Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #32

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Does a Seasonal Selloff approach?

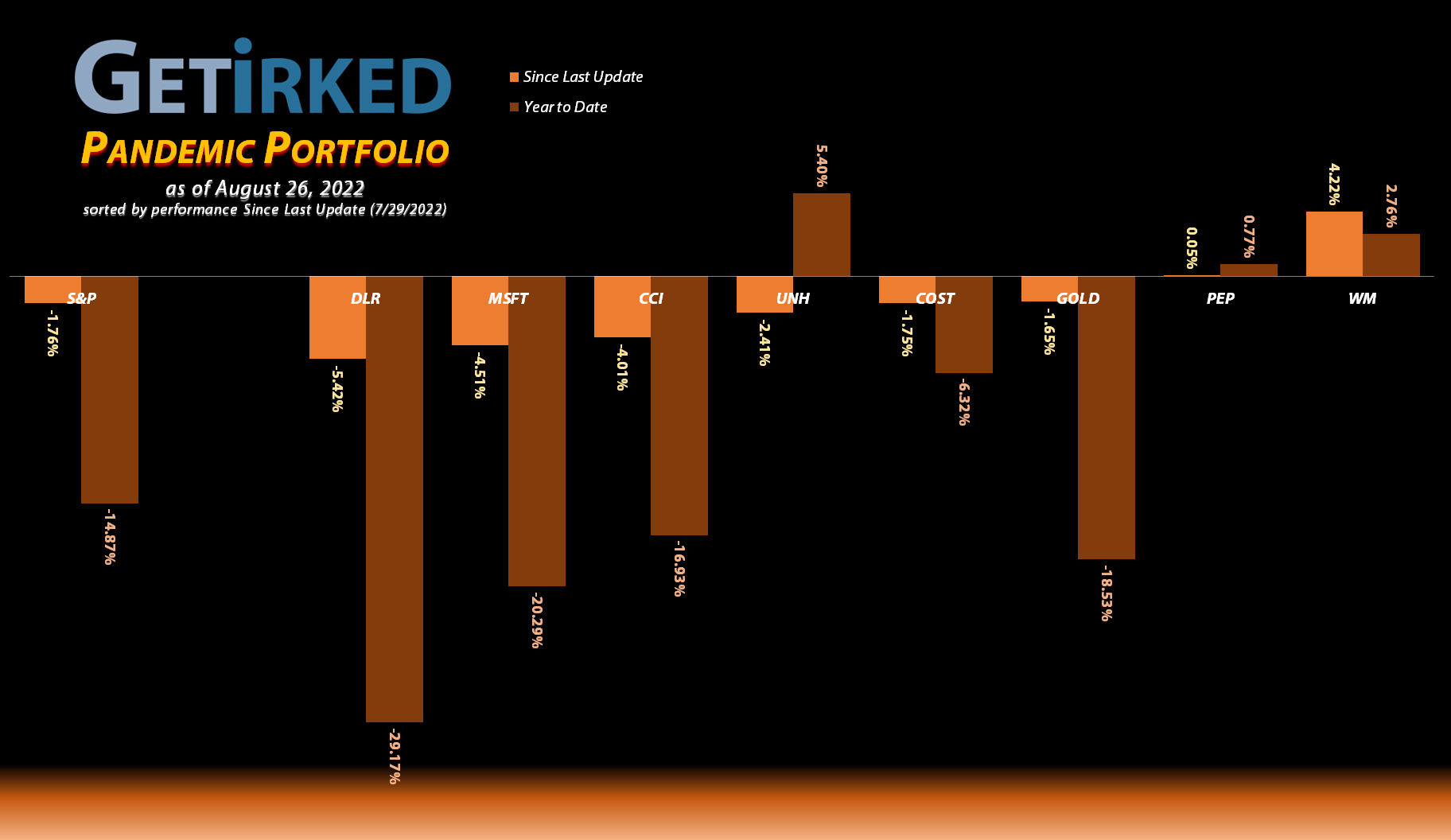

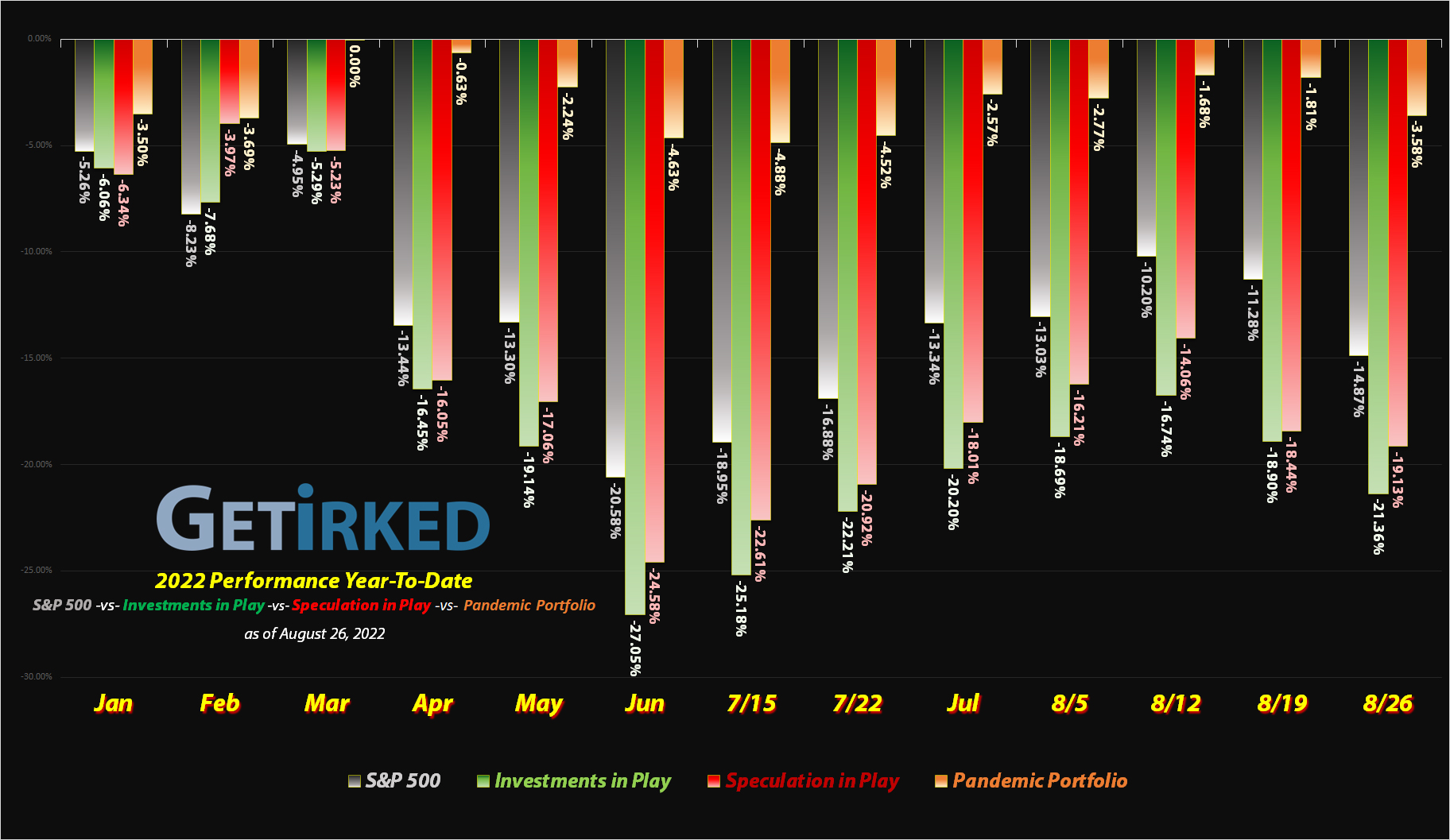

Leading into the beginning of August, the Pandemic Portfolio and the rest of the market saw continuing gains on top of an amazing July, all from the bottom in June after the Fed’s first 0.75% interest rate hike.

