Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #19

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Time for profit-taking?

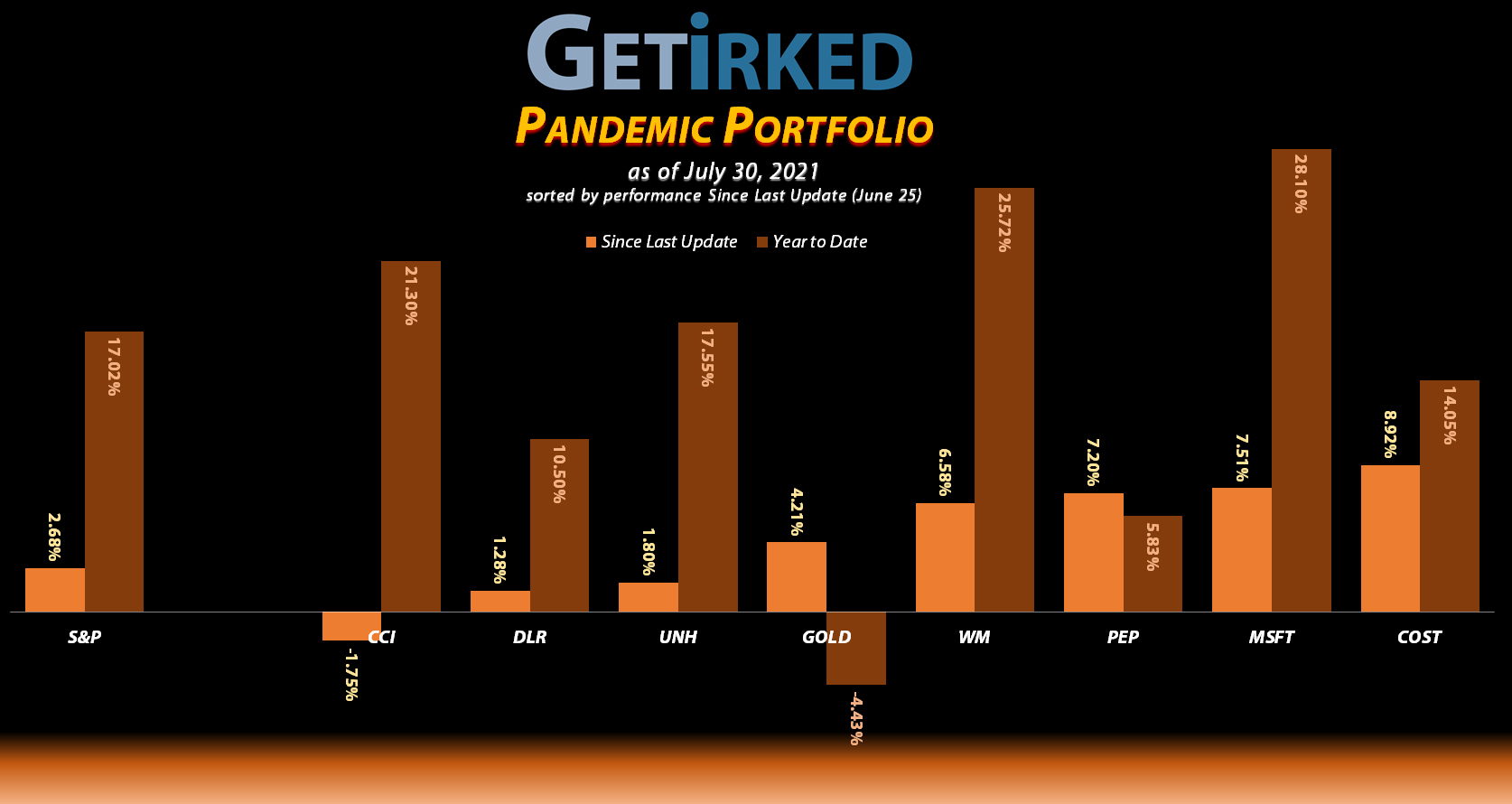

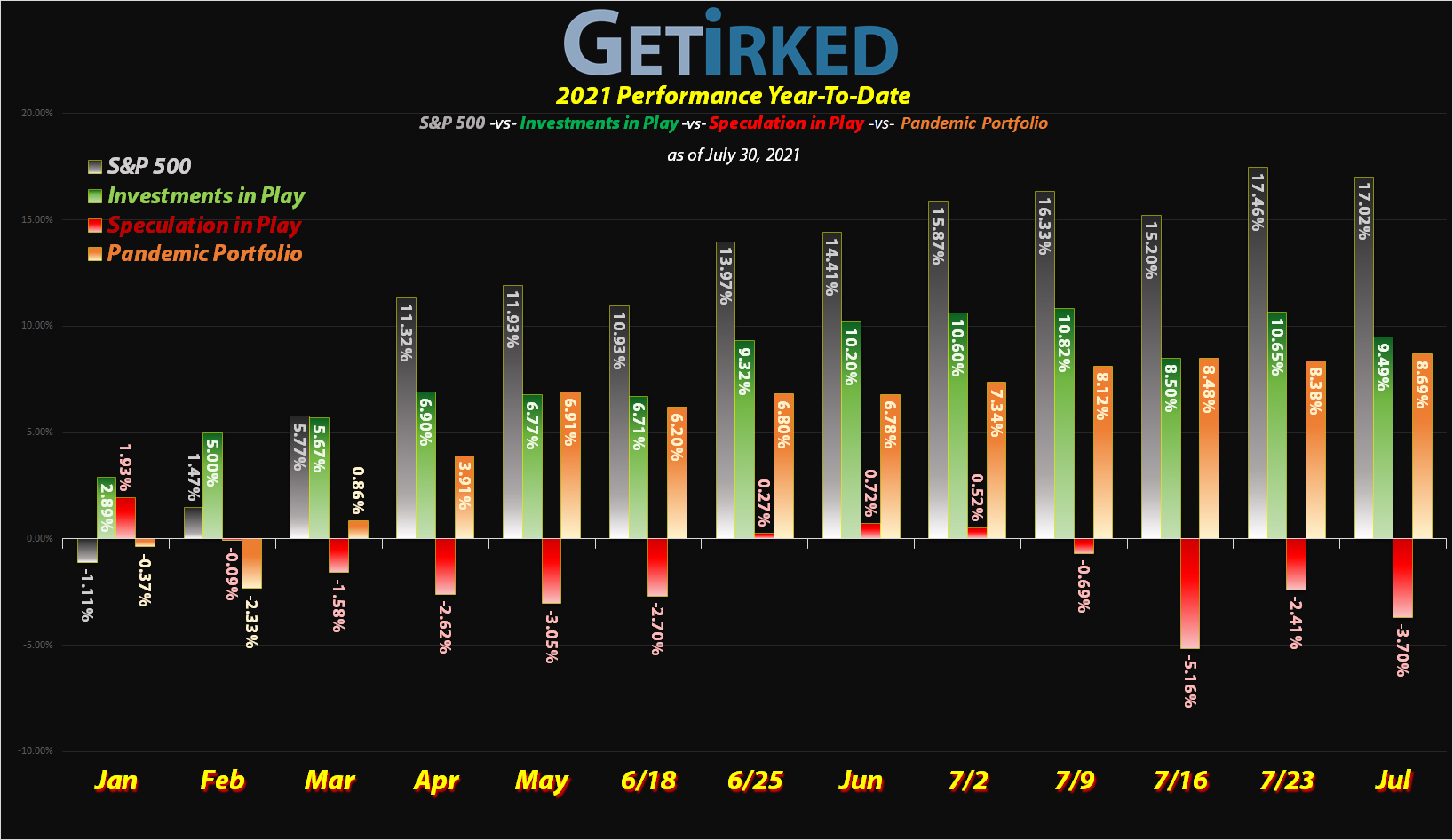

This past month has been quite a busy one. As the market continues to feel extremely toppy, I decided it was time to start taking profits in some of the Pandemic Portfolio’s chubbier positions in case the markets see the correction so many pundits claim we can expect.

Accordingly, I took profits and reduced my per-share cost in half of the positions in this portfolio – quite a busy month given how conservative I typically am when it comes to making moves in this long-term portfolio.

Only one position – Costco (COST) – didn’t see action this week with the positions where profits weren’t taken all received reinvested dividends over the course of the month; it really has been quite busy!

