Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #35

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Will Santa Claus bring his rally this Xmas?

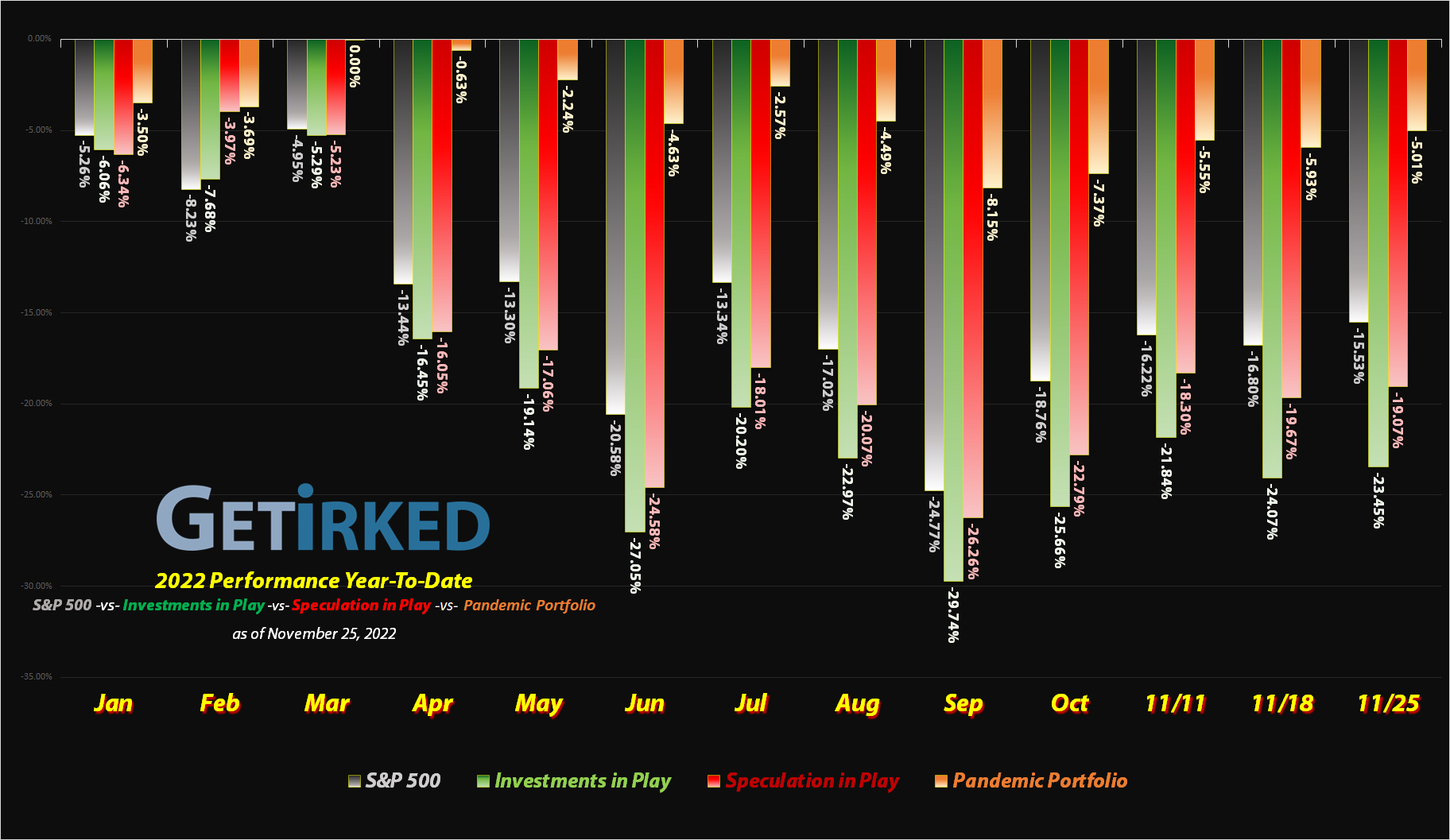

The stock market rallied over the last month on the back of weaker-than-feared inflation data, resulting in many exuberant analysts and pundits to claim stocks will continue to rally into the end of the year.

Why so bullish?

Many hedge funds and professional investment firms need to make their performance look good, and, seasonally speaking, December typically is a good time of the year, particularly with a historical rally which begins right before Christmas and goes to New Year’s Eve, nicknamed “The Santa Claus Rally.”

