Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #21

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Let’s put the fleet out to sea…

There’s an old navy adage – “a ship in the harbor is safe, but that’s not what ships were made for.” In the case of the Pandemic Portfolio, I’ve been reviewing it and I feel the cash position is positively insane.

Given that for the majority of the time since its inception in May 2020 the Pandemic Portfolio has been 60%+ cash, it’s quite incredible that these stocks have pulled off the performances they have. That being said, the point of investing is to put money to work for the long term, and even with a time horizon of 25+ years, having this much cash sit on the sidelines for more than a year isn’t going to cut it.

Accordingly, I’ve raised the price targets and quantity buys for every position in the portfolio, except for Barrick Gold (GOLD), of course, because that poor bugger keeps dropping to my next price target and is currently the biggest position in the portfolio.

The past month was not a slow one, by any stretch. All but two positions saw increases in their allocations over the month. Let’s take a look at the moves made in the Pandemic Portfolio since August’s update…

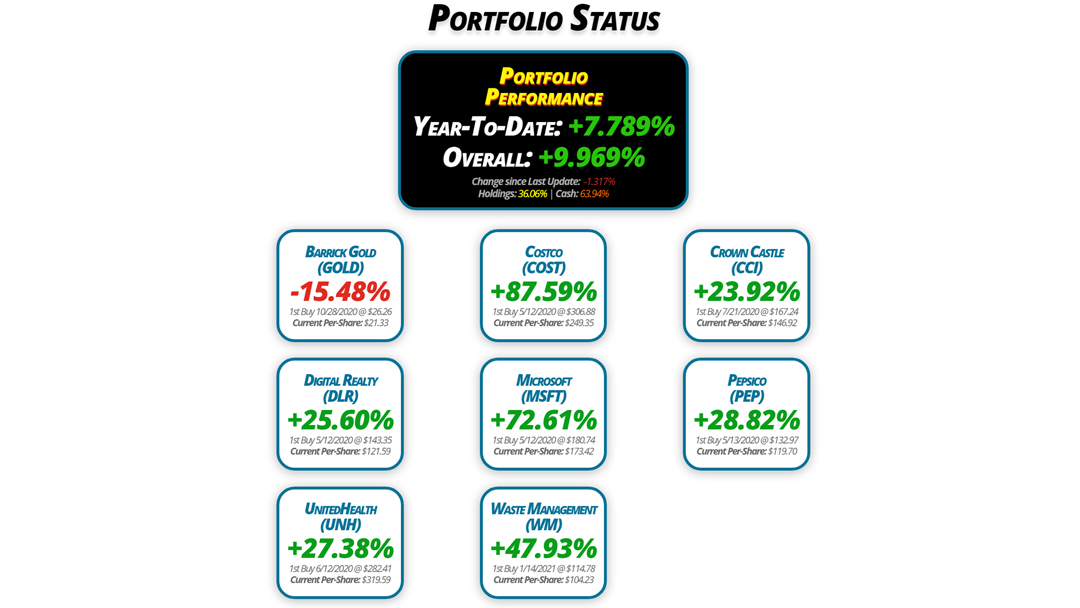

Portfolio Status

Portfolio

Performance

Year-To-Date: +7.789%

Overall: +9.969%

Change since Last Update: -1.317%

Holdings: 36.06% | Cash: 63.94%

Barrick Gold

(GOLD)

-15.48%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $21.33

Digital Realty

(DLR)

+25.60%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $121.59

UnitedHealth

(UNH)

+27.38%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $319.59

Costco

(COST)

+87.59%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $249.35

Microsoft

(MSFT)

+72.61%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $173.42

Waste Management

(WM)

+47.93%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $104.23

Crown Castle

(CCI)

+23.92%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $146.92

Pepsico

(PEP)

