Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #27

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

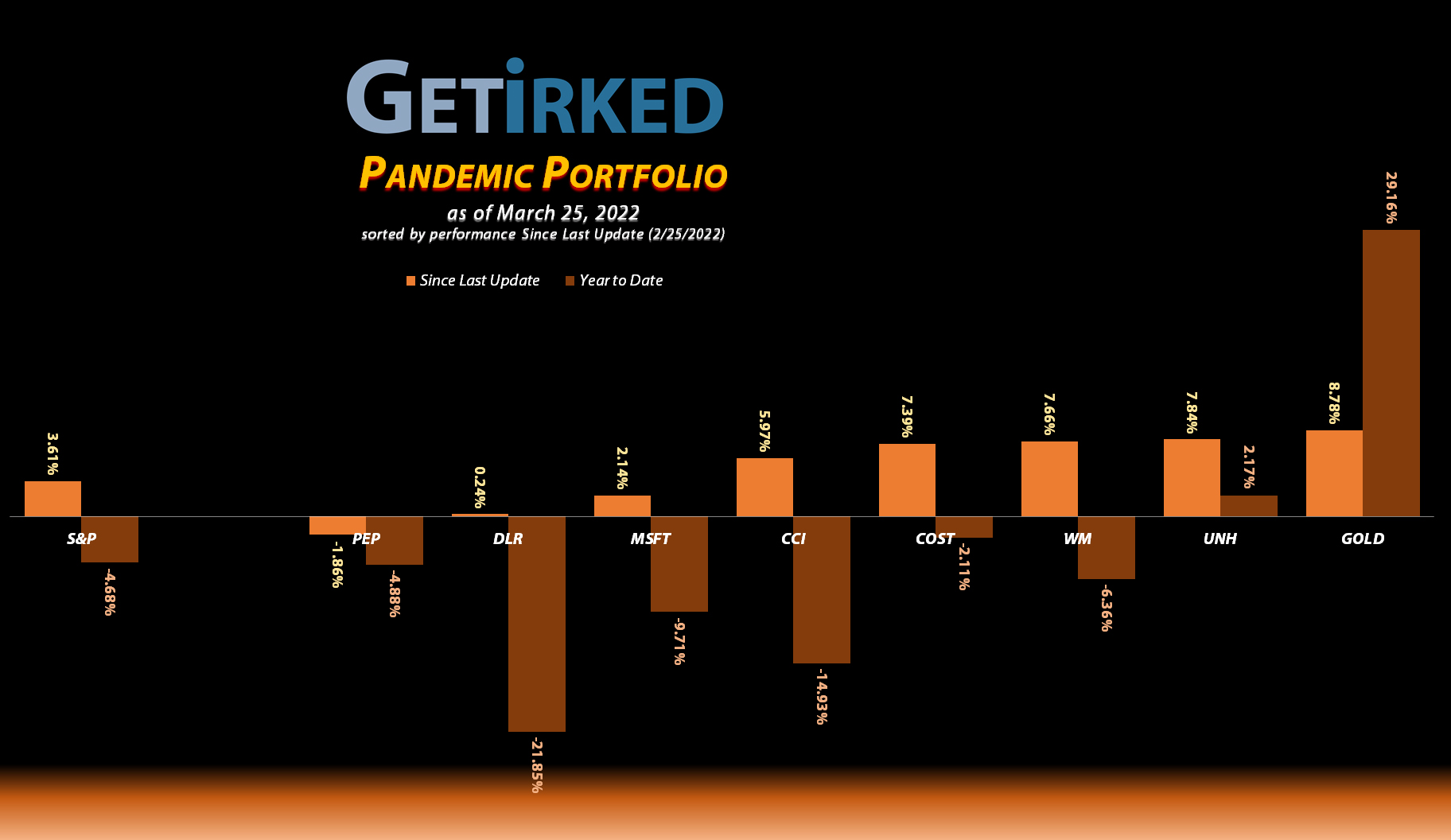

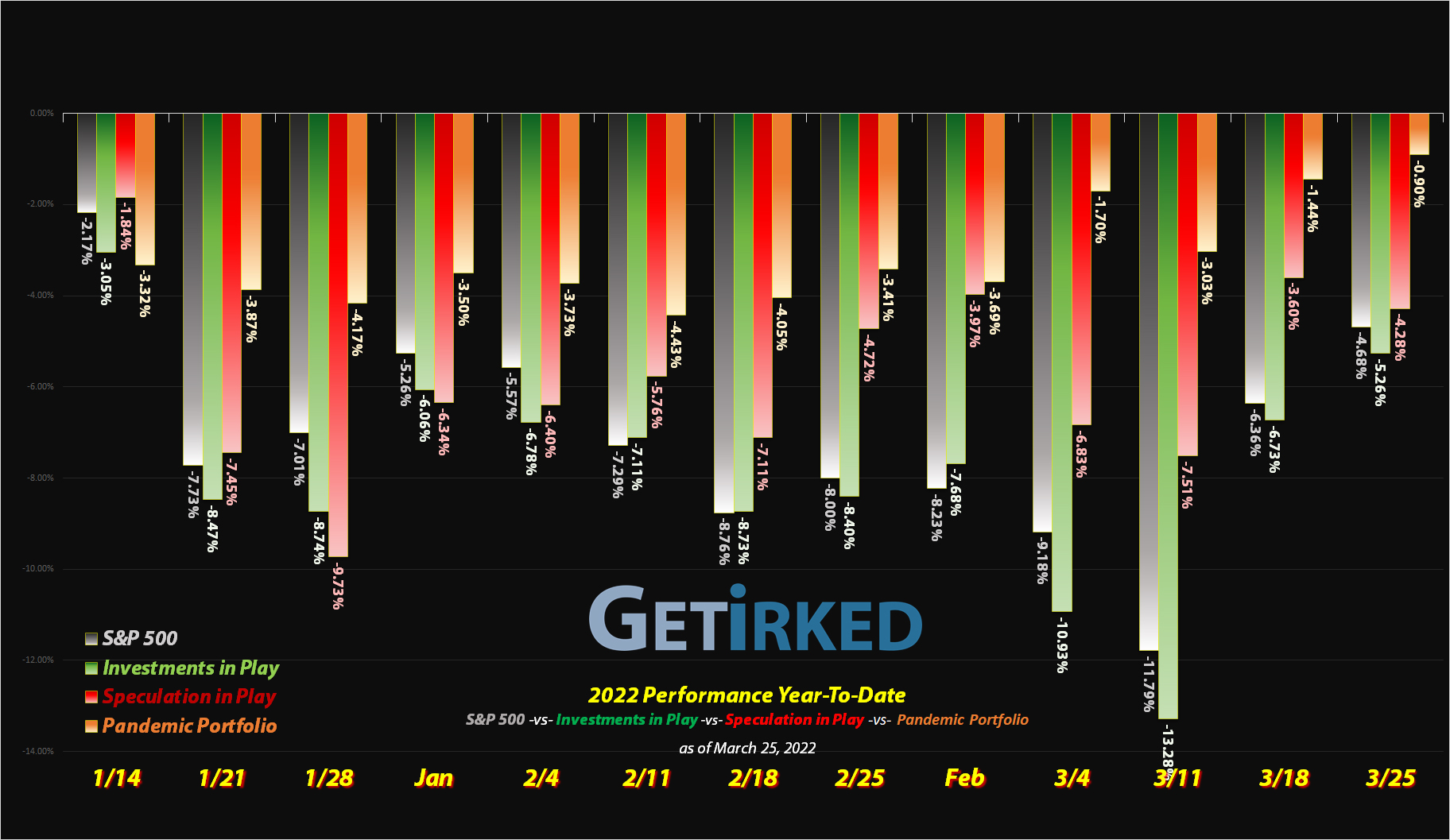

Volatility reigns supreme

Geopolitical strife between Ukraine and Russia combined with inflationary concerns and threats of interest rate hikes from the Federal Reserve, a lot happened since the last update which created significant volatility and large price swings across the entire Pandemic Portfolio.

