Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #40

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

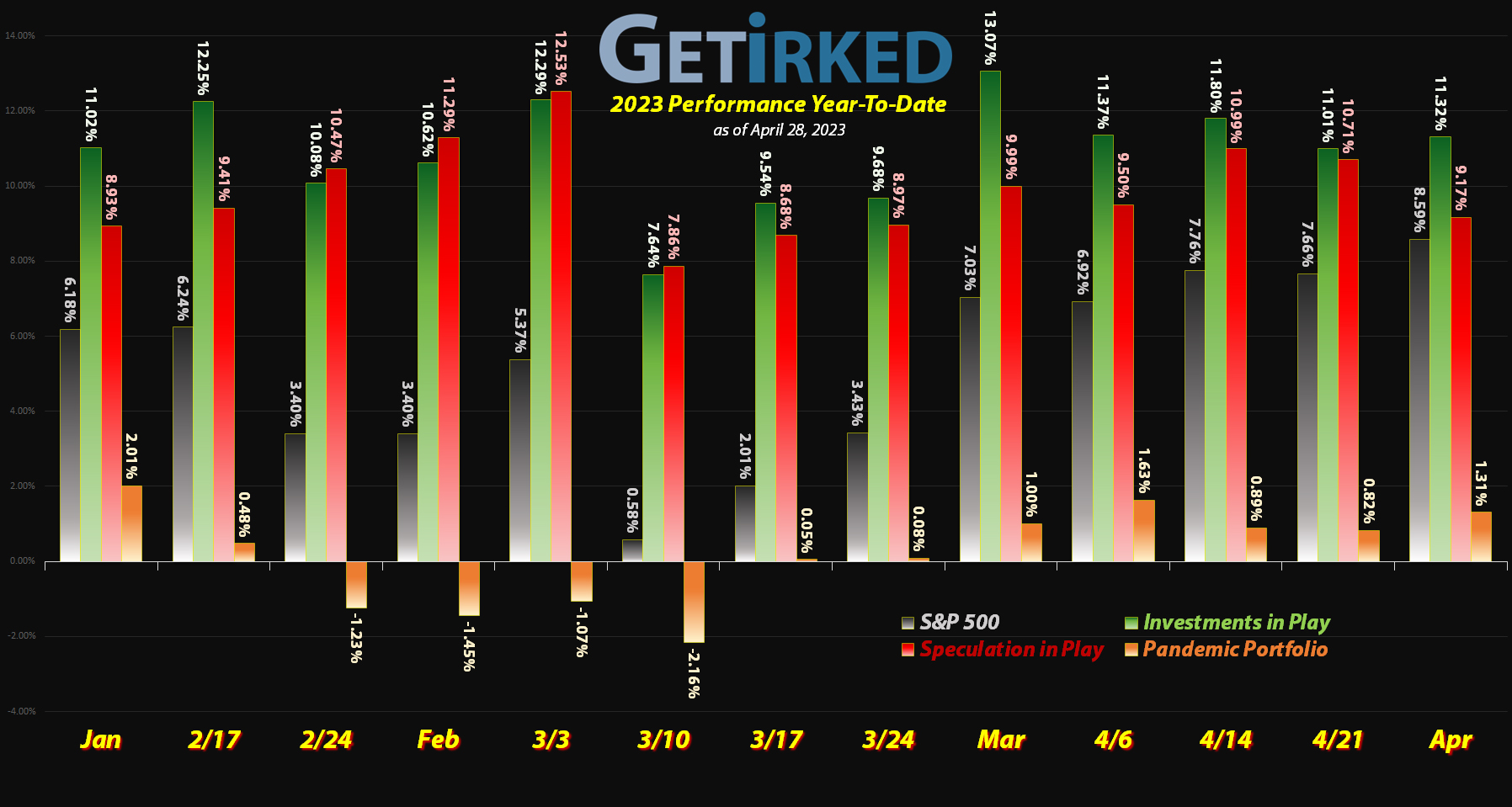

Rally off March’s selloff… but May is coming.

