Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #30

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

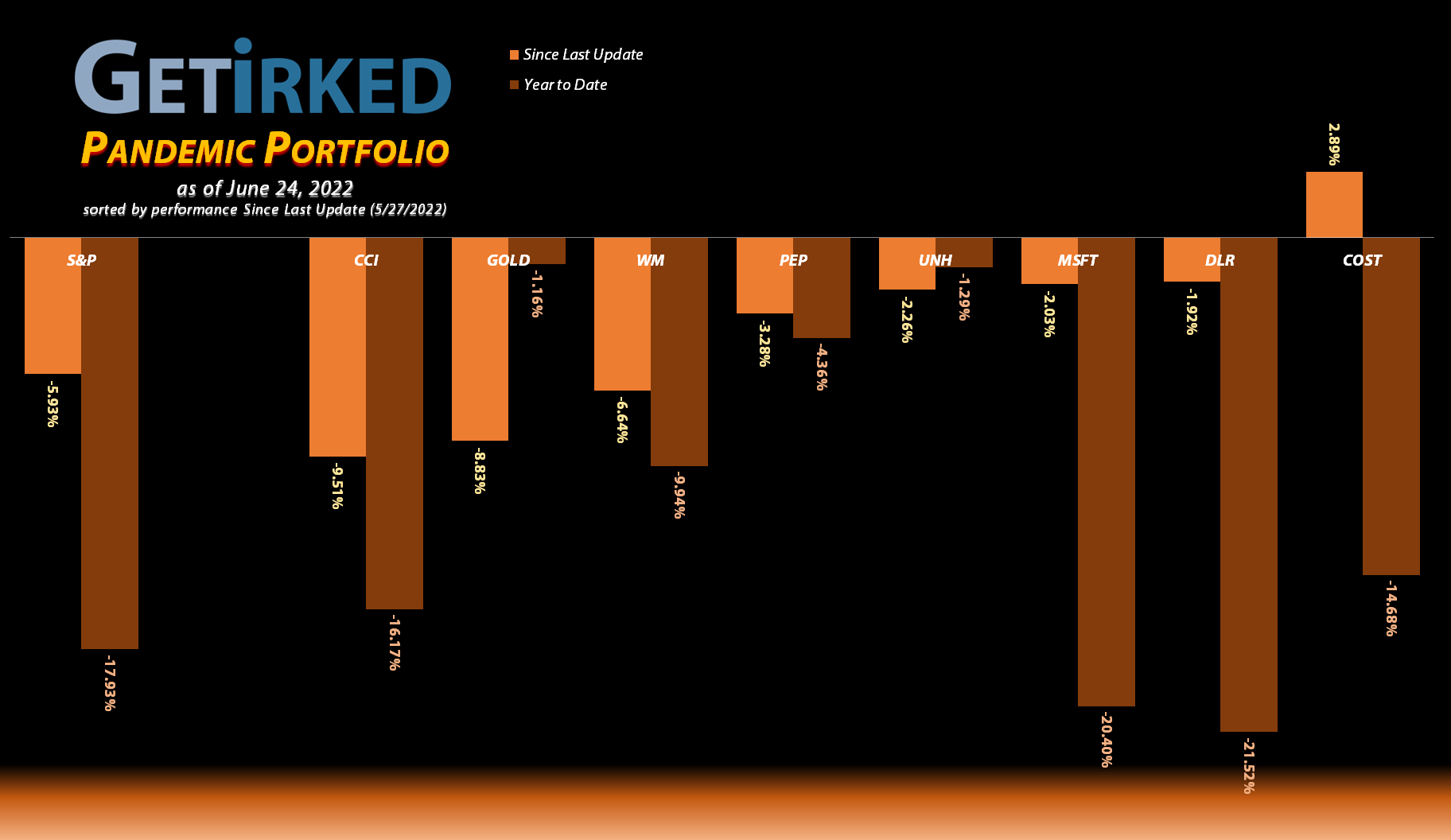

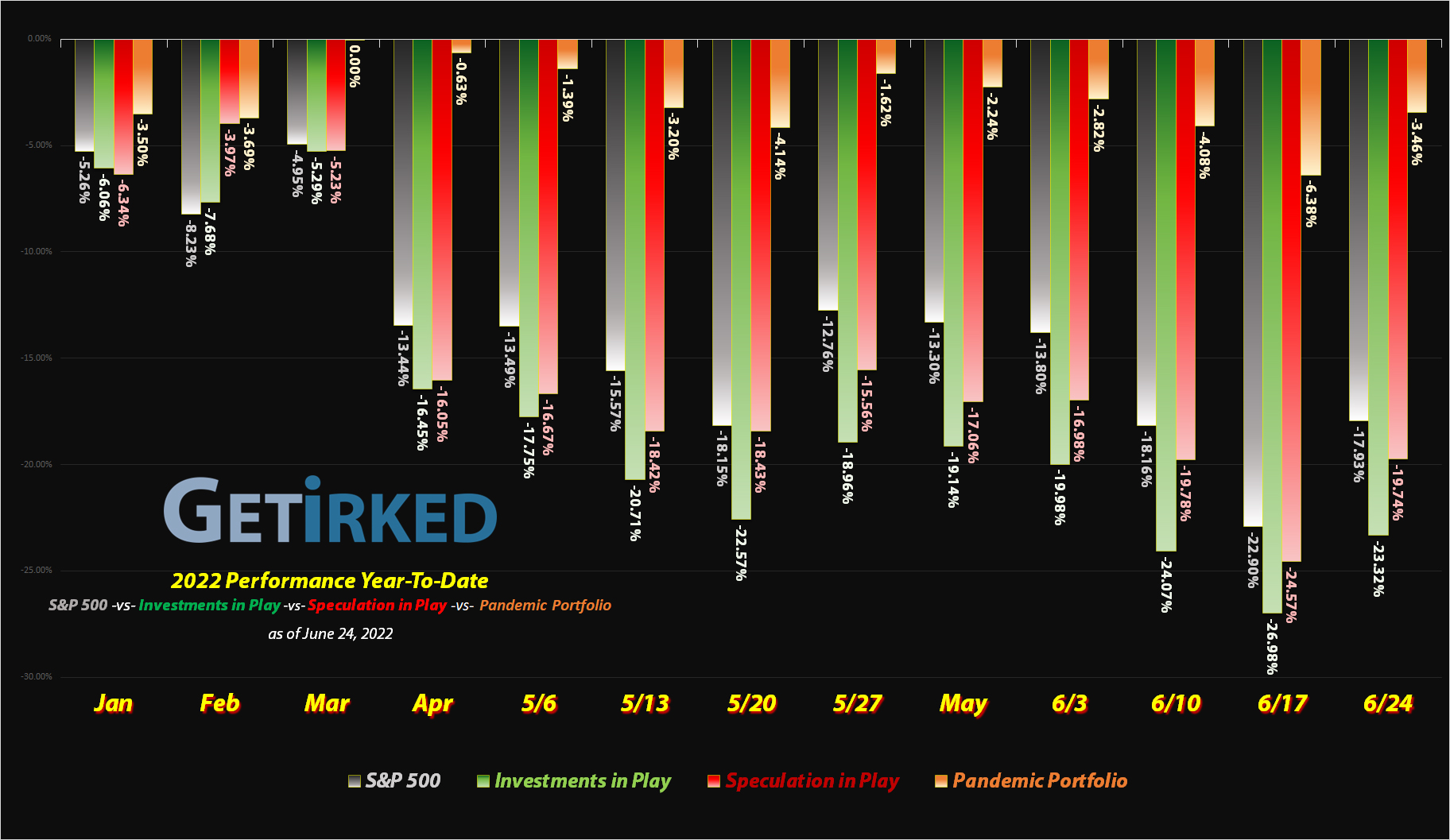

The “June Swoon” isn’t messing around…

Historically, professional traders refer to a “June Swoon,” a time when a lot of the pros have left town for their summer vacations where the low trading volume can result in incredible volatility, typically to the downside (thus the “swoon”). This June was no different as we saw a nausea-inducing drawdown that was one of the record books… literally.

For the first time in its entire history, the S&P 500 saw twelve (12) down weeks in a row. Truly, these are… wait for it… unprecedented times (I bet you thought you’d never see “unprecedented” again after 2020, eh? I’m bringing it back… ugh).