+28.82%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $119.70

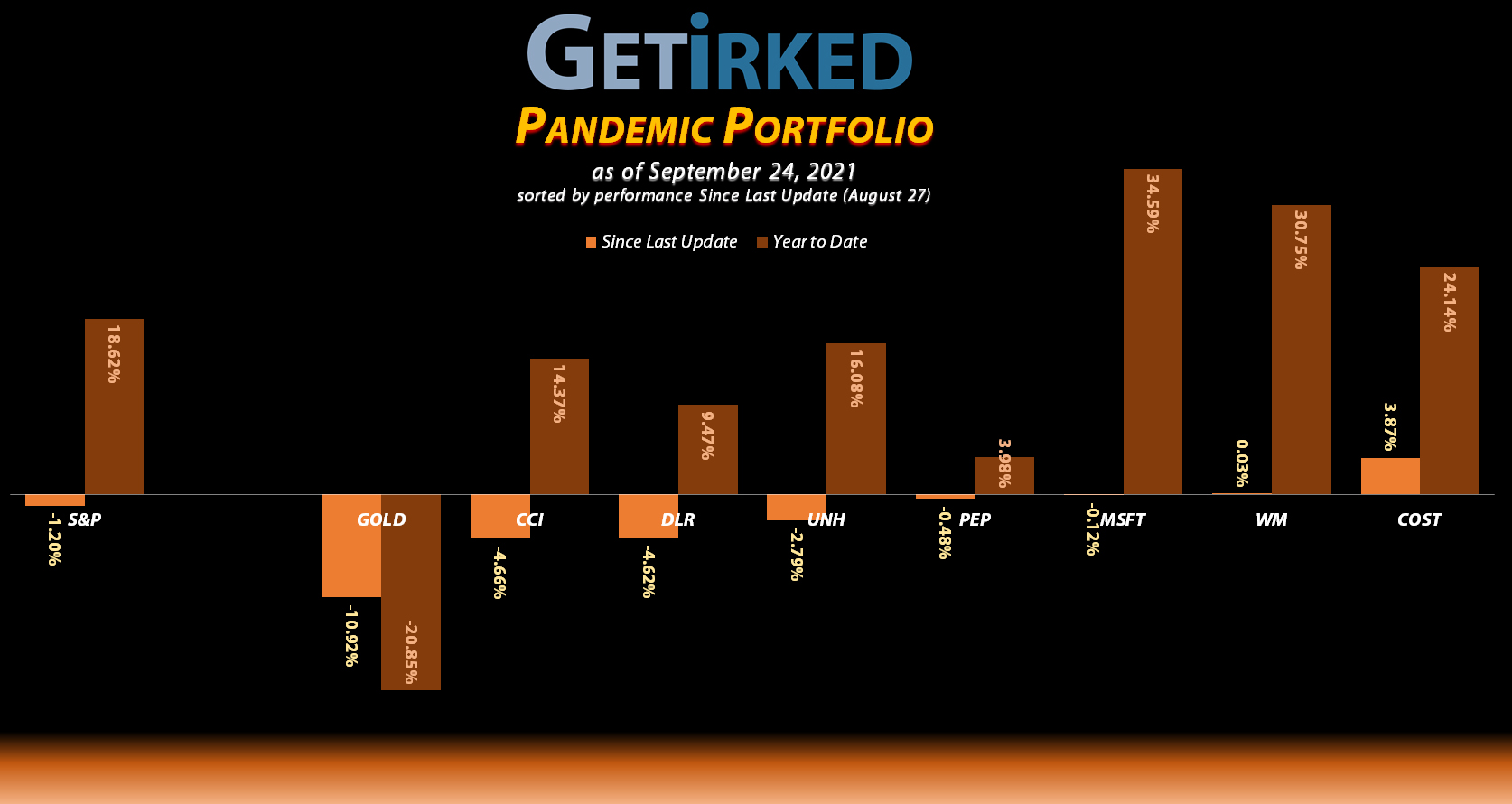

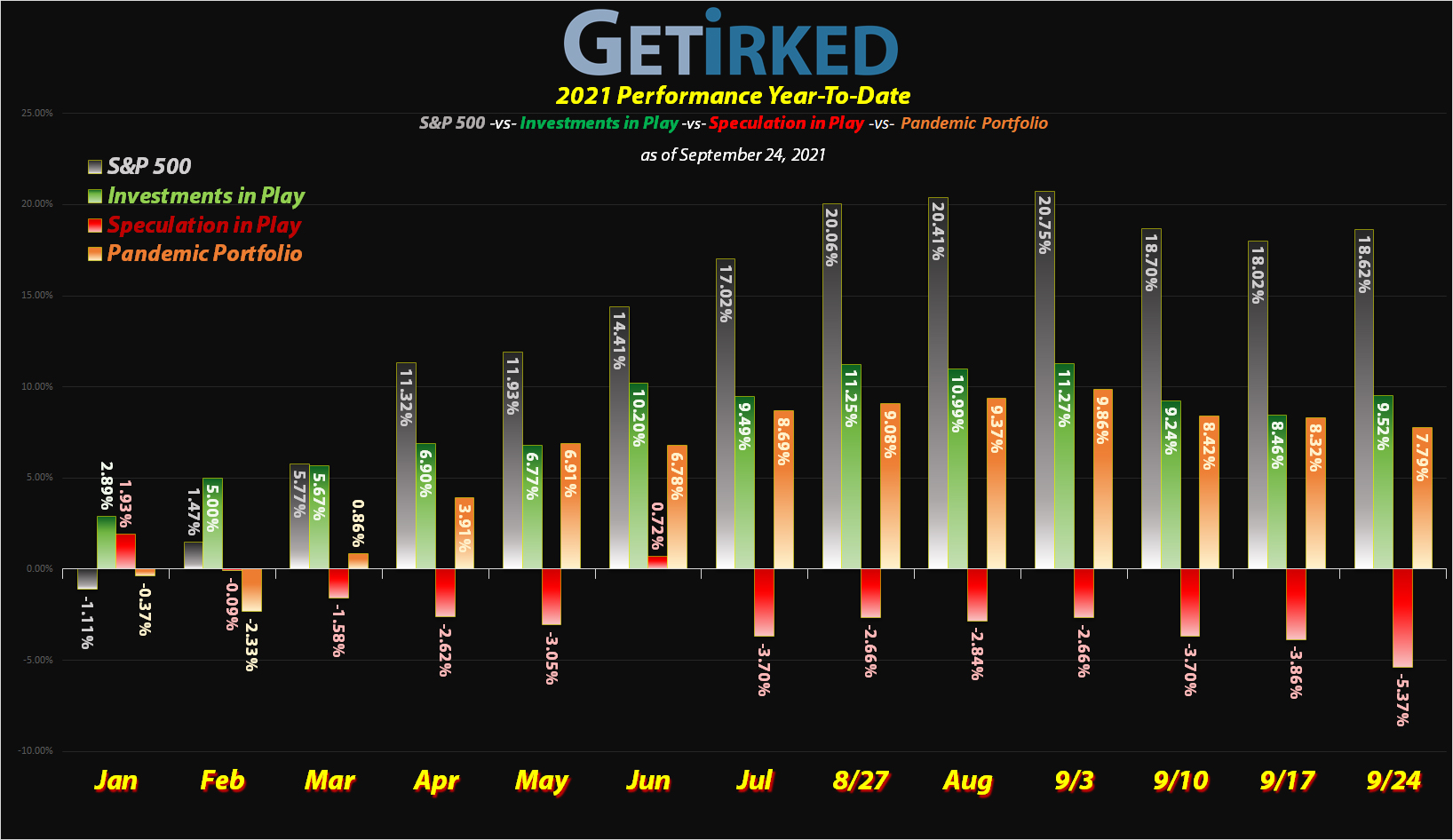

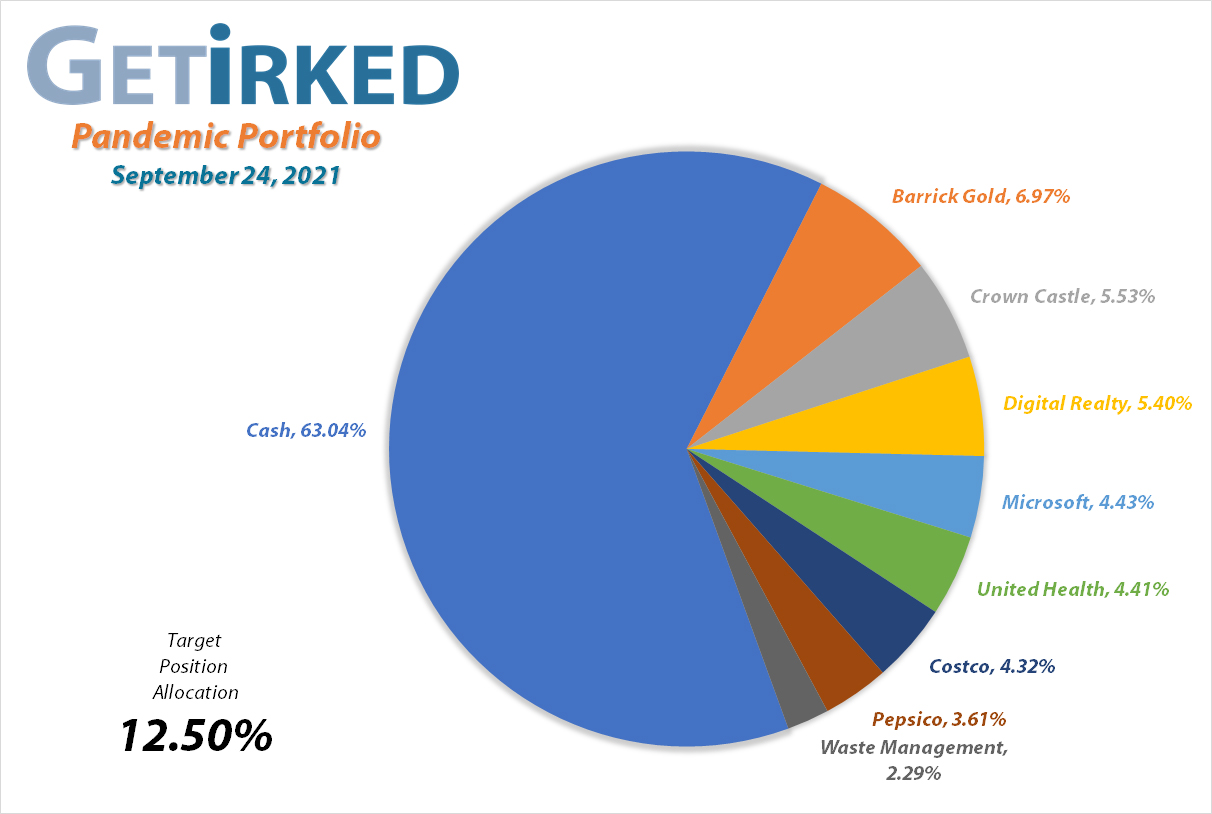

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position & Dividend

Current Price: $18.03

Per-Share Cost: $21.33 (-2.156% since last update)

Profit/Loss: -15.47%

Allocation: 6.968%* (-0.125% since last update)

Next Buy Target: $16.75

The precious yellow metal saw a precarious one-day selloff on Thursday, September 16, dropping substantially and bringing all the miners with it. Barrick Gold (GOLD) dropped straight through my buy target with an order filling at $18.53, lowering my per-share cost -1.239% from $21.80 to $21.53.

