Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #26

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Geopolitical Unrest and Inflation Concerns…

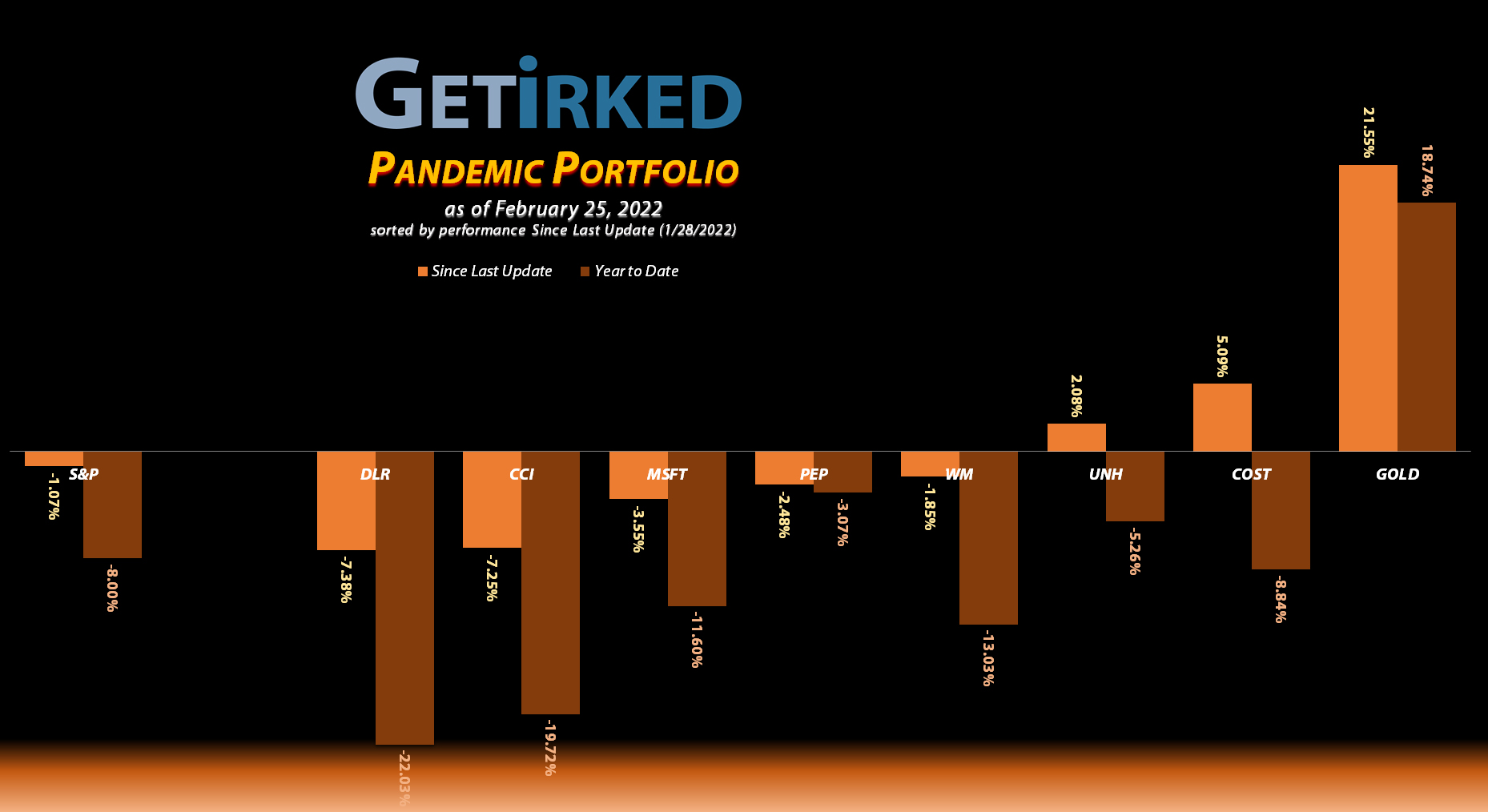

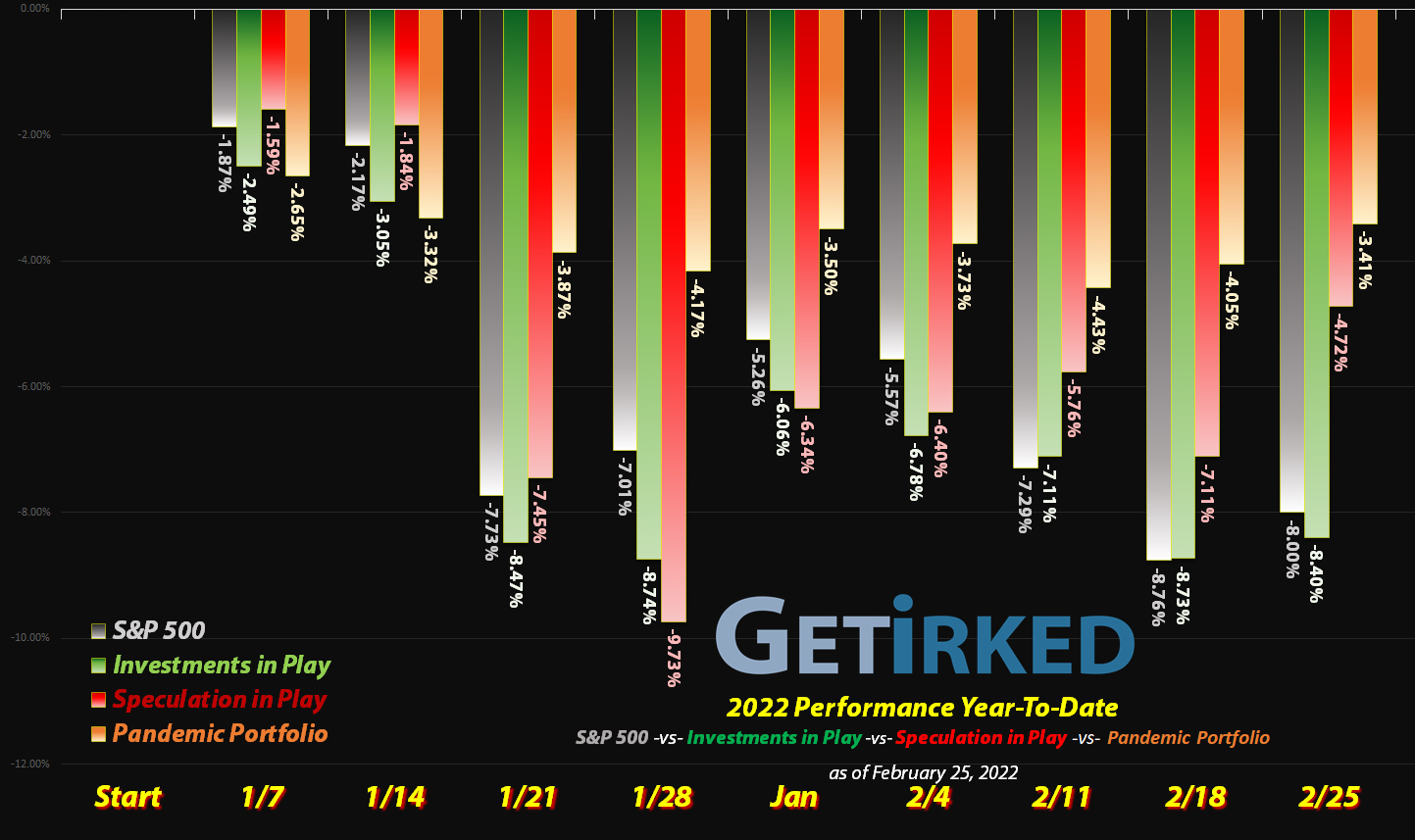

Nothing will unsettle the stock market like geopolitical unrest, and with Russia’s invasion of Ukraine having heated up since our last update, the entire Pandemic Portfolio had quite a ride.

The only position which saw major upside was Barrick Gold (GOLD), which received the double-bonus of investors moving into the yellow metal during times of political uncertainty combined with ever-increasing inflation (despite the Federal Reserve’s assurances that they will do everything in their power to fight it).