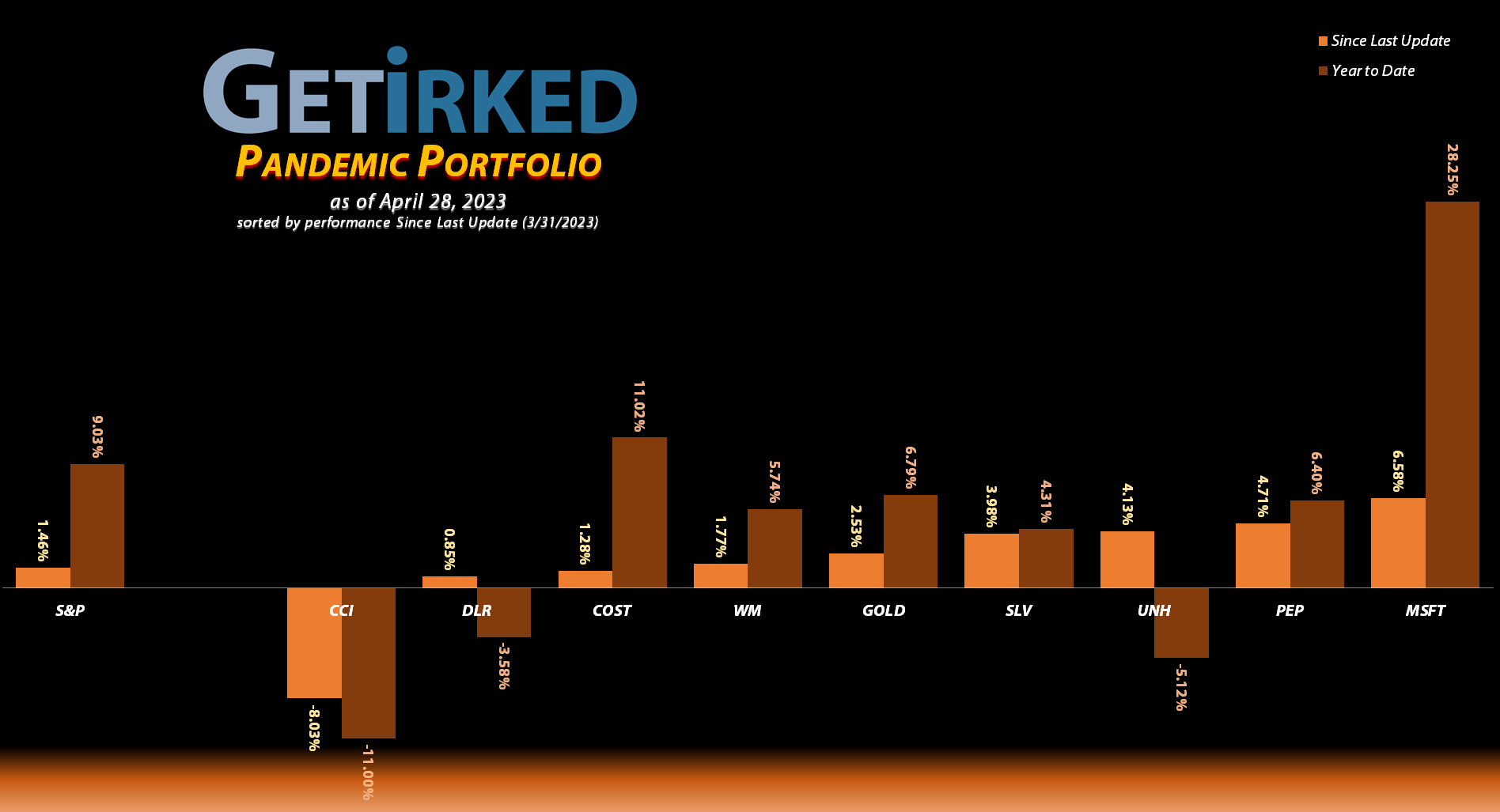

The Pandemic Portfolio continued to struggle over the past month. While many popular stocks like Microsoft (MSFT), Pepsico (PEP), and Waste Management (WM) rallied, the Real Estate Investment Trusts (REITs) continued to get pounded meaning that Crown Castle (CCI) and Digital Realty Trust (DLR) suffered.

Additionally, the precious metals also saw a pretty significant pullback from their recent highs, resulting in both Barrick Gold (GOLD) and the silver ETF (SLV) getting slapped around.

Finally, even UnitedHealth (UNH), an incredibly popular stock during recessions, saw a truly substantial pullback after reporting a great earnings report, oddly enough.

As a result, even though the general market rallied quite a bit since the last update, the Pandemic Portfolio’s exposure to a few hard-hit sectors resulted in dismal performance over the last month.