These periods of volatility are actually normal over time in the markets, and the best thing to do is either plan for them or ignore them. The absolute worst course of action is to panic and sell off with the herd. Even if there’s more downside ahead, chances are the market will see a significant bounce off oversold lows.

In fact bull rallies during bear markets are notorious for being some of the most powerful upside moves we see in the markets. As bears press their luck to the downside, oversold conditions result in a crescendo of buying. As the bears realize they’re losing and start covering their bets, that only causes more upside. The result are epic bull rallies even in an overall bearish trend.

In other words, if you do want to sell positions, wait for one of these crazy bull rallies, even if we’re in the middle of a long-winded downturn.

Let’s get on with the update and take a look at the moves that happened since the last update in the Pandemic Portfolio’s positions…

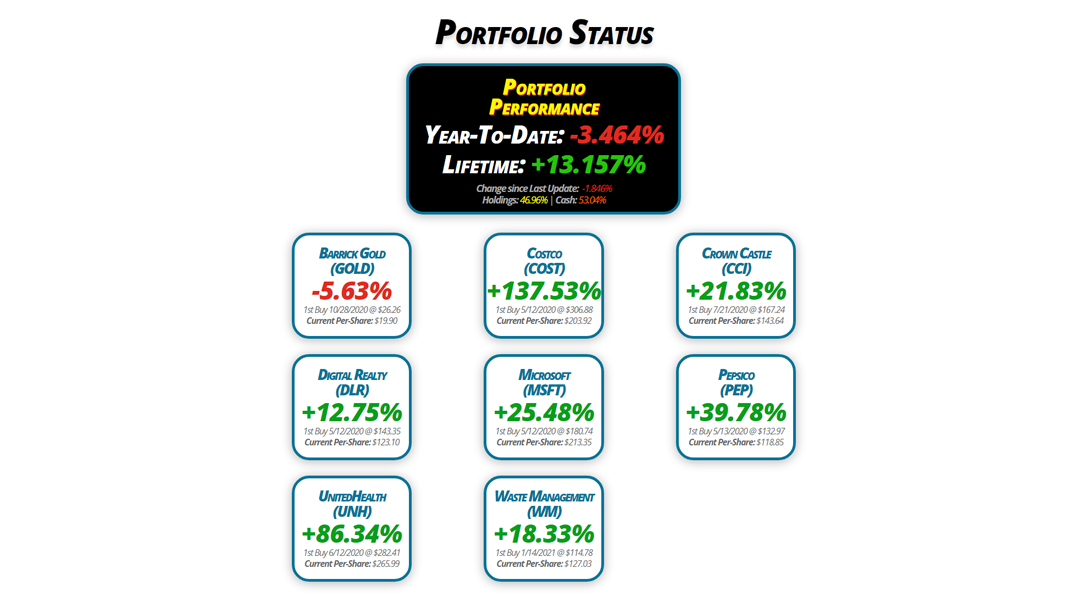

Portfolio Status

Portfolio

Performance

Year-To-Date: -3.464%

Lifetime: +13.157%

Change since Last Update: -1.846%

Holdings: 46.96% | Cash: 53.04%

Barrick Gold

(GOLD)

-5.63%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $19.90

Digital Realty

(DLR)

+12.75%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $123.10

UnitedHealth

(UNH)

+86.34%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $265.99

Costco

(COST)

+137.53%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $203.92

Microsoft

(MSFT)

+25.48%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $213.35

Waste Management

(WM)

+18.33%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $127.03

Crown Castle

(CCI)

+21.83%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $143.64

Pepsico

(PEP)

