Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #29

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Happy 2nd Birthday to the Pandemic Portfolio!

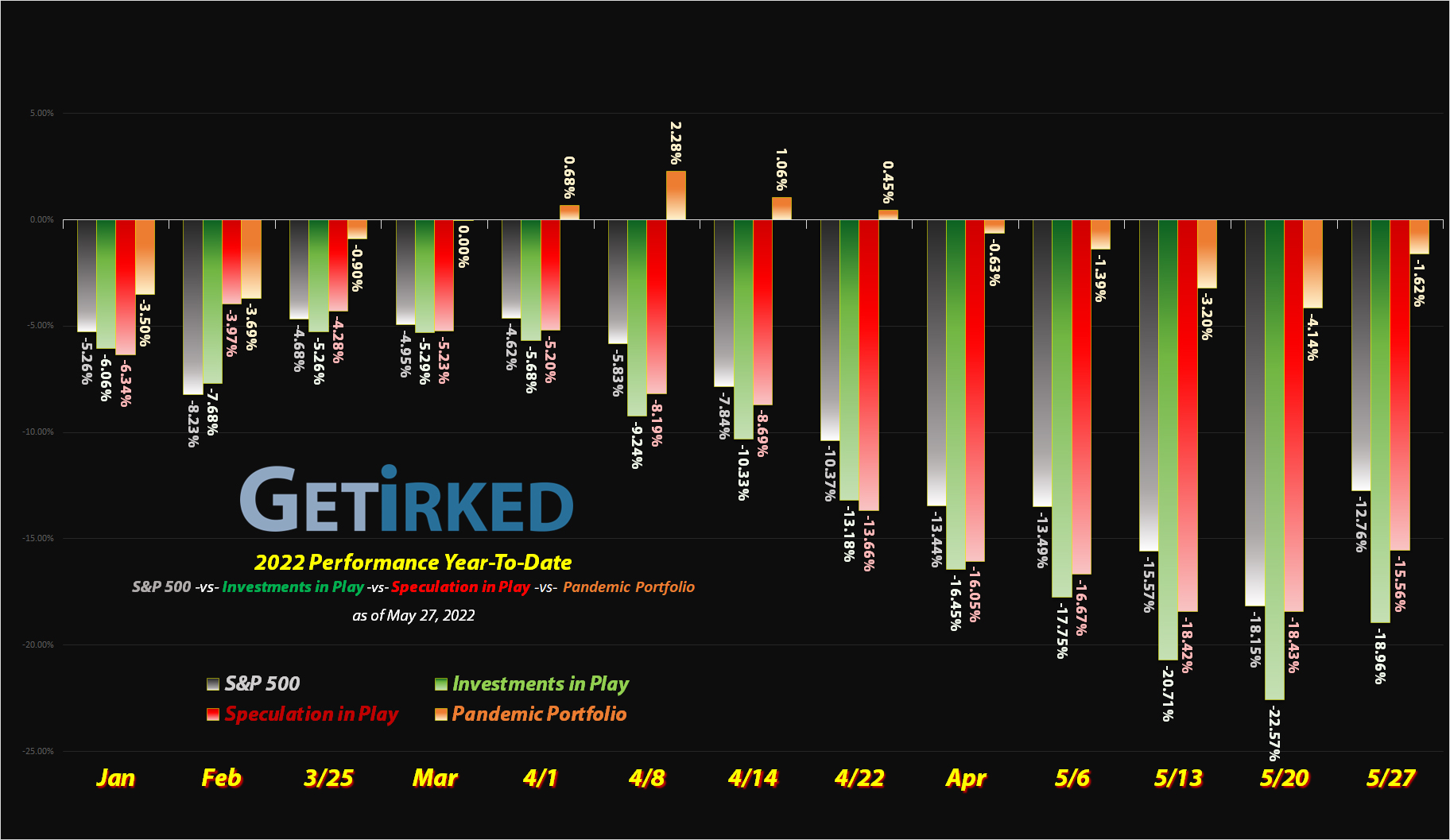

The Pandemic Portfolio turned two this month, marking two full years since I embarked on the journey to create a portfolio that could perform both in pandemics and in inflationary times (I wish I could say I’m a seer and knew definitively we would have inflation, but it was just an educated guess back in May 2020… so much for “transitory,” eh?).