Let’s take a look at the changes since our last update…

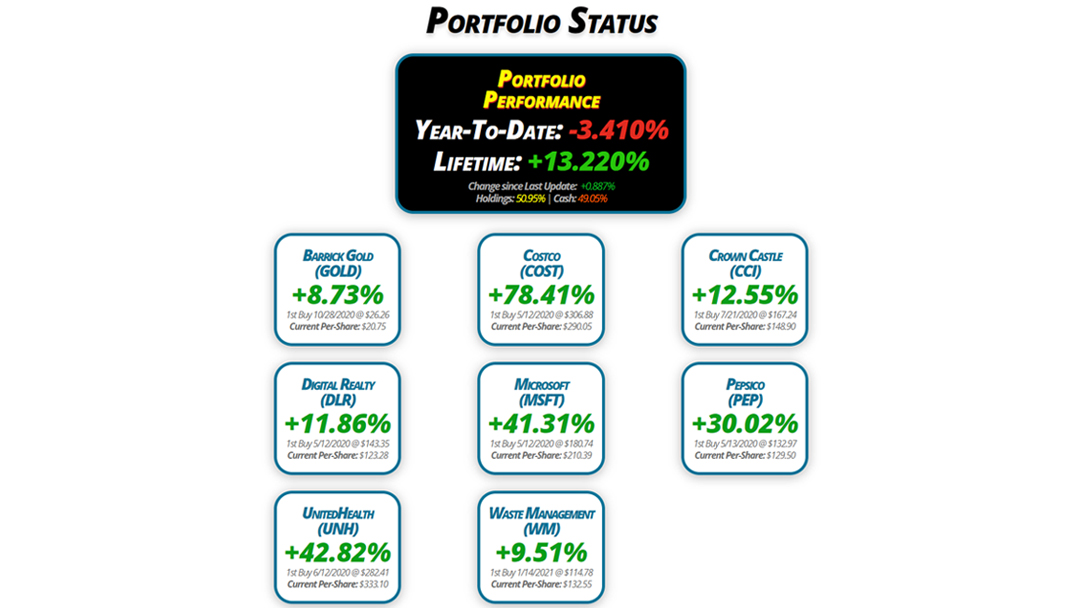

Portfolio Status

Portfolio

Performance

Year-To-Date: -3.410%

Lifetime: +13.220%

Change since Last Update: +0.887%

Holdings: 50.95% | Cash: 49.05%

Barrick Gold

(GOLD)

+8.73%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $20.75

Digital Realty

(DLR)

+11.86%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $123.28

UnitedHealth

(UNH)

+42.82%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $333.10

Costco

(COST)

+78.41%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $290.05

Microsoft

(MSFT)

+41.31%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $210.39

Waste Management

(WM)

+9.51%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $132.55

Crown Castle

(CCI)

+12.55%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $148.90

Pepsico

(PEP)