However, September and October are notorious for selloffs, seeing a selloff ranging from 4.5% to more than 20% nearly every year for more than a decade with 2017 being the only exception. That kind of powerful seasonality means I’m planning for that kind of downside action in 2022, particularly since global economic concerns combined with the ongoing war in Ukraine portend nothing good for economic growth domestically or abroad.

Let’s take a look at how the positions changed in the past month…

Portfolio Status

Portfolio

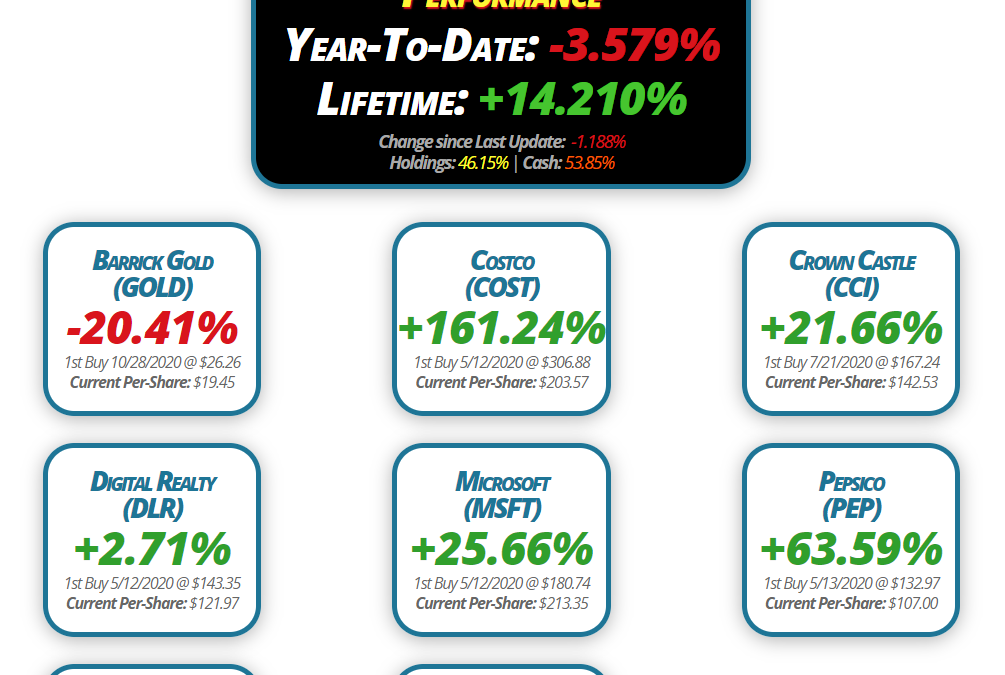

Performance

Year-To-Date: -3.579%

Lifetime: +14.210%

Change since Last Update: -1.188%

Holdings: 46.15% | Cash: 53.85%

Barrick Gold

(GOLD)

-20.41%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $19.45

Digital Realty

(DLR)

+2.71%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $121.97

UnitedHealth

(UNH)

+99.58%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $265.18

Costco

(COST)

+161.24%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $203.57

Microsoft

(MSFT)

+25.66%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $213.35

Waste Management

(WM)

+42.51%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $120.35

Crown Castle

(CCI)

+21.66%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $142.53

Pepsico

(PEP)