Since its inception back in May 2020, the Pandemic Portfolio is now up +15.32% over its lifetime which annualizes to a +7.66% gain per year, not too shabby for a portfolio that’s been more than 50% in cash for the majority of its existence (man, it’s hard to put money to work in a bull market…)

Let’s take a look at how the positions changed since the last update…

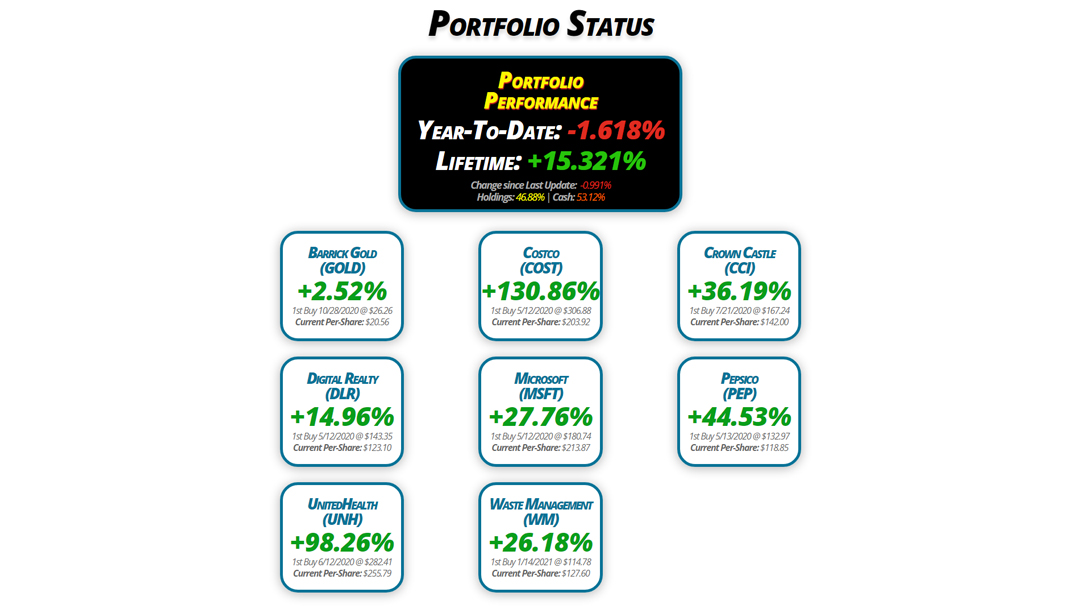

Portfolio Status

Portfolio

Performance

Year-To-Date: -1.618%

Lifetime: +15.321%

Change since Last Update: -0.991%

Holdings: 46.88% | Cash: 53.12%

Barrick Gold

(GOLD)

+2.52%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $20.56

Digital Realty

(DLR)

+14.96%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $123.10

UnitedHealth

(UNH)

+98.26%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $255.79

Costco

(COST)

+130.86%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $203.92

Microsoft

(MSFT)

+27.76%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $213.87

Waste Management

(WM)

+26.18%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $127.60

Crown Castle

(CCI)

+36.19%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $142.00

Pepsico

(PEP)