Will that happen again this year?

There are so many geopolitical and macroeconomic variables swirling around that I have absolutely no idea what the next month is going to look like. That’s why I always say you need to make a plan: what are you going to do if the market goes up tomorrow and what are you going to do if the market goes down tomorrow?

And, with that, let’s see what happened to the Pandemic Portfolio since the last update in October…

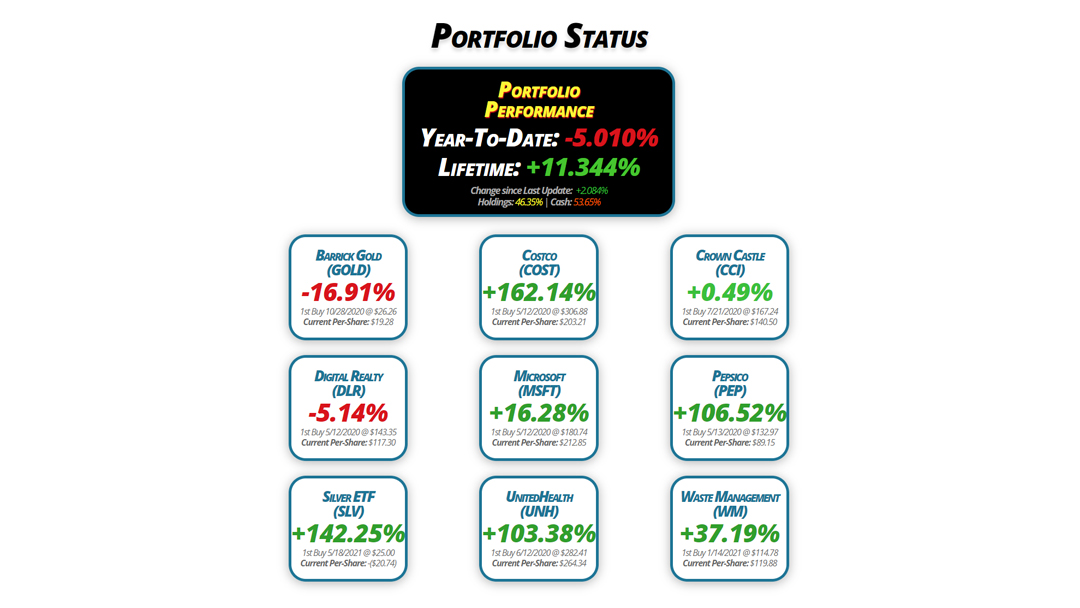

Portfolio Status

Portfolio

Performance

Year-To-Date: -5.010%

Lifetime: +11.344%

Change since Last Update: +2.084%

Holdings: 46.35% | Cash: 53.65%

Barrick Gold

(GOLD)

-16.91%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $19.28

Digital Realty

(DLR)

-5.14%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $117.30

Silver ETF

(SLV)

+142.25%

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($20.74)

Costco

(COST)

+162.14%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $203.21

Microsoft

(MSFT)

+16.28%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $212.85

UnitedHealth

(UNH)

+103.38%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $264.34

Crown Castle

(CCI)

+0.49%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $140.50

Pepsico

(PEP)

+106.52%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $89.15

Waste Management

(WM)

