Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #25

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Volatility means everything’s on sale!

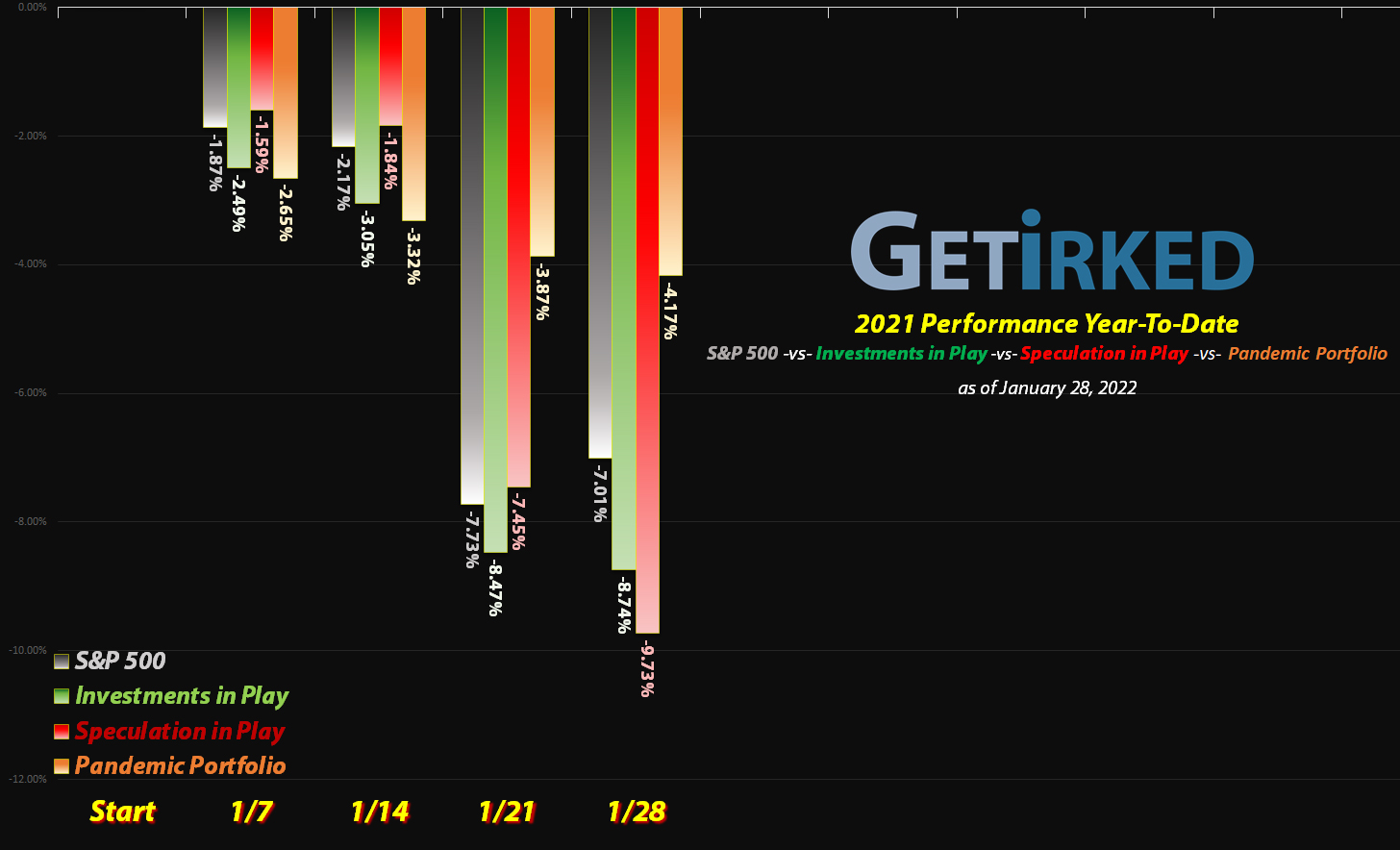

My New Year’s Resolution was to get more aggressive and start adding to my positions across the board and the market did not disappoint. A combination of slowing economic growth, rising inflation, and geopolitical concerns with Russia meant January was the most volatile January seen in decades (if not ever).

In my experience, the keys to managing volatility are to use limit orders, buy in stages, and be patient. If you can’t handle the ups-and-downs of daily price action, stop looking at your portfolio every day.

I always remind myself that I have a multi-decade time horizon. Current volatility and price fluctuation offers me opportunities to add to positions at a discount, and then I will hold those positions until it’s time to take profits according to my discipline – and, sometimes, that means waiting months, years, or longer.