From here, my next buy target is $16.75 and my next sell target is near its last point of significant resistance around $25.25.

Barrick also paid out its quarterly dividend and capital return (an annualized payout of more than 4%) the week of September 13, lowering my per-share a further -0.929% from $21.53 to $21.33.

As of this update, GOLD is $18.03, down -2.70% from where I added.

Costco (COST): Strategy Update

Current Price: $467.75

Per-Share Cost: $249.35 (Unchanged since last update)

Profit/Loss: +87.59%

Allocation: 4.316%* (+0.210% since last update)

Next Buy Target: $451.90

After reporting another amazing earnings report on Thursday, September 23, I embraced the theme of this month’s update and substantially raised my next buy target of Costco (COST).

Given this company’s constantly amazing performance, it’s time to put more money to work here, so I’ve raised my buy target to $451.90, above the low it set during September’s selloff.

Crown Castle (CCI): Added to Position

Current Price: $182.07

Per-Share Cost: $146.92 (+2.383% since last update)

Profit/Loss: +23.92%

Allocation: 5.334%* (+0.030% since last update)

Next Buy Target: $180.60

Crown Castle Inc (CCI) sold off along with the other REIT-related plays near the beginning of the month, triggering a buy order which filled at $189.03 on Friday, September 10.

The order replaced half of the shares I sold on July 14 for $201.73, locking in a -6.30% discount and raising my per-share cost +2.383% from $143.50 to $146.92. My current per-share basis is still a discount of -12.15% from my initial buy of CCI on July 21, 2020 at $167.24.

