Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #34

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

What will November bring?

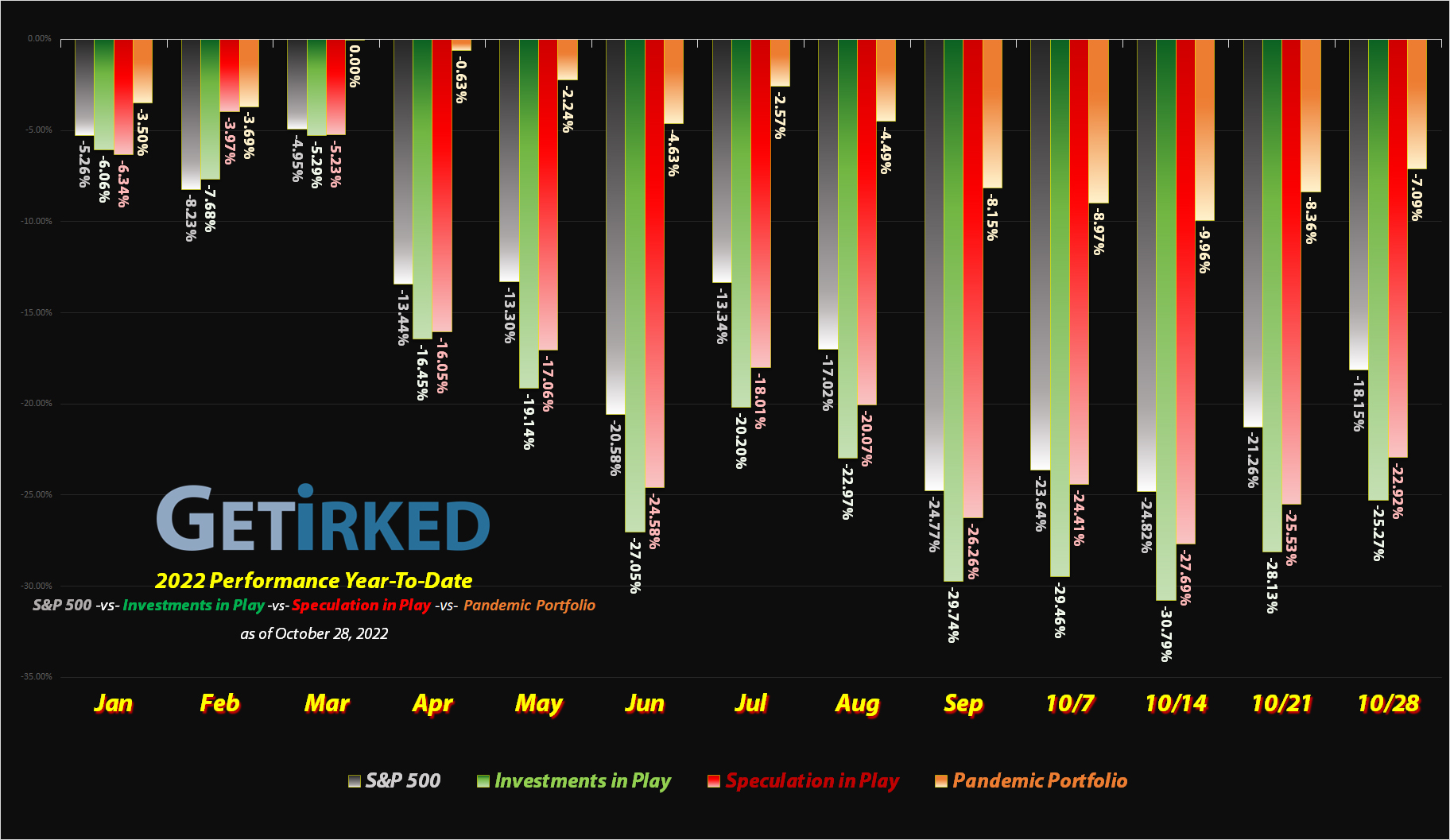

The whipsaw volatility from September continued in earnest throughout October, certainly living up to the promises of previous years that this is truly the most volatile time of the year for the markets, seasonally speaking.

As you’ll learn below, not only did I add to a few positions since the last update, I also took profits in others, a further indication of exactly how much of a stock-picker’s market we’re truly seeing right now.

As we enter into November, seasonality and historical trends suggest we may see the current rally continue into the year’s end. Of course, with Federal Chairman Jerome Powell announcing the next rate hike on November 2 along with his views for future hikes combined with the macroeconomic environment and geopolitical concerns, it’s really anyone’s guess what we’ll see in the final two months of 2022.

In the meantime, let’s take a look at what changed since the last update!

