Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #33

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

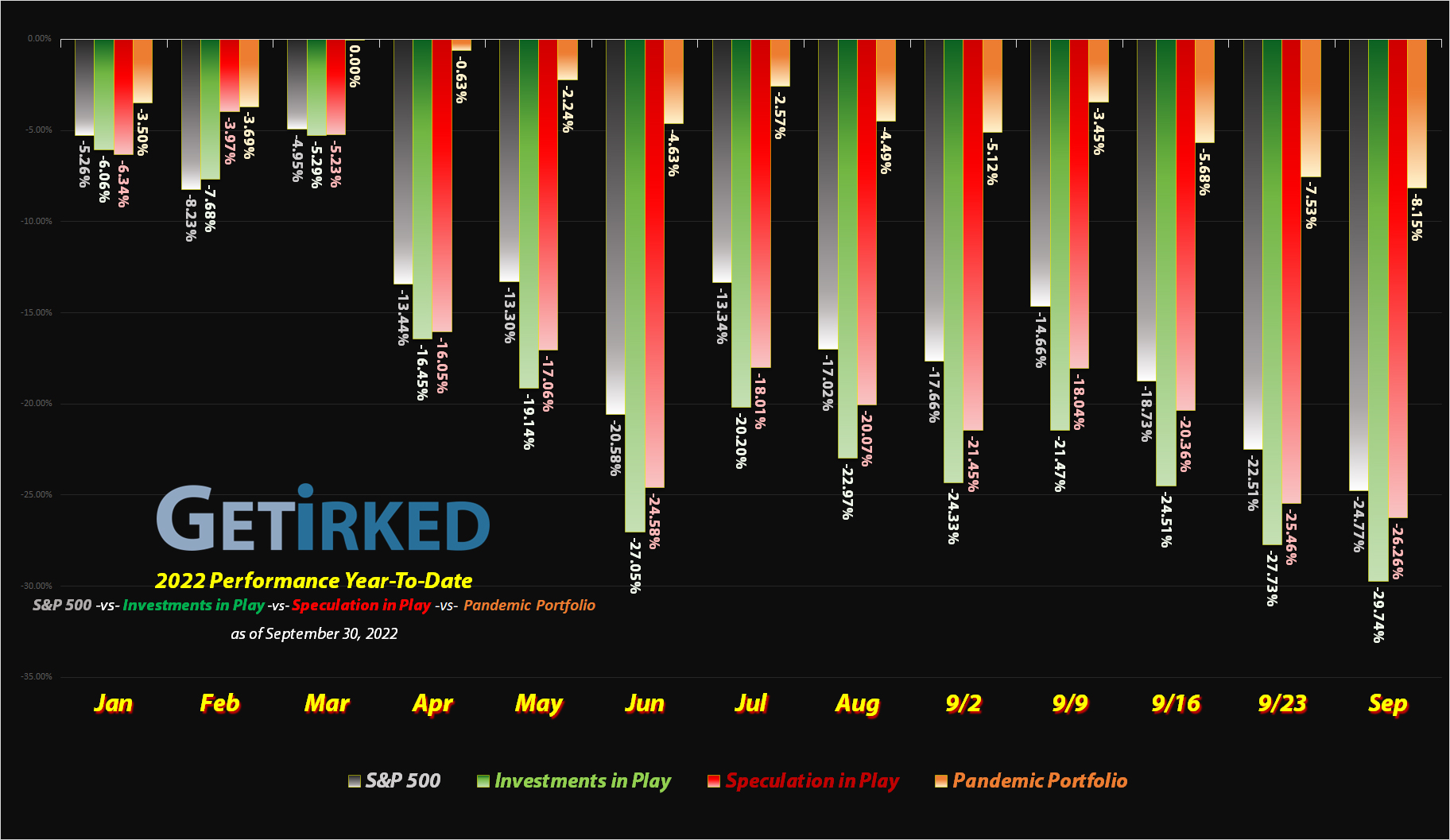

The September Swoon

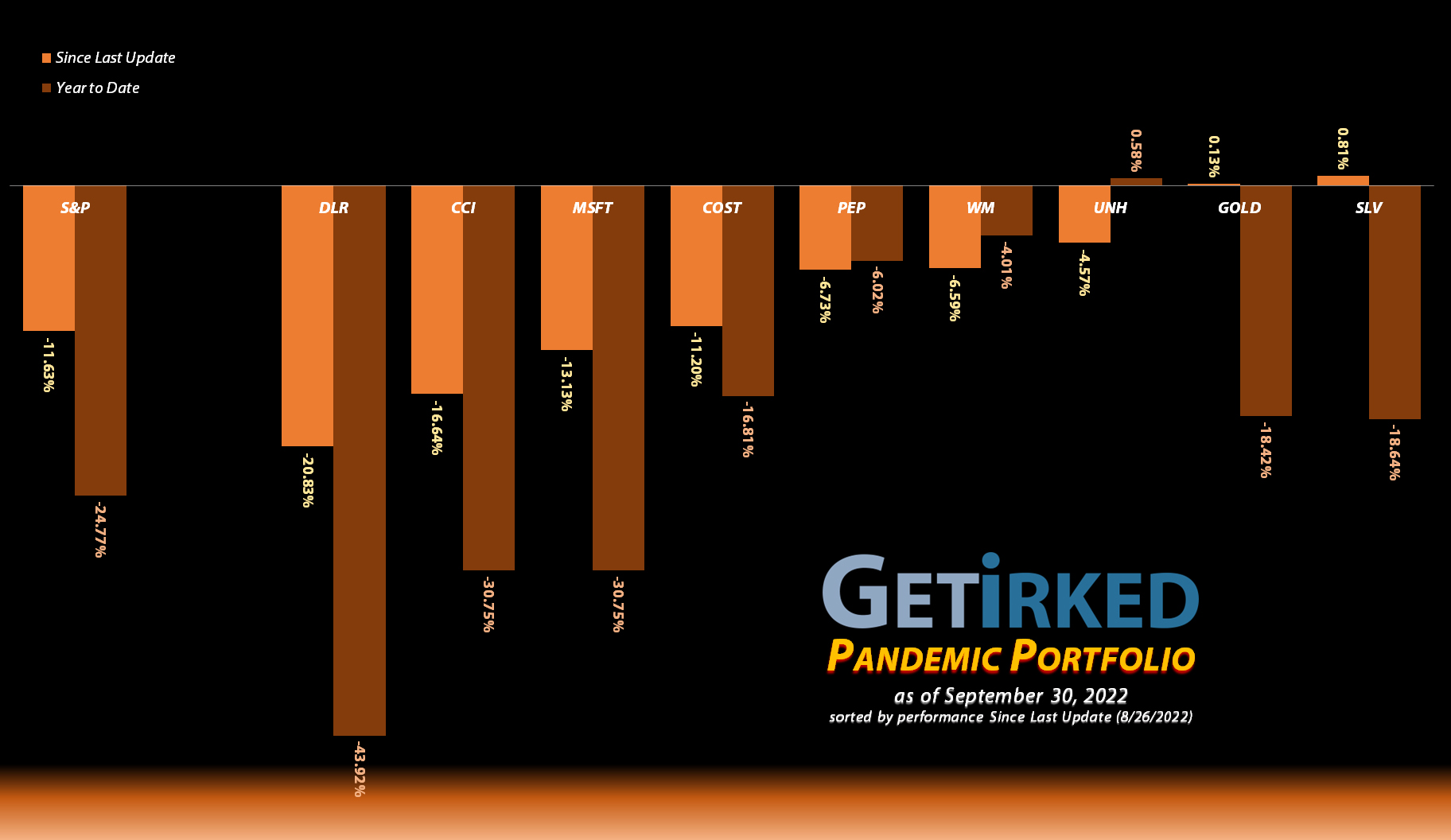

Historically, the time from summer’s highs to October’s lows is a rocky one, and this year fit the bill perfectly, with the entire market selling off to its June lows (and then some) throughout this month.

For the most part, the positions in the Pandemic Portfolio held up remarkably well, exactly why they were chosen for the portfolio in the first place. The entire portfolio is designed to hold stocks that should hold up well during a Black Swan Event like the pandemic (thus where the portfolio received its moniker) as well during inflationary/recessionary times.

As you’ll read below, some of the positions have fared far better than others when it comes to how they’ve been handling the historic inflation we’re currently experiencing.

