Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #3

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

With a Never-Ending Bull Market, It’s Time to Strategize

In this update, I’m revisiting each of my positions to see how they’re performing and to pick new buy targets for each one.

Most of the positions have flown since the initial purchase which means new buying will likely raise my per-share cost – something I hate to do but something that must be done when sticking to a strict portfolio structure.

Below, I’ve written my new strategies for each position as well as revisiting Dividend Reinvestment with Costco (COST) and adding to Crown Castle, Inc. (CCI), the only position in the portfolio that’s moved lower since its initial purchase.

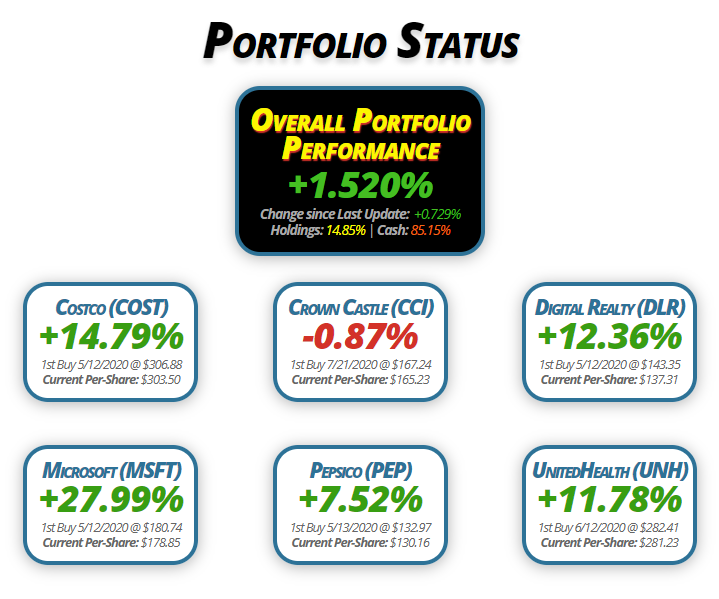

Portfolio Status

Overall Portfolio

Performance

+1.520%

Change since Last Update: +0.729%

Holdings: 14.85% | Cash: 85.15%

Costco (COST)

+14.79%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $303.50

Crown Castle (CCI)

-0.87%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $165.23

Digital Realty (DLR)

+12.36%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $137.31

Microsoft (MSFT)

+27.99%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $178.85

Pepsico (PEP)

+7.52%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $130.16

UnitedHealth (UNH)

+11.78%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $281.23

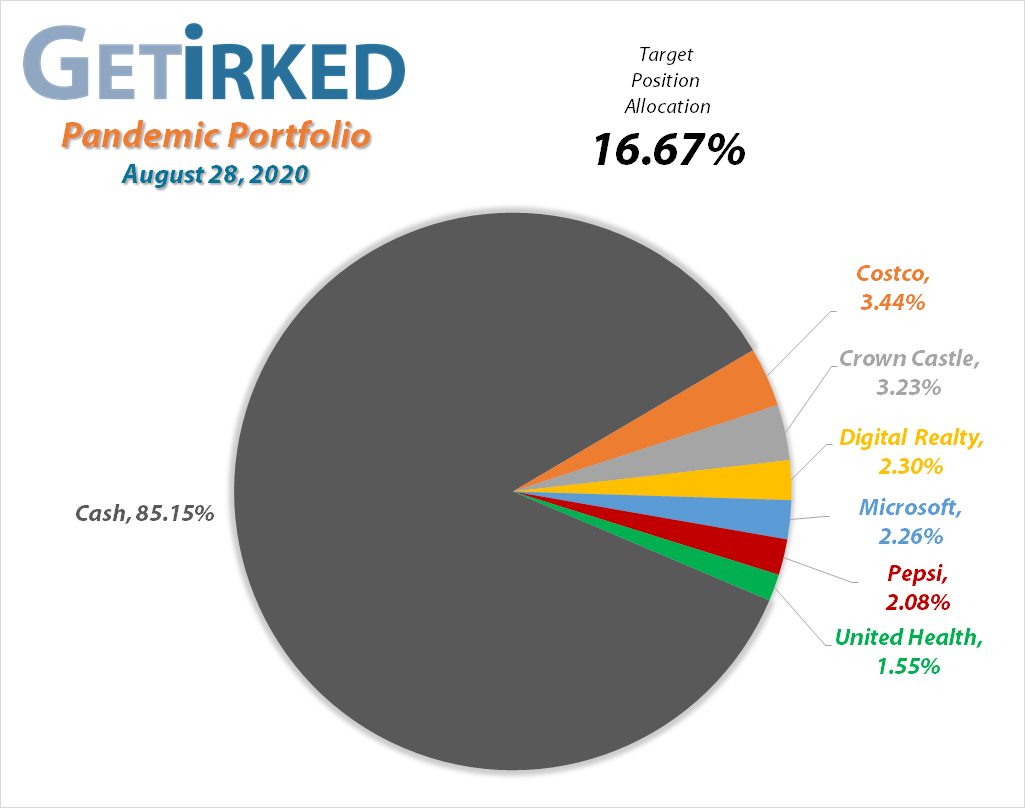

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Costco (COST): Dividend Reinvestment