Despite this, very few actions were taken this update when compared to the last one, basically boiling down to additional profit-taking in Barrick Gold (GOLD) as well as an addition to Pepsico (PEP) when the latter saw an unusual dive to the downside following concerns over PEP’s Russian properties.

Let’s take a look at the moves that happened since the last update….

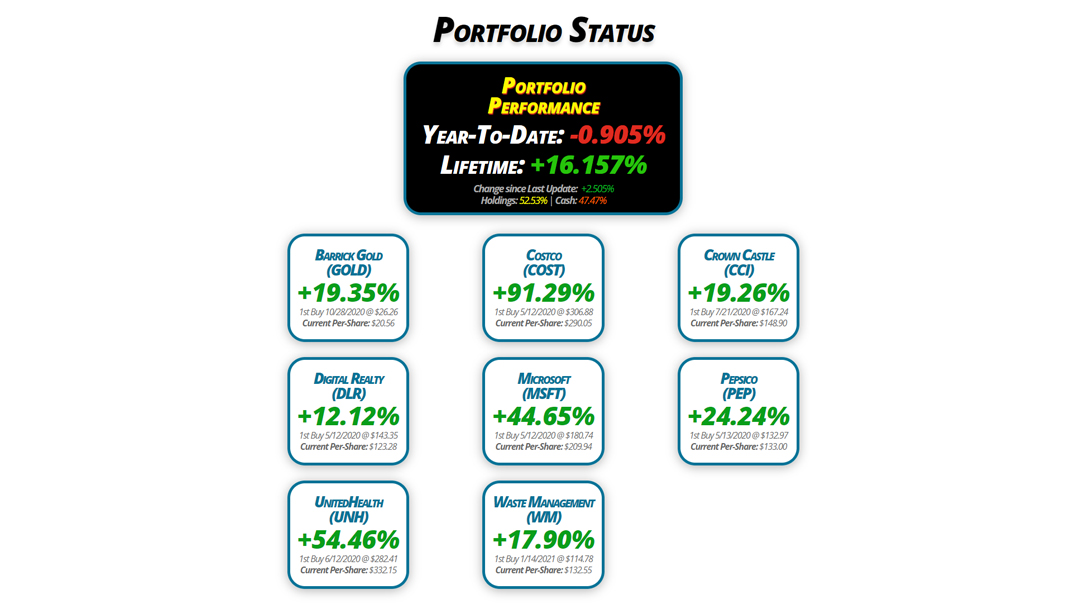

Portfolio Status

Portfolio

Performance

Year-To-Date: -0.905%

Lifetime: +16.157%

Change since Last Update: +2.505%

Holdings: 52.53% | Cash: 47.47%

Barrick Gold

(GOLD)

+19.35%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $20.56

Digital Realty

(DLR)

+12.12%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $123.28

UnitedHealth

(UNH)

+54.46%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $332.15

Costco

(COST)

+91.29%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $290.05

Microsoft

(MSFT)

+44.65%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $209.94

Waste Management

(WM)

+17.90%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $132.55

Crown Castle

(CCI)

+19.26%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $148.90

Pepsico

(PEP)

