Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #23

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Playing the Waiting Game…

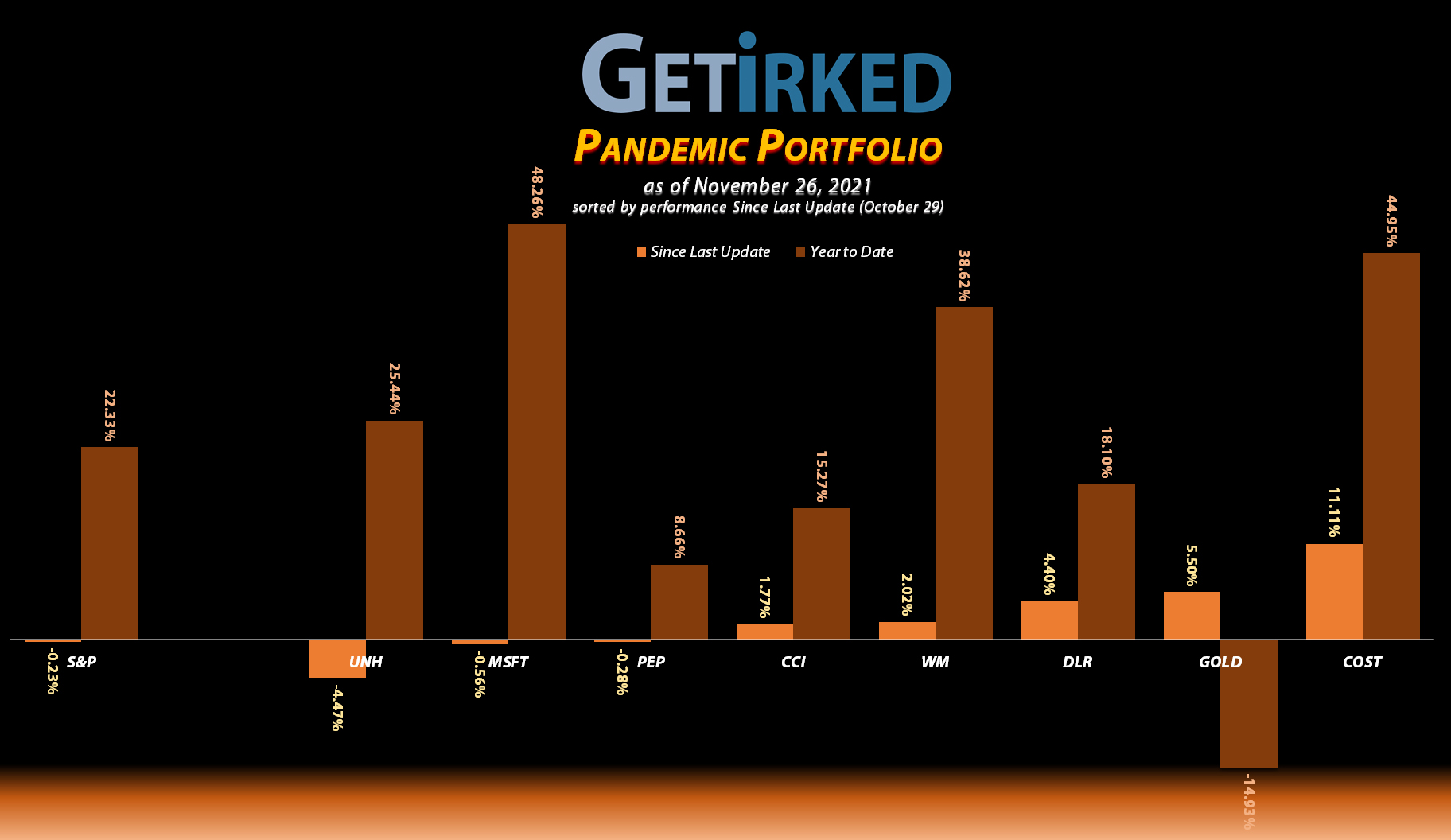

