Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #39

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

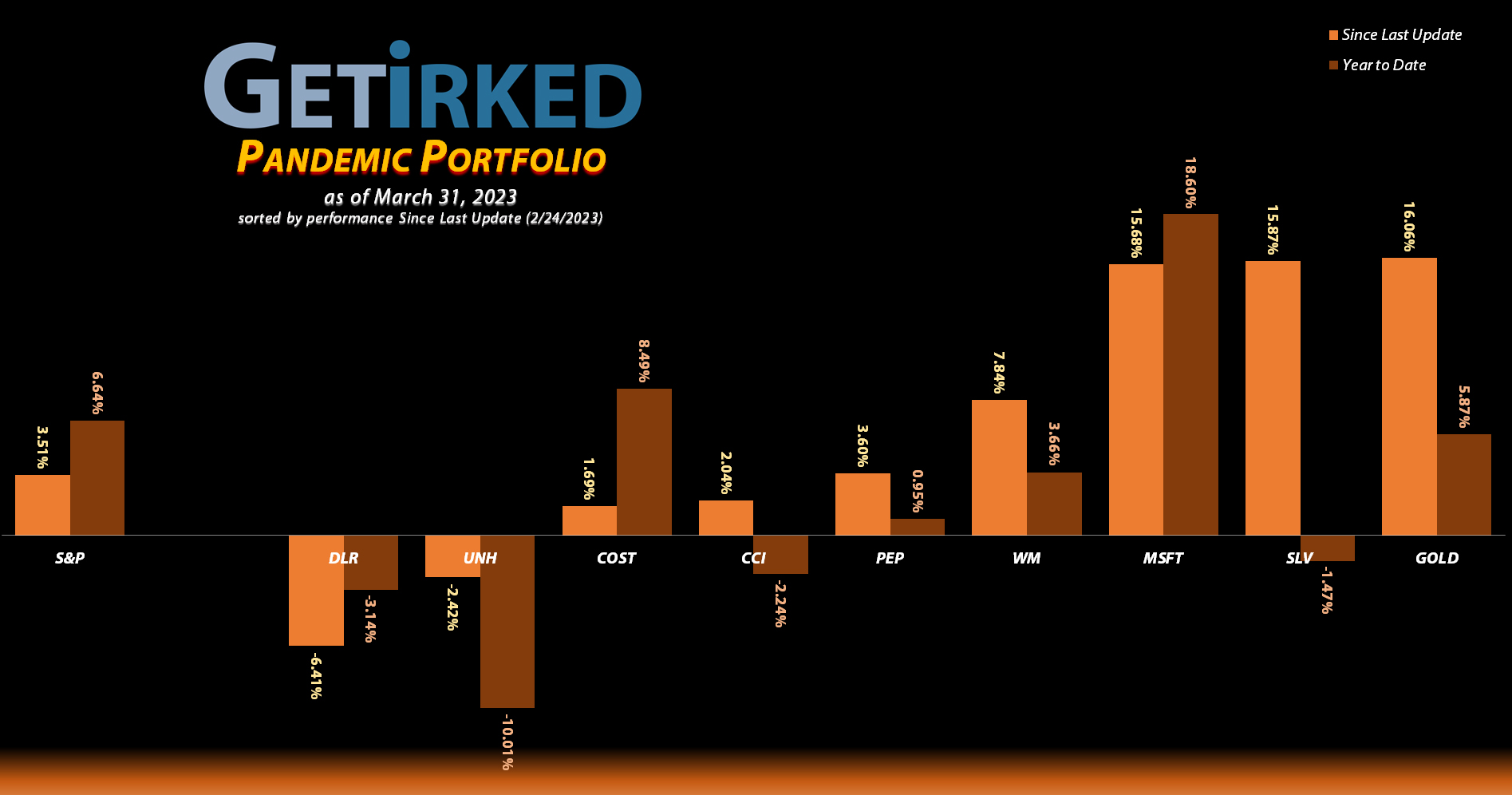

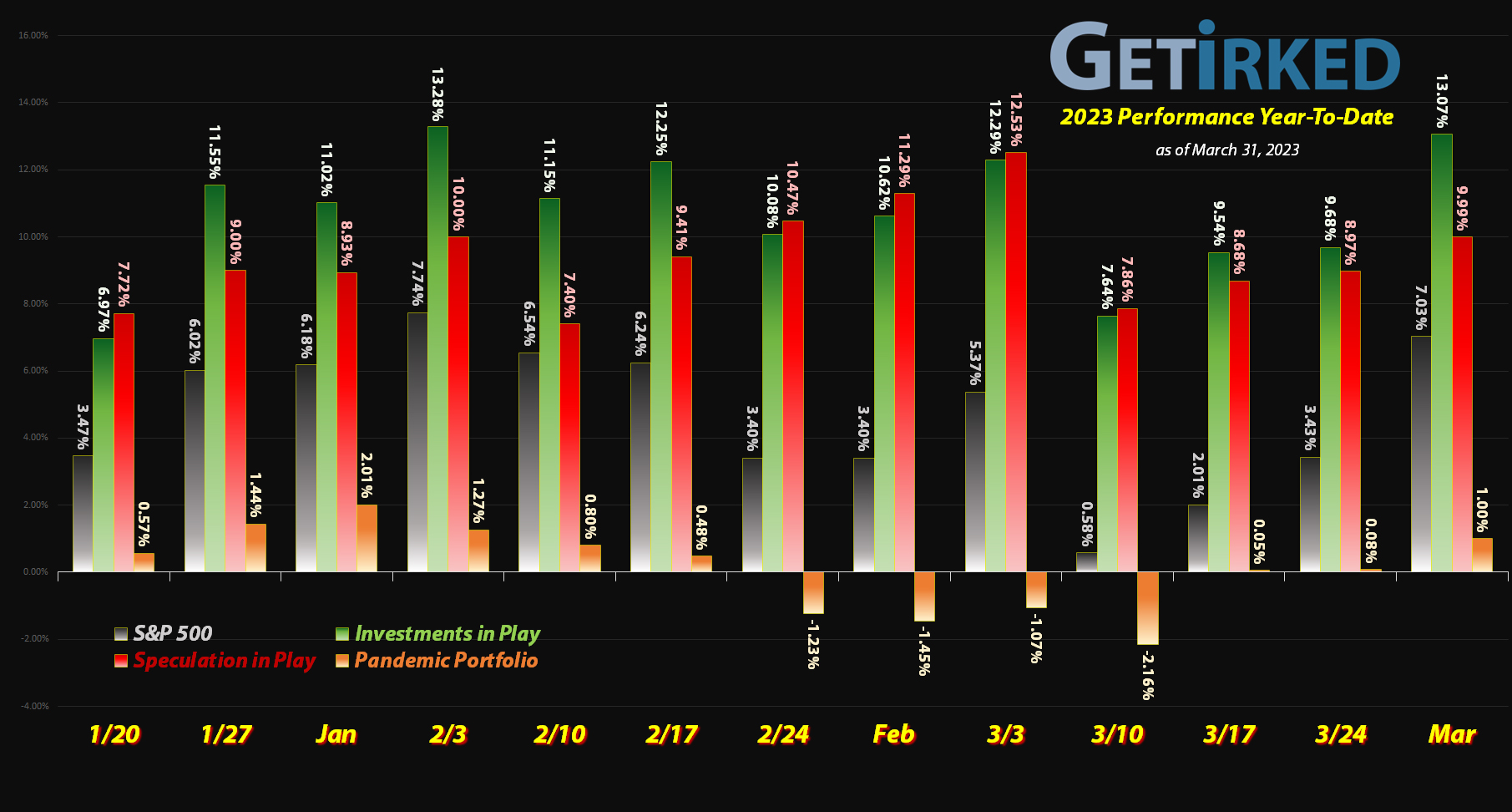

Banking Crisis splits the portfolio in two

It was the best of times and it was the worst of times for the Pandemic Portfolio since the last update. When three banks – Silvergate Capital (SI), Silicon Valley Bank, (SIVB), and Signature Bank (SBNY) – collapsed within a few weeks of each other, the crisis sent a panic through the markets.

With tightening credit conditions as a result of regional banks providing a huge portion of loans to commercial real estate – like Crown Castle (CCI) and Digital Realty Trust (DLR) in this portfolio – the portfolio took quite a hit.