+24.24%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $133.00

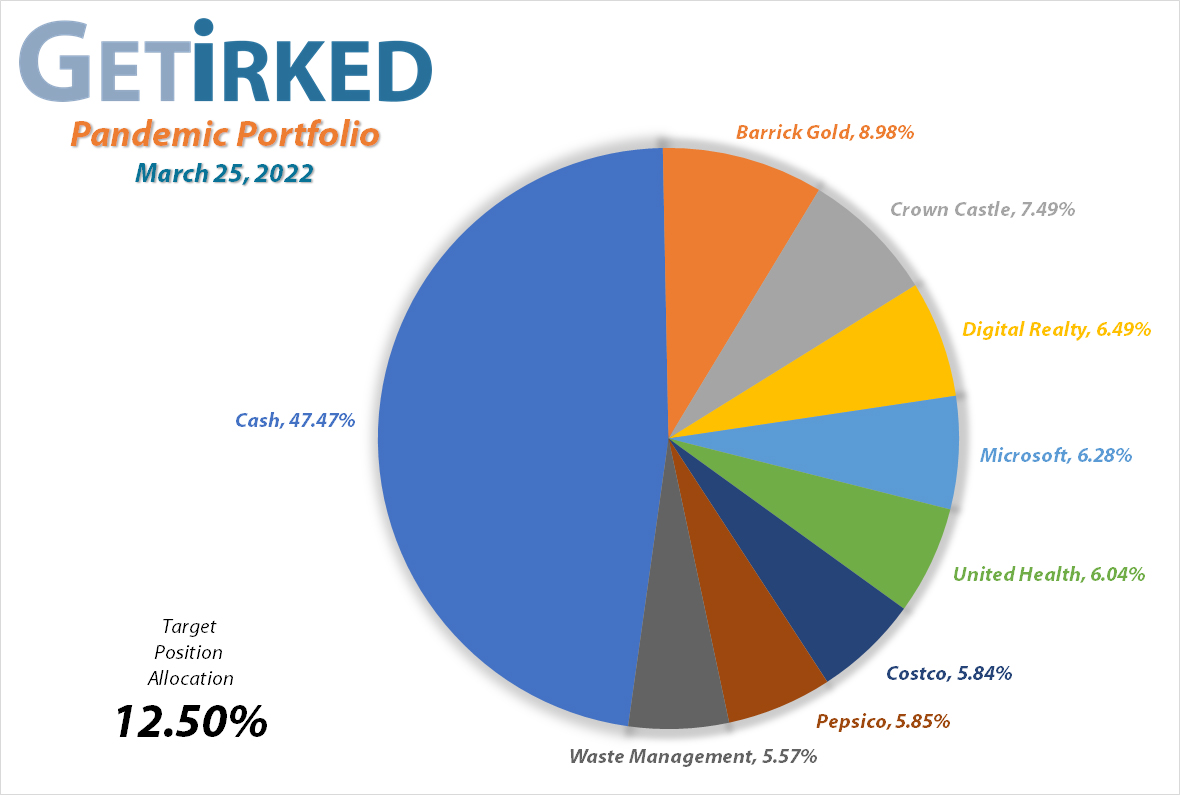

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Profit-Taking & Dividends

Current Price: $24.54

Per-Share Cost: $20.56 (-0.916% since last update)

Profit/Loss: +19.35%

Allocation: 8.979%* (+0.212% since last update)

Next Buy Target: $17.65

Given the yellow metal’s recent historical trends not to perform as an inflation hedge like all the goldbugs claimed it would, I decided to further reduce my Barrick Gold (GOLD) position when it bounced from the selloff at the end of February following Russia’s invasion of Ukraine.

My first sell order filled at $22.84 on Monday, February 28, but when the price of gold continued to rise, Barrick followed, so a second order filled at $24.94 on Monday, March 7. The combined orders gave me an average selling price of $23.89 and locked in +36.749% in gains on the remainder of the shares that I bought for $17.47 back on December 15, 2021.

While the sales only lowered my per-share cost -0.482% from $20.75 to $20.65, reducing the position size remains a top priority since gold has a tendency to trade very cyclically and I don’t want to get stuck upside-down again if gold should pull back as it has in the past.

On Tuesday, March 15, GOLD paid out its quarterly dividend which lowered my per-share cost -0.436% from $20.65 to $20.56. From here, my next sell target is $26.40, just below a past point of support, and my next buy target is $17.65, above the low of GOLD’s most recent major selloff.

GOLD is $24.54 as of this update, up +2.721% from where I took profits.

Costco (COST): Strategy Update

Current Price: $555.71

Per-Share Cost: $290.50 (Unchanged since last update)

Profit/Loss: +91.29%

Allocation: 5.837%* (+0.251% since last update)

Next Buy Target: $483.90

The last month was relatively quiet for Costco (COST). While it did sell off with the rest of the market earlier in the month, COST showed remarkable resilience and found support well above the lows it reached earlier in the year. Accordingly, I have raised my next buy price target to $483.90, just above the lows from its March selloff.