+37.19%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $119.88

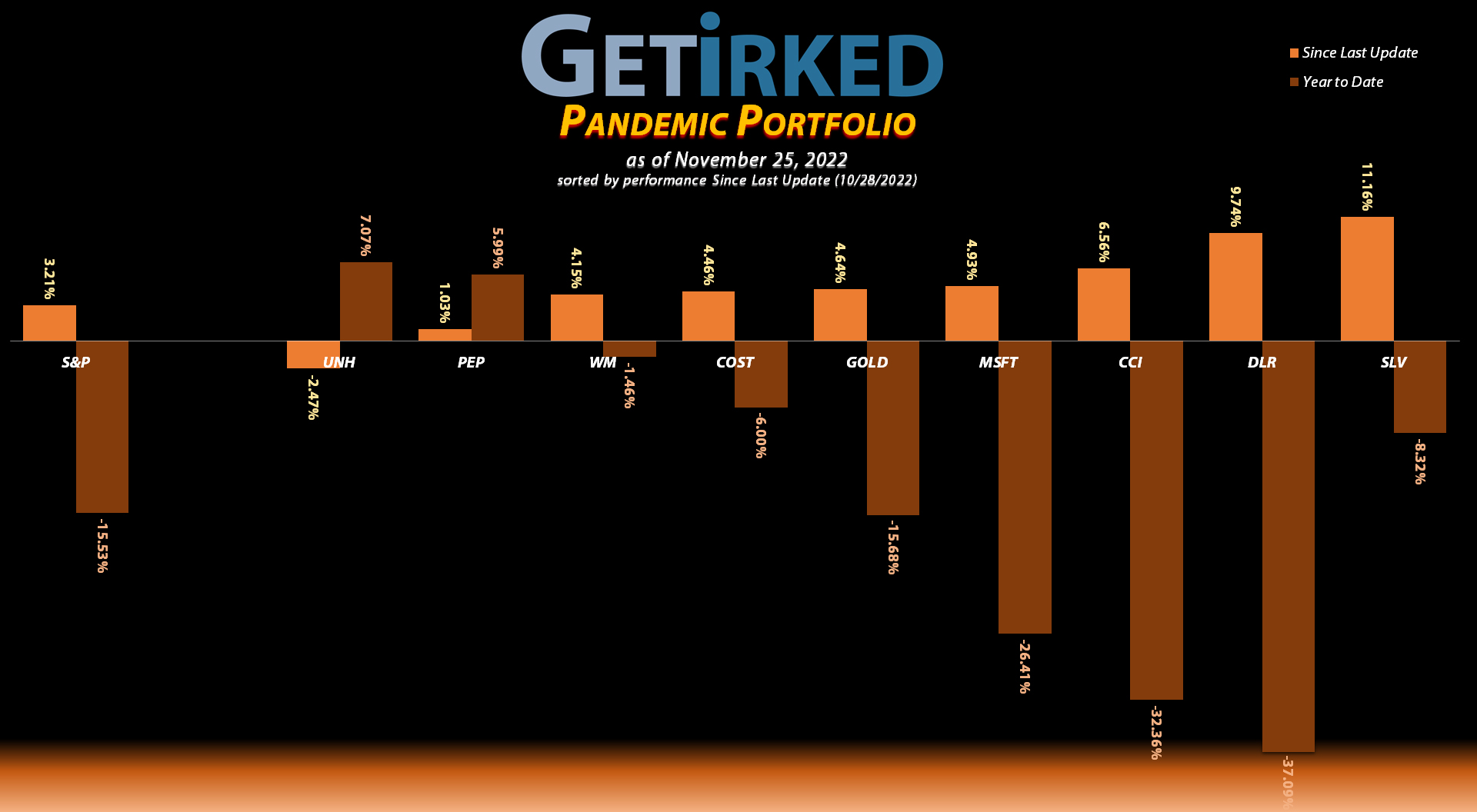

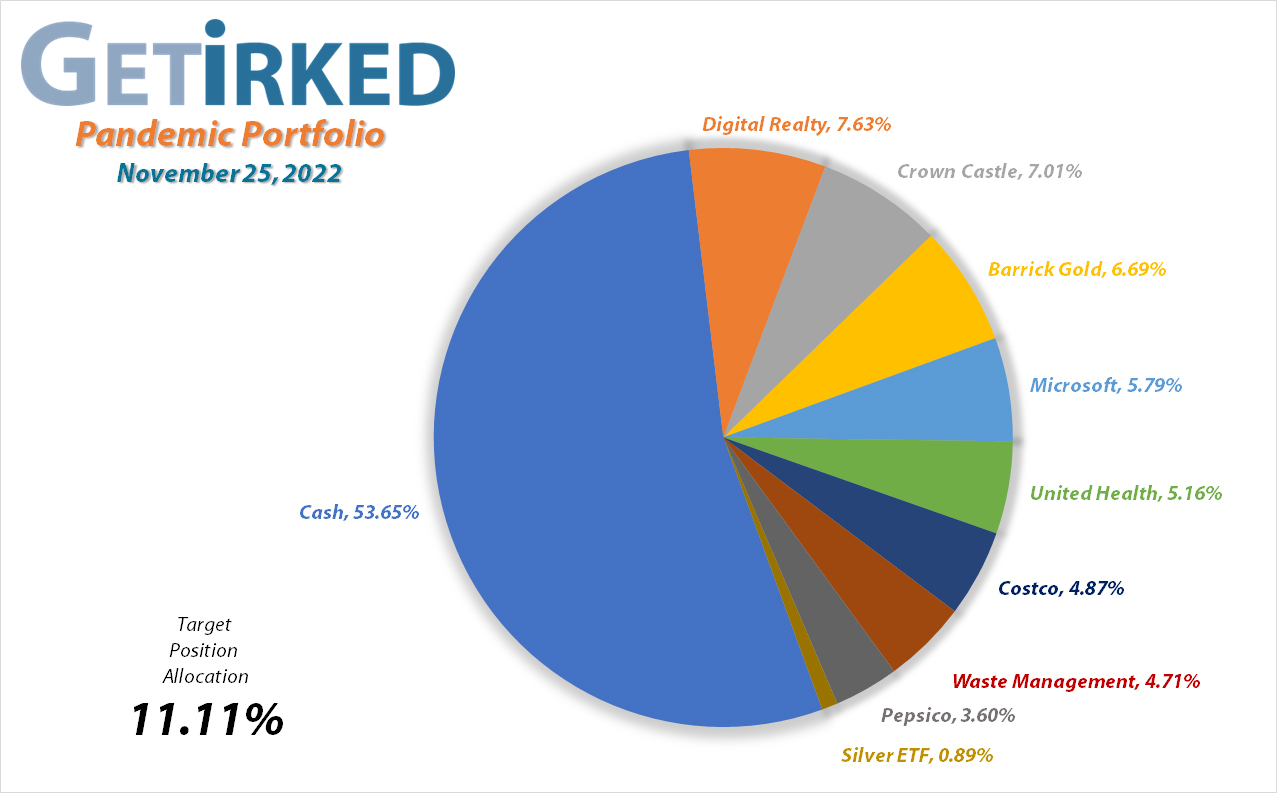

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $16.02

Per-Share Cost: $19.28 (Unchanged since last update)

Profit/Loss: -16.91%

Allocation: 6.690%* (+0.153% since last update)

Next Buy Target: $13.35

Gold saw a significant bounce off its lows early in November when the market believed inflation might be easing, however the precious yellow metal has been pulling back in recent days.

Accordingly, I have raised my next buy target for Barrick Gold (GOLD) up to $13.35, slightly above the stock’s 2022 low of $13.01. My sell target remains the same as it has been for the last few updates at $19.60.

Costco (COST): Dividend Reinvestment

Current Price: $533.66

Per-Share Cost: $203.21 (-0.177% since last update)

Profit/Loss: +162.14%

Allocation: 4.874%* (+0.103% since last update)

Next Buy Target: $455.90

It’s hard to get too excited about Costco’s (COST) piddly dividend, currently at less than 0.5% annually, however, something is better than nothing.

COST paid out its quarterly dividend on Friday, November 12, lowering my per-share cost -0.177% from $203.57 to $203.21. While there are still rumors swirling about a tasty special dividend (these one-time payouts have been about $10.00/share in the past), there’s no solid news on anything special any time soon.