+30.02%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $129.50

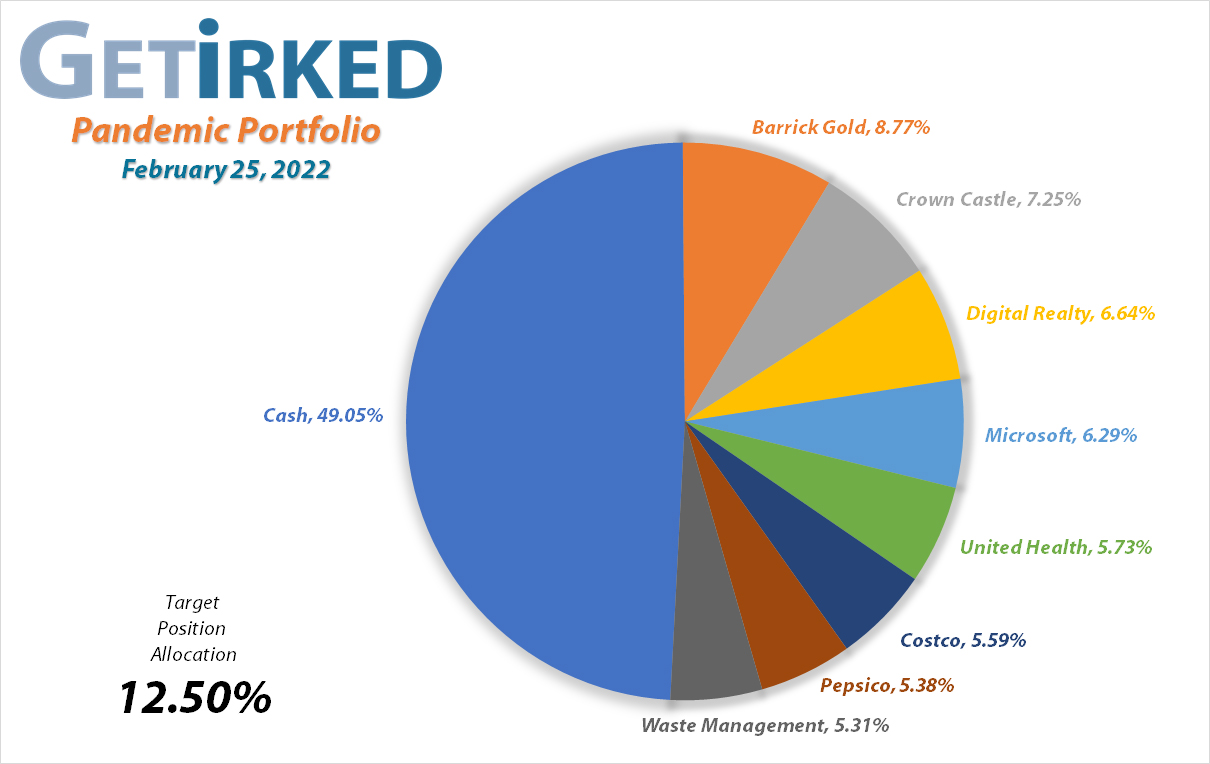

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Profit-Taking

Current Price: $22.56

Per-Share Cost: $20.75 (-0.240% since last update)

Profit/Loss: +8.73%

Allocation: 8.767%* (+1.084% since last update)

Next Buy Target: $17.80

The yellow metal finally saw a pop thanks to the Russia-Ukraine geopolitical tensions in February, and I wasted no time reducing my position in Barrick Gold (GOLD) which had rapidly become the largest position in the Pandemic Portfolio thanks to ongoing weakness for what feels like forever in the sector.

My order filled at $21.72 on Wednesday, February 16, 2022, locking in a +24.33% gain on some of the shares I bought for $17.47 on December 15, 2021, and lowering my per-share cost a negligible -0.240% from $20.80 to $20.75. However, more importantly, the sale also lowered my allocation in GOLD, freeing up capital to add back in should the sector sell off once again as it has so many times in the past.

From here, my next buy target is $17.80, above a past point of support, and my next sell target is just under $25.00, slightly below GOLD’s 2021 high.

GOLD is $22.56 as of this update, up +3.867% from where I took profits.

Costco (COST): Dividend Reinvesment

Current Price: $517.49

Per-Share Cost: $290.50 (-0.155% since last update)

Profit/Loss: +78.41%

Allocation: 5.586%* (+0.237% since last update)

Next Buy Target: $470.90

Costco (COST) paid out its quarterly dividend on February 22, which, after automatically reinvesting, lowered the per-share cost of my position a negligible -0.155% from $290.50 to $290.05 (still better than nothing).

COST’s regular dividend is notoriously small as it pays out only $3.16/shr annually which works out to a little over 0.5%. However, COST pays out special dividends like clockwork, and many analysts suggest that the company will pay out another special dividend this year.

In December 2020, the last time COST paid out a special dividend, the company generously paid out $10/shr which worked out to a yield of more than 2.5% at the stock’s share price around $380 at the time.

In the meantime, I’ll continue adding to COST as it sells off.

Crown Castle (CCI): Added to Position x 2

Current Price: $167.58

Per-Share Cost: $148.90 (+2.810% since last update)

Profit/Loss: +12.55%

Allocation: 7.252%* (+0.980% since last update)

Next Buy Target: $152.70

Following the hotter-than-expected Consumer Price Index (CPI) report in mid-February, the Real Estate Investment Trusts (REITs) sold off as investors went to cash rather than having the relatively-high yield of REITs.

Naturally, the selloff hit Crown Castle (CCI), too, causing it to trigger a buy order which filled at $169.18 on Monday, February 14. Later, on February 23, CCI came under even more selling pressure and triggered a second buy order which filled at $160.34, giving me an average buy price of $164.76.

The orders locked in a -19.096% discount on shares I sold less than two months ago at $203.65 on December 27, 2021 and raised my per-share cost +2.810% from $144.83 to $148.90, still a -10.97% reduction from my first buy at $167.24 back on July 21, 2020.