Crown Castle (CCI): Strategy Update

Current Price: $177.58

Per-Share Cost: $148.90 (Unchanged since last update)

Profit/Loss: +19.26%

Allocation: 7.490%* (+0.238% since last update)

Next Buy Target: $152.70

Crown Castle (CCI) saw quite a bit of volatility since the last update, however, the price action did not cause it to break the lows it found earlier in the year, and, naturally, it hasn’t risen anywhere near its all-time high where I plan to take profits.

Accordingly, my plan remains the same with my next buy price target at $152.70 and my next sell target at $207.85.

Digital Realty Trust (DLR): Strategy Update

Current Price: $138.23

Per-Share Cost: $122.55 (Unchanged since last update)

Profit/Loss: +12.12%

Allocation: 6.489%* (+0.587% since last update)

Next Buy Target: $124.70

Just like CCI above, Digital Realty Trust (DLR) saw a lot of wild swings with the rest of the Real Estate Investment Trusts (REITs) since the last update, but the swings did not cause DLR to hit a buy or sell target. My plan remains the same with the next buy target at $124.70 and my next sell target near its all-time high at $176.15.

Microsoft (MSFT): Dividend Reinvestment

Current Price: $303.68

Per-Share Cost: $209.94 (-0.214% since last update)

Profit/Loss: +44.65%

Allocation: 6.278%* (-0.014% since last update)

Next Buy Target: $272.90

Microsoft (MSFT) paid out its quarterly dividend on Friday, March 12. As always, I reinvest dividends wherever possible resulting in an increase of allocation and a decrease in my per-share cost.

In MSFT’s case, the reinvested dividend lowered my per-share cost -0.214% from $210.39 to $209.94. Not a huge difference, but every little bit matters.

Since MSFT continues to demonstrate amazing strength during selloffs, I have raised my next buy price target to $272.90, a bit above its lows.

Pepsico (PEP): Added to Position

Current Price: $165.24

Per-Share Cost: $133.00 (+2.703% since last update)

Profit/Loss: +24.24%

Allocation: 5.376%* (+0.478% since last update)

Next Buy Target: $150.55

Pepsico (PEP) demonstrated the dangers of globalization since our last update – PEP has significant exposure to the Russian economy after purchasing a Russian milk company a few years ago. As a result, PEP came under significant selling pressure since our last update, dropping through a buy order on Tuesday, March 8 which filled at $158.31

The order raised my per-share cost +2.703% from $129.50 to $133.00. From here, my next buy price target is $150.55, above a past point of support. I currently have no sell targets on PEP as continue to try to aggressively grow the portfolio and reduce its cash hoard.

PEP is $165.24 as of this update, up +4.377% from where I added.

UnitedHealth (UNH): Dividend Reinvestment

Current Price: $513.03

Per-Share Cost: $332.15 (-0.285% since last update)

Profit/Loss: +54.46%

Allocation: 6.036%* (+0.310% since last update)

Next Buy Target: $448.90

UnitedHealth (UNH) paid out its quarterly dividend on Wednesday, March 23, lowering my per-share cost -0.285% from $333.10 to $332.15. UNH currently pays out $5.80/share annually which works out to around a 1.15% yield at its current price levels, not too shabby.

I’ve raised my next buy price target to $448.90, just above the low from UNH’s last big selloff.

Waste Management (WM): Strategy Update

Current Price: $156.28

Per-Share Cost: $132.55 (Unchanged since last update)

Profit/Loss: +17.90%

Allocation: 4.794%* (+0.777 since last update)

Next Buy Target: $133.95

After an exciting update in February, Waste Management (WM) saw quite an increase in its stock price since the last update. Since it found a significant amount of support right around where I made my last buy at $138.74 on February 24, I have raised my price target from around $130 to $133.95, a higher point where WM has found support in the past.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.