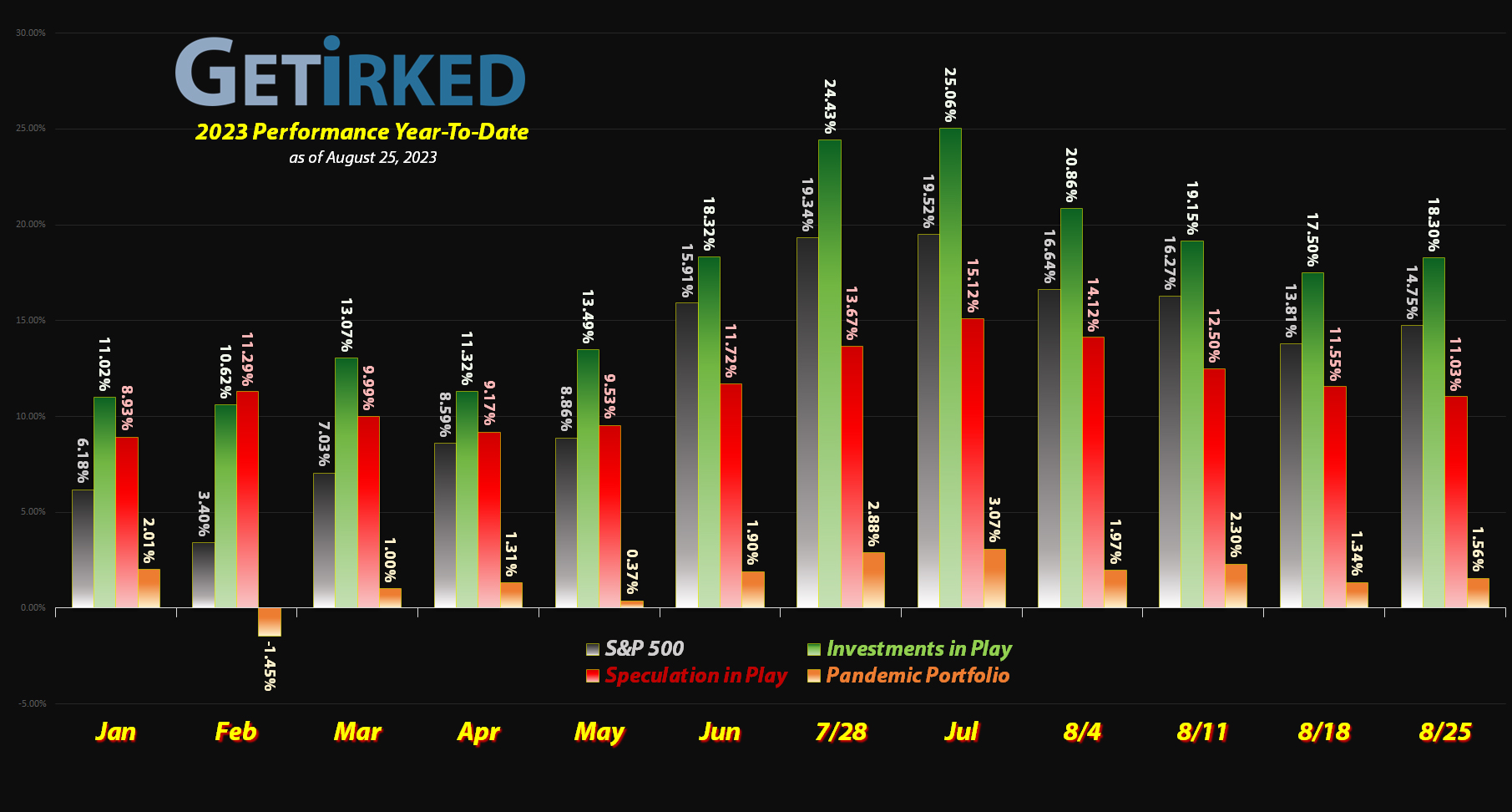

The Summer Rally Ended…

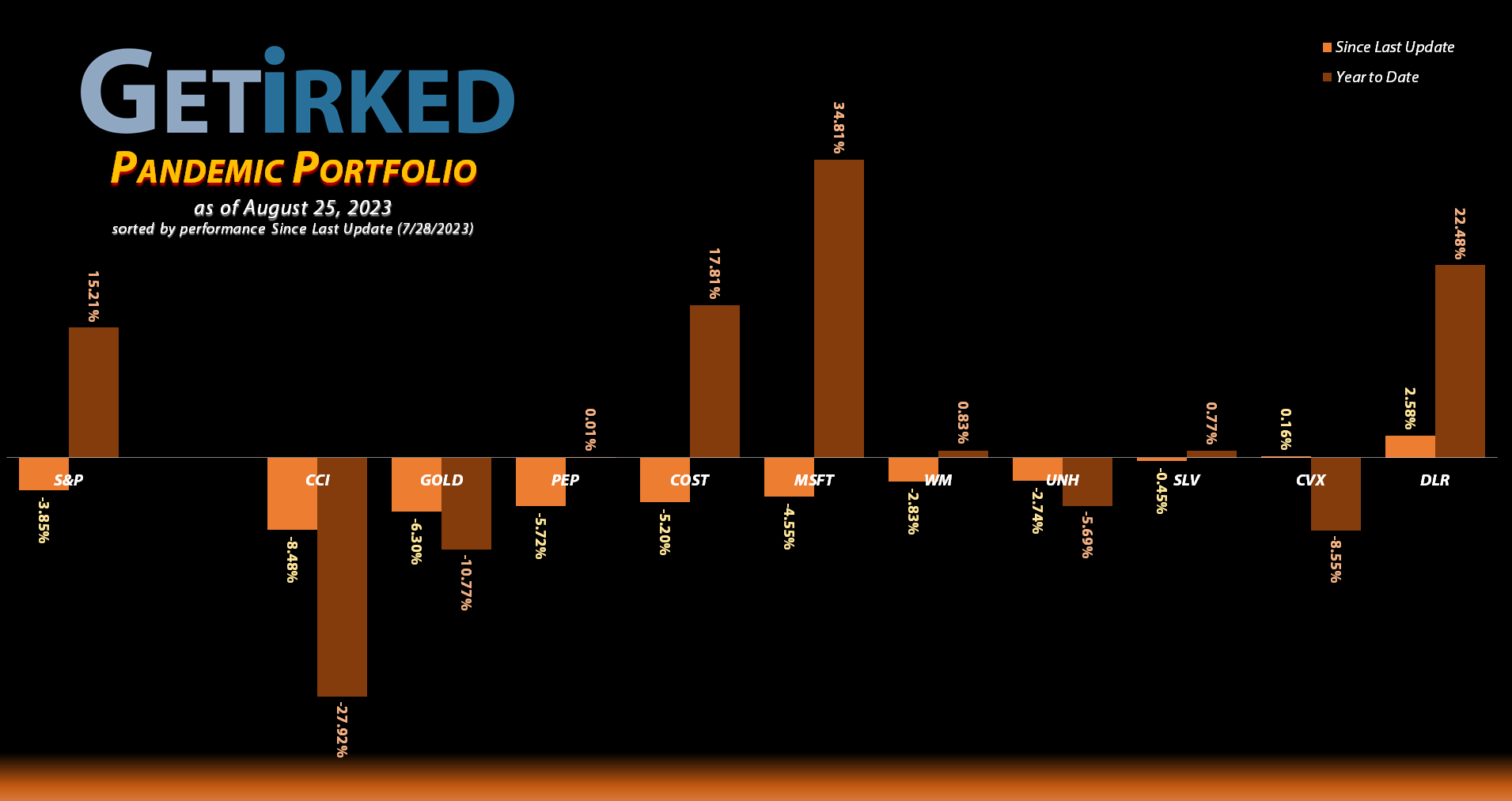

From the beginning of August, it became apparent that the epic rally we’d seen since March had reached its end. Almost no sector was spared selling pressure with consumer staples, retail, and precious metals getting hit the hardest.

However, just because the market has rotated from Selling Season into Buying Season doesn’t mean I suddenly saw action in the Pandemic Portfolio. In fact, it’s been quite the opposite as I’ve had to sit on my hands and wait for prices to come to me. They’re getting there, however.