Let’s take a look at the moves made since the last update…

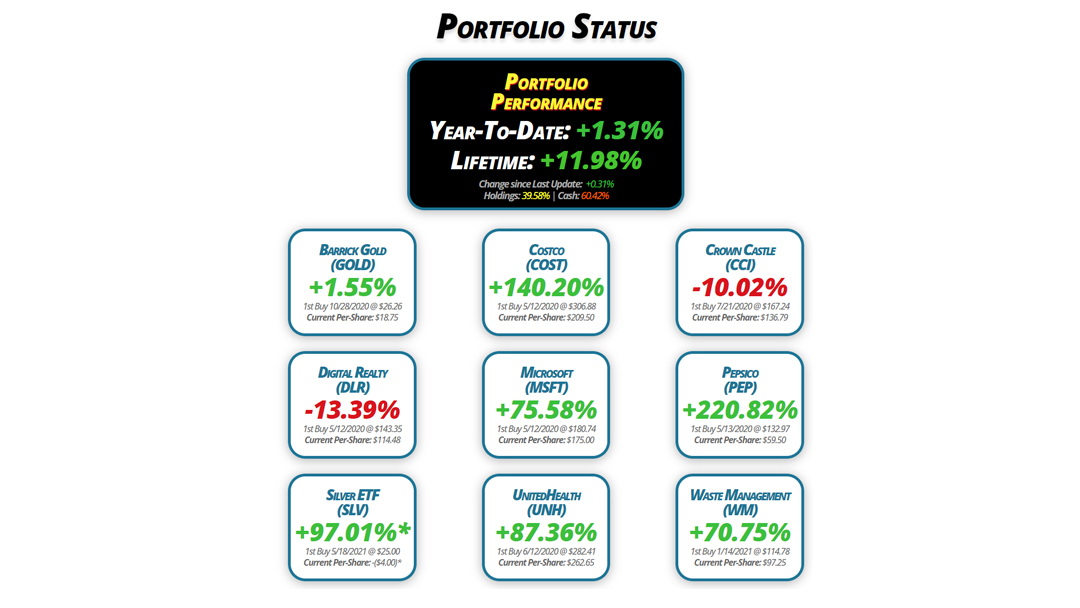

Portfolio Status

Portfolio

Performance

Year-To-Date: +1.31%

Lifetime: +11.98%

Change since Last Update: +0.31%

Holdings: 39.58% | Cash: 60.42%

Barrick Gold

(GOLD)

+1.55%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.75

Digital Realty

(DLR)

-13.39%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $114.48

Silver ETF

(SLV)

+97.01%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Costco

(COST)

+140.20%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $209.50

Microsoft

(MSFT)

+75.58%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $175.00

UnitedHealth

(UNH)

+87.36%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $262.65

Crown Castle

(CCI)

-10.02%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $136.79

Pepsico

(PEP)

+220.82%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $59.50

Waste Management

(WM)