Let’s see what happened since the last update…

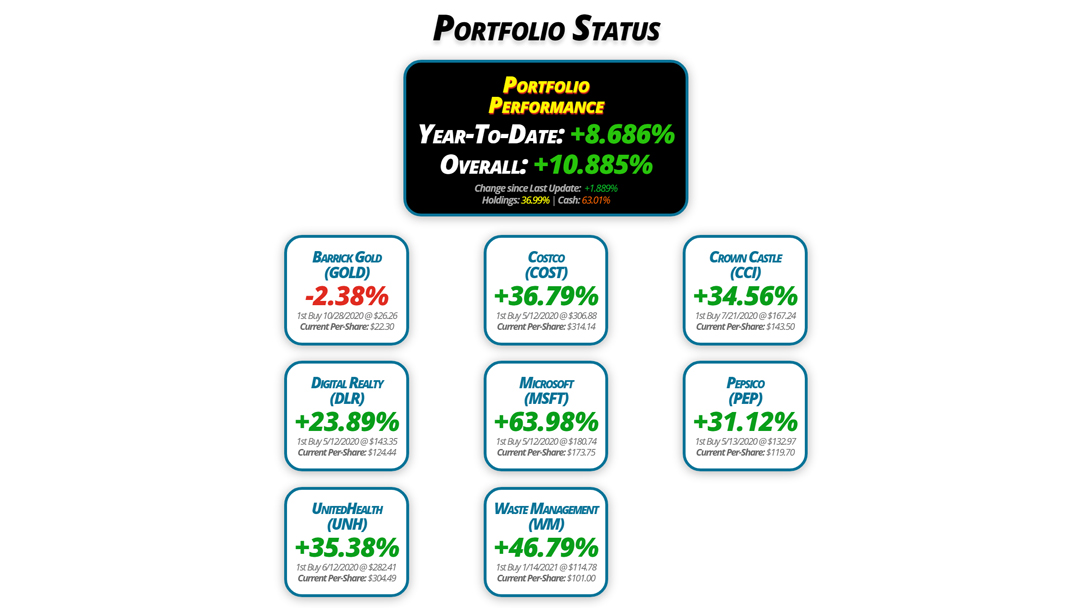

Portfolio Status

Portfolio

Performance

Year-To-Date: +8.686%

Overall: +10.885%

Change since Last Update: +1.889%

Holdings: 36.99% | Cash: 63.01%

Barrick Gold

(GOLD)

-2.38%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $22.30

Digital Realty

(DLR)

+23.89%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $124.44

UnitedHealth

(UNH)

+35.38%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $304.49

Costco

(COST)

+36.79%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $314.14

Microsoft

(MSFT)

+63.98%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $173.75

Waste Management

(WM)

+46.79%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $101.00

Crown Castle

(CCI)

+34.56%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $143.50

Pepsico

(PEP)

+31.12%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $119.70

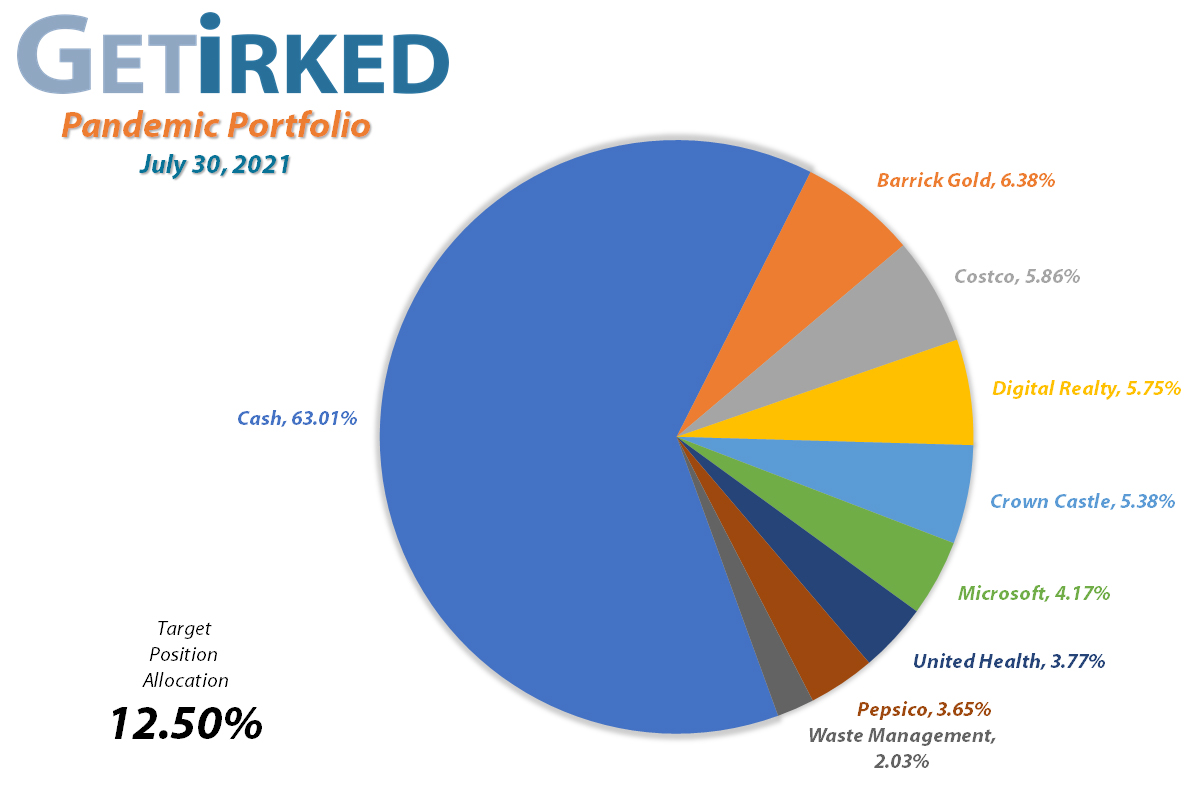

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position

Current Price: $21.77

Per-Share Cost: $22.30 (-0.580% since last update)

Profit/Loss: -2.38%

Allocation: 6.381%* (+0.368% since last update)

Next Buy Target: $18.95

The yellow metal continued to see selling pressure since our last update, causing Barrick Gold (GOLD) to sell off and trigger a buy order I had in place which filled at $20.73 on Monday, June 28. The order lowered my per-share cost -0.580% from $22.43 to $22.30.