Let’s take a look at what’s happened in the positions since the last update…

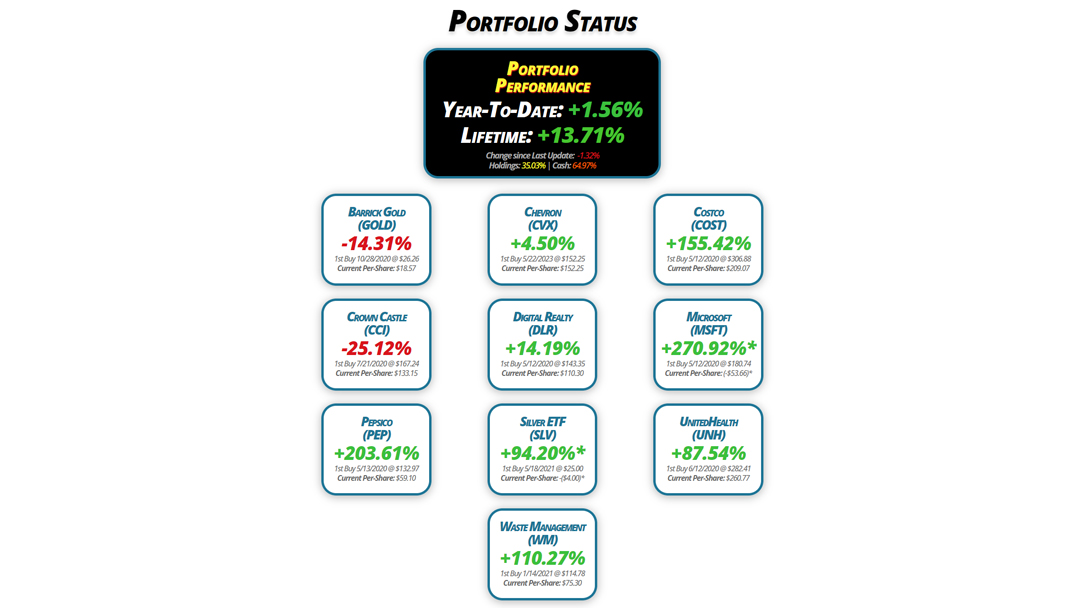

Portfolio Status

Portfolio

Performance

Year-To-Date: +1.56%

Lifetime: +13.71%

Change since Last Update: -1.32%

Holdings: 35.03% | Cash: 64.97%

Barrick Gold

(GOLD)

-14.31%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.57

Crown Castle

(CCI)

-25.12%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $133.15

Pepsico

(PEP)

+203.61%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $59.10

Chevron

(CVX)

+4.50%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $152.25

Digital Realty

(DLR)

+14.19%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $110.30

Silver ETF

(SLV)

+94.20%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Waste Management

(WM)

+110.27%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $75.30

Costco

(COST)

+155.42%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $209.07

Microsoft

(MSFT)

+270.92%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$53.66)*

UnitedHealth

(UNH)