Current Price: $348.37

Per-Share Cost: $303.50 (lowered -0.20% from last update)

Profit/Loss: +14.79%

Allocation: 3.439%*

Next Buy Target: $305.78

Costco (COST) paid out its quarterly dividend on Friday, August 14: $0.70 per share. This equates to $2.80 annually for an annual yield of 0.83% at Costco’s $338.50 closing price on August 14. The dividend lowered my per-share cost -0.2% from $304.12 to $303.50.

Once again, Dividend Reinvestment Programs are a painless way to increase a position’s size since nothing is required of the investor besides simply holding the stock through the dividend release date (Ex Div Date).

In light of Costco’s new all-time high of $348.44 made on August 28, 2020, next buying target to $305.78 followed by $288, $271.50, and so on.

Crown Castle (CCI): Added to Position

Current Price: $163.79

Per-Share Cost: $165.23 (lowered -1.20% from last update)

Profit/Loss: -0.87%

Allocation: 3.227%*

Next Buy Target: $148.90

I raised my price target after watching Crown Castle lose support at $160.00 but finding it near $159 over the week of August 24-28. On Wednesday, August 26, I had a buy order to add a small amount to the position fill at $159.19.

The buy reduced my per-share cost a decent -1.20% from $167.24 to $165.23. My next buy target for the stock will add the same quantity around $149 near CCI’s 200-day Simple Moving Average (SMA) as well as a period of past support.

CCI closed the week at $163.79, up +2.89% from where I added.

Digital Realty Trust (DLR): New Strategy

Current Price: $154.29

Per-Share Cost: $137.31 (unchanged from last update)

Profit/Loss: +12.36%

Allocation: 2.258%*

Next Buy Target: $140.90

Digital Realty Trust (DLR) has performed remarkably well over the past few months, hitting a new all-time high of $165.49 on July 31 before pulling back to settle in the low $150s. I’ve raised my price target to $140.90, above my per-share cost but near a past period of support.

Subsequent price targets for the stock are around $130, $125, $120 and so on.

Microsoft (MSFT): New Strategy

Current Price: $228.91

Per-Share Cost: $178.85 (unchanged from last update)

Profit/Loss: +27.99%

Allocation: 2.258%*

Next Buy Target: $203.80

With news that Microsoft (MSFT) and Wal-Mart (WMT) are trying to buy the social media platform TikTok, Microsoft’s stock continued to skyrocket to a new all-time high of $231.15.

I’m skeptical Microsoft may sell off to my per-share cost, so I’m creating a more aggressive buying strategy, targeting $203-204, a period of past support for the stock, where I’ll begin to add, followed by $194, $184.50, and $176.50.

Pepsico (PEP): New Strategy

Current Price: $139.94

Per-Share Cost: $130.16 (unchanged from last update)

Profit/Loss: +7.52%

Allocation: 2.078%*

Next Buy Target: $130.35

Unlike many of the other positions in this portfolio, Pepsico (PEP) hasn’t seen remarkable movement over the past few months, instead consolidating slowly higher reaching near the $140 mark. Accordingly, I’ve only raised my price target slightly to $130.35, a consistent historical point of support for the stock.

Following that buy are additional targets at $128.75, $1124.50, $119.70, $113.80, and so on.

UnitedHealth (UNH): Strategy Update

Current Price: $300.79

Per-Share Cost: $281.23 (unchanged from last update)

Profit/Loss: +11.78%

Allocation: 1.555%*

Next Buy Target: $276.25

Unlike the rest of the positions in this portfolio, I have no intention to add to UnitedHealth (UNH) before it drops through my buy target. Historically, health-related stocks get slammed during a Presidential Election year, and I see no reason this year should be different.

Given that my per-share cost is roughly only 10% down from UNH’s price as of writing, the probability it could pull back below my per-share cost during a marketwide or sector-specific selloff is pretty high.

My next buy target is $276.25 followed by $247.50, $227.60, and so on.

* Target allocation for each position in the portfolio is 16.67% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.