+44.53%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $118.85

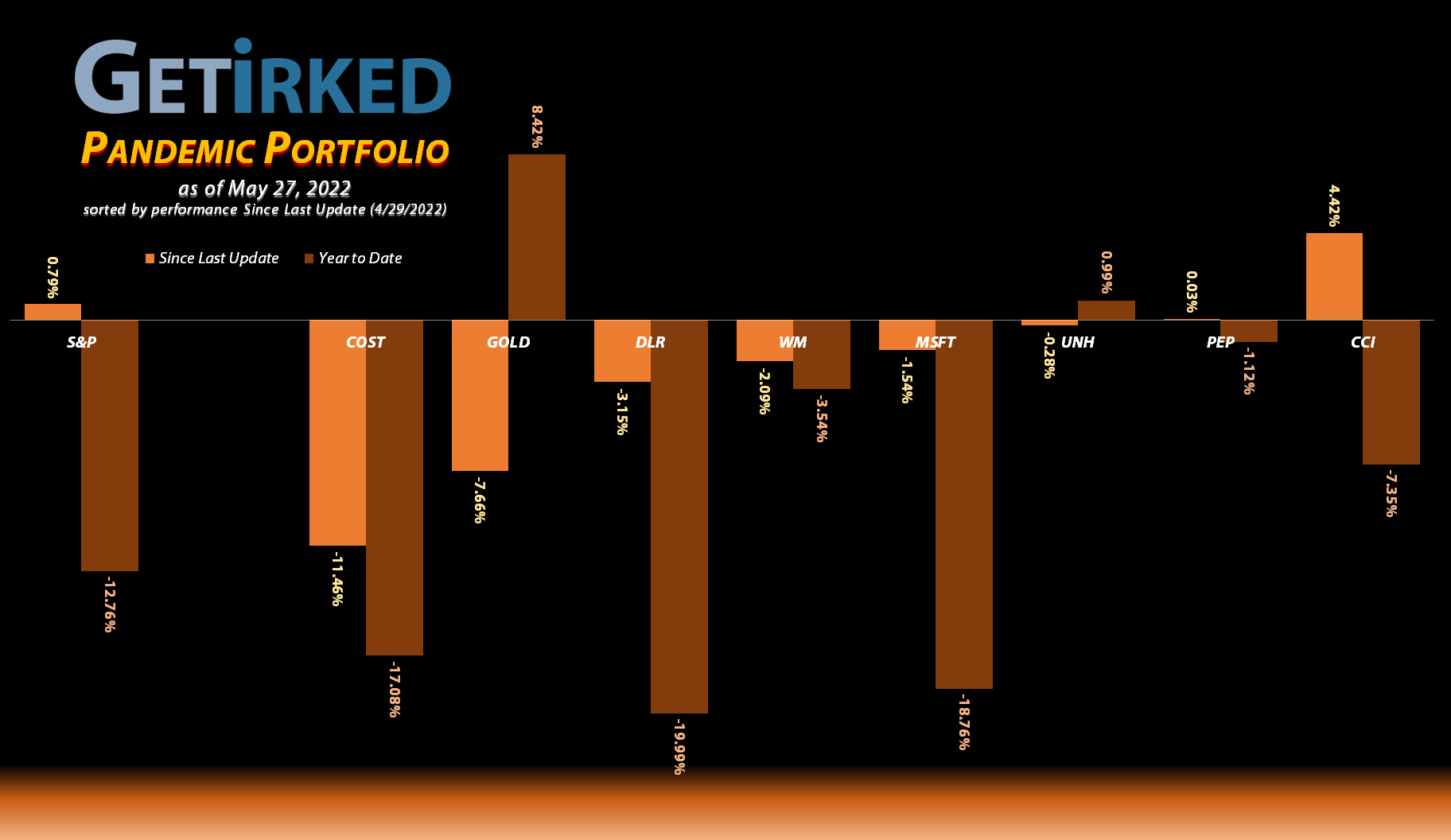

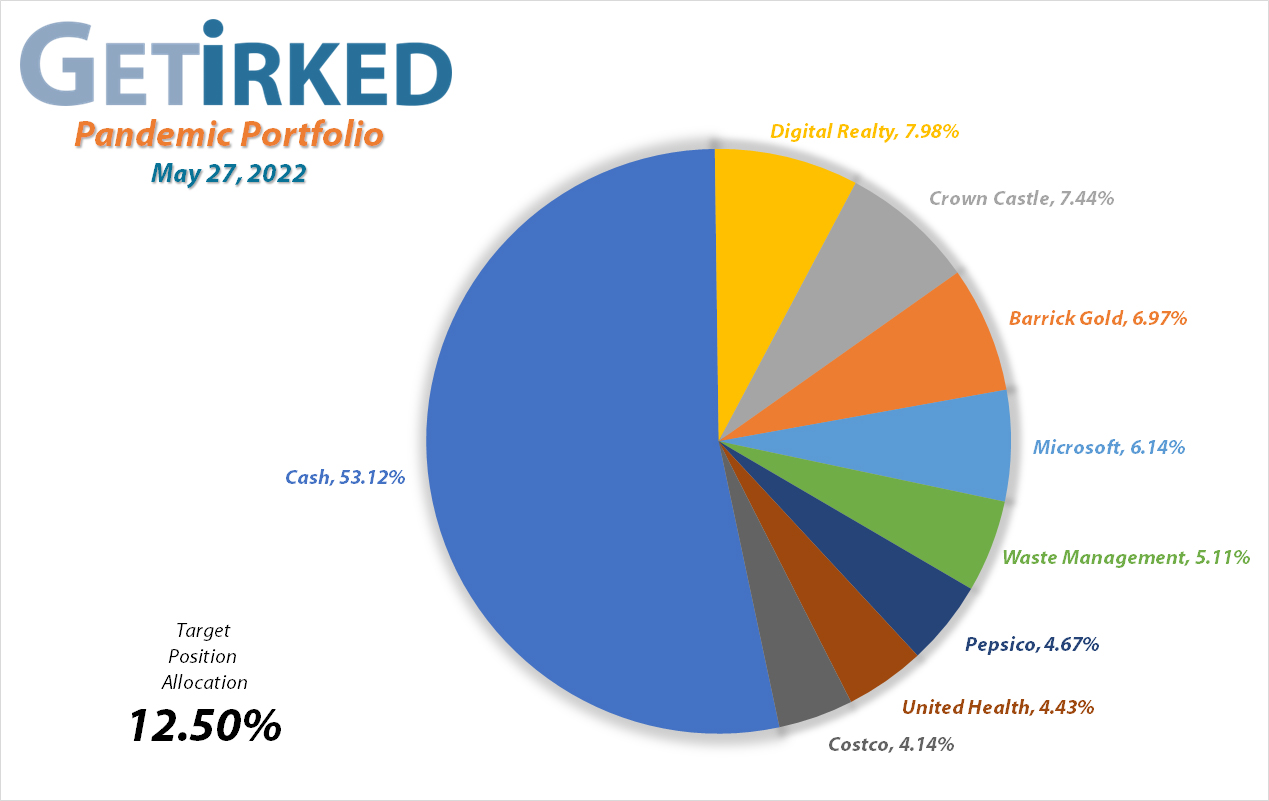

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $20.60

Per-Share Cost: $20.09 (Unchanged since last update)

Profit/Loss: +2.52%

Allocation: 6.967%* (-0.503% since last update)

Next Buy Target: $17.75

The yellow metal continued to exhibit weakness since its selloff in April, causing goldminers like our Barrick Gold (GOLD) to remain relatively flat and uninteresting since the past update. My price target to add more to Barrick is $17.75, a bit above its most recent low, but I have no interest to add sooner since gold just isn’t acting right.

Accordingly, I’m also prepared to take profits if GOLD sees another pop with my first sell target at $24.60, a bit below the high of GOLD’s last rally earlier in 2022.

Costco (COST): Added To Position x 3 & Dividends

Current Price: $470.76

Per-Share Cost: $203.92 (+32.596% since last update)

Profit/Loss: +130.86%

Allocation: 4.144%* (+0.223% since last update)

Next Buy Target: $381.90

Costco (COST) kicked off the month in the same downtrend it ended April, triggering a buy order on Monday, May 2 at $525.79. The order locked in a -12.897% discount replacing some of the shares I sold at $603.64 on April 7.

Then, on Wednesday, May 11, COST continued to sell off and triggered my next buy order which filled at $491.45, locking in a -18.586% discount replacing still more of the shares I sold on April 7.

