Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #28

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

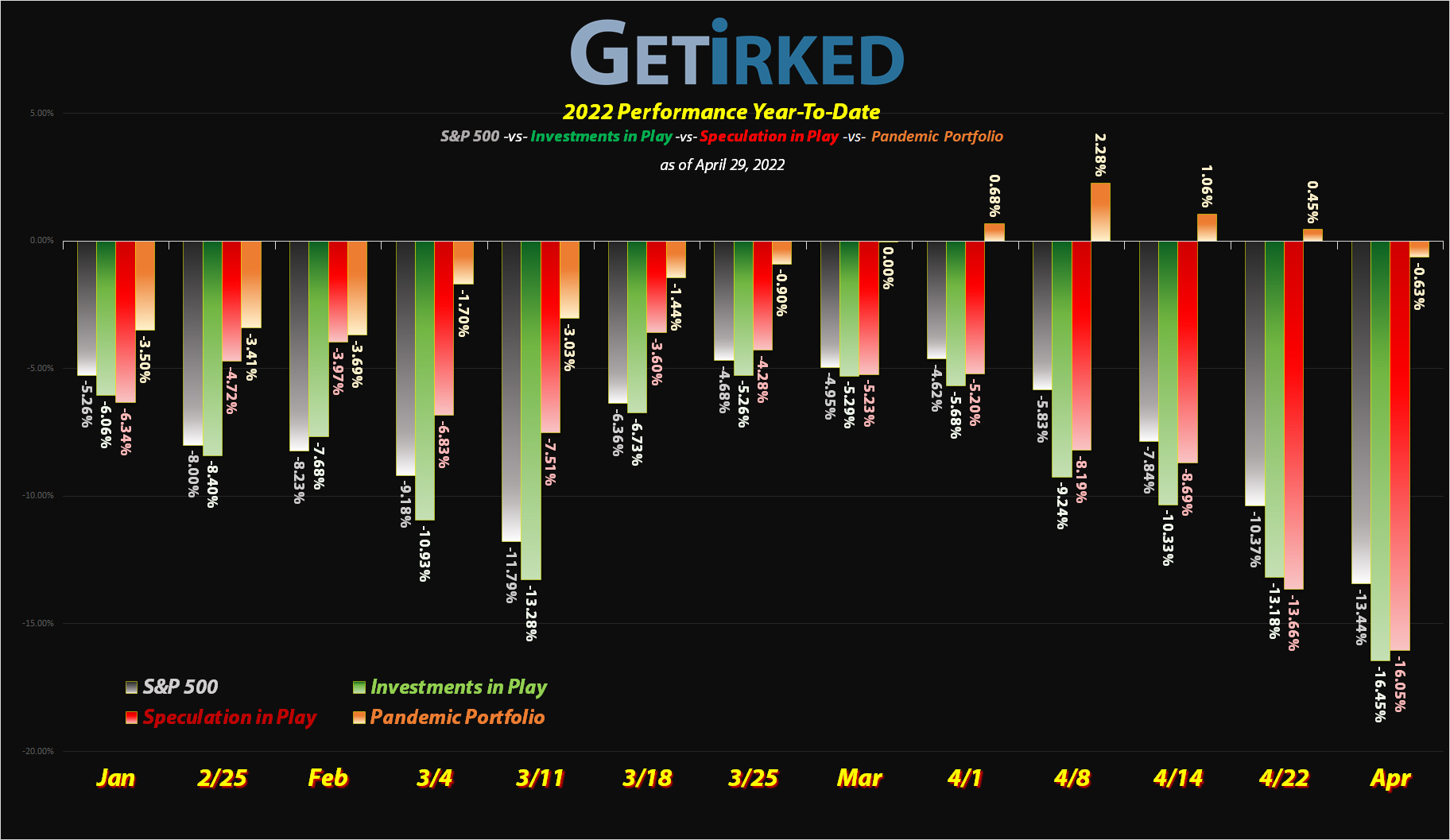

No one is safe in a market-wide selloff…

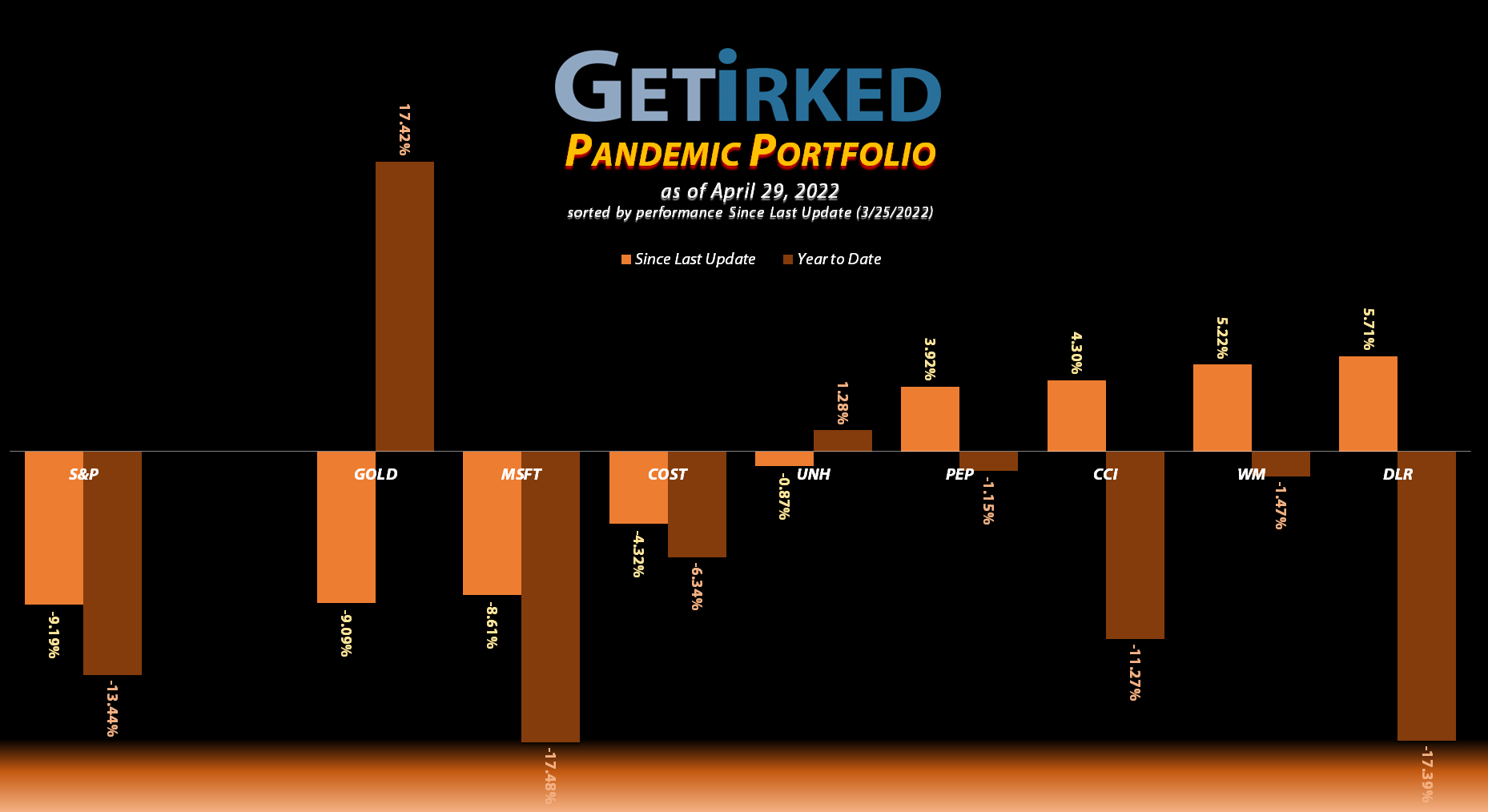

Throughout the majority of April, the Pandemic Portfolio held up incredibly well, even offering positive returns for the year when the indexes and the rest of my portfolios were deep in the red. Accordingly, you’ll see that I took profits in nearly every one of the Pandemic Portfolio’s positions – not because any of them had exceeded their allocation targets, but because when positions hit highs in the middle of a shaky market, it’s time to take something off the table.

And that profit-taking turned out to be the right thing to do as Federal Reserve Chairman Jerome Powell turned hawkish and came out with an aggressive plan to fight inflation. This caused the Pandemic Portfolio’s “inflation-resistant” stocks to get hit as investors panic-sold out of every sector.

