Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #43

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

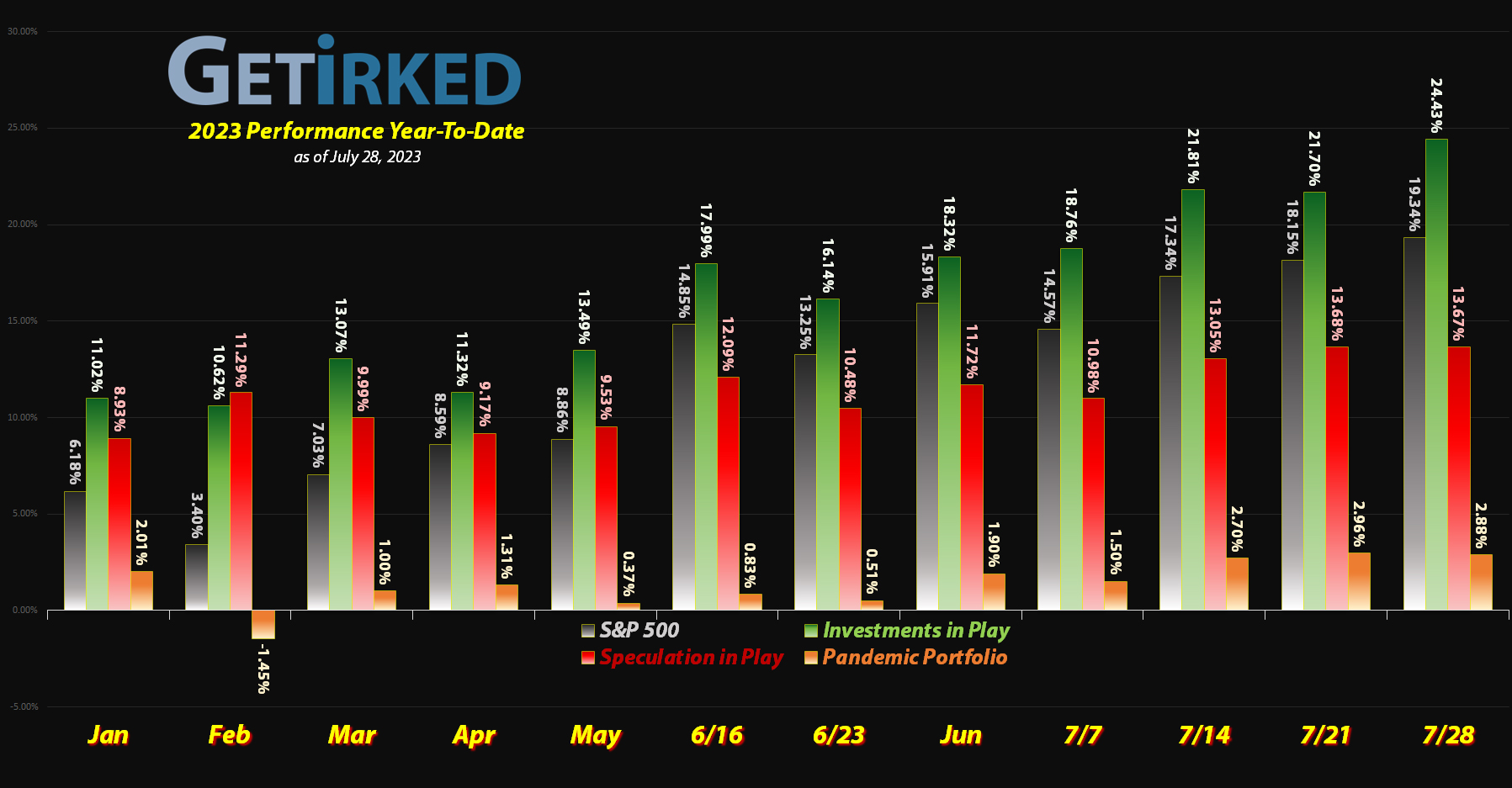

Finally catching a break…

After months of underperformance, the Pandemic Portfolio finally started to see some signs of life this month as investors rotated into more defensive plays including commodities, healthcare, industrials, and precious metals. As a result, many of the positions in the portfolio finally saw a boost, lifting the entire portfolio (which still has a cash position far in excess of 60%).

Since I do have such a large cash hoard, I am looking at adding a few new positions to the portfolio if we see a marketwide selloff: Caterpillar (CAT), the construction equipment manufacturer, and Cameco (CCJ), the uranium miner (a play on the likely use of nuclear energy to meet green environmental goals worldwide).