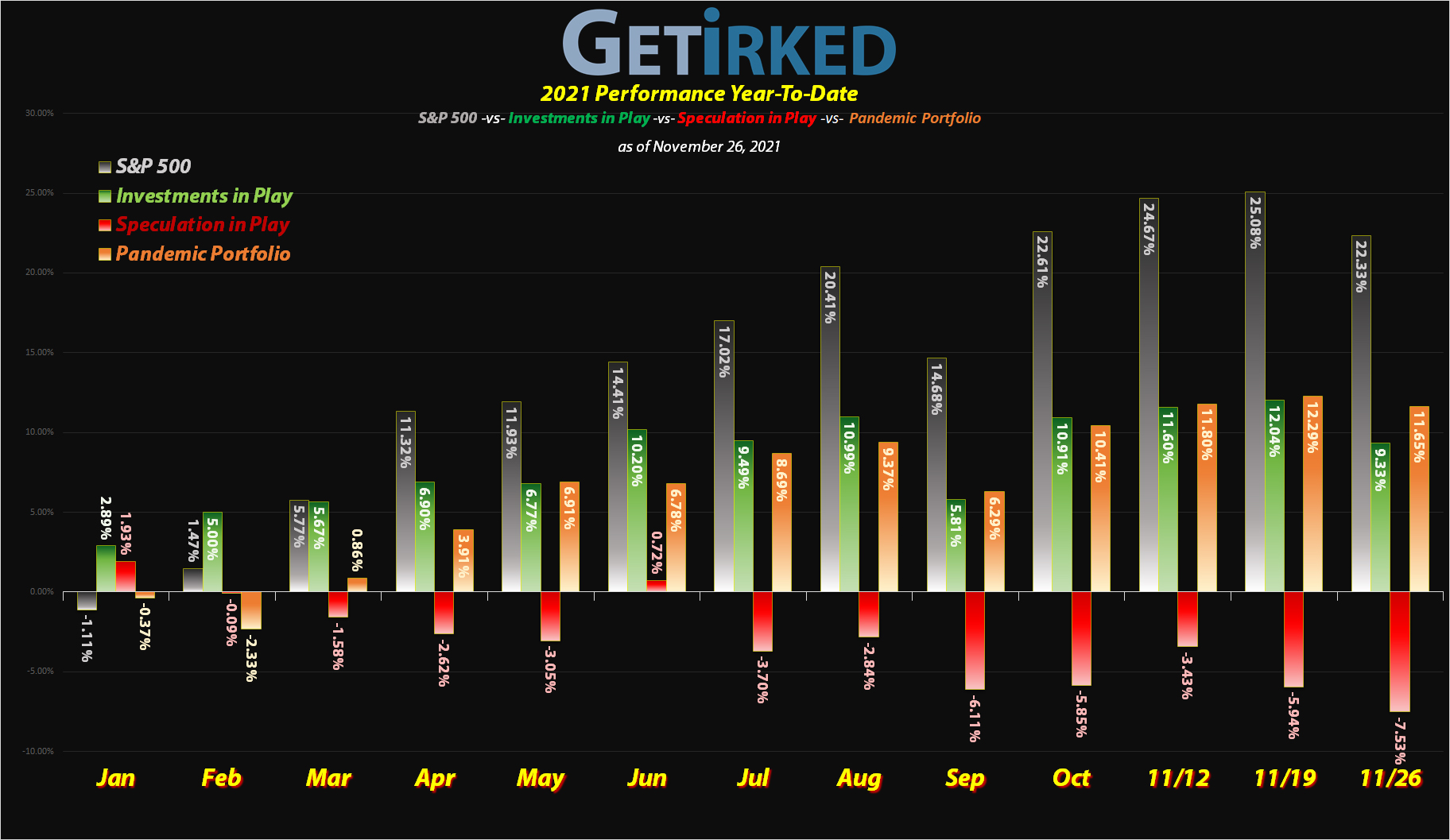

Whereas last month’s update was pretty exciting with lots of buys during the September-October selloff, the past month has seen the market rebound to make new highs.