Let’s take a look at all the moves that happened since the last update…

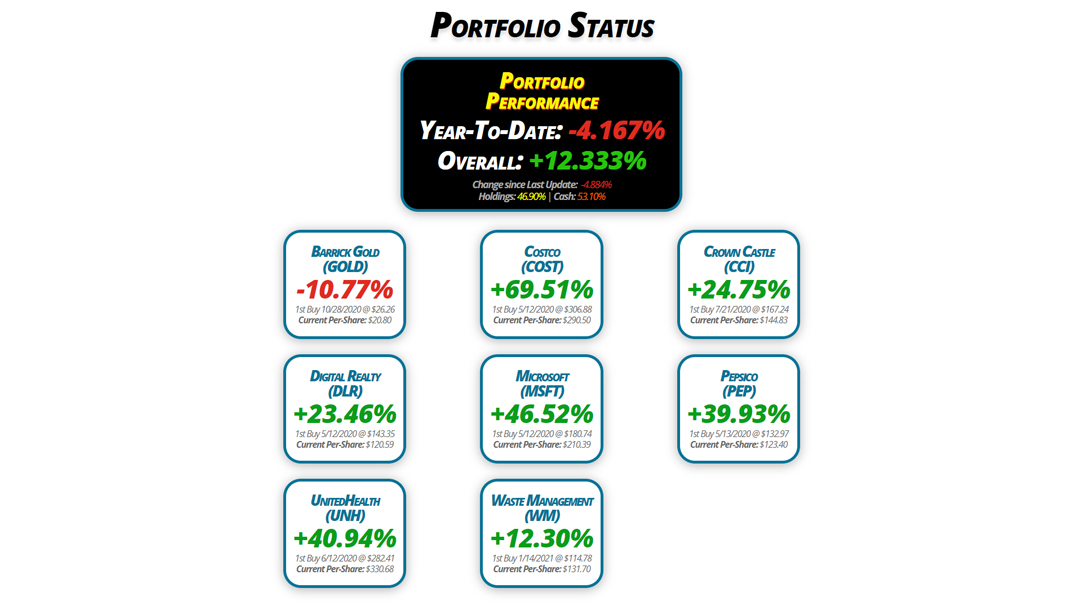

Portfolio Status

Portfolio

Performance

Year-To-Date: -4.167%

Overall: +12.333%

Change since Last Update: -4.884%

Holdings: 46.90% | Cash: 53.10%

Barrick Gold

(GOLD)

-10.77%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $20.80

Digital Realty

(DLR)

+23.46%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $120.59

UnitedHealth

(UNH)

+40.94%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $330.68

Costco

(COST)

+69.51%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $290.50

Microsoft

(MSFT)

+46.52%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $210.39

Waste Management

(WM)

+12.30%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $131.70

Crown Castle

(CCI)

+24.75%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $144.83

Pepsico

(PEP)

+39.93%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $123.40

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $18.56

Per-Share Cost: $20.80 (Unchanged since last update)

Profit/Loss: -10.77%

Allocation: 7.683%* (+0.146% since last update)

Next Buy Target: $16.50

The yellow metal continues not to act in the way that all the goldbugs claimed it would. Despite countries printing money, debasing their currency and a substantial increase in inflation, gold still can’t get out of its own way and always sells off with the rest of the market, eventually.

Some analysts claim that gold isn’t reacting because the inflation is transitory while others claim gold is just about to take off. For me, all this means is I continue sitting on my hands and waiting because until it goes one way or another; I’m nowhere near adding to my Barrick Gold (GOLD) position nor am I taking profits anytime soon.

Costco (COST): Added to Position x 3

Current Price: $492.43

Per-Share Cost: $290.50 (+11.397% since last update)

Profit/Loss: +69.51%

Allocation: 5.349%* (+0.121% since last update)

Next Buy Target: $448.90

In keeping up with my New Year’s Resolution of getting more aggressive, I made a buy in Costco (COST) when it sold off near the beginning of January with a buy order which filled at $538.62 on Friday, January 7. On Friday, January 14, I made a second buy at $509.80. The market wasn’t done with COST at that point and I made a third buy on Friday, January 21 at $483.72.

The combined buys gave me an average buying price of $518.51 and raised my per-share cost +11.397% from $260.78 to $290.50, still a -5.34% reduction from my first buy at $306.88 on May 12, 2020.

From here, my next buy target is $448.90, and I have no sell targets until the position outgrows the target allocation for the portfolio.

COST is $492.43 as of this update, down -5.030% from my average buy price.