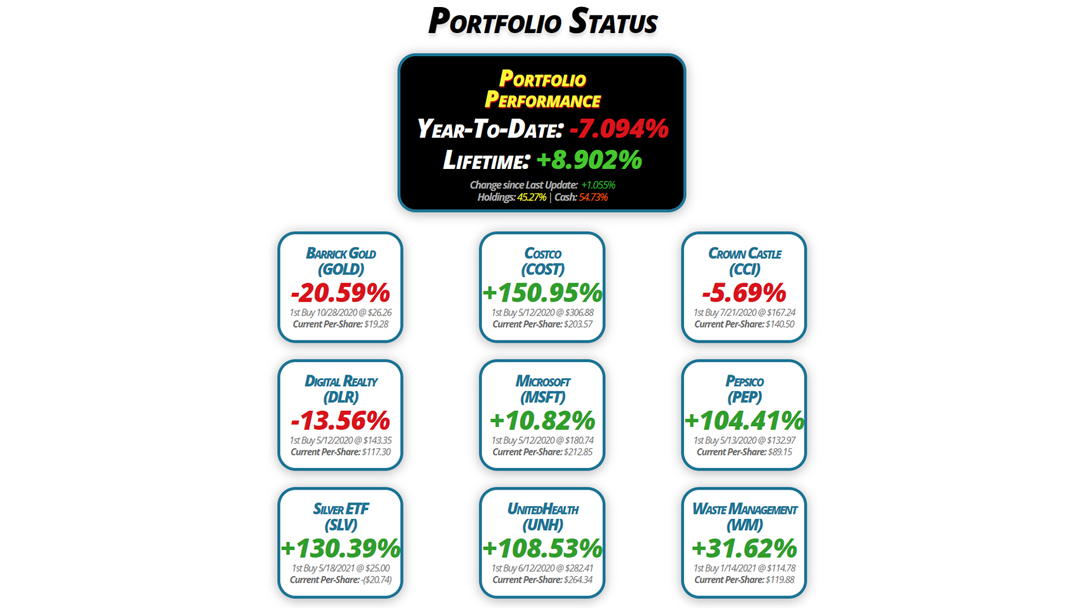

Portfolio Status

Portfolio

Performance

Year-To-Date: -7.094%

Lifetime: +8.902%

Change since Last Update: +1.055%

Holdings: 45.27% | Cash: 54.73%

Barrick Gold

(GOLD)

-20.59%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $19.28

Digital Realty

(DLR)

-13.56%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $117.30

Silver ETF

(SLV)

+130.39%

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($20.74)

Costco

(COST)

+150.95%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $203.57

Microsoft

(MSFT)

+10.82%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $212.85

UnitedHealth

(UNH)

+108.53%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $264.34

Crown Castle

(CCI)

-5.69%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $140.50

Pepsico

(PEP)

+104.41%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $89.15

Waste Management

(WM)

+31.62%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $119.88

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $15.31

Per-Share Cost: $19.28 (Unchanged since last update)

Profit/Loss: -20.59%

Allocation: 6.537%* (-0-.157% since last update)

Next Buy Target: $12.90

The precious yellow metal’s sickening downtrend continued through much of October before finally finding respite in the last week of the month. Naturally, wherever gold goes, so goes the goldminers, so Barrick Gold (GOLD) tested its 2022 lows at $13.97 earlier in October before finding support (at $13.99, just $0.02 above its low!) and bouncing to finish the month.

Of course, without breaking through to new lows or bouncing up to new highs, there’s not a whole lot going on with my position with my next buy target at $12.90, above GOLD’s pandemic low, and my next sell target at $19.60, under a key level of resistance.

Costco (COST): Strategy Update

Current Price: $510.87

Per-Share Cost: $203.57 (Unchanged since last update)

Profit/Loss: +150.95%

Allocation: 4.771%* (-0.310% since last update)

Next Buy Target: $410.90

Costco (COST) sold off with the rest of the market in October, however the stalwart bulk retailer found support far above its 2022 lows. In other words, I sat on my hands with this one throughout the entire month.

My gameplan remains the same, however, with my price target at $410.90, a bit above its 2022 lows at $406.51 and I have no intention to take profits any time before COST sees a significant breakout above its $612.27 all-time high.

Crown Castle (CCI): Added & Dividends

Current Price: $132.50

Per-Share Cost: $140.50 (-1.424% since last update)

Profit/Loss: -5.69%

Allocation: 6.724%* (+0.043% since last update)

Next Buy Target: $114.60

Crown Castle (CCI) paid out its quarterly dividend on Monday, October 3, lowering my per-share cost -0.982% from $142.53 to $141.13, a nice reduction to the overall cost of the position.

On Friday, October 7, CCI lost support and finally fell through my per-share price, triggering my next buy order which filled at $134.20 and lowered my per-share cost -0.446% from $141.13 to $140.50.

From here, my next buy target is $114.60, slightly above the pandemic bottom, and my next sell target is $152.10, below a point of resistance from CCI’s recent bull run.

CCI is $132.50 as of this update, down -1.27% from where I added.

Digital Realty Trust (DLR): Added & Dividends

Current Price: $101.39

Per-Share Cost: $117.30 (-2.938% since last update)

Profit/Loss: -13.56%

Allocation: 7.112%* (+0.608% since last update)

Next Buy Target: $77.45

Digital Realty Trust (DLR) paid out its quarterly dividend on Monday, October 3, which lowered my per-share cost -1.109% from $120.85 to $119.51, a substantial cut (that also happens to be desperately needed seeing as how badly the recession has smacked the real estate -and- tech sectors).

