Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #36

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

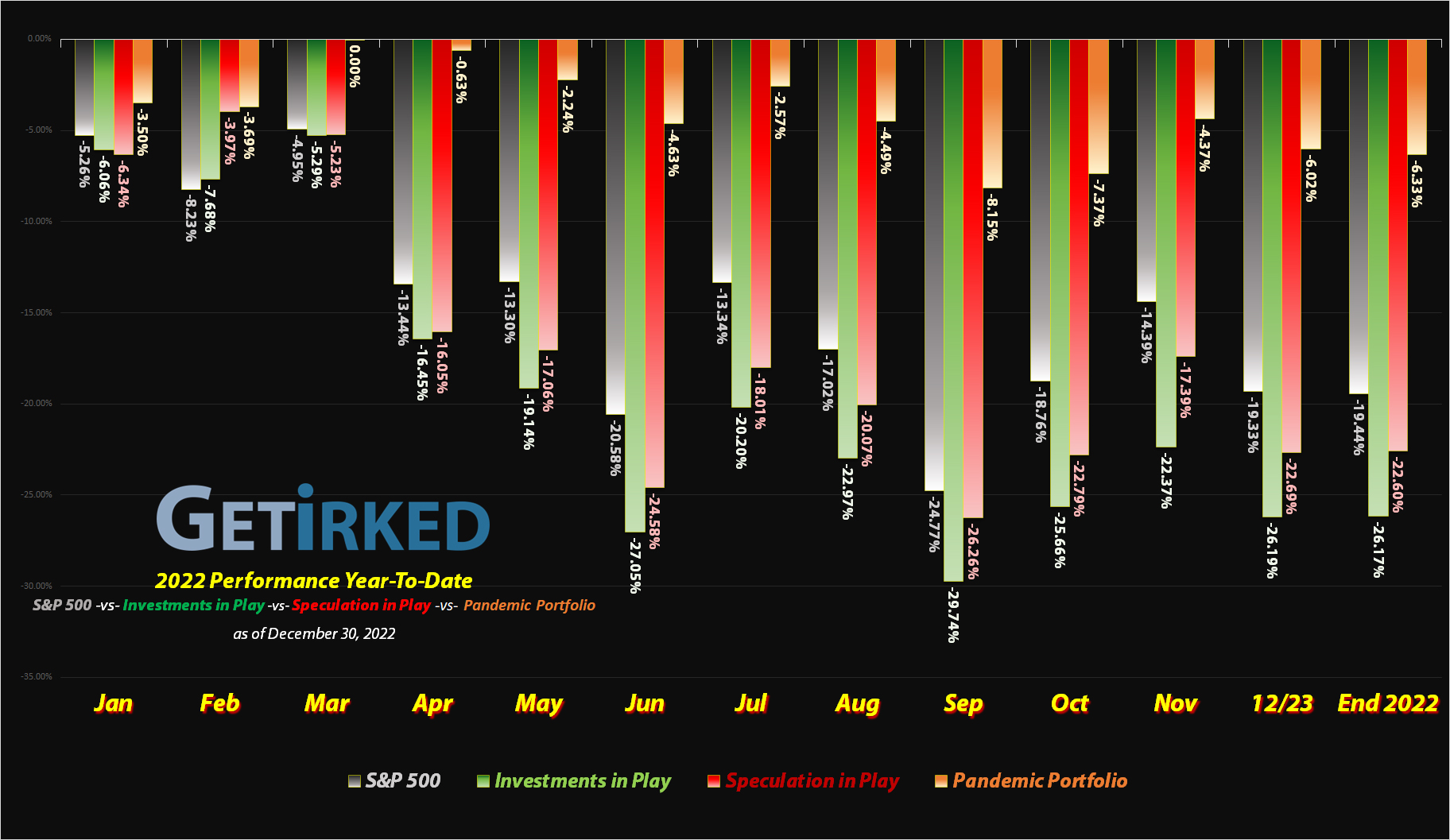

What a year 2022 was!

Anyone else feel particularly exhausted after the utter wipeout that was 2022 in the stock market?! At least it’s over and we can focus on… what will likely be another insane year in 2023.