However, with bank account holders fearing their deposits may no longer be secure, many investors shifted into assets with no counterparty risk (i.e. you can actually hold the asset in your own hands) which caused precious metals to pop. As a result, the portfolio saw a bump from Barrick Gold (GOLD) and the iShares Silver ETF (SLV) – though not as much of a pop as it got hit from the REITs.

Let’s get an update on all of the positions since my last post in February…

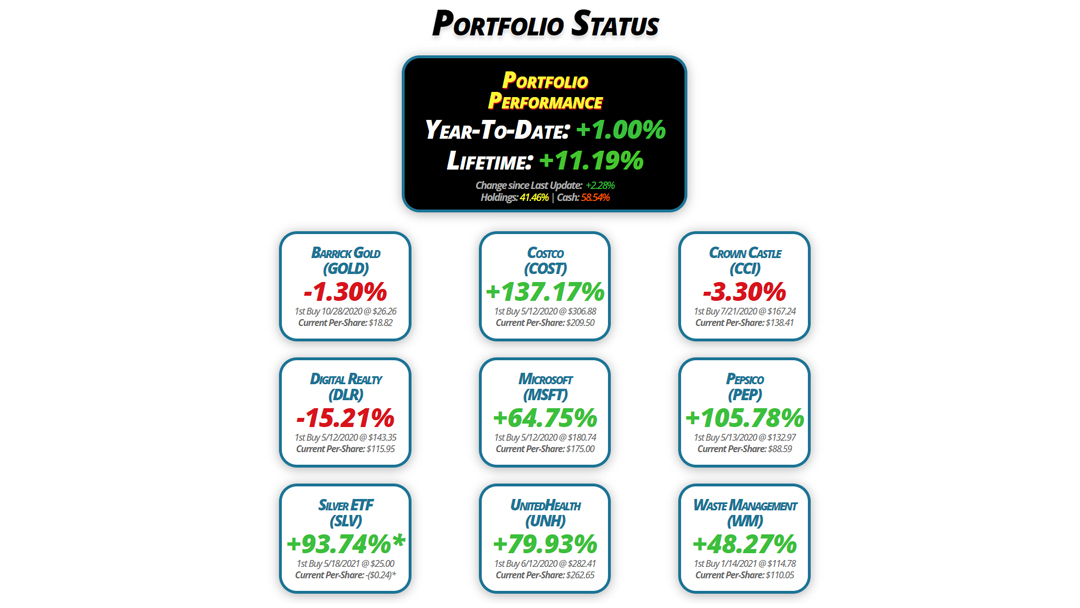

Portfolio Status

Portfolio

Performance

Year-To-Date: +1.00%

Lifetime: +11.19%

Change since Last Update: +2.28%

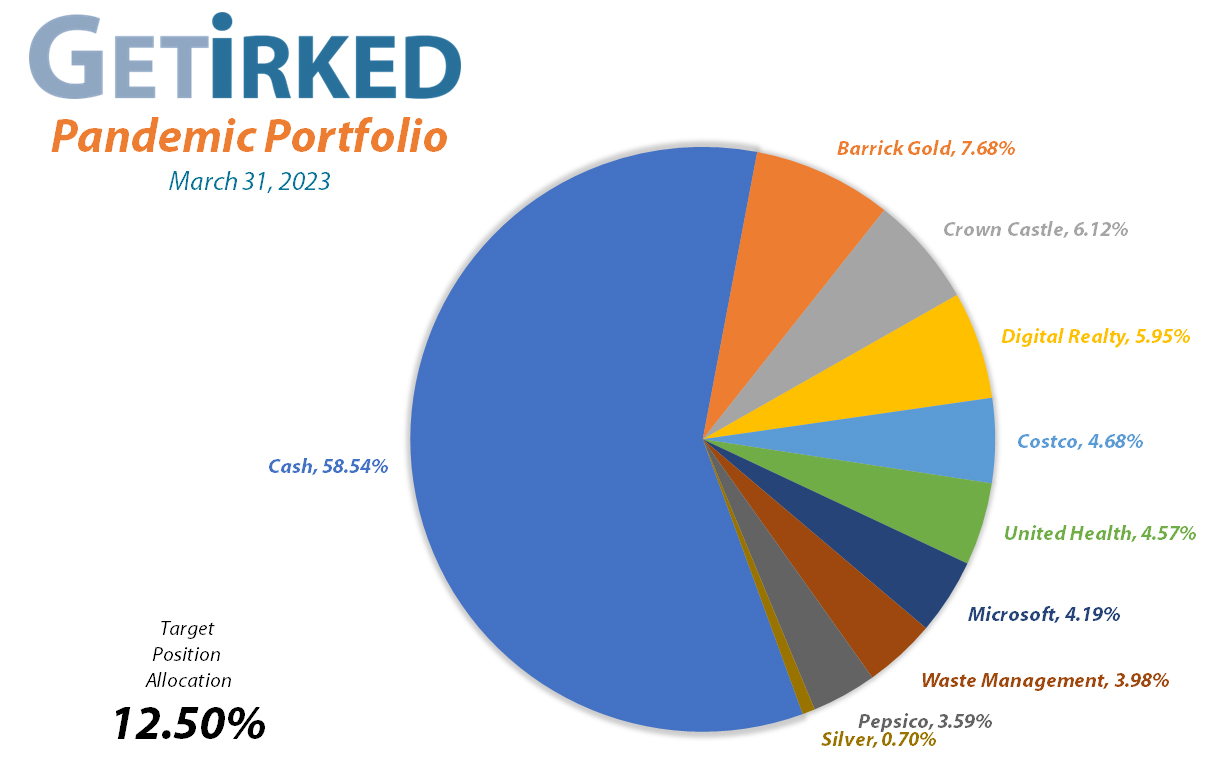

Holdings: 41.46% | Cash: 58.54%

Barrick Gold

(GOLD)

-1.30%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.82

Digital Realty

(DLR)

-15.21%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $115.95

Silver ETF

(SLV)

+93.74%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($0.24)*

Costco

(COST)

+137.17%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $209.50

Microsoft

(MSFT)

+64.75%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $175.00

UnitedHealth

(UNH)

+79.93%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $262.65

Crown Castle

(CCI)

-3.30%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $138.41

Pepsico

(PEP)

+105.78%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $88.59

Waste Management

(WM)

+48.27%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $110.05

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is not its own position, so there is one less in allocation size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Dividend Received

Current Price: $18.57

Per-Share Cost: $18.82 (-0.42% since last update)

Profit/Loss: -1.30%

Allocation: 7.68%* (+0.91% since last update)

Next Buy Target: $15.76