Aside from Barrick Gold (GOLD) which has been brought down with the rest of the weakness in the precious metals sector, every other position has demonstrated incredible strength, so just like the past few updates, it’s time to get aggressive so I’ve revisited all of the positions and once again raised price targets (and buying quantities) substantially to add during the next selloff.

Let’s take a look at what’s happened to the Pandemic Portfolio this update…

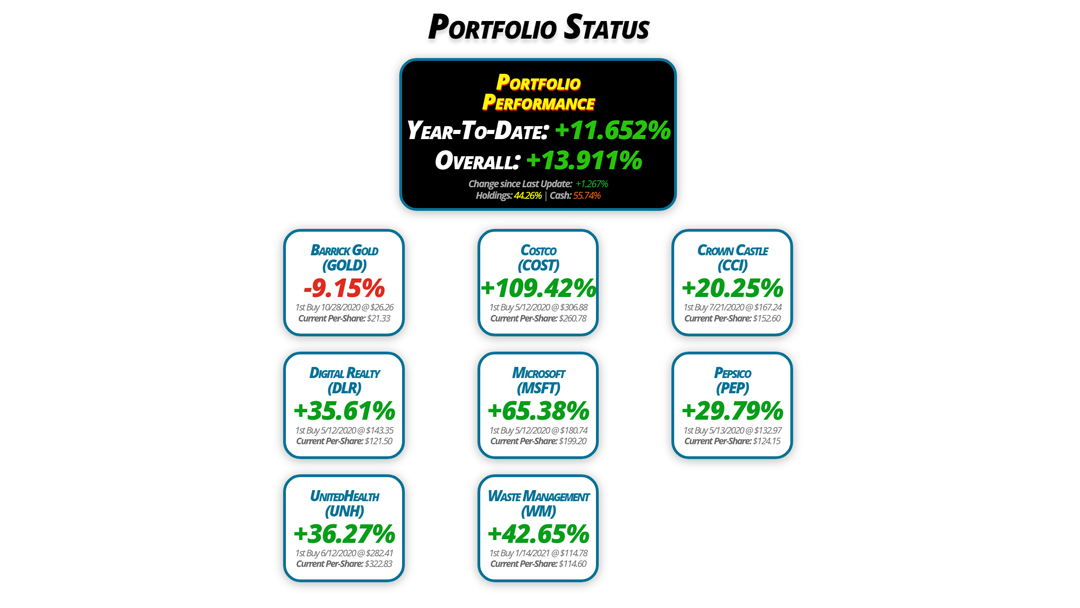

Portfolio Status

Portfolio

Performance

Year-To-Date: +11.652%

Overall: +13.911%

Change since Last Update: +1.267%

Holdings: 44.26% | Cash: 55.74%

Barrick Gold

(GOLD)

-9.15%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $21.33

Digital Realty

(DLR)

+35.61%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $121.50

UnitedHealth

(UNH)

+36.27%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $322.83

Costco

(COST)

+109.42%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $260.78

Microsoft

(MSFT)

+65.38%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $199.20

Waste Management

(WM)

+42.65%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $114.60

Crown Castle

(CCI)

+20.25%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $152.60

Pepsico

(PEP)