From here, my next buy target is $152.70, above a past point of support, and I am once again targeting the high of CCI’s trading range to take profits near its all-time high at $208.30.

CCI is $167.58 as of this update, up +1.712% from my $164.76 average buy price.

Digital Realty Trust (DLR): Added to Position

Current Price: $137.90

Per-Share Cost: $122.55 (+1.625% since last update)

Profit/Loss: +11.86%

Allocation: 5.902%* (+0.740% since last update)

Next Buy Target: $125.30

As a REIT-substitute, Digital Realty Trust (DLR) was not exempt from the selloff and triggered a buy order I had in place which filled on Friday, February 11 at $139.97. Following Russia’s invasion of Ukraine, the subsequent selloff triggered a second buy order on Thursday, February 24 at $130.54, giving me an average buying price of $135.26.

The buy orders locked in a -18.582% discount on shares I sold at $166.13 not too long ago on November 23, 2021 and raised my per-share cost +2.223% from $120.59 to $123.28, still a -14.00% discount from my initial buy at $143.35 back on May 12, 2020.

From here, my next buy target is $125.30, above a past point of support, and since DLR and Crown Castle (CCI) continue to trade in ranges, my next sell target for DLR is near its all-time high at $176.15.

DLR is $137.90 as of this update, up +1.952% from my $135.26 average buy.

Microsoft (MSFT): Strategy Update

Current Price: $297.31

Per-Share Cost: $210.39 (Unchanged since last update)

Profit/Loss: +41.31%

Allocation: 6.292%* (-0.284% since last update)

Next Buy Target: $266.90

Since the last update, Microsoft (MSFT) announced that the company plans to acquire video game manufacturer Activision-Blizzard (ATVI). The move will help MSFT move further toward its plan of becoming a major player in the metaverse, the theoretical next step of the Internet where users will be able to experience the online world virtually.

After seeing a nice bounce following its selloff in January, Microsoft once again came under selling pressure throughout the month. Accordingly, I did not raise my price target to add more until Microsoft sells off below its January low.

Pepsico (PEP): Added to Position

Current Price: $168.38

Per-Share Cost: $129.50 (+4.943% since last update)

Profit/Loss: +30.02%

Allocation: 5.376%* (+0.588% since last update)

Next Buy Target: $158.75

Despite blowing out its fourth-quarter earnings report, Pepsico (PEP) announced it foresees cost challenges in its future guidance when it reported on Thursday, February 10. Investors reacted by selling off the stock which caused it to drop to my next price target with a buy order that filled at $167.51.

The buy raised my per-share cost (hate it, hate it, hate it) +4.494% from $123.40 to $129.50, still a -2.61% reduction from my first buy in the position at $132.97 on May 13, 2020. From here, my next buy target is $158.75, above a past point of support, and I have no sell targets for the position at this time.

As of this update, PEP closed at $168.38, up +0.519% from where I added.

UnitedHealth (UNH): Added to Position

Current Price: $475.75

Per-Share Cost: $333.10 (+0.732% since last update)

Profit/Loss: +42.82%

Allocation: 5.726%* (+0.187% since last update)

Next Buy Target: $421.90

The Russia-Ukraine conflict left no stock untouched during its selloff toward the month’s end with UnitedHealth (UNH) testing its January 2022 lows where I added more with a buy order on Thursday, February 24 at $449.73.

The buy raised my per-share cost +0.732% from $330.68 to $333.10. From here, my next buy target is $421.90, above a past point of support, and I have no sell targets for UNH at this time.

As of this update, UNH is $475.75, up +5.786% from where I added.

Waste Management (WM): Added to Position

Current Price: $145.16

Per-Share Cost: $132.55 (+0.645% since last update)

Profit/Loss: +9.51%

Allocation: 4.794%* (+0.932% since last update)

Next Buy Target: $130.25

Waste Management (WM) slipped quite a bit during the selloff on the morning of Thursday, February 24 after Russia invaded Ukraine, dropping briefly through my next buy target which filled at $138.74.

The buy raises my per-share cost +0.645% from $131.70 to $132.55. From here, my next price target is below my new per-share cost down at $130.25, and I have no sell targets for this position at this time.

WM is $145.16 as of this update, up +4.627 from where I added.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.