Rather than go into detail with my prognostications here, I’ll leave this video I’ve made giving my 2023 gameplan below which includes what I see as headwinds as well as potential positive catalysts coming in the year ahead.

With that, let’s take a look at how the portfolio’s positions did since the last update!

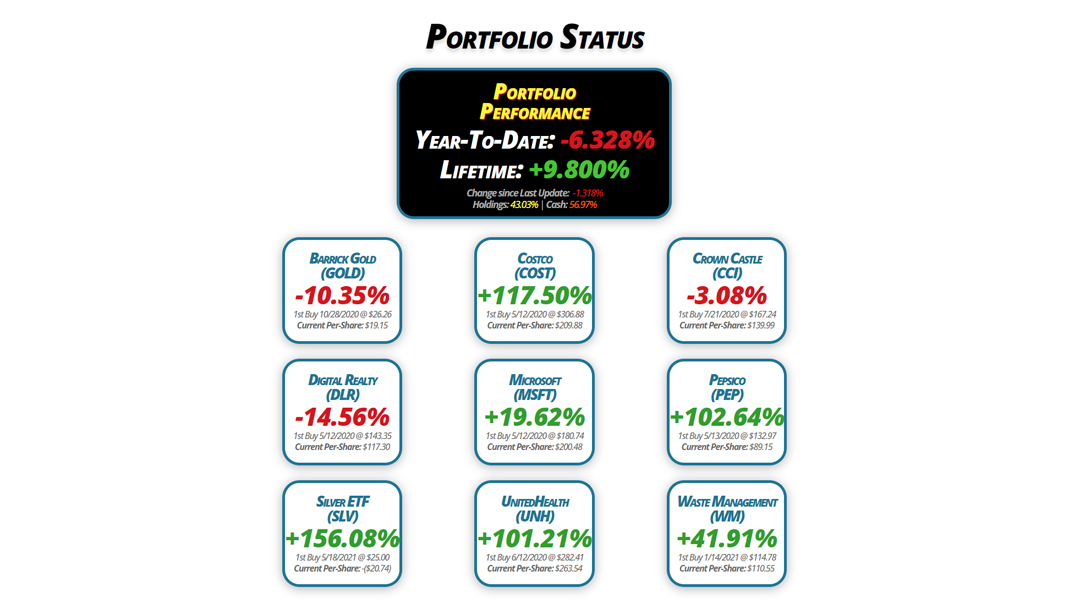

Portfolio Status

Portfolio

Performance

Year-To-Date: -6.328%

Lifetime: +9.800%

Change since Last Update: -1.318%

Holdings: 43.03% | Cash: 56.97%

Barrick Gold

(GOLD)

-10.35%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $19.15

Digital Realty

(DLR)

-14.56%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $117.30

Silver ETF

(SLV)

+156.08%

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($20.74)

Costco

(COST)

+117.50%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $209.88

Microsoft

(MSFT)

+19.62%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $200.48

UnitedHealth

(UNH)

+101.21%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $263.54

Crown Castle

(CCI)

-3.08%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $139.99

Pepsico

(PEP)

+102.64%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $89.15

Waste Management

(WM)

+41.91%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $110.55

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Dividend Payout

Current Price: $17.17

Per-Share Cost: $19.15 (-0.674% since last update)

Profit/Loss: -10.35%

Allocation: 7.271%* (+0.581% since last update)

Next Buy Target: $13.05

Barrick Gold (GOLD) paid out its quarterly dividend on Thursday, December 15, and, because of its HQ located in Canada, my broker will not allow me to reinvest the dividends so I have to take them as cash. Regardless, the dividend lowered my per-share cost -0.674% from $19.28 to $19.15.

From here, my next buy price target for GOLD is right near its 2022 low of $13.01, and my next sell target is $19.75, just under a key point of resistance.

Costco (COST): Added to Position

Current Price: $456.50

Per-Share Cost: $209.88 (+3.282% since last update)

Profit/Loss: +117.50%

Allocation: 4.348%* (-0.526 since last update)

Next Buy Target: $410.90

When Costco (COST) sold off with the rest of the market mid-month, it was time to add back to the position with a small buy which filled at $460.52 on Friday, December 16.