On Tuesday, May 16, Costco paid out its quarterly dividend which lowered my per-share cost -0.16% from $190.18 to $189.88. While relatively small compared to its peers at less than a percent yield, COST is notorious for paying a small quarterly dividend in favor of paying out special one-time dividends from time-to-time, although it has been more than a year and a half since its last special dividend payout.

After Wal-Mart (WMT) and Target (TGT), retail competitors, reported dismal earnings and negative forward guidance, COST got truly smacked on Wednesday, May 18, triggering a third buy which filled at $442.12. The buy locked in a -26.76% discount replacing still more of the shares I sold at $603.64 back on April 7, and raised my per-share cost +7.394% from $189.88 to $203.92.

The combined buys gave me an average buying price of $486.45 and increased my per-share cost a total of +32.596% from $153.79 to $203.92 (still a -33.55% reduction from my initial buy in COST at $306.88 on May 12, 2020).

From here, my next buy target is $381.90, above a past point of support, and I have no sell targets at this time as I rebuild this position from the profits I took in the month of April.

As of this update, COST is $470.76, down -3.23% from my $486.45 average buy.

Crown Castle (CCI): Strategy Update

Current Price: $193.39

Per-Share Cost: $142.00 (Unchanged since last update)

Profit/Loss: +36.19%

Allocation: 7.443%* (+0.386% since last update)

Next Buy Target: $157.35

Crown Castle (CCI) and the rest of the Real Estate Investment Trusts (REITs) caught a bid since the past update as investors rolled into reliable yield plays over the riskier growth stocks in the market. That being said, my next buy target remains at $157.35, slightly above CCI’s 2022 low.