+87.54%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $260.77

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

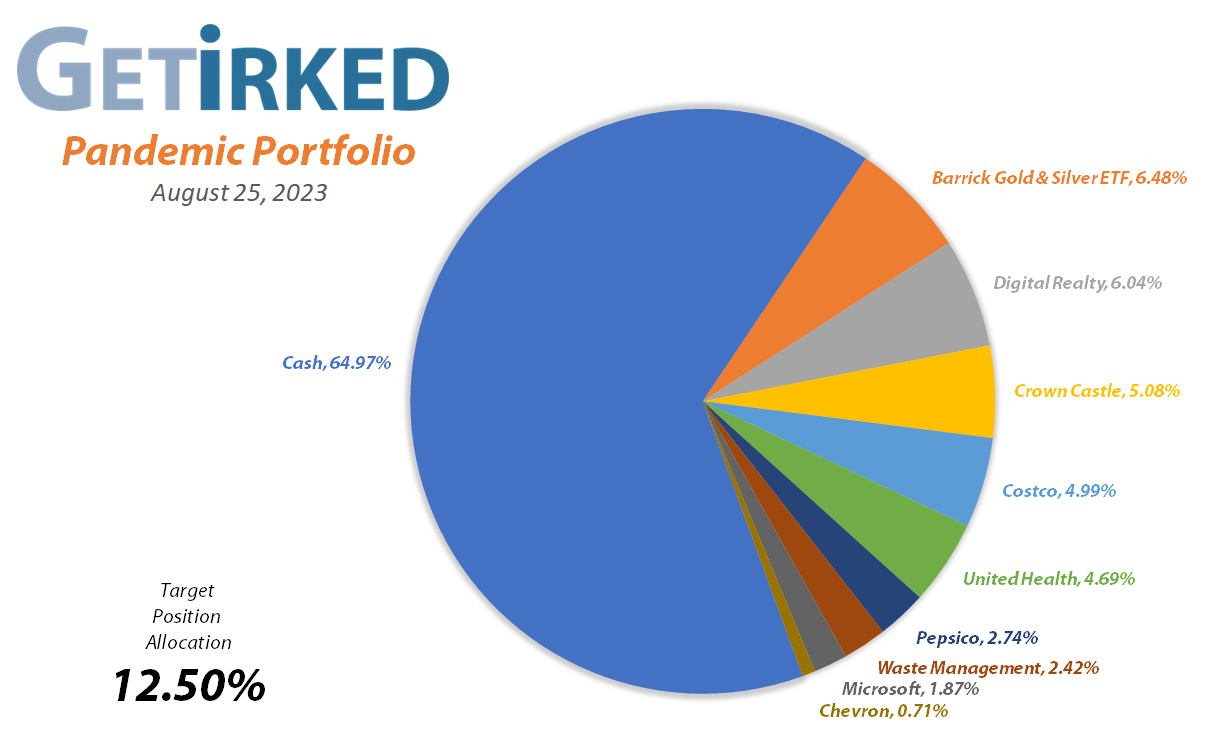

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $15.91

Per-Share Cost: $18.57 (Unchanged since last update)

Profit/Loss: -14.31%

Allocation: 5.88%* (-0.32% since last update)

Next Buy Target: $14.93

The precious metals continued to get absolutely pounded since the past update, but Barrick Gold (GOLD) still hasn’t reached my next buy target at $14.93, yet. However, GOLD’s getting closer… maybe next month?

Chevron (CVX): Strategy Update

Current Price: $159.10

Per-Share Cost: $152.25 (Unchanged since last update)

Profit/Loss: +4.50%

Allocation: 0.71%* (+0.01% since last update)

Next Buy Target: $150.75

Chevron (CVX) and the rest of the energy sector has held up remarkably well despite overall weakness in the oil price headed into the end of August. That being said, I’m remaining steadfast with my next buy target and I refuse to raise my cost basis (for the moment).

Maybe I’ll change my mind after the dividend gets reinvested in September…

Costco (COST): Strategy Update

Current Price: $534.01

Per-Share Cost: $209.07 (Unchanged since last update)

Profit/Loss: +155.42%

Allocation: 4.99%* (-0.21% since last update)

Next Buy Target: $477.89

Costco (COST) reversed its rally when strong consumer data rolled out earlier in August. With the consumer so strong overall, the possibility for the Federal Reserve to raise interest rates further remains likely. As for Costco, there’s no other retailer I’d rather be invested in, and I’m not lowering my next buy target down at $477.89 where I’ll add more.

Crown Castle (CCI): Strategy Update

Current Price: $99.70

Per-Share Cost: $133.15 (Unchanged since last update)

Profit/Loss: -25.12%

Allocation: 5.08%*(-0.40% since last update)

Next Buy Target: $93.37

Crown Castle (CCI) remained under selling pressure the entire month, breaking support at each level. Despite commentary from Twitter followers suggesting my price target at $93.37 was far too low earlier in August, CCI’s selloff is starting to make it look more and more likely that my buy order will be filled in the coming days and weeks.