+39.78%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $118.85

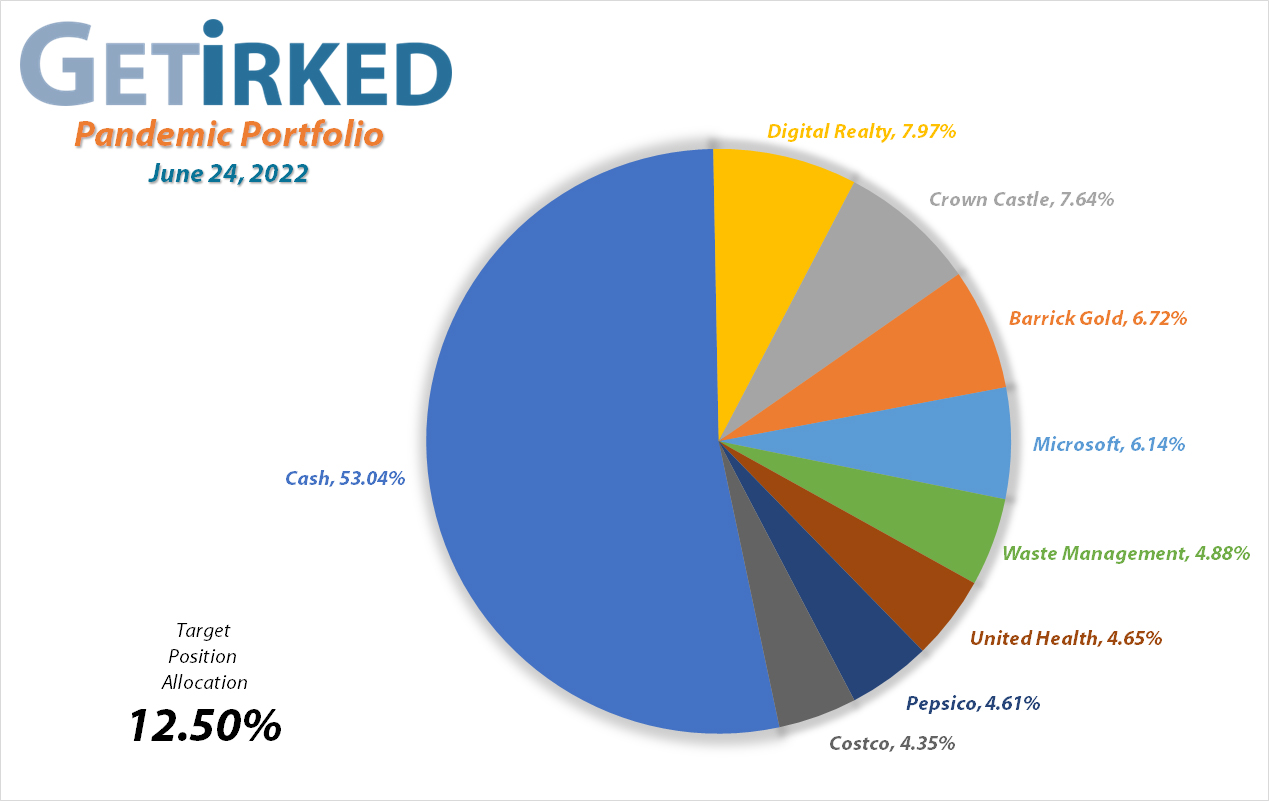

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position & Dividends

Current Price: $18.78

Per-Share Cost: $19.90 (-0.946% since last update)

Profit/Loss: -5.63%

Allocation: 6.722%* (-0.245% since last update)

Next Buy Target: $17.80

Barrick Gold (GOLD) paid out its quarterly dividend on Tuesday, June 14, and, since GOLD is headquartered in a foreign country (Canada), my broker does not offer fractional shares, only providing a cash payout. While this means the dividends do not compound, even cash dividends reduce the cost basis and this resulted in my per-share cost dropping -0.846% from $20.09 to $19.92.

Later in the month, the precious yellow metal continued to weaken, causing related stocks like Barrick to sell off where GOLD triggered my next buy order which filled at $19.28 on Thursday, June 23. While the buy only lowered my per-share cost an additional -0.100% from $19.92 to $19.90, the buy locked in a substantial -25.21% discount replacing some of the shares I sold for $25.78 back on April 11.

From here, my next buy price target is above a past point of support at $17.80, and my next sell target is $25.85, below its 2022 high.

GOLD is $18.78 as of this update, down -2.59% from where I added.

Costco (COST): Strategy Update

Current Price: $484.37

Per-Share Cost: $203.92 (Unchanged since last update)

Profit/Loss: +137.53%

Allocation: 4.346%* (+0.202% since last update)

Next Buy Target: $409.90

Costco (COST) bounced after its selloff in May and spent much of June consolidating within a range. At this point, I plan to add to the position if it tests its May low with a buy at $409.90, above its $406.51 low. If it heads higher, then I’ll just sit on what I have and wait for its next move.