+70.75%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $97.25

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

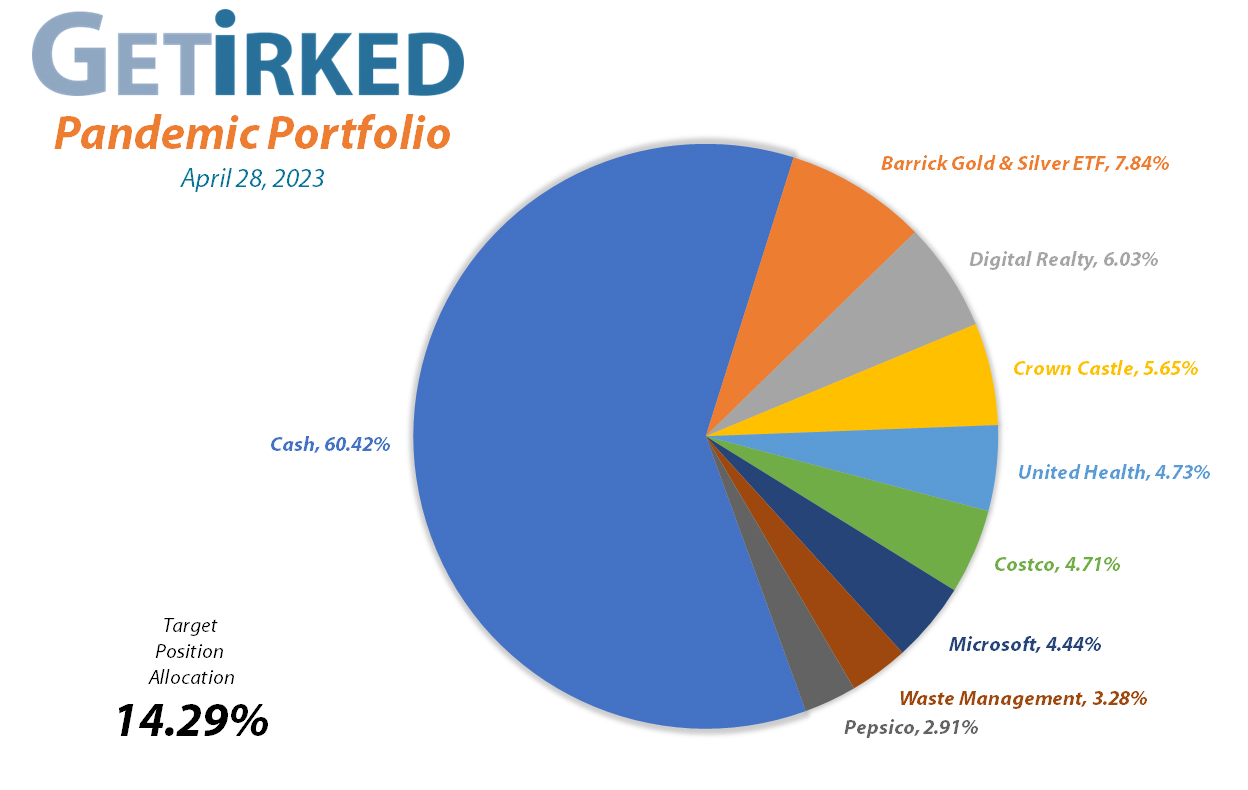

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Profit-Taking

Current Price: $19.04

Per-Share Cost: $18.75 (-0.37% since last update)

Profit/Loss: +1.55%

Allocation: 7.23%* (-0.45% since last update)

Next Buy Target: $15.83

The goldminers finally reacted positively to the precious yellow metal’s skyrocketing break of $2,000 with Barrick Gold (GOLD) triggering my next sell order on Tuesday, April 4 at $19.61.

The sale locked in +18.99% in gains on shares I bought less than two months ago for $16.48 on February 17 and lowered my per-share cost -0.37% from $18.82 to $18.75. While that’s a very small cost basis reduction, I also trimmed a relatively small quantity. Despite my personal belief that gold is breaking out, I want to be prudent and disciplined, taking profits when I can.

From here, my next sell target is $20.11, slightly below a past point of resistance now that GOLD’s pulled back, and my next buy target is $15.83, slightly above GOLD’s lows from earlier in 2023.

GOLD is $19.04 as of this update, down -2.91% from where I took profits.

Costco (COST): Strategy Update

Current Price: $503.22

Per-Share Cost: $209.50 (Unchanged since last update)

Profit/Loss: +140.20%

Allocation: 4.71%* (+0.03% since last update)

Next Buy Target: $449.89

Costco (COST) has continued to trade in a bearish range since the last update, making me lower lows and lower highs. Despite the lower lows, the stock still hasn’t retreated to my next buy target at $449.89, a consistent level of support tested several times within the past year.

I still have no sell targets for Costco as it has been an exceptionally outperforming company for years. I am very comfortable with my per-share cost and rumors continue to swirl that Costco is planning to pay out a special dividend (something it does every 2-3 years and it has been nearly 3 years since its last payout).

As a result, COST continues to find a floor of support as investors have been piling into the stock for both its outstanding historical performance but also the potential of a juicy dividend incoming shortly.

Crown Castle (CCI): Dividend Reinvestment

Current Price: $123.09

Per-Share Cost: $136.79 (-1.17% since last update)

Profit/Loss: -10.02%

Allocation: 6.03%* (-0.09% since last update)

Next Buy Target: $114.32

Crown Castle (CCI) paid out its quarterly dividend on Monday, April 2, which, after reinvesting to take advantage of compound interest, lowered my per-share cost -1.17% from $138.41 to $136.79.

From here, my next buy target is $114.32, slightly above CCI’s pandemic bottom, and my next sell target is $158.53, slightly below a key point of resistance.

Digital Realty Trust (DLR): Dividend Reinvestment

Current Price: $99.15

Per-Share Cost: $114.48 (-1.27% since last update)

Profit/Loss: -13.39%

Allocation: 6.03%* (+0.08% since last update)

Next Buy Target: $77.45

Digital Realty Trust (DLR) paid out its quarterly dividend on Monday, April 2, which, after reinvestment, lowered my per-share cost -1.27% from $115.95 down to $114.48.

