Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #38

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

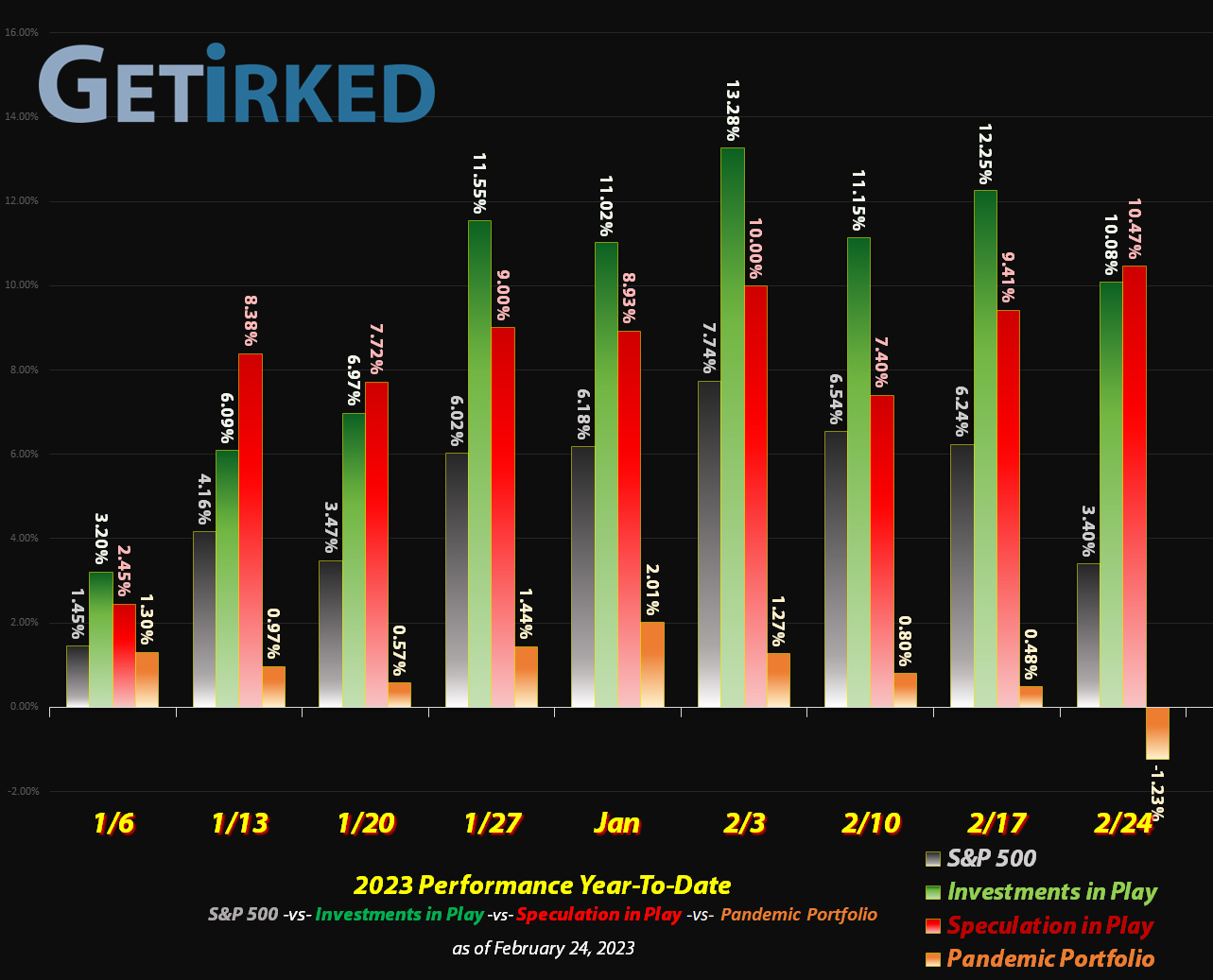

Still no love for the Pandemic Portfolio…

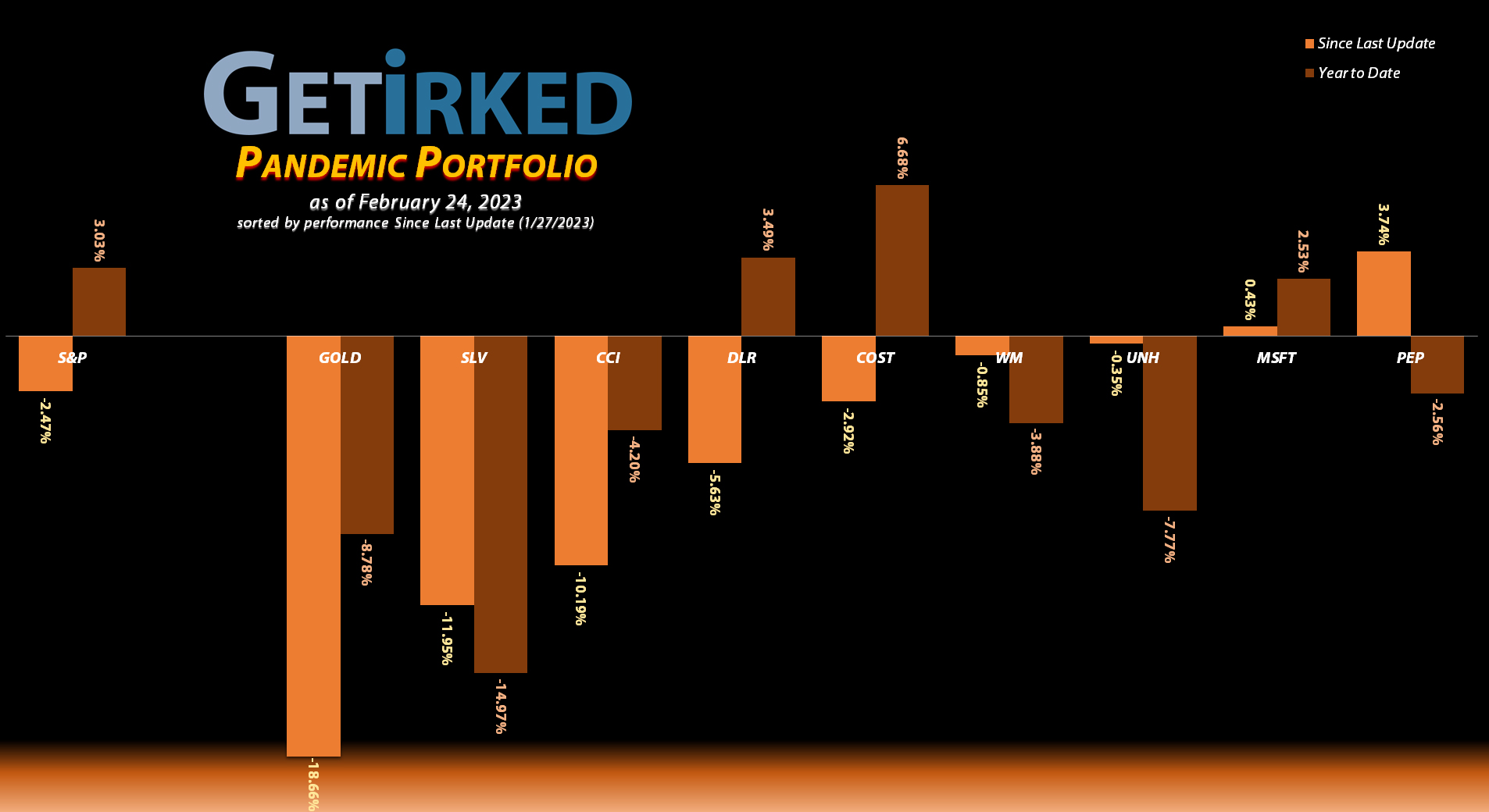

The entire portfolio remains under pressure as many of the stocks I had chosen for their ability to hold up in a recession have not proven themselves capable of holding up in a high-inflationary environment like we’re currently experiencing.

With the Federal Reserve raising interest rates to combat the inflation, the precious metals have come under significant selling pressure which has dinged two of the positions in the portfolio. Additionally, the two Real Estate Investment Trust (REIT) positions in the portfolio have also gotten beaten up due to the interest rate environment.