Crown Castle (CCI): Strategy Update

Current Price: $141.19

Per-Share Cost: $140.50 (Unchanged since last update)

Profit/Loss: +0.49%

Allocation: 7.007%* (+0.283% since last update)

Next Buy Target: $115.80

The entire commercial real estate sector seems to have finally bottomed, with Crown Castle (CCI) bouncing off its October lows in a pretty dramatic way. Given that CCI sold off even more than I anticipated, I am going to take profits should it take a stab at the $150.00 mark to lock in gains off shares I bought in October and to reduce my position allocation if the space rolls over again.

My next buy target is $115.80, near CCI’s pandemic low. Surprisingly, where others in the space including the portfolio’s own Digital Realty Trust (DLR), sold through their pandemic bottoms, Crown Castle hasn’t gotten that low. Of course, that doesn’t it mean it won’t make a run for it…

Digital Realty Trust (DLR): Strategy Update

Current Price: $111.27

Per-Share Cost: $117.30 (Unchanged since last update)

Profit/Loss: -5.14%

Allocation: 7.634%* (+0.522% since last update)

Next Buy Target: $79.90

Just like Crown Castle (CCI) above and the rest of the real estate sector, Digital Realty Trust (DLR) bounced hard off its October lows (interesting point – my last buy in DLR was at $85.78 in October, just $0.02 off its current 2022 low at $85.76… those are just my two cents… I’ll let myself out).