+63.59%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $107.00

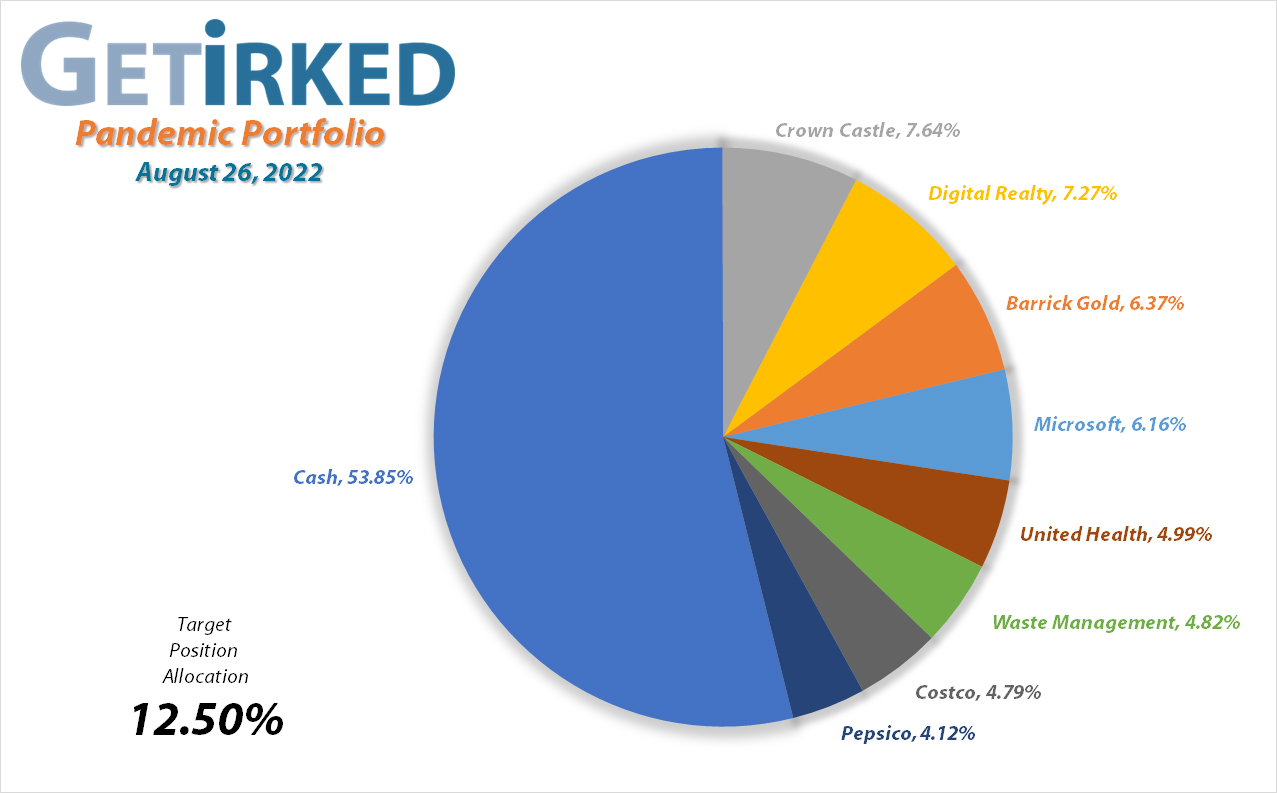

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $15.48

Per-Share Cost: $19.45 (Unchanged since last update)

Profit/Loss: -20.41%

Allocation: 6.369%* (-0.039% since last update)

Next Buy Target: $12.80

The precious yellow metal remained flat for the past month but demonstrated relatively little progress since selling off substantially from its 2022 highs. According, Barrick Gold (GOLD) and the rest of the gold complex hasn’t really moved all that much, either.

Given my already-substantial position in GOLD, I’m keeping my next buy target down at $12.80, right above its pandemic selloff low, as I believe a seasonal pullback in the stock market will also cause gold to break through its 2022 low.

Costco (COST): Dividend Reinvestment

Current Price: $531.82

Per-Share Cost: $203.57 (-0.172% since last update)

Profit/Loss: +161.24%

Allocation: 4.785%* (-0.027% since last update)

Next Buy Target: $408.90

Costco (COST) paid out its quarterly dividend on August 12, lowering my per-share cost just -0.172% from $203.92 to $203.57. Costco is an odd stock for the retail sector because its regular dividend provides a relatively small yield at just 0.66%, however, in addition to its substantial growth, investors hang around for the bountiful special dividends the company pays out (although no one really knows when the next one may be coming…).