Let’s take a look at the moves that happened in this portfolio since the last update…

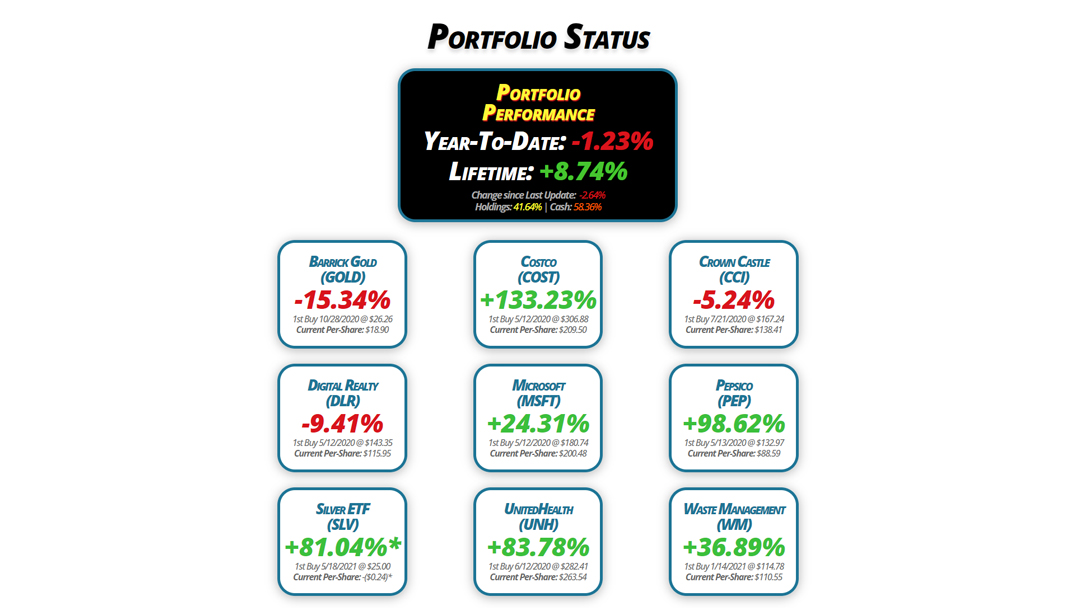

Portfolio Status

Portfolio

Performance

Year-To-Date: -1.23%

Lifetime: +8.74%

Change since Last Update: -2.64%

Holdings: 41.64% | Cash: 58.36%

Barrick Gold

(GOLD)

-15.34%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.90

Digital Realty

(DLR)

-9.41%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $115.95

Silver ETF

(SLV)

+81.04%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($0.24)*

Costco

(COST)

+133.23%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $209.50

Microsoft

(MSFT)

+24.31%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $200.48

UnitedHealth

(UNH)

+83.78%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $263.54

Crown Castle

(CCI)

-5.24%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $138.41

Pepsico

(PEP)

+98.62%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $88.59

Waste Management

(WM)

+36.89%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $110.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