The buy locked in a -23.709% discount, replacing some of the shares I sold for $603.64 back on April 7, and raised my per-share cost +3.282% from $203.21 to $209.88, still a -31.61% reduction from where I initially opened the position at $306.88 back on May 12, 2020.

From here, my next buy target is $410.90, above COST’s 2022 lows, and I have no sell targets for the stock at this time.

COST is $456.50 as of this update, down -0.87% from where I added.

Crown Castle (CCI): Profit-Taking

Current Price: $135.67

Per-Share Cost: $139.99 (-0.363% since last update)

Profit/Loss: -3.08%

Allocation: 6.210%* (-0.797% since last update)

Next Buy Target: $114.75

I took profits in Crown Castle (CCI) on Tuesday, December 13 when it popped with the rest of the markets with a sale that went through at $145.66, locking in +8.54% in gains on shares I bought for $134.20 back on October 7.

It might seem weird to take profits so soon, especially when the sale only lowered my per-share cost -0.363% from $140.50 to $139.99, however this action was entirely because CCI sold off far more significantly than I anticipated in October, dropping another -9.22% from where I added before finding a low near $122.00.

Accordingly, I felt it was prudent to take profits should CCI retest its low. From here, my next sell target is $163.45, below a past point of resistance and CCI’s current 200-Day Simple Moving Average (SMA), and my next buy target is above its lows from the pandemic at $114.75.

As of this update, CCI is $135.67, down -6.86% from where I took profits.

Digital Realty Trust (DLR): Strategy Update

Current Price: $100.22

Per-Share Cost: $117.30 (Unchanged since last update)

Profit/Loss: -14.56%

Allocation: 6.973%* (-0.661% since last update)

Next Buy Target: $78.25

Digital Realty Trust (DLR) actually got pretty close to my next sell target around $118.00 before collapsing with the rest of the market throughout the month. With the Federal Reserve reiterating their intent to keep the benchmark interest rate high (and higher, if necessary), Real Estate Investment Trusts (REITs) like Crown Castle (CCI) and Digital Realty (DLR) will continue to come under pressure.

From here, I’m maintaining my next buy target at $78.25, below DLR’s 2022 low and above the next level of support, and my next sell target remains $118.05, slightly higher than here and below the next level of resistance.

Microsoft (MSFT): Dividends & Profit-Taking

Current Price: $239.82

Per-Share Cost: $200.48 (-5.811% since last update)

Profit/Loss: +19.62%

Allocation: 4.610%* (-1.177% since last update)

Next Buy Target: $199.80

Microsoft (MSFT) paid out its quarterly dividend on Friday, December 9. After reinvestment, the small dividend payout still lowered my per-share cost -0.277% from $212.85 to $212.26.

On Tuesday, December 13, Microsoft roared higher with the rest of the market following a cooler-than-feared CPI report, hitting my sell order which filled at $262.00 and lowered my per-share cost an additional -5.55% from $212.26 to $200.48.

From here, I continue to have sell targets with my next sell at $293.85. As I’m expecting the market as a whole, but technology specifically, to crack through and make new lows in 2023, my next buy target is lower than my new cost basis down at $199.80, above a past point of support.

As of this update, MSFT is $239.82, down -8.47% from where I took profits.

Pepsico (PEP): Strategy Update

Current Price: $180.65

Per-Share Cost: $89.15 (Unchanged since last update)

Profit/Loss: +102.64%

Allocation: 3.584%* (-0.018% since last update)

Next Buy Target: $162.00

Pepsico (PEP) remains one of the darling investments during a recession with investors piling into the name throughout the month. Given how PEP is often a slow-mover, this position requires patience as I wait for its next move, whichever way that happens to be.