Crown Castle (CCI): Strategy Update

Current Price: $173.41

Per-Share Cost: $142.53 (Unchanged since last update)

Profit/Loss: +21.66%

Allocation: 7.636%* (-0.236% since last update)

Next Buy Target: $154.20

Crown Castle (CCI) and the real estate sector has been fairly rangebound for some time. I’ve lowered my next profit-taking target to $184.20, below its most recent high and my next buy target is $154.20, slightly above its 2022 lows. In the meantime, while I wait, I’ll happily collect CCI’s bountiful dividend.

Digital Realty Trust (DLR): Strategy Update

Current Price: $125.27

Per-Share Cost: $121.97 (Unchanged since last update)

Profit/Loss: +2.71%

Allocation: 7.271%* (-0.337% since last update)

Next Buy Target: $116.05

Digital Realty Trust (DLR), with its exposure to technology, has demonstrated even greater weakness than its REIT brethren like CCI above. Just like CCI, I’ve lowered my next profit-taking target to $134.95, slightly below DLR’s most recent high.

Additionally, since I’ve already made a purchase in DLR near its 2022 lows, my next buying target for the stock is $116.05, even lower than 2022’s low, above a past point of support from the pandemic selloff.

Microsoft (MSFT): Strategy Update

Current Price: $268.09

Per-Share Cost: $213.35 (Unchanged since last update)

Profit/Loss: +25.66%

Allocation: 6.161%* (-0.220% since last update)

Next Buy Target: $241.90

Microsoft (MSFT) demonstrated such significant strength after its earning report that I raised my next buying target to $241.90, above its 2022 low, so I could add more to this position should it sell off to that point.

Since Microsoft has been quite a successful position in the portfolio, I’m taking a much more conservative approach to profit-taking. My next target is around $380, much higher than its current $349.67 all-time high, where analysts believe MSFT is heading.

Pepsico (PEP): Profit-Taking

Current Price: $175.04

Per-Share Cost: $107.00 (-9.353% since last update)

Profit/Loss: +63.59%

Allocation: 4.119%* (-0.721% since last update)

Next Buy Target: $155.35

The month kicked off with a bang when Pepsico (PEP) announced it would be buying a 8.5% stake in the energy/fitness drink maker Celsius for $550 million on Monday, August 1, causing the stock to pop through my next sell target which filled at $176.75.

The sale locked in +16.505% in gains on shares I bought back on September 30, 2021 for $151.71, and lowered my per-share cost -9.353% from $118.04 to $107.00. From here, my next sell target is just under $200.00, a point of psychological resistance, and my next buy target is $155.35, above its most recent pullback low.

PEP is $175.04 as of this update, down -0.967% from where I took profits.

UnitedHealth (UNH): Strategy Update

Current Price: $529.25

Per-Share Cost: $265.18 (Unchanged since last update)

Profit/Loss: +99.58%

Allocation: 4.989%* (-0.071% since last update)

Next Buy Target: $450.90

Healthcare has historically been seen as a safe haven for investors during recessions since, even in a recession, taking care of our health remains a top priority for consumers. Accordingly, UnitedHealth (UNH) saw extreme outperformance in the rally off June’s lows and has held up even in the weakness seen in stocks in August.

I’ve raised my next buy target to $450.90, above UNH’s 2022 low, and I currently have no intention to reduce my position with sell targets as I have already lowered my per-share cost -6.10% from my initial buy at $282.41 on June 12, 2020 and would rather capitalize on further upside.

Waste Management (WM): Profit-Taking

Current Price: $171.51

Per-Share Cost: $120.35 (-5.259% since last update)

Profit/Loss: +42.51%

Allocation: 4.817%* (-0.477% since last update)

Next Buy Target: $139.10

Waste Management (WM) really became the belle of the ball from late July into early August after reporting an upside surprise during earnings season. WM rocketed through my next profit-taking target which filled on Friday, August 5 at $169.41, lowering my per-share cost -5.259% from $127.03 to $120.35.

From here, my next profit target is right under $176.00, right around WM’s current all-time high. My next buy target is down at $139.10, slightly above WM’s low for 2022.

As of this update, WM is $171.51, up +1.240% from where I took profits.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.