From here, my next buy target is $77.45, slightly above the next level of support below DLR’s 2022 lows. My next sell target is $125.62, just under a key level of resistance should DLR break through its high from 2022.

Microsoft (MSFT): Strategy Update

Current Price: $307.26

Per-Share Cost: $175.00 (Unchanged since last update)

Profit/Loss: +75.58%

Allocation: 4.44%* (+0.25% since last update)

Next Buy Target: $219.45

Microsoft (MSFT) was saved by its multi-billion dollar investment in the startup company, OpenAI, which developed the extremely popular ChatGPT artificial intelligence platform.

As a result, Microsoft has held up pretty well since the last update, resisting pullbacks as investors pile into the stock for its AI exposure. My gameplan remains unchanged, however, as I will wait patiently for Microsoft to pull back to $219.45 before adding, a key point of support from earlier this year.

I do have a sell target for Microsoft, too, at $349.16, slightly below its all-time high where I will pull additional profits out of this extremely successful investment.

Pepsico (PEP): Profit-Taking & Dividend

Current Price: $190.89

Per-Share Cost: $59.50 (-32.84% since last update)

Profit/Loss: +220.82%

Allocation: 2.91%* (-0.61% since last update)

Next Buy Target: $161.18

Pepsico (PEP) paid out its quarterly dividend on Monday, April 2, which, by reinvesting, lowered my per-share cost -0.63% from $88.59 to $88.03.

PEP kept rallying throughout the month, triggering my next sell order on Thursday, April 20 at $185.38. The sale locked in +36.17% in gains selling shares I bought for $136.14 on January 29, 2021 and lowered my per-share cost -32.41% from $88.03 to $59.50.

From here, my next buy target is $161.18, above a key level of support from 2022, and my next sell target is $202.99, a price calculated using Fibonacci Method where I will remove all remaining capital from the position.

PEP is $190.89 as of this update, +2.97% from where I took profits.

iShares Silver ETF (SLV): Profit-Taking

Current Price: $23.00

Per-Share Cost: -$4.00* (-$3.76 since last update)

Profit/Loss: +97.01%

Allocation: 0.62%* (-0.08% since last update)

Next Buy Target: $18.40

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

The price of precious metals continued to rally early into April causing the iShares Silver ETF (SLV) to cross through a key point of resistance and trigger my next sell order which filled at $22.29 on Tuesday, April 4.

The sale locked in +33.47% in gains on some of the shares I bought for $16.70 back on August 31, 2022 and lowered my per-share “cost” -$3.76 from -$0.24 to -$4.00 (since all capital has been taken out of this position, each share adds $4.00 to the portfolio’s bottom line in addition to the value of the share).

From here, my next sell target is $24.50, slightly below the next key level of resistance, and my next buy target is $18.40, slightly above SLV’s low in February 2023.

SLV is $23.00 as of this update, up +3.19% from where I took profits.

UnitedHealth (UNH): Strategy Update

Current Price: $492.09

Per-Share Cost: $262.65 (Unchanged since last update)

Profit/Loss: +87.36%

Allocation: 4.73%* (+0.16% since last update)

Next Buy Target: -NO BUY TARGET-

Despite reporting an impressive quarter, UnitedHealth (UNH) pulled back substantially after reporting, dropping more than -9% from peak to trough. Accordingly, I have lowered my sell target down to $527.59, slightly below its recent high of $530.45 where I will close the position entirely.

As mentioned in prior posts, UnitedHealth’s (UNH) unsavory business practices have motivated me to close the position and move on to greener pastures, despite the company offering excellent returns… I simply cannot tolerate its unethical business practices.

Waste Management (WM): Profit-Taking

Current Price: $166.05

Per-Share Cost: $97.25 (-11.63% since last update)

Profit/Loss: +70.75%

Allocation: 3.28%* (-0.70% since last update)

Next Buy Target: $139.52

Waste Management (WM) rallied into its quarterly earnings report in the last week of April, triggering my next sell order which filled on Tuesday, April 25 at $166.64.

The sale locked in a relatively minor +3.71% in gains on shares I bought for $160.68 back on December 2, 2021, but, more importantly, reduced my per-share cost -11.63% from $110.05 to $97.25.

From here, my next sell target is $199.84, just under the key psychological resistance of the $200 mark, and my next buy target is $139.52, just above a key level of support that WM tested many times in the past few years.

WM is $166.05 as of this update, down -0.35% from where I took profits.

* Target allocation for each position in the portfolio is 14.29% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.