Let’s take a look at the moves that happened since the last update…

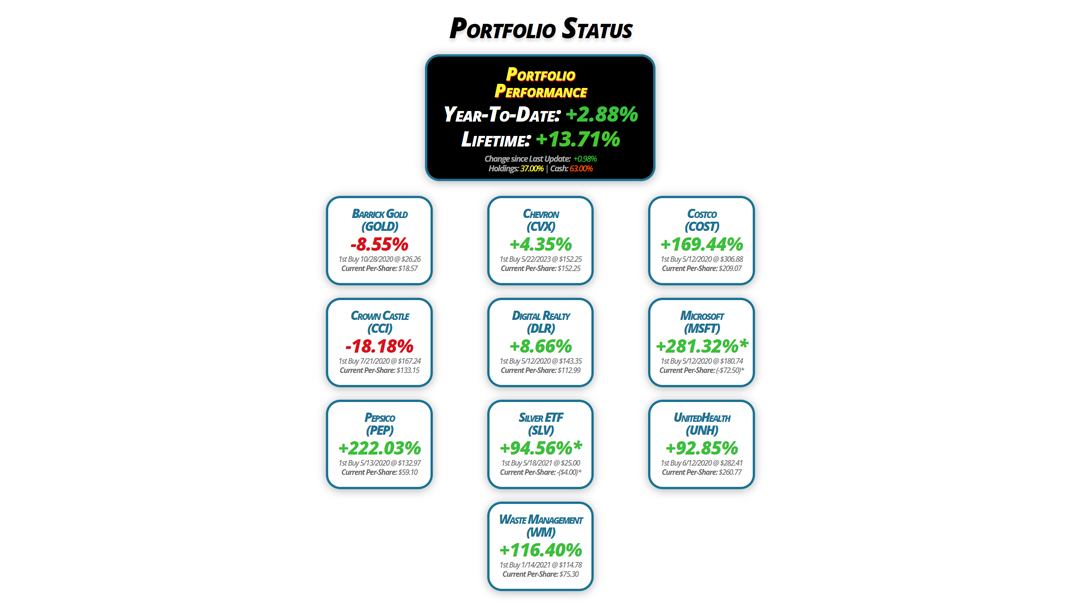

Portfolio Status

Portfolio

Performance

Year-To-Date: +2.88%

Lifetime: +13.71%

Change since Last Update: +0.98%

Holdings: 37.00% | Cash: 63.00%

Barrick Gold

(GOLD)

-8.55%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.57

Crown Castle

(CCI)

-18.18%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $133.15

Pepsico

(PEP)

+222.03%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $59.10

Chevron

(CVX)

+4.35%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $152.25

Digital Realty

(DLR)

+8.66%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $112.99

Silver ETF

(SLV)

+94.56%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Waste Management

(WM)

+116.40%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $75.30

Costco

(COST)

+169.44%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $209.07

Microsoft

(MSFT)

+281.32%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$72.50)*

UnitedHealth

(UNH)

+92.85%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $260.77

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $16.98

Per-Share Cost: $18.57 (Unchanged since last update)

Profit/Loss: -8.55%

Allocation: 6.20%* (-0.04% since last update)

Next Buy Target: $15.21

Barrick Gold (GOLD) and the rest of the precious metals space saw a bit of a bounce since the last update when the U.S. Dollar sold off against the rest of the world’s currencies. Still, gold is not seeing the boost that all the goldbugs expect (and continue to predict).

As a result, this position remains in a holding pattern until something changes. My next buy target is $15.21, above a point of support from the past, and my next sell target is $19.03, slightly under a key point of resistance.

Chevron (CVX): Strategy Update

Current Price: $158.87

Per-Share Cost: $152.25 (Unchanged since last update)

Profit/Loss: +4.35%

Allocation: 0.70%* (Unchanged since last update)

Next Buy Target: $150.15

Chevron (CVX) continued to excel over the past month, preannouncing its earnings on Monday, July 24, where it gave an upside surprise. Despite this, I’m leaving my buying price target at $150.15. The market remains so bullish and frothy that I can’t help but feel there’s another shoe to drop.

Costco (COST): Strategy Update

Current Price: $563.32

Per-Share Cost: $209.07 (Unchanged since last update)

Profit/Loss: +169.44%

Allocation: 5.20%* (+0.18% since last update)

Next Buy Target: $477.89

Costco (COST) has positively rocketed since the last update despite its poor earnings report. Many investors are looking for defensive positions to protect their portfolios against recession, and Costco provides the ultimate blend of defensive and growth – an odd combination.

My next buy target remains at $477.89, above a key level of support COST pulled back to after its earnings report, and I have no sell targets in this position at this time as it is one of the best performers in the portfolio.

Crown Castle (CCI): Dividend Reinvestment

Current Price: $108.94

Per-Share Cost: $133.15 (-1.33% since last update)

Profit/Loss: -18.18%

Allocation: 5.48%* (-0.23% since last update)

Next Buy Target: $93.37

Crown Castle (CCI) paid out its quarterly dividend on Monday, July 3. After reinvestment, the dividend lowered my per-share cost -1.33% from $134.95 down to $133.15.