Read on to discover how the positions have changed since last month’s update…

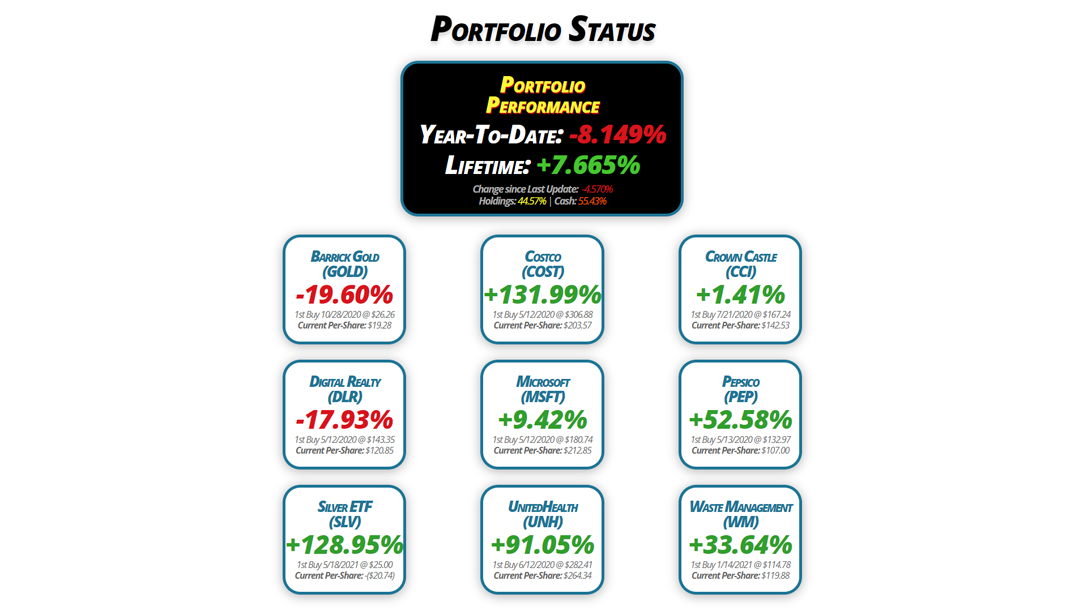

Portfolio Status

Portfolio

Performance

Year-To-Date: -8.149%

Lifetime: +7.665%

Change since Last Update: -4.570%

Holdings: 44.57% | Cash: 55.43%

Barrick Gold

(GOLD)

-19.60%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $19.28

Digital Realty

(DLR)

-17.93%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $120.85

Silver ETF

(SLV)

+128.95%

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($20.74)

Costco

(COST)

+131.99%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $203.57

Microsoft

(MSFT)

+9.42%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $212.85

UnitedHealth

(UNH)

+91.05%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $264.34

Crown Castle

(CCI)

+1.41%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $142.53

Pepsico

(PEP)

+52.58%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $107.00

Waste Management

(WM)