From here, I plan to take profits if Digital Realty continues its run with my next sell target at $118.00, just slightly above my current per-share cost, but a significant gain off where I last added. My next buy target is $79.90, lower than DLR’s 2022 lows and near the next level of potential support.

Microsoft (MSFT): Strategy Update

Current Price: $247.49

Per-Share Cost: $212.85 (Unchanged since last update)

Profit/Loss: +16.28%

Allocation: 5.787%* (+0.148% since last update)

Next Buy Target: $201.40

Microsoft (MSFT) continues to bounce around quite a bit, exhibiting a lot of volatility. Even though MSFT got very close to my current per-share cost when it crashed in October before bouncing, I am still going to wait until it drops below my per-share cost before I add any more to this position with my next buy target at $201.40, above a key level of support.

I also plan to take some of the position off the table if Mr. Softy makes a run for $280 which would put the stock right at the 50% mark between its all-time high and its 2022 low.

Pepsico (PEP): Strategy Update

Current Price: $184.11

Per-Share Cost: $89.15 (Unchanged since last update)

Profit/Loss: +106.52%

Allocation: 3.602%* (-0.043% since last update)

Next Buy Target: $162.00

Pepsico (PEP) continues to remain a darling of the markets as investors pile into the consumer staples names in an effort to find a safe haven against inflation and a potential recession.

Since I’ve already taken quite a bit of profits out of the position, I have raised my next buy target to $162.00, slightly above PEP’s October low. I do plan to continue taking profits if Pepsi continues its rally with a sell target just under $200.00, a key psychological resistance for many investors and retail traders.

iShares Silver ETF (SLV): Strategy Update

Current Price: $19.72

Per-Share Cost: -$20.74* (Unchanged since last update)

Profit/Loss: +142.25%

Allocation: 0.886%* (+0.072% since last update)

Next Buy Target: $13.75

* Projected Per-Share Cost after Assignment: $20.84. In May 2021, I sold Jan 2023 $25 puts on SLV. If I am assigned this January (meaning SLV’s price is less than $25.00 at the time of expiration), the actual per-share cost for this position will be much higher at $20.84. If I am not assigned, then the listed per-share cost represents the actual cost including the profits received from selling the puts.

—

Much like gold, silver saw a pretty significant rally over the last month, however, also like gold, that rally has lost a lot of steam as we near the end of November. Accordingly, my next buy target to add to my position remains at $13.75, quite a bit below SLV’s current 2022 low at $16.19.

My days are getting numbered when it comes to getting assigned with the puts I sold back in May 2021. If the third Friday of January 2023 comes around and SLV is under $25.00, I will get assigned and have to buy the shares I promised to pick up at the cost of $25.00 each.

Between the premium I collected selling the puts and the shares I bought of SLV at $16.70 back in August of this year, that will give me a per-share cost of $20.84, a reduction of -16.64% from the $25.00 buy price, but I could also potentially be quite a bit in the red depending on how silver plays between now and then.

It’s definitely getting a little more exciting, sports fans!

UnitedHealth (UNH): Strategy Update

Current Price: $537.62

Per-Share Cost: $264.34 (Unchanged since last update)

Profit/Loss: +103.38%

Allocation: 5.161%* (-0.249% since last update)

Next Buy Target: $500.90

UnitedHealth (UNH) remains one of the outperformers in the entire market this year, one of the only stocks which has actually seen a positive return in 2022. However, that doesn’t mean it won’t sell off. In fact, the last few weeks have seen UNH pull back quite a bit after making a new all-time high at $558.10 back in October.

I do plan to add more to the position should it breach $500.90, right at its September low, and I will take profits if UNH makes a try for the $600.00 mark.

Waste Management (WM): Strategy Update

Current Price: $164.46

Per-Share Cost: $119.88 (Unchanged since last update)

Profit/Loss: +37.19%

Allocation: 4.742%* (-0.035% since last update)

Next Buy Target: $139.20

While Waste Management (WM) has fallen quite a bit from its $175.98 made back in August, it found support around $150.00, much higher than my next buy target at $139.20, slightly above WM’s 2022 low.

Despite exhibiting a great amount of strength, I have bought up my per-share cost +4.28% from my initial buy, so I am not in a big hurry to add to this position. In fact, I plan to take even more profits if it makes another attempt at its all-time high with my next sell target around $174.50.

* Target allocation for each position in the portfolio is 11.11% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.