When the hot CPI report released on Thursday, October 13, Digital Realty continued to plumb new lows, triggering my next buy order which filled at $85.78, lowering my per-share cost -1.849% from $119.51 to $117.30.

From here, my next buy target is $77.45, above a past point of support, and my next sell target is $121.60, below a point of resistance from DLR’s last rally.

DLR is $101.39 as of this update, up +18.20% from where I added.

Microsoft (MSFT): Strategy Update

Current Price: $235.87

Per-Share Cost: $212.85 (Unchanged since last update)

Profit/Loss: +10.82%

Allocation: 5.639%* (+0.007% since last update)

Next Buy Target: $200.15

Microsoft (MSFT) had a rough month, losing its 2022 lows just made last month to find even deeper lows at $219.13 mid-month. Mr. Softy looked like it was going to bounce, but then reported a disappointing quarter with weak guidance, causing the stock to fall back again, although nowhere near its $219.13 low.

Given the weakness in the name and the macroeconomic headwinds facing enterprise software and consumer products, I have lowered my price target to right above $200.00, a past point of support and key psychological buy price for many investors.

Pepsico (PEP): Dividends & Profit-Taking

Current Price: $182.23

Per-Share Cost: $89.15 (-16.682% since last update)

Profit/Loss: +104.41%

Allocation: 3.645%* (-0.388% since last update)

Next Buy Target: $161.20

Pepsico (PEP) paid out its quarterly dividend on Monday, October 3, lowering my per-share cost -0.692% from $107.00 to $106.26.

The crazy volatility continued throughout the month with Pepsico rocketing after its blowout earnings report to test its all-time high on Wednesday, October 26 when it triggered my next sell order which filled at $180.78.

The sale locked in +32.79% in gains on shares I bought for $136.14 back on January 19, 2021, and lowered my per-share cost -16.10% from $106.26 to $89.15. From here, my next sell target is around $200, a psychological point of resistance, and my next buy target is $161.20, above the lows of PEP’s most recent selloff.

PEP is $182.23 as of this update, up +0.80% from where I took profits.

iShares Silver ETF (SLV): Strategy Update

Current Price: $17.74

Per-Share Cost: -$20.74* (Unchanged since last update)

Profit/Loss: +130.39%

Allocation: 0.814%* (+0.001% since last update)

Next Buy Target: $14.35

* Projected Per-Share Cost after Assignment: $20.84. In May 2022, I sold Jan 2023 $25 puts on SLV. If I am assigned this January (meaning SLV’s price is less than $25.00 at the time of expiration), the actual per-share cost for this position will be much higher at $20.84. If I am not assigned, then the listed per-share cost represents the actual cost including the profits received from selling the puts.

—

Just like gold and the rest of the precious metals, silver couldn’t get out of its own way, either, selling off nearly -15% from the high set earlier in the month to its low. However, the shiny stuff did find support above its 2022 lows which led more bullish pundits to believe a rally may be in store as investors hide out in the “inflation hedge” (I put that in quotes since neither silver nor gold have actually performed the way they should this year thanks to the incredibly strong U.S. dollar).

Thanks to a bounce off the lows, silver returned to a point of consolidation toward the end of October. Naturally, with each month that passes, the expiration date for my sold put spreads looms nearer. Once again, if the iShares Silver ETF (SLV) doesn’t close above $25.00 by the third Friday in January, I’ll have a much, much larger position in silver.

UnitedHealth (UNH): Strategy Update

Current Price: $551.24

Per-Share Cost: $264.34 (Unchanged since last update)

Profit/Loss: +108.53%

Allocation: 5.410%* (+0.396% since last update)

Next Buy Target: $450.90

The healthcare sector truly lived up to its reputation as a “safe haven” during recession as investors piled into the space. With UnitedHealth (UNH) being one of the premiere Best-of-Breed positions out there, it was only natural for the stock to see a significant pop off its October lows as the rest of the market rallied.

For me, I’d prefer to be patient since every buy I make above $264.34 raises my cost basis, so I’m sticking with my buy price target of $450.90, above UNH’s lows for the year. I have decided that I will take more profits in the position if it breaks through its all-time high at $553.29 and makes a run for $600, though I can’t imagine that outcome being all that likely given all the macroeconomic and geopolitical concerns facing the market, even if UNH is a “safe haven.”

Waste Management (WM): Strategy Update

Current Price: $157.79

Per-Share Cost: $119.88 (Unchanged since last update)

Profit/Loss: +31.62%

Allocation: 4.742%* (-0.125% since last update)

Next Buy Target: $139.20

Just like many of the names in this portfolio which were specifically selected for their ability to hold up in a recession, Waste Management (WM) performed spectacularly throughout October, finding support significantly above its 2022 lows even when the market dipped below the lows for the year.

Accordingly, after initially wanting to set a buy price target below my $119.88 cost basis, I have once again raised my price target to $139.20, above WM’s low for the year and to a point where it will raise my cost basis once more. However, I also have plans to take more profits if the garbage collector makes another attempt to break through its all-time high at $175.98.

* Target allocation for each position in the portfolio is 11.11% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.