+33.64%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $119.88

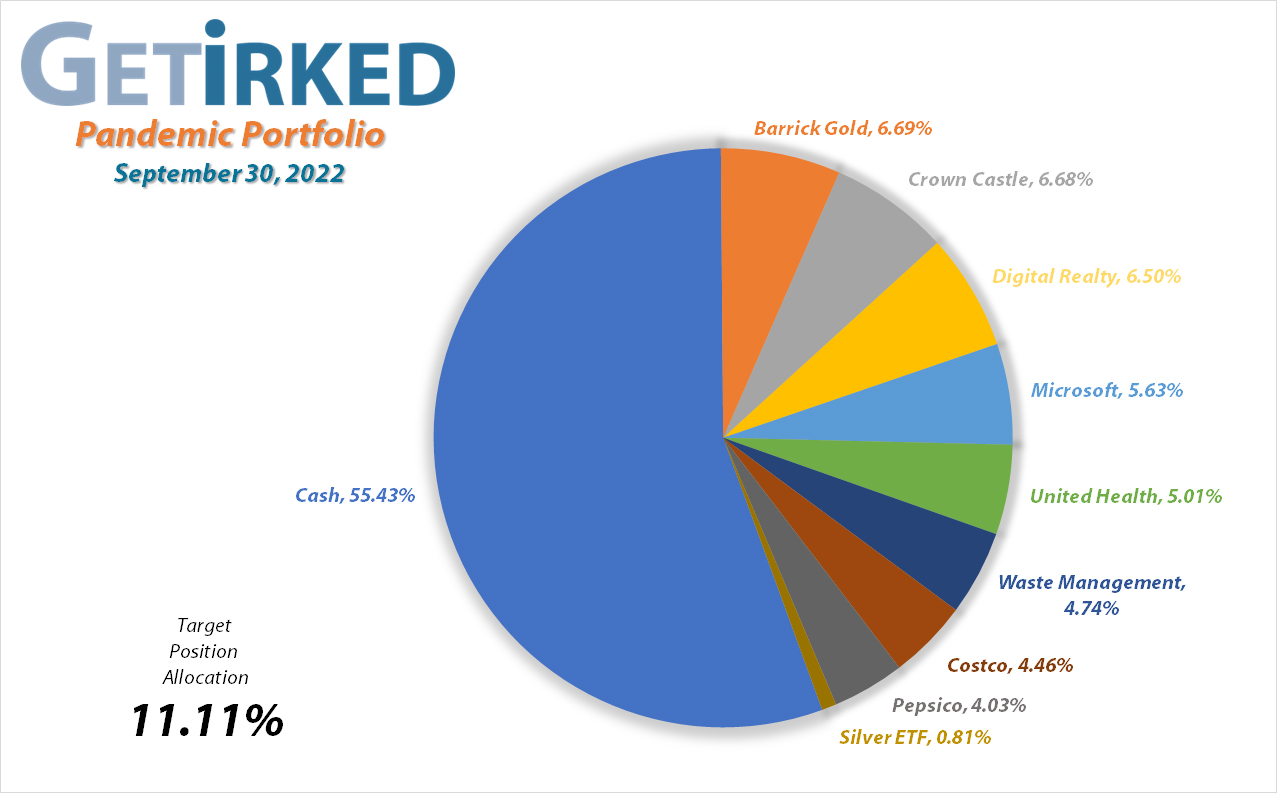

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Dividend Reinvestment

Current Price: $15.50

Per-Share Cost: $19.28 (-0.874% since last update)

Profit/Loss: -19.60%

Allocation: 6.694%* (+0.325% since last update)

Next Buy Target: $12.80

Barrick Gold (GOLD) paid out its quarterly dividend on Thursday, September 15, an ample dividend that lowered my per-share cost -0.874% from $19.45 to $19.28, not bad for a quarterly payout.

The precious yellow metal has been positively decimated as the U.S. dollar increases in strength against the other world currencies, an odd outcome of how markets work since inflation is degrading the U.S. dollar’s buying power, but in relation to other countries’, the U.S. dollar is the best house in a bad neighborhood.

As a result, gold, when priced in USD, is getting slammed which provides a double-whammy to gold miners who have to deal with inflation in terms of costs, but deflation to their earnings in terms of gold price. For the moment, goldminers are definitely one of the more painful places to be in this market.

Costco (COST): Strategy Update

Current Price: $472.27

Per-Share Cost: $203.57 (Unchanged since last update)

Profit/Loss: +131.99%

Allocation: 4.461%* (-0.324% since last update)

Next Buy Target: $408.90

Costco (COST) has remained a stalwart throughout all of the selling pressure that took place since our last update. While COST did report its profit margins were taking a hit due to inflation concerns which caused the stock to sell off toward the end of the September, Costco is still nowhere near its 2022 lows which means that remains my price target to add more to the stock. I still have no additional profit-taking targets for this position unless it breaks significantly through its current $612.27 all-time high.

Crown Castle (CCI): Strategy Update

Current Price: $144.55

Per-Share Cost: $142.53 (Unchanged since last update)

Profit/Loss: +1.41%

Allocation: 6.681%* (-0.955% since last update)

Next Buy Target: $133.95

Like all of the Real Estate Investment Trust (REIT) investment vehicles, the cellular tower stocks like Crown Castle (CCI) have really took it on the chin during the recent selloff.

In fact, due to the weakness experienced by CCI’s compatriot in this portfolio, Digital Realty Trust (DLR), I have actually lowered my next buy target for Crown Castle down to $133.95, above a past point of support, and lower than the stock has been throughout 2022. My next sell target is around $184, just below the top of CCI’s rally in August.

Digital Realty Trust (DLR): Added to Position

Current Price: $99.18

Per-Share Cost: $120.85 (-0.918% since last update)

Profit/Loss: -17.93%

Allocation: 6.504%* (-0.767% since last update)

Next Buy Target: $86.85

Digital Realty Trust (DLR) got slammed incredibly hard after the Federal Reserve raised interest rates, likely due to the double-whammy of being in real estate and the technology sector at the same time; neither of those sectors experienced “Happy Fun Times” since the last update.

On Thursday, September 22, DLR got dangerously close to its pandemic bottom, triggering my next buy order which filled at $106.14. The buy lowered my per-share cost -0.918% from $121.97 to $120.85.