Let’s take a look at where the Pandemic Portfolio positions have moved since the last update…

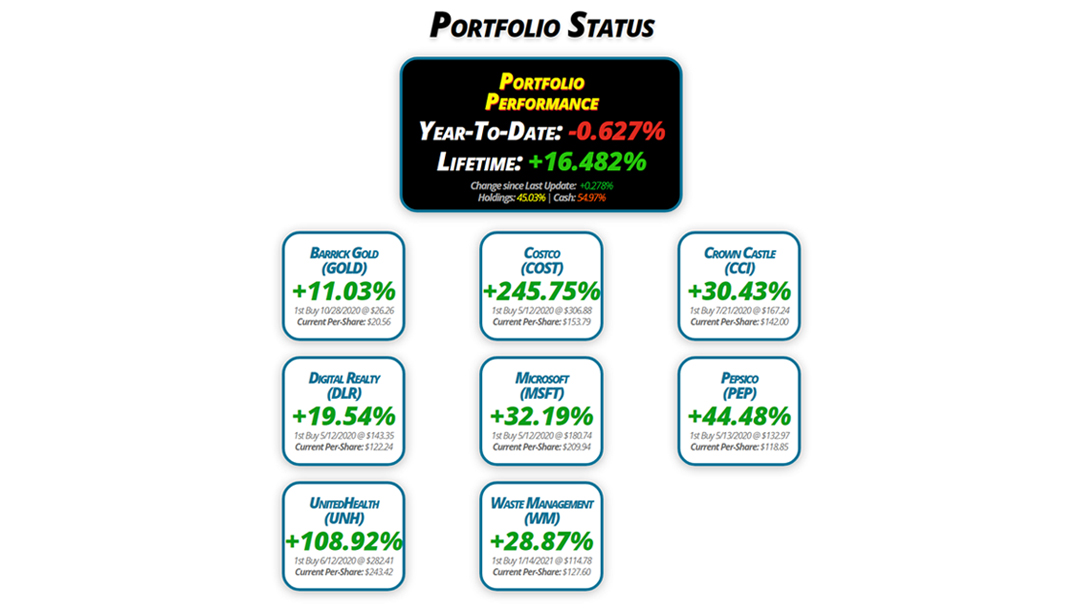

Portfolio Status

Portfolio

Performance

Year-To-Date: -0.627%

Lifetime: +16.482%

Change since Last Update: +0.278%

Holdings: 45.03% | Cash: 54.97%

Barrick Gold

(GOLD)

+11.03%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $20.56

Digital Realty

(DLR)

+19.54%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $122.24

UnitedHealth

(UNH)

+108.92%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $243.42

Costco

(COST)

+245.75%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $153.79

Microsoft

(MSFT)

+32.19%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $209.94

Waste Management

(WM)

+28.87%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $127.60

Crown Castle

(CCI)

+30.43%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $142.00

Pepsico

(PEP)