From here, my next buy target is $180.60, above a past period of strong support, and I have no sell targets at this time.

CCI closed at $182.07 as of this update, down -3.68% from where I added.

Digital Realty Trust (DLR): Added to Position

Current Price: $152.72

Per-Share Cost: $121.59 (+2.176% since last update)

Profit/Loss: +25.60%

Allocation: 5.400%* (+0.167% since last update)

Next Buy Target: $151.10

After hitting a new all-time high of $168.30 over the past month, I decided to add a few of the shares I sold at $163.99 on August 20 back in when DLR pulled back on Thursday, September 9 with an order that filled at $159.05.

While I only locked in a -3.01% discount, I only replaced half of the share I sold on September 9 with the expectation that DLR may drop further. The buy raised my per-share cost +2.176% from $119.00 to $121.59, still -15.18% from my initial buy on May 12, 2020 at $143.35.

From here, my next buy target is $151.10 and I have no sell targets at this time.

DLR closed at $152.72 as of this update, down -3.98% from where I added.

Microsoft (MSFT): Dividend Reinvestment

Current Price: $299.35

Per-Share Cost: $173.42 (-$0.33 since last update)

Profit/Loss: +72.61%

Allocation: 4.374%* (+0.055% since last update)

Next Buy Target: $283.75

Microsoft (MSFT) paid out its quarterly dividend of $0.56/shr on Thursday, September 9, providing an annual yield of 0.76%. Such a small dividend has little effect when reinvested, though it did reduce my per-share cost -$0.33 from $173.75 to $173.42.

Given Microsoft’s ongoing strength and resilience, I did raise my buy price target to $283.75 so I could start adding to the position if it sells off.

Pepsico (PEP): Strategy Update

Current Price: $154.20

Per-Share Cost: $119.70 (Unchanged since last update)

Profit/Loss: +28.82%

Allocation: 3.614%* (+0.026% since last update)

Next Buy Target: $149.25

Given how volatile Pepsico (PEP) has been during past market selloffs, its newfound strength and versatility has been impressive, to say the least. PEP was barely fazed by the September selloff, with a bottom made at $152.42, not even 5% off its all-time high (just -4.52%).

Even still, while I’ve raised my buy price target for PEP, I’d like to see it sell off a bit more than that as I don’t believe the strength will hold, so I’ve set my new buy target at $149.25, above its 150-day Moving Average and right around a past period of strong support.

UnitedHealth (UNH): Added to Position & Dividends

Current Price: $407.08

Per-Share Cost: $319.59 (+0.983% since last update)

Profit/Loss: +27.38%

Allocation: 4.413%* (+0.151% since last update)

Next Buy Target: $389.90

UnitedHealth (UNH) and the rest of the health sector saw a bit of weakness near the beginning of September with selling pressure triggering a buy order I had in place which filled at $406.41 on Friday, September 10. The purchase raised my per-share cost +1.324% from $316.48 to $320.67.

On Tuesday, September 21, UnitedHealth paid out its quarterly dividend of $1.45/shr, an annual yield of 1.40% as of its $412.34 close on the day. The dividend reduced my per-share cost -0.337% from $320.67 to $319.59.

From here, my next buy target is $389.90 and I have no sell targets at this time.

As of this update, UNH is $407.08, up +0.16% from where I added.

Waste Management (WM): Added & Dividends

Current Price: $154.19

Per-Share Cost: $104.23 (+3.198% since last update)

Profit/Loss: +47.93%

Allocation: 2.290%* (+0.188% since last update)

Next Buy Target: $142.30

After watching Waste Management (WM) continue to demonstrate resilience during selloffs and incredible strength, I decided I had made a mistake selling shares at $144.74 on July 15. I added some of them back into the position when WM showed weakness on Thursday, September 9 with a $154.15 order.

The order raised my per-share cost +3.564% from $101.00 to $104.60, however, that price is still -9.01% off my initial buy on January 14 at $114.96. From here, my next buy target is $142.30 and I have no sell targets at this time.

On Friday, September 17, WM paid out its quarterly dividend $0.575 per share which worked out to an annual yield of about 1.51% at its $152.68 closing price. The dividend, which reinvested into my position, lowered my per-share cost by -0.35% from $104.60 to $104.23.

As of this update, WM is $154.19, up +$0.04 from where I added.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.