Barrick Gold (GOLD) paid out its quarterly dividend on Wednesday, March 15. Since its dividend is variable, this payout was quite a bit lower than prior payouts due to inflation, about 2.29% annually.

As a result, the payout only lowered my per-share cost -0.42% from $18.90 to $18.82. And, as I’ve mentioned previously, since GOLD is headquartered in Canada, my brokerage doesn’t allow me to reinvest the dividend. This makes little difference to the reduction in cost basis, although it does prevent the dividend from automatically compounding, which is a bit of a bummer.

Costco (COST): Strategy Update

Current Price: $496.87

Per-Share Cost: $209.50 (Unchanged since last update)

Profit/Loss: +137.17%

Allocation: 4.68%* (-0.03% since last update)

Next Buy Target: $449.89

Costco (COST) traded in a pretty solid range since the last update, pulling back a bit during the March selloff but not enough to hit my next buy target which is above its repeated floor of support seen twice in 2022 at $449.89.

In the meantime, it’s just a waiting game – either for its quarterly dividend, a special dividend, or a pullback.

Crown Castle (CCI): Strategy Update

Current Price: $133.84

Per-Share Cost: $138.41 (Unchanged since last update)

Profit/Loss: -3.30%

Allocation: 6.12%* (-0.01% since last update)

Next Buy Target: $114.31

Crown Castle (CCI) continued to pull back with the rest of the Real Estate Investment Trusts (REITs) over the past month, particularly with the failure of Silicon Valley Bank. Since regional banks supply much of the loans for commercial real estate enterprises, such as Crown Castle, tighter credit conditions are not good news for REITs.

My next buy target remains slightly above CCI’s pandemic low – not its 2022 low – further down at $114.31 and my next sell target is slightly above its 2022 high at $159.10, just below the next area of potential resistance.