Crown Castle (CCI): Dividend Reinvestment

Current Price: $180.68

Per-Share Cost: $144.83 (-0.801% since last update)

Profit/Loss: +24.75%

Allocation: 6.272%* (-0.616% since last update)

Next Buy Target: $167.00

Crown Castle (CCI) paid out its quarterly dividend of $1.47/shr on Monday, January 3 which worked out to an annual yield of 2.83%. The reinvested dividend lowered my per-share cost -0.801% from $146.00 to $144.83.

Being a Real Estate Investment Trust (REIT) alternative, CCI sees a lot of price action in relation to the benchmark interest rate, so January’s been a rough month and is sending CCI down toward my price target once more.

Digital Realty Trust (DLR): Dividend Reinvestment

Current Price: $148.88

Per-Share Cost: $120.59 (-0.749% since last update)

Profit/Loss: +23.46%

Allocation: 5.902%* (-0.767% since last update)

Next Buy Target: $140.00

Digital Realty Trust (DLR) paid out its quarterly dividend which reinvested on Tuesday, January 18. The dividend lowered my per-share cost -0.749% from $121.50 to $120.59, not bad for just holding on to shares for three months.

Like CCI above, DLR’s primary function as a REIT means January’s been rough for the stock, and it’s currently on the way down to my next buy target.

Microsoft (MSFT): Added to Position x 3

Current Price: $308.26

Per-Share Cost: $210.39 (+4.360% since last update)

Profit/Loss: +46.52%

Allocation: 6.576%* (+0.425% since last update)

Next Buy Target: $256.90

Microsoft (MSFT) sold off hard with the rest of tech during the early-January market-wide rout, so I decided it was time to add to the position with a buy order that filled at $314.59 on Thursday, January 6. On Thursday, January 13, I added even more to Microsoft with an order that filled at $306.63. On Monday, January 24, I added again with an order at $282.05.

The combined orders gave me an average per-share buy price of $298.37 and raised my per-share cost +4.360% from $201.60 to $210.39. From here, my next buy price target is $256.90 and I have no sell targets for this position until it exceeds the portfolio allocation target.

MSFT is $308.26 as of this update, up +3.315% from my average buy price.

Pepsico (PEP): Dividend Reinvestment

Current Price: $172.67

Per-Share Cost: $123.40 (-0.604% since last update)

Profit/Loss: +39.93%

Allocation: 4.788%* (+0.409% since last update)

Next Buy Target: $162.45

Pepsico (PEP) paid out its quarterly dividend which, of course, I reinvested on January 10, lowering my per-share cost -0.604% from $124.15 to $123.40. PEP has remained an incredible stalwart as the rotation of tech stocks into consumer staples made it one of “the” places to be.

Even January’s selloff saw PEP lose very little of its edge as investors continue to pile in for its relative safety. Accordingly, I have raised my price target higher than I would prefer for this position as I’d like to add more and any selloff will be a gift in this monster.

UnitedHealth (UNH): Added to Position x 2

Current Price: $466.06

Per-Share Cost: $330.68 (+2.740% since last update)

Profit/Loss: +40.94%

Allocation: 5.539%* (+0.706% since last update)

Next Buy Target: $418.90

UnitedHealth (UNH) got positively slammed on Thursday, January 6, gapping lower at the open and triggering my next buy order that filled at $480.02 early in Thursday morning trading. On Tuesday, January 25, I added to my UNH position again at $449.10, giving me an average buy price of $469.26.

The combined orders raised my per-share cost +2.74% from $321.86 to $330.68 as I want to continue actively and aggressively building my position in UNH.

From here, my next price target is $418.90, slightly above a past point of support, and I have no sell targets for this position until it exceeds the target allocation of the portfolio.

UNH is $466.06 as of this update, down -0.682% from my average buy price.

Waste Management (WM): Added to Position x 2

Current Price: $147.90

Per-Share Cost: $131.70 (+7.082% since last update)

Profit/Loss: +12.30%

Allocation: 4.794%* (+1.733% since last update)

Next Buy Target: $138.75

While Waste Management (WM) held up well throughout much of the month, it did start to exhibit increasing weakness as the selling pressure swelled. I raised my price target which ended up with a filled buy order during early January’s selloff with a $160.75 buy on Friday, January 7. Later in the month, WM continued to sell off, triggering a buy order that filled on Monday, January 24 at $148.66, giving me an average buy price of $154.71.

The combined orders raised my per-share cost (I hate raising my per-share cost – I hate it, I hate it) +7.082% from $122.99 to $129.00. From here, my next buy target is $138.75, above a past point of support and, just as with many of the positions in the portfolio, I have no real foreseeable sell targets at this time.

WM is $147.90 as of this update, down -4.402% from my average buy price.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.