I do also have plans to take profits in CCI starting at $198.35, just under the high of its last bull run, and then even more profit-taking targets after that slightly under its all-time high.

Digital Realty Trust (DLR): Added to Position x 2

Current Price: $141.51

Per-Share Cost: $123.10 (+0.704% since last update)

Profit/Loss: +14.96%

Allocation: 7.976%* (+1.077% since last update)

Next Buy Target: $115.40

Digital Realty Trust (DLR) got positively slammed during the market-wide selloff, dropping from the high of its last bull rally around $153.00 all the way down (and through) my next buy target which filled at $130.19 on Tuesday, May 10. The buy raised my per-share cost +0.540% from $122.24 to $122.90.

A few days later on Thursday, May 12, DLR tested its lows and triggered my next buy order at $125.50 which raised my per-share cost +0.163% from $122.90 to $123.10, and gave me a $127.85 average buy price.

Following its selloff, Digital Realty really took off with CCI and the rest of the real estate sector, popping quite a bit off its lows. From here, my next buy target is $115.40, above a past point of strong support, and my next sell target is $144.70, below a point where DLR has found regular resistance.

DLR is $141.51 as of this update, up +10.68% from my $127.85 average buy.

Microsoft (MSFT): Added to Position x 2

Current Price: $273.24

Per-Share Cost: $213.87 (+1.872% since last update)

Profit/Loss: +27.76%

Allocation: 6.139%* (+0.418% since last update)

Next Buy Target: $238.90

Microsoft (MSFT) finally broke down with the rest of the market early in the month on Friday, May 6, triggering a buy order which filled at $272.28. The buy raised my per-share cost +1.091% from $209.94 to $212.23.

On Thursday, May 12, MSFT lost support even further, triggering my next buy which filled at $255.49, giving me a $263.88 average buy price. The second buy raised my per-share cost a bit more, +0.773% from $212.23 to $213.87.

From here, my next buy target is $238.90, above a past point of support, and my next sell target is $352.60, slightly above Mr. Softy’s all-time high which I expect it to exceed the next time it makes a run up there.

MSFT is $273.24 as of this update, up +3.55% from my $263.88 average buy.

Pepsico (PEP): Strategy Update

Current Price: $171.77

Per-Share Cost: $118.85 (Unchanged since last update)

Profit/Loss: +44.53%

Allocation: 4.626%* (+0.048% since last update)

Next Buy Target: $153.45

Pepsico (PEP) got hit particularly hard when megastore retailers Wal-Mart (WMT) and Target (TGT) reported shockingly bad earnings, scaring investors away from the usually beloved consumer staples like PEP. However, the selloff did not cause PEP to drop anywhere near my $153.45 price target, above its 2022 lows, before Pepsi found support and raised higher.

As a result, for the past month the stock has remained largely in No Man’s Land between my buy target and my next sell price target up at $177.15 where I will pull even more profits from the position, slightly below its all-time high.

UnitedHealth (UNH): Added to Position

Current Price: $507.11

Per-Share Cost: $255.79 (+5.082% since last update)

Profit/Loss: +98.26%

Allocation: 4.428%* (+0.257% since last update)

Next Buy Target: $448.90

Despite being a stalwart in past selloffs, even the healthcare sector got slammed during May’s selloff with UnitedHealth (UNH) triggering my next buy order at $485.15 on Tuesday, May 10.

The buy locked in a -9.586% discount replacing some of the shares I sold at $536.59 on April 7 and raised my per-share cost +5.082% from $243.42 to $255.79. From here, my next buy target is $448.90, above a past point of support, and I have no sell targets for UNH at this time.

UNH is $507.11 as of this update, up +4.53% from where I added.

Waste Management (WM): Strategy Update

Current Price: $161.00

Per-Share Cost: $127.60 (Unchanged since last update)

Profit/Loss: +26.18%

Allocation: 5.164%* (-0.057% since last update)

Next Buy Target: $139.25

Waste Management (WM) did get whacked during the market selloff since our last update, however, the stock found support significantly higher than it did earlier in the year, leaving my next buy price target at $139.25, slightly above the lows the stock saw earlier in 2022.

I do have intentions to take profits if WM tests its all-time high with a sell target slightly below $170 where I will continue to make efforts to reduce the per-share cost of my position.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.