Digital Realty Trust (DLR): Strategy Update

Current Price: $98.31

Per-Share Cost: $115.95 (Unchanged since last update)

Profit/Loss: -15.21%

Allocation: 5.95%* (-0.55% since last update)

Next Buy Target: $75.50

Just like Crown Castle (CCI) above, Digital Realty Trust (DLR) – obvious a REIT – got hit hard since the last update. In fact, DLR is exhibiting such weakness that I’ve lowered my next buy target from where it was around $85.76 – DLR’s low from 2022 – down to $75.50, the next area of support.

Additionally, I do plan to take more profits – even after selling twice in the previous update – if DLR breaks 2022’s highs at $122.43 with a profit target at $134.61, just under the next key area of potential resistance.

Microsoft (MSFT): Profit-Taking & Dividend

Current Price: $288.30

Per-Share Cost: $175.00 (-12.71% since last update)

Profit/Loss: +64.75%

Allocation: 4.19%* (-0.65% since last update)

Next Buy Target: $214.37

Microsoft (MSFT) paid out its relatively small quarterly dividend on March 10, which, after reinvesting, lowered my per-share cost -0.27% from $200.48 to $199.93.

On Wednesday, March 29, Microsoft saw more resistance trying to make it over $280 so I decided it was time to take profits with a sell order that went through at $280.55. The sale locked in +20.38% in gains on shares I bought for $233.06 on February 22, 2021 and lowered my per-share cost -12.47% from $199.93 down to $175.00

From here, my next buy target is at $214.37, a bit above Microsoft’s 2022 low, and my next sell target is $349.16, slightly under MSFT’s all-time high.

As of this update, MSFT is $288.30, up +2.77% from where I took profits.

Pepsico (PEP): Strategy Update

Current Price: $182.30

Per-Share Cost: $88.59 (Unchanged since last update)

Profit/Loss: +105.78%

Allocation: 3.54%* (+0.04% since last update)

Next Buy Target: $157.01

Pepsico (PEP) saw quite a rally since the last update as the Regional Banking Crisis scared investors into defensive stocks like the consumer staples. Accordingly, while I do have a buying target down at $157.01, a past point of support, it’s more likely PEP will hit my next sell target at $186.19, slightly under its all-time high.

iShares Silver ETF (SLV): Strategy Update

Current Price: $22.12

Per-Share Cost: -$0.24* (Unchanged since last update)

Profit/Loss: +93.74%

Allocation: 0.70%* (+0.09% since last update)

Next Buy Target: $16.21

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

The precious metals saw quite a pop since the last update as fears of unstable banks pushes investors into assets with no counterparty risk like gold and silver. Since I still have a small position in the silver ETF (SLV) that I obtained from my incredibly risk (stupid) 18-month put option sales, I plan to take profits if it reaches $22.29, slightly below its highs from late 2022.

I also continue to plan to add to SLV, but until I’m able to pull more profits out of the position, I won’t add unless it drops to $16.21 slightly above its 2022 low.

UnitedHealth (UNH): Dividend Reinvestment

Current Price: $472.59

Per-Share Cost: $262.65 (-0.34% since last update)

Profit/Loss: +79.93%

Allocation: 4.57%* (-0.21% since last update)

Next Buy Target: -NO BUY TARGET-

While I wait for UnitedHealth (UNH) to recover its strength so I can fully close the position, it has been nice collecting dividends along the way. UNH paid out its quarterly dividend on Wednesday, March 22, lowering my per-share cost -0.34% from $263.54 down to $262.65.

As mentioned previously, I still plan to close this position entirely due to ethical concerns I have with stories I’ve heard about how the company treats both patients and medical providers with a sell target around $550.00.

Waste Management (WM): Dividend Reinvestment

Current Price: $163.17

Per-Share Cost: $110.05 (-0.45% since last update)

Profit/Loss: +48.27%

Allocation: 3.98%* (+0.23% since last update)

Next Buy Target: $139.57

Waste Management (WM) paid out its quarterly dividend on Friday, March 24 which, after reinvesting, lowered my per-share cost -0.45% from $110.55 down to $110.05.

From here, my next buy target is $139.57, above a past point of key support, and my next sell target is $169.29, just under a past point of resistance.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.