My next buy target remains down at $162.00, above a past point of support in the last big selloff, and my next sell target is right around $200.00, a key level of psychological resistance as investors always grapple with those large price points with a lot of zeros at the end of them.

iShares Silver ETF (SLV): Strategy Update

Current Price: $22.03

Per-Share Cost: -$20.74* (Unchanged since last update)

Profit/Loss: +156.08%

Allocation: 1.003%* (+0.117% since last update)

Next Buy Target: $13.75

* Projected Per-Share Cost after Assignment: $20.84. In May 2021, I sold Jan 2023 $25 puts on SLV. If I am assigned this January (meaning SLV’s price is less than $25.00 at the time of expiration), the actual per-share cost for this position will be much higher at $20.84. If I am not assigned, then the listed per-share cost represents the actual cost including the profits received from selling the puts.

—

This position’s starting to get really, REALLY exciting, sports fans! As you likely know, if SLV doesn’t rise above $25.00 by the third Friday in January (the 20th), these put options I sold back in May 2021 will be exercised by its holder and I will be forced to buy 100 shares of SLV for each put option I sold.

However, things have started to get interesting. Both gold and silver prices have been rallying into the year end with many analysts believing that gold and silver will be good places to put money into 2023. This has made my put options actually be “in the money.”

Even though SLV is quite a bit under $25.00, because the amount of time left on this option is very small and shrinks every day, the price to buy this put option goes down. Since I sold it, the way I close this trade is by buying back the put option, so as the cost goes down, the amount of money I received when I sold the puts goes up, thus making the trade more profitable.

At this point, if SLV approaches $25.00, I will close this position by buying pack the puts for $0.73. This means I’ll pay $73.00 to buy back each put option I sold, pocketing more than $300.00 for each put contract (I initially sold them for $375.00 each back on May 2021).

If the price of the puts doesn’t drop to my $0.73 target, I may close them at a higher price, thereby decreasing the amount of profit I get to keep, or I may even let them get exercised and suddenly have a large position in SLV.

UnitedHealth (UNH): Dividend & Planned Closure

Current Price: $530.27

Per-Share Cost: $263.54 (-0.303% since last update)

Profit/Loss: +101.21%

Allocation: 5.178%* (+0.017% since last update)

Next Buy Target: -NO BUY TARGET-

UnitedHealth (UNH) paid out its small but useful quarterly dividend on Wednesday, December 14, which, after reinvestment into the position, lowered my per-share cost -0.303% from $264.34 to $263.54.

UnitedHealth has been a tough investment for me. While healthcare is a great place to be during a recession, many of my friends work in the medical industry, and the horror stories I’ve heard from first-hand experiences of how UnitedHealth has treated some of its claimants have left a bad taste in my mouth.

Every investor is different. Some invest in tobacco companies like Altria (MO) since the company offers a great dividend, but I choose not to. I don’t want to invest in companies where I wouldn’t use the product myself or I don’t respect the way the company does business.

Sure, this means I could miss out on an opportunity, but I’d rather be true to myself and invest in companies that I respect. Therefore, I’ve decided that I will be closing my UnitedHealth position when the selloff stops and we see a rally in the coming months.

Waste Management (WM): Profit-Taking & Dividends

Current Price: $156.88

Per-Share Cost: $110.55 (-7.783 since last update)

Profit/Loss: +41.91%

Allocation: 3.854%* (-0.888% since last update)

Next Buy Target: $139.35

Waste Management (WM) popped through my next sell target on Wednesday, November 30 following Fed Chair Jerome Powell’s announcement that the Fed would be decreasing the amount of rate hikes going forward. The sell order filled at $167.60, locking in just +4.261% in gains on shares I bought for $160.75 back on January 7 of this year.

The reason behind my aggressive profit-taking is two-fold: (1) Waste Management sold off more than I expected it would throughout 2022 so I wanted to take profits while I had them, and (2) the sale finally lowered my per-share cost below where I first opened the position at $114.96 on January 14, 2021, dropping it -7.407% from $119.88 down to $111.00.

On Monday, December 19, Waste Management paid out its quarterly dividend which, after reinvestment, lowered my per-share cost -0.405% from $111.00 down to $110.55.

From here, my next sell target is $174.50, a few pennies short of WM’s all-time high, and my next buy target is $139.35, above a strong point of support where Waste Management has continuously bottomed over the past two years.

As of this update, WM is $156.88, down -6.40% from where I took profits.

* Target allocation for each position in the portfolio is 11.11% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.