+44.48%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $118.85

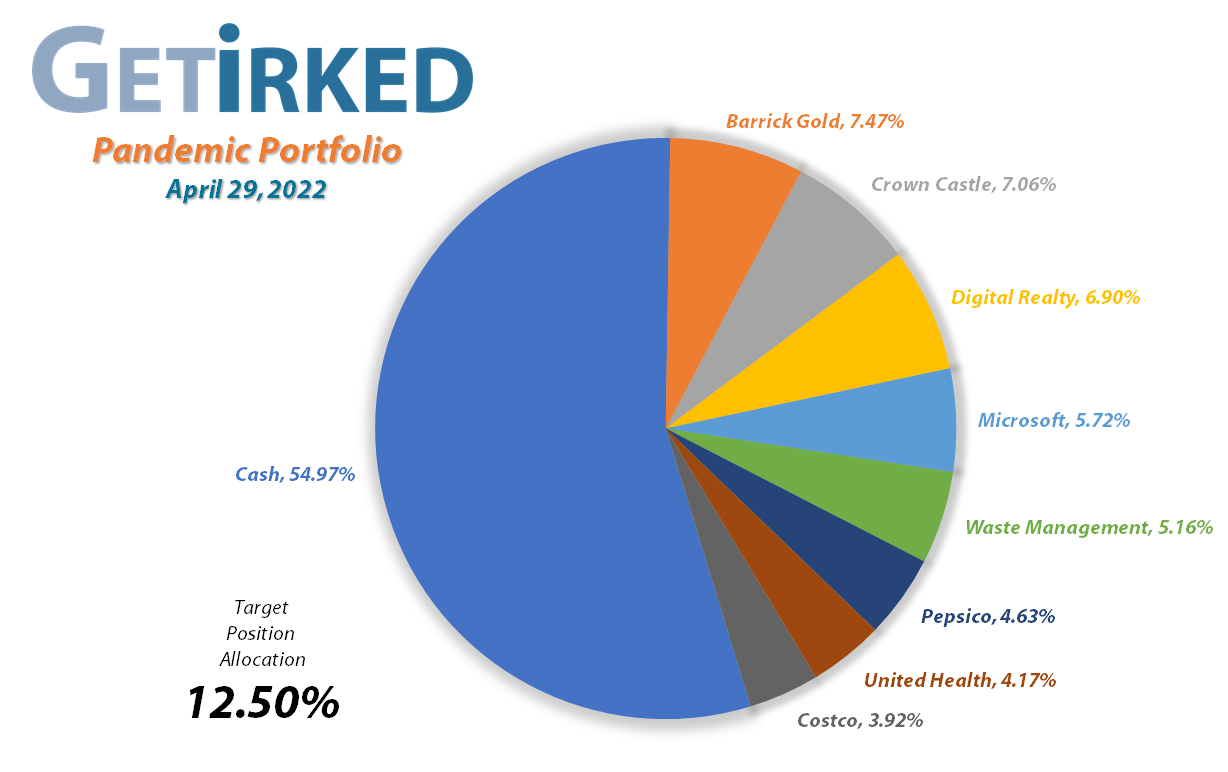

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Profit-Taking

Current Price: $22.31

Per-Share Cost: $20.09 (-2.286% since last update)

Profit/Loss: +11.03%

Allocation: 7.470%* (-1.509% since last update)

Next Buy Target: $17.75

With all the geopolitical turmoil combined with a hawkish Fed and inflation running out of control, investors turned once more to the precious yellow metal, gold, and caused Barrick (GOLD) to head higher at the beginning of April. GOLD triggered a sell order I had in place which filled at $25.78 on Monday, April 11.

However, once Fed Chair Jerome Powell came out hawkish mid-month, price action took a turn for the worst for all commodities, including gold. By the end of April, gold sold off significantly from its recent highs and brought all the gold stocks down with it, making my decision to take profits even more prudent.

The sale locked in +39.126% in gains on shares I bought for $18.53 on September 16, 2021 and lowered my per-share cost -2.286% from $20.56 to $20.09. From here, my next sell target is $25.30, a bit under GOLD’s 2022 high where I plan to take even more out of this weakening sector, and my next buy target is $17.75, near GOLD’s 2022 lows which appear as if they could to be GOLD’s next stop.

GOLD is $22.31 as of this update, down -13.46% from where I took profits.

Costco (COST): Profit-Taking

Current Price: $531.72

Per-Share Cost: $153.79 (-47.060% since last update)

Profit/Loss: +245.75%

Allocation: 3.921%* (-1.916% since last update)

Next Buy Target: $523.90

After reporting blowout year-over-year same-store stores, Costco (COST) broke through $600 to make new all-time highs. Now, don’t get me wrong – I love Costco – both the store (I am, quite literally, a card-carrying member) and the stock – but in this toppy market of uncertainty, I can’t have stocks at all-time highs be the biggest positions in any of my portfolios without taking some profits, at least.

So, on Thursday, April 7, a sell order of mine filled at $603.64, locking in +28.71% in gains selling shares I bought over the last year for an average buying price of $469.01. Additionally, the sale lowered my per-share cost a whopping -47.060% from $290.50 down to $153.79.

From here, my next buy target is $523.90, above a past point of support, and I have no sell targets at this time.

COST is $531.72 as of this update, down -11.910% from where I took profits.

Crown Castle (CCI): Profit-Taking & Dividends

Current Price: $185.21

Per-Share Cost: $142.00 (-4.634% since last update)

Profit/Loss: +30.43%

Allocation: 7.057%* (-0.433% since last update)

Next Buy Target: $157.35

Crown Castle (CCI) paid out its quarterly dividend on Thursday, March 31. After reinvestment, the dividend lowered my per-share cost -0.792% from $148.90 down to $147.72.

Throughout April, investors continued rotating out of growth stocks and into value stocks including Real Estate Investment Trusts (REIT), so it was time to take profits in CCI with a sell order that went through at $198.52 on Monday, April 11, locking in +23.812% in gains on shares I bought at $160.34 less than two months ago on April 23.

The sale lowered my per-share cost -3.872% from $147.72 to $142.00. From here, my next buy price target is $157.35, above the low of CCI’s last selloff, and my next sell target unchanged at $208.95 just under CCI’s all-time high.

CCI is $185.21 as of this update, down -6.705% from where I took profits.

Digital Realty Trust (DLR): Dividend Reinvestment

Current Price: $146.12

Per-Share Cost: $122.24 (-0.844% since last update)

Profit/Loss: +19.54%

Allocation: 6.899%* (+0.410% since last update)

Next Buy Target: $130.20

Digital Realty Trust (DLR) paid out its quarterly dividend on Thursday, March 31. After reinvestment, the dividend lowered my per-share cost -0.844% from $123.28 down to $122.24.