Digital Realty Trust (DLR): Profit-Taking x 2

Current Price: $125.95

Per-Share Cost: $110.30 (-2.38% since last update)

Profit/Loss: +14.19%

Allocation: 6.04%* (-0.84% since last update)

Next Buy Target: $86.46

Digital Realty Trust (DLR) rallied to around the $125.00 where it saw repeated resistance, leading me to take profits with a sale that went through at $124.70 on Wednesday, August 2. I sold 7.83% of the allocation, locking in +10.36% selling over my $112.99 cost basis and lowering my per-share cost -0.88% from $112.99 to $112.00.

Later, on Thursday, August 24, I took even more profits when DLR triggered my next sell order filling at $130.31 selling another 8.50% of my position, giving me an average selling price of $127.51. The second sale locked in +16.35% in gains over my $112.00 cost basis, lowering my per-share cost -1.52% from $112.00 to $110.30.

From here, my next buy target is $86.76, slightly above the low DLR saw in May and my next sell target is $143.52, just under a key point of resistance.

DLR is $125.95 as of this update, down -1.22% from my $127.51 average sale.

Microsoft (MSFT): Added to Position x 2

Current Price: $322.98

Per-Share Cost: -$53.66* (+25.99% since last update)

Profit/Loss: +270.92%

Allocation: 1.87%* (+0.03% since last update)

Next Buy Target: $294.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

It was time to start replacing some of the shares I sold when Microsoft (MSFT) pulled back on Tuesday, August 8 with a buy that went through at $325.08. Microsoft continued to sell off and on Friday, August 18, a second buy went through at $312.85, giving me an average buy price of $318.97.

I locked in a -8.00% discount replacing some of the shares I sold for $346.72 back on June 15, increased my allocation by 5.06% and raised my per-share “cost” +25.99% from -$72.50 to -$53.66 (a negative per-share cost indicates all capital has been removed in addition to $53.66 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I will continue adding with my next buy target at $294.89. I still have no plans to take any profits in Microsoft at this point as I do want to see how much higher Microsoft may go when it rallies once more.

MSFT is $322.98 as of this update, up +1.26% from my $318.97 average buy.

Pepsico (PEP): Strategy Update

Current Price: $179.42

Per-Share Cost: $59.10 (Unchanged since last update)

Profit/Loss: +203.61%

Allocation: 2.74%* (-0.13% since last update)

Next Buy Target: $169.54

Pepsico (PEP) came under selling pressure with the rest of the consumer staples sector throughout August. PEP’s not a particularly fast mover, however, so it may still take some time for it to reach my buy target at $169.54. That being said, I have no intention of adjusting it – I do believe PEP will trigger that buy target and potentially head even lower.

iShares Silver ETF (SLV): Strategy Update

Current Price: $22.22

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +94.20%

Allocation: 0.59%* (Unchanged since last update)

Next Buy Target: $18.75

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Just like gold and the rest of the precious metals space, silver (SLV) saw a lot of selling pressure throughout August. Despite seeing a bit of a bounce in the second to last week of the month, the selling returned in the final week.

There’s still quite some room between its current price level around $20 and my next buy target at $18.75, but since I’m playing with the House’s Money, I’m in no hurry with this position.

UnitedHealth (UNH): Strategy Update

Current Price: $489.06

Per-Share Cost: $260.77 (Unchanged since last update)

Profit/Loss: +87.54%

Allocation: 4.69%* (-0.07% since last update)

Next Buy Target: -NO BUY TARGET-

United Health (UNH) rallied significantly off its low near $445.68, hitting a recent high just over $515 before pulling back once more. Since I do want to close this position entirely, I’ve lowered my selling price target to $513.16 where I will sell the entire position and move on to less controversial pastures.

Waste Management (WM): Strategy Update

Current Price: $158.33

Per-Share Cost: $75.30 (Unchanged since last update)

Profit/Loss: +110.27%

Allocation: 2.42%* (-0.04% since last update)

Next Buy Target: $149.21

The selling pressure in Waste Management (WM) has been positively relentless over the past month, but the stock has held support right around $159.00 remarkably well. Despite its strength, I’m remaining stead with my next buy target at $149.21. If and when WM breaks that support at $159, I think it’s highly likely it will sell off and fill my next buy target.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.