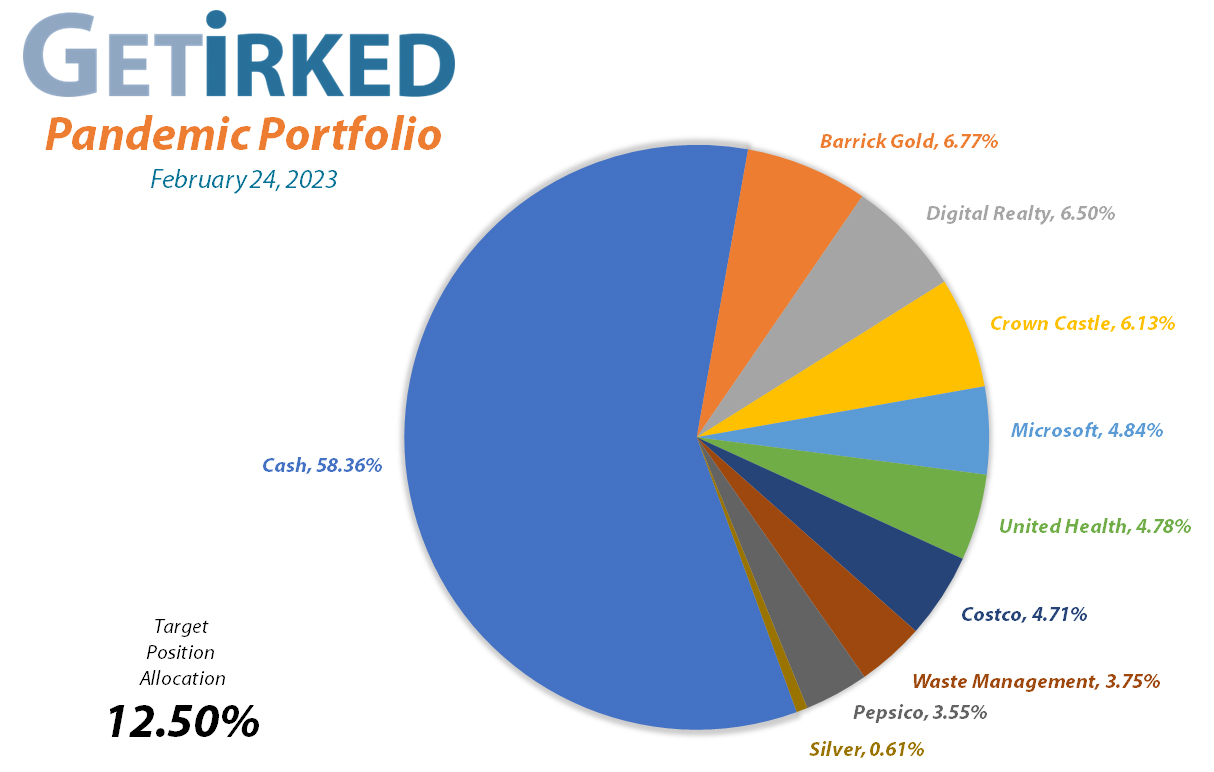

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is not its own position, so there is one less in allocation size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position

Current Price: $16.00

Per-Share Cost: $18.90 (-1.05% since last update)

Profit/Loss: -15.34%

Allocation: 6.769%* (-0.74% since last update)

Next Buy Target: $14.52

The precious yellow metal positively collapsed when macroeconomic concerns made it apparent that the Federal Reserve will likely have to hike interest rates much higher and keep there much longer than anyone expected. Accordingly, the goldminers fell apart with Barrick Gold (GOLD) collapsing to my next buy target which filled at $16.48 on Friday, February 17.

The buy locked in a -16.39% discount replacing some of the shares I sold a month ago for $19.71 on January 13, and reinforced my discipline, “If you don’t take profits when you have them, the market will take them from you.”

The sale lowered my per-share cost -1.05% from $19.10 to $18.90. From here, my next buy target is $14.52, above a past point of support, and my next sell target is $20.12, slightly below GOLD’s recent high in January.

As of this update, GOLD is $16.00, down -2.91% from where I added.

Costco (COST): Dividend Reinvestment

Current Price: $488.61

Per-Share Cost: $209.50 (-0.18% since last update)

Profit/Loss: +133.23%

Allocation: 4.708%* (-0.02% since last update)

Next Buy Target: $449.89

Costco (COST) paid out its quarterly dividend on Friday, February 17. While relatively meager at about 0.7% annually, the reinvested dividend did lower my per-share cost -0.18% from $209.88 to $209.50. Naturally, all shareholders are still waiting that sweet, sweet special dividend which was mentioned in the last earnings call, though we don’t have an expected delivery date, yet.

Costco has been one of the only positions in the portfolio that continues to perform as the portfolio was designed – to have companies that outperform during good times or bad times. Since the past update, Costco has increased in value and maintained its composure even during pullbacks.

Accordingly, the plan remains unchanged: I will add to COST if it sells off far enough to its recent lows around $450.00, and I have no plans to take profits until it far exceeds its current all-time high more than $600.

Crown Castle (CCI): Strategy Update

Current Price: $131.16

Per-Share Cost: $138.41 (Unchanged since last update)

Profit/Loss: -5.24%

Allocation: 6.132%* (-0.53% since last update)

Next Buy Target: $115.99

Just like the rest of the Real Estate Investment Trusts (REITs) which were hated throughout 2022, Crown Castle (CCI) bounced throughout January until peaking in mid-February and beginning its pullback.

In light of how frothy the market has become, I’ve lowered my buy price target to below CCI’s 2022 lows as I am not certain those will hold support. Instead, I’m using CCI’s pandemic low around $116.00 as my next buy price target, and I will sell more if CCI approaches $160.