Since DLR has continued to find resistance under $155.00, I’ve lowered my next sell target to $152.60. My next buy target remains slightly above DLR’s recent 2022 low at $130.20.

Microsoft (MSFT): Strategy Update

Current Price: $277.52

Per-Share Cost: $209.94 (Unchanged since last update)

Profit/Loss: +32.19%

Allocation: 6.278%* (-0.557% since last update)

Next Buy Target: $271.90

Microsoft (MSFT) started to lose strength when the rest of tech sold off throughout the month. When Microsoft reported earnings toward the end of April, the massive tech company shocked analysts who were expecting downside news by reporting a blowout quarter.

Microsoft quickly found support and bounced higher, leading me to raise my next buy target to $271.90. Additionally, I will take profits if “Mr. Softy” makes a run at its all-time high with a sell target at $336.55.

Pepsico (PEP): Profit-Taking & Dividends

Current Price: $171.71

Per-Share Cost: $118.85 (-10.139% since last update)

Profit/Loss: +44.48%

Allocation: 4.626%* (-0.750% since last update)

Next Buy Target: $153.80

Pepsico (PEP) paid out its quarterly dividend on Thursday, March 31, which, after reinvestment, lowered my per-share cost -0.556% from $133.00 to $132.26.

PEP rallied hard off its February lows with the rest of the consumer staples space, leading me to take profits when it appeared to becoming overbought on Friday, April 8 with a sell order at $173.53. The sale locked in +9.614% in gains selling shares I purchased for $158.31 on March 8 and lowered my per-share cost -4.295% from $132.26 to $126.58.

On April 27, I took even more profits after PEP reported an excellent quarter and made a run for new all-time highs. The sale went through at $175.12, locking in a relatively minor +4.543% gain on shares I bought for $167.51 on February 10, 2022, and lowered my per-share cost -6.11% from $126.58 to $118.85, a total reduction of -10.139% from last month’s update. The combined sales gave me an average sale price of $174.33.

Now, that might not seem like significant gains, but given that I underestimated how much PEP could sell off (it dropped to a low of $153.37 in March with my lowest buy up at $158.31) and that I was actually too aggressive adding to it, I wanted to reduce the allocation and the per-share cost.

From here, my next buy price target is $153.80 and I have no sell targets at this time since PEP is a quality long-term play for the current economic condition.

PEP is $171.71 as of this update, down -1.5% from my $174.33 average sell price.

UnitedHealth (UNH): Profit-Taking

Current Price: $508.55

Per-Share Cost: $243.42 (-26.714% since last update)

Profit/Loss: +108.92%

Allocation: 4.171%* (-1.865% since last update)

Next Buy Target: $476.90

Over the past month, UnitedHealth (UNH) and the rest of the healthcare sector have positively taken off, and while healthcare is typically a safe asset to invest in during potential recession, UNH’s run became so overbought that I absolutely had to take profits given the market’s volatility lately.

That opportunity came on Thursday, April 7 with a sell order that filled at $536.59, locking in +28.37% in gains selling shares I bought over the past six months for an average price of $417.99. The sale also lowered my per-share cost -26.714% from $332.15 to $243.42.

Since I have lowered the allocation size of the position so dramatically, I plan to be far more aggressive adding back to the position with my first buy target at $476.90, a past point of support. Naturally, I have no additional sell targets for UNH at this time as I have reduced this position enough already.

UNH is $508.55 as of this update, down -5.236% from where I took profits.

Waste Management (WM): Profit-Taking & Dividends

Current Price: $164.44

Per-Share Cost: $127.60 (-3.734% since last update)

Profit/Loss: +28.87%

Allocation: 5.164%* (+0.370% since last update)

Next Buy Target: $138.85

Waste Management (WM) paid out its quarterly dividend on Thursday, March 31. After reinvestment, the dividend lowered my per-share cost -0.407% from $132.55 down to $132.01.

Once WM started making a stab near its all-time highs, I realized it was time to reduce the position slightly, particularly since I had been far too aggressive adding to it this year during the selloff. My sell order went through on Thursday, April 7 at $164.26, locking in +18.394% in gains on shares I bought back on February 24 for $138.74 and lowering my per-share cost -3.334% from $132.01 down to $127.60.

From here, my next buy target is $138.85, slightly above the low of WM’s February selloff lows. Given that WM recently made a brand-new all-time high despite the down market, I’ve targeted $176.00 as my next sell target using the Fibonacci Retracement method.

WM is $164.44 as of this update, up +$0.18 from where I took profits.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.