+29.79%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $124.15

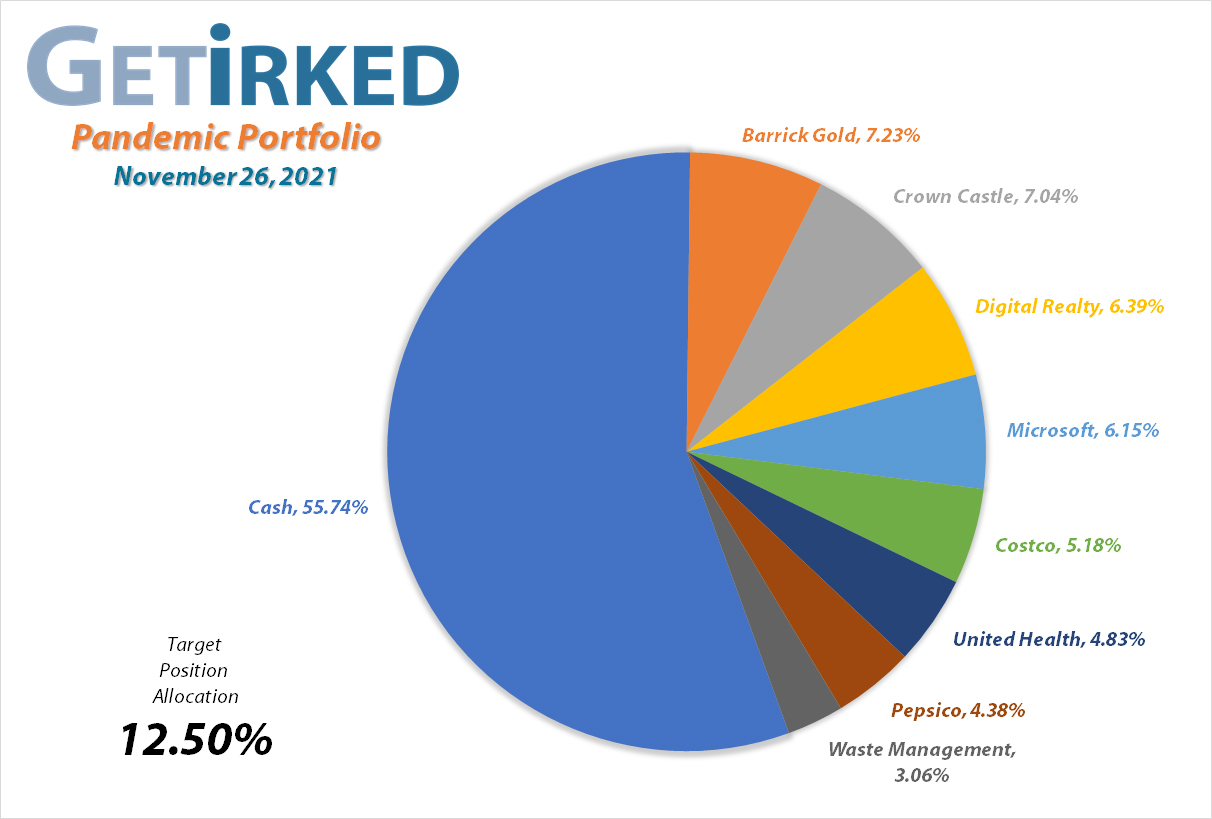

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $19.38

Per-Share Cost: $21.33 (Unchanged since last update)

Profit/Loss: -9.15%

Allocation: 7.231%* (+0.299% since last update)

Next Buy Target: $17.70

After looking like the precious metals sector was finally getting the respect it deserves, the bottom fell out when President Joe Biden announced current Federal Reserve Chair Jerome Powell would be the administration’s nomination.

The result? The markets believe Powell and his cronies may be more hawkish and will raise the interest rate to stem inflation. No inflation, no need for gold. So, gold, and Barrick Gold (GOLD) by extension, sold off.

Many economists believe there’s nothing the Fed can do to prevent inflation so gold will still have a place in long-term portfolios, however, for the moment, there’s pain ahead.

That being said, I raised my price target to $17.70, a past point of support, so I can add more to the position if we see it sell off that low again.

Costco (COST): Dividend Reinvestment

Current Price: $546.13

Per-Share Cost: $260.78 (-0.153% since last update)

Profit/Loss: +109.42%

Allocation: 5.175%* (+0.472% since last update)

Next Buy Target: $458.15

Costco (COST) paid out its quarterly dividend on November 15, currently a very minor yield of just over 0.60% annually. The reinvested dividends lowered my position’s per-share cost -0.153% from $216.18 to $260.78. Fortunately, COST has a long tradition of paying out substantial special dividends which is the real reason many investors hold the stock.