Digital Realty Trust (DLR): Profit-Taking

Current Price: $105.04

Per-Share Cost: $115.95 (-0.02% since last update)

Profit/Loss: -9.41%

Allocation: 6.498%* (-1.22% since last update)

Next Buy Target: $86.34

When the markets rallied following Federal Reserve Chairman Jerome Powell’s press conference on Wednesday, February 1, I decided to substantially reduce my Digital Realty Trust (DLR) position as I’m a bit wary about data center demand in the coming months.

I sold shares I bought for $106.14 and $85.78 on September 22, 2022 and October 13, 2022, respectively, at $116.09, locking in +20.98% in gains on the average $95.96 buying price of the two lots.

While the sale only lowered my per-share cost a negligible -0.02% from $115.97 to $115.95, it served the more important purpose of reducing exposure given that DLR sold off -26.24% lower than where I took profits just last year.

From here, my next sell target is $140.24, below a key point of past resistance, and my next buy target is $86.34, a bit above DLR’s $85.63 low from 2022.

DLR is $105.04 as of this update, down -9.52% from where I took profits.

Microsoft (MSFT): Strategy Update

Current Price: $249.22

Per-Share Cost: $200.48 (Unchanged since last update)

Profit/Loss: +24.31%

Allocation: 4.838%* (+0.14% since last update)

Next Buy Target: $197.98

Microsoft (MSFT) saw a significant rally following news of its investment in OpenAI, the company behind the chatbot ChatGPT which became incredibly popular since the beginning of 2023. While Microsoft has pulled back a bit from its recent high, it’s still up significantly since the start of 2023.

Even still, I’m not confident that MSFT’s 2022 lows will hold down at $213.43, so my next buy target is under my current per-share cost, below $200.00, and I do plan to take profits if Microsoft makes a run for $300 or higher.

Pepsico (PEP): Strategy Update

Current Price: $175.96

Per-Share Cost: $88.59 (Unchanged since last update)

Profit/Loss: +98.62%

Allocation: 3.547%* (+0.21% since last update)

Next Buy Target: $161.05

Pepsico (PEP) has become a favorite among consumer product investors, but this has also made the stock quite overpriced and it carries a high valuation. Because of this, I have lowered my next target to add more to my position to PEP’s October 2022 lows just above $161.00.

I believe that if we do see a selloff in the coming weeks or months, PEP’s 2023 low around $167 won’t hold, so I can be patient with this outperformer.

iShares Silver ETF (SLV): Strategy Update

Current Price: $19.09

Per-Share Cost: -$0.24* (Unchanged since last update)

Profit/Loss: +81.04%

Allocation: 0.614%* (-0.07% since last update)

Next Buy Target: $16.23

After seeing a decent pop from the beginning of 2023, the precious metals space has been decimated following inflation reports indicating the Federal Reserve will likely raise the interest rates significantly higher, not a good environment for nonyielding assets like gold and silver.

Believe it or not, I do plan to add to my SLV position if we see enough of a selloff, however that selloff will have to be significant with SLV testing its 2022 lows down around $16.19 before I consider putting more money to work.

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

UnitedHealth (UNH): Planned Closure

Current Price: $484.33

Per-Share Cost: $263.54 (Unchanged since last update)

Profit/Loss: +83.78%

Allocation: 4.775%* (+0.10% since last update)

Next Buy Target: -NO BUY TARGET-

The market really fell out of love with healthcare this year as investors wait to hear whether President Biden plans to run for reelection. If Biden chooses to run again, healthcare stocks will rally as investors will know what to expect.

However, since healthcare remains a favored target for Democrat rhetoric, if the Biden decides not to run again, healthcare stocks like UnitedHealth (UNH) will remain under pressure.

As I mentioned in previous updates, I am planning to close my UNH position entirely due to ideological issues I have with the way the company operates its business. That being said, since UNH has sold off significantly, I will hold what I have until it reaches my sell target of $546.74, and I will not add to it.

Waste Management (WM): Strategy Update

Current Price: $151.33

Per-Share Cost: $110.55 (Unchanged since last update)

Profit/Loss: +36.89%

Allocation: 3.754%* (+0.06% since last update)

Next Buy Target: $139.34

Waste Management (WM) has fallen under selling pressure since the beginning of the year with competitors in the space outperforming the name. That being said, I still have faith in both management and the investment for the long-term, so I have no plans to close the position.

However, I will take profits if WM makes a run for $170, a past level of resistance, and I won’t be adding to it unless it nears $139, a consistent level of support and its 2022 low.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.