Crown Castle (CCI): Added to Position

Current Price: $174.99

Per-Share Cost: $143.64 (+1.155% since last update)

Profit/Loss: +21.83%

Allocation: 7.637%* (+0.194% since last update)

Next Buy Target: $146.50

Crown Castle (CCI) sold off pretty spectacularly mid-month and triggered my next buy target on Tuesday, June 14 at $158.19. The buy locked in a -20.32% discount replacing shares I sold just two months ago at $198.52 on April 11, 2022 and raised my per-share cost +1.155% from $142.00 to $143.64, still a -14.11% reduction from my first buy at $167.24 on July 21, 2020.

From here, my next buy price target is $146.50, above a past point of support, and my next sell target is $193.70, just below its most recent high.

CCI is $174.99 as of this update, up +10.62% from where I added.

Digital Realty Trust (DLR): Strategy Update

Current Price: $138.80

Per-Share Cost: $123.10 (Unchanged since last update)

Profit/Loss: +12.75%

Allocation: 7.973%* (-0.003% since last update)

Next Buy Target: $115.40

Digital Realty Trust (DLR) saw a lot of volatility over the past month thanks to the dramatic moves in the market, however, the stock has yet to reach my buy or sell targets. Accordingly, I’m just waiting on this one, collecting its ample dividends as I do.

My next buy price target is $115.40, above a past point of support, and my next sell target is $140.50, slightly below the high of its most recent bull rally.

Microsoft (MSFT): Dividend Reinvestment

Current Price: $267.70

Per-Share Cost: $213.35 (-0.243% since last update)

Profit/Loss: +25.48%

Allocation: 6.139%* (+0.006% since last update)

Next Buy Target: $238.90

Microsoft (MSFT) paid out its quarterly dividend on Thursday, June 9, and, while not all that significant, the reinvested dividend did lower my per-share cost -0.24% from $213.87 to $213.35. As I like to say, sure, that’s not a huge decrease, but considering it’s quite literally money for nothing, you won’t ever find me complaining.

Pepsico (PEP): Strategy Update

Current Price: $166.13

Per-Share Cost: $118.85 (Unchanged since last update)

Profit/Loss: +39.78%

Allocation: 4.607%* (-0.019% since last update)

Next Buy Target: $147.95

Pepsico (PEP) got hit particularly hard with the rest of the consumer staples names after the dramatic increase in the rate of inflation indicated that it may be difficult for the consumer staples names to maintain their profit margins.

Sure, the food stocks can raise their prices, but they can only do so far before consumers will switch from brand names to store brands. Accordingly, my next buy price target is $147.95, above a past point of support, and I do plan to take profits if PEP gets up to its all-time high with a sell target at $177.15.

UnitedHealth (UNH): Added to Position

Current Price: $495.64

Per-Share Cost: $265.99 (+3.988% since last update)

Profit/Loss: +86.34%

Allocation: 4.653%* (+0.225% since last update)

Next Buy Target: $389.90

UnitedHealth (UNH) held up well during the market selloff until finally on Thursday, June 16, when it triggered my next buy order which filled at $451.58.

The buy locked in a -15.84% discount replacing some of the shares I sold for $536.59 on April 7, and raised my per-share cost +3.988% from $255.79 to $265.99, still a -5.82% reduction from where I first opened the position at $282.41 back on June 12, 2020.

From here, my next buy target is $389.90, above a past point of support, and I have no sell targets for the position at this time.

UNH is $495.64 as of this update, up +9.76% from where I added.

Waste Management (WM): Dividend Reinvestment

Current Price: $150.31

Per-Share Cost: $127.03 (-0.447% since last update)

Profit/Loss: +18.33%

Allocation: 4.881%* (-0.283% since last update)

Next Buy Target: $120.55

Waste Management (WM) paid out its quarterly dividend on Friday, June 17 which reinvested into my position, lowering my per-share cost -0.447% from $127.60 to $127.03.

While WM did sell off to very near its 2022 lows over the course of the past month, I have decided to wait until it sells off a bit below my cost basis in an effort to reduce my cost closer to my initial buy at $114.96 on January 14, 2021.

From here, my next buy price target is $120.55, above a past point of support, and my next sell target is $169.45, below WM’s last bully rally high.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.