When CCI gave its quarterly earnings report, it provided pretty poor guidance for the rest of the year. Accordingly, I’ve lowered my buy price target quite a bit. If we see a recession in the 3rd or 4th quarter of 2023 like some Bears predict, the combination of a marketwide selloff with Crown Castle’s weak profit predictions won’t bode well for the stock.

From here, my next buy target is $93.37, above a past point of support, and my next sell target is $146.18, just under a key point of resistance.

Digital Realty Trust (DLR): Dividend & Profits

Current Price: $122.78

Per-Share Cost: $112.99 (-1.30% since last update)

Profit/Loss: +8.66%

Allocation: 6.89%* (Unchanged since last update)

Next Buy Target: $86.91

Digital Realty Trust (DLR) paid out its quarterly dividend on Monday, July 3. After reinvestment, the dividend lowered my per-share cost -1.05% from $114.48 to $113.28.

On Tuesday, July 18, DLR started to pull back from some resistance it encountered around $117, so I used stop-loss limit sell orders to lock in some gains and reduce the allocation size (DLR was the largest position in the portfolio at this point).

My sale filled at $116.97, lowering my per-share cost 0.26% from $113.28 to $112.99. From here, my next sell target is $126.46, below the high DLR made after reporting a good quarter on Thursday, July 27, and my next buy target is $86.91, slightly above the low DLR saw in May 2022.

DLR is $122.78 as of this update, up +4.97% from where I took profits.

Microsoft (MSFT): Strategy Update

Current Price: $338.37

Per-Share Cost: -$72.50* (Unchanged since last update)

Profit/Loss: +281.32%

Allocation: 1.84%* (-0.03% since last update)

Next Buy Target: $323.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

After rocketing to a new all-time high earlier in the month, Microsoft (MSFT) saw a bit of a pullback going into the end of the month as some of the hype was pulled out of the AI balloon when Taiwan Semiconductor (TSM) reported mediocre forward guidance.

Microsoft (MSFT) somewhat disappointed when it reported earnings, giving murkier guidance than analysts were hoping for. As a result, I’m lowering my buy price target to $323.89 where I will start (slowly) replacing some of the shares I sold last month at higher levels.

Pepsico (PEP): Dividend Reinvestment

Current Price: $190.31

Per-Share Cost: $59.10 (-0.67% since last update)

Profit/Loss: +222.03%

Allocation: 2.87%* (+0.06% since last update)

Next Buy Target: $169.54

Pepsico (PEP) paid out its quarterly dividend on Monday, July 3. After reinvestment, the dividend lowered my per-share cost -0.67% from $59.50 down to $59.10.

From here, my next buy target is $169.54, near a past point of support, and my next sell target is $202.99 where I will remove all remaining capital from this position.

iShares Silver ETF (SLV): Strategy Update

Current Price: $22.32

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +94.56%

Allocation: 0.59%* (+0.03% since last update)

Next Buy Target: $18.75

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Silver (SLV) saw a pretty significant pop over the past month. In addition to seeing the benefits of the precious metals sector, silver’s industrial use means it also correlates to the commodities sector, as a whole.

However, even after popping, the silver metal didn’t get anywhere close to my next profit-taking target at $24.75, so it was a hands-off position this month. My next buy target is $18.75, above the low SLV saw in March.

UnitedHealth (UNH): Strategy Update

Current Price: $502.91

Per-Share Cost: $260.77 (Unchanged since last update)

Profit/Loss: +92.85%

Allocation: 4.76%* (+0.17% since last update)

Next Buy Target: -NO BUY TARGET-

After pulling back substantially mid-month, UnitedHealth (UNH) exploded to the upside when it reported good earnings, lifting the entire healthcare sector. As a result, UNH is actually approaching my sell target where I still plan to close the position entirely at $523.39.

Waste Management (WM): Strategy Update

Current Price: $162.94

Per-Share Cost: $75.30 (Unchanged since last update)

Profit/Loss: +116.40%

Allocation: 2.46%* (-0.19% since last update)

Next Buy Target: $149.21

Waste Management (WM) exhibited some serious strength since last month when the industrials sector started to make new all-time highs. Thanks to profit-taking measures I’ve taken, my cost basis is currently -34.50% below where I initially opened the position at $114.96 on January 14, 2021.

WM reported a disappointing quarter in the last week of July. Originally, I was going to raise my buying price target on the back of the strength Waste Management had shown since the last update, however, thanks to that bad earnings report, I’m leaving my buy price target at $149.21, a level WM has visited many, many times in the past.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.