COST’s incredible strength over the past few months has motivated me to get much more aggressive, both raising my price target to add more to the position up to $458.15 and increasing the quantity substantially as well. From here, I have no current sell targets for this position.

Crown Castle (CCI): Strategy Update

Current Price: $183.50

Per-Share Cost: $152.60 (Unchanged since last update)

Profit/Loss: +20.25%

Allocation: 7.037%* (+0.045% since last update)

Next Buy Target: $167.70

Crown Castle (CCI) saw a bit of a pop since the last update which puts my position squarely in No Man’s Land. If it drops back to $167.70, above its most recent point of support, I’ll add to the position. If it makes another stab at its all-time high near $205, I will take profits.

In the meantime, I’ll sit on my hands and just collect the dividends.

Digital Realty Trust (DLR): Profit-Taking

Current Price: $164.76

Per-Share Cost: $121.50 (-3.602% since last update)

Profit/Loss: +35.61%

Allocation: 6.893%* (-0.500% since last update)

Next Buy Target: $141.20

Digital Realty Trust (DLR) really took off during Thanksgiving Week, and since both DLR and Crown Castle (CCI) seem to trade within a range right now, I decided to take some profits on Tuesday with a sale order that filled at $166.13.

The sale locked in +16.175% in gains on shares I bought for $143.00 not too long ago on October 5 and lowered my per-share cost -3.602% from $126.04 to $121.50. The sale gave my position an overall -15.24% reduction per-share from my first buy at $143.35 back on May 12, 2020.

For the moment, I have no additional sell targets for DLR and my next buy target is $141.20, a bit above a past point of support where I’ll replace the shares I sold during this update.

As of this update, DLR is $164.76, down -0.82% from where I took profits.

Microsoft (MSFT): Strategy Update

Current Price: $329.44

Per-Share Cost: $199.20 (Unchanged since last update)

Profit/Loss: +65.38%

Allocation: 6.151%* (-0.111% since last update)

Next Buy Target: $294.30

Microsoft (MSFT) has continued its remarkable rally with the rest of Big Tech, breaking through to new all-time highs since the last update. Given the outperformance of the stock, I have no selling targets until Microsoft exceeds the 12.5% target allocation for the portfolio, but I do plan to add more if it dips down to $294.30, a recent point of support.

Pepsico (PEP): Strategy Update

Current Price: $161.14

Per-Share Cost: $124.90 (Unchanged since last update)

Profit/Loss: +29.79%

Allocation: 4.379%* (-0.062% since last update)

Next Buy Target: $154.35

Like most of the positions in this portfolio, Pepsico (PEP) has excelled since the last update, making new all-time highs. From here, I intend to add more to the position if it pulls back to $154.35, and I have no sell targets until the position exceeds the 12.5% target allocation for the portfolio.

Just like many of the other positions, this stock is floating in No Man’s Land for the moment where I will simply sit on my hands and collect dividends.

UnitedHealth (UNH): Strategy Update

Current Price: $439.91

Per-Share Cost: $322.83 (Unchanged since last update)

Profit/Loss: +36.27%

Allocation: 4.833%* (-0.282% since last update)

Next Buy Target: $387.35

UnitedHealth (UNH) performed incredibly well following the last update initially before losing strength midway through November. My next buy target to add a substantial quantity to this position is $387.35 and I have no sell targets for the stock since it’s nowhere near exceeding the 12.5% target allocation for the portfolio.

Waste Management (WM): Strategy Update

Current Price: $163.47

Per-Share Cost: $114.60 (Unchanged since last update)

Profit/Loss: +42.65%

Allocation: 3.061%* (+0.027% since last update)

Next Buy Target: $158.85

Waste Management (WM) has continued to outperform since the last update so it’s time to get much more aggressive with this position. I’ve raised my buy target substantially higher than the last support with a target of $158.85 followed closely by a second buy target at $148.10 and a third at $137.20.

Given that WM is the smallest position in the portfolio, any concepts of selling to take profits are a distant dream. For WM, I will either be adding to the position or holding while I wait for the next juicy dividend payout.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.