From here, my next buy price target is $86.85, slightly above a distant past point of support, and my next sell target is $138.60, right below where DLR has been experiencing resistance throughout 2022.

DLR is $99.18 as of this update, down -6.56% from where I added.

Microsoft (MSFT): Dividend Reinvestment

Current Price: $232.90

Per-Share Cost: $212.85 (-0.234% since last update)

Profit/Loss: +9.42%

Allocation: 5.632%* (-0.529% since last update)

Next Buy Target: $199.85

Microsoft (MSFT) paid out its quarterly dividend on Thursday, September 8, which, after being reinvested, lowered the per-share cost of my position -0.234% from $213.35 to $212.85. Sure, MSFT’s dividend is relatively small with an annual yield of slightly under 1%, the fact that such a high-growth tech stock has a dividend at all is the reason Mr. Softy holds a place in the Pandemic Portfolio.

Pepsico (PEP): Strategy Update

Current Price: $163.26

Per-Share Cost: $107.00 (Unchanged since last update)

Profit/Loss: +52.58%

Allocation: 4.033%* (-0.086% since last update)

Next Buy Target: $149.65

Pepsico (PEP) has become the darling of the dance along with the rest of the recession-resistant consumer staple plays. While not entirely immune to selling pressure, PEP held up remarkably well during September’s swoon and remains significantly above its 2022 lows.

That being said, I’m still being cautious with my next buy target at $149.65, above a past point of support, and I currently have no sell targets in the name.

iShares Silver ETF (SLV): Added to Position

Current Price: $17.50

Per-Share Cost: -$20.74* (*New Position*)

Profit/Loss: +128.95%

Allocation: 0.813%* (*New Position*)

Next Buy Target: $13.85

* Projected Per-Share Cost after Assignment: $20.84. In May 2021, I sold Jan 2023 $25 puts on SLV. If I am assigned this January (meaning SLV’s price is less than $25.00 at the time of expiration), the actual per-share cost for this position will be much higher at $20.84. If I am not assigned, then the listed per-share cost represents the actual cost including the profits received from selling the puts.

—

Newer readers may be confused why I suddenly have a position in the iShares Silver Exchange Traded Fund (SLV) in the Pandemic Portfolio. Well, in May 2021, with inflation rearing its head, I believed we would see a significant pop in the precious metals so I sold put options on SLV, the ETF that tracks silver.

Obviously, this ended up not being the case as silver has sold off in a spectacular fashion since that time. Selling those puts means I am obligated to buy 100 shares of SLV for each put I sold at $25.00 when the puts expire in January 2023.

I continue to believe in the long-term potential of both silver and gold, so rather than twiddle my thumbs during what could be a generational buying opportunity, I have instead started using the profits I gained from selling those Jan 2023 put options to start building a position.

The listed per-share price is negative because I am still using the profits to build this position, however I have added an asterisk to show the actual per-share cost after assignment as well.

I made my first real purchase in SLV on Wednesday, August 31, 2022 when the price of silver dropped again with a buy order that filled at $16.70. My next buy target is $13.85, above a past point of support.

SLV is $17.50 as of this update, up +4.79% from where I added.

UnitedHealth (UNH): Dividend Reinvestment

Current Price: $505.04

Per-Share Cost: $264.34 (-0.317% since last update)

Profit/Loss: +91.05%

Allocation: 5.014%* (+0.025% since last update)

Next Buy Target: $450.90

UnitedHealth (UNH) paid out its quarterly dividend which was reinvested in the Pandemic Portfolio on Wednesday, September 21, lowering the per-share cost -0.317% from $265.18 to $264.34.

Despite the weakness throughout the majority of the market, the healthcare sector continues to hold up spectacularly well with UnitedHealth refusing to sell off. My plan remains the same with my next buy target near UNH’s 2022 lows down at $449.70.

Waste Management (WM): Dividend Reinvestment

Current Price: $160.21

Per-Share Cost: $119.88 (-0.391% since last update)

Profit/Loss: +33.64%

Allocation: 4.742%* (-0.075% since last update)

Next Buy Target: $139.20

Waste Management (WM) paid out its quarterly dividend on Monday, September 26, which, after reinvestment, lowered my per-share cost -0.391% from $120.35 to $119.88.

From here, my next buy target for the stock is $139.20, near its 2022 low, and my next sell target is around its all-time high of $176.00.

* Target allocation for each position in the portfolio is 11.11% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.