From here, my next buy target is $18.95, slightly above the low of its last selloff, and I currently have no sell targets in place.

As of this update, GOLD closed at $21.77, up +5.02% from where I added.

Costco (COST): Strategy Update

Current Price: $429.72

Per-Share Cost: $314.14 (Unchanged since last update)

Profit/Loss: +36.79%

Allocation: 5.860%* (+0.616% since last update)

Next Buy Target: $332.10

Costco (COST) has been a stalwart bull over the past month, rising ever higher and showing great resilience during rotations from growth to value and vice versa. While I don’t have the complete faith that I used to in the position, I do find it hard to see how COST will see a sizable selloff like it did earlier this year.

Accordingly, I’m not taking profits in the position, however, I am also keeping my next buy target significantly lower, down at $332.10, after witnessing the death-defying drop COST was able to do in early 2021.

Crown Castle (CCI): Dividends & Profit-Taking

Current Price: $193.09

Per-Share Cost: $143.50 (-5.99% since last update)

Profit/Loss: +34.56%

Allocation: 5.383%* (-0.813% since last update)

Next Buy Target: $181.20

Crown Castle (CCI) paid out its quarterly dividend of $1.33/shr on July 1 which worked out to be an annual yield of 2.746% at its $193.74 closing price. After reinvesting the dividend through my broker’s Dividend Reinvestment Program (DRiP), my per-share cost dropped -0.68% from $152.65 to $151.61.

On Wednesday, July 14, CCI made an attempt for its all-time high which motivated me to take profits as I believe the market’s feeling particularly frothy. My sell order filled at $201.73 locking in +32.39% in gains on shares I bought back on January 6, 2021 for $152.38. The sale also lowered my per-share cost -5.35% from $151.61 down to $143.50. I have no additional sell targets at this time, and, from here, my next buy target for CCI is $181.20.

As of this update, CCI closed at $193.09, down -4.28% from where I sold.

Digital Realty Trust (DLR): Dividend Reinvestment

Current Price: $154.16

Per-Share Cost: $124.44 (-0.77% since last update)

Profit/Loss: +23.89%

Allocation: 5.752%* (+0.017% since last update)

Next Buy Target: $138.00

Digital Realty Trust (DLR) paid out its quarterly dividend of $1.16/shr on July 1 which worked out to be an annual yield of 3.086% at its $150.38 closing price.

After reinvesting the dividend through DRiP, my per-share cost dropped -0.77% from $125.40 to $124.44. From here, my next buy target for DLR is $138.00.

Microsoft (MSFT): Profit-Taking

Current Price: $284.91

Per-Share Cost: $173.75 (-12.87% since last update)

Profit/Loss: +63.98%

Allocation: 4.172%* (-0.994% since last update)

Next Buy Target: $250.65

Over the past month, Microsoft (MSFT), along with many of the positions in the Pandemic Portfolio, started making new all-time highs. Given how overbought and frothy the entire market feels, particularly the growth names like Microsoft, I decided the prudent thing to do would be to take some profits.

A sell order for Microsoft filled on July 13 at $282.77, locking in +22.10% in gains on some of the shares I bought back on March 19 for $231.59, and lowering my per-share cost -12.87% from $199.41 to $173.75. From here, my next buy target is $250.65 and I have no additional sell targets.

As of this update, MSFT closed at $284.91, up +0.76% from where I sold.

Pepsico (PEP): Dividends & Profit-Taking

Current Price: $156.95

Per-Share Cost: $119.70 (-5.11% since last update)

Profit/Loss: +31.12%

Allocation: 3.648%* (-0.496% since last update)

Next Buy Target: $137.90

Pepsico (PEP) paid out its quarterly dividend on July 1, lowering my per-share cost 0.72% from $126.15 to $125.24. Later in the month, PEP made new all-time highs, so, like Microsoft (MSFT) above, I decided it was time to take some profits.

A sell order for Pepsico filled on July 13 at $153.81, locking in +18.58% in gains on some of the shares I bought on February 26 for $129.71, and lowering my per-share cost an additional 4.42% from $125.24 to $119.70. From here, my next buy target is $137.90 and I have no additional sell targets at this time.

As of this update, PEP closed at $156.95, up +2.04% from where I sold.

UnitedHealth (UNH): Dividend Reinvestment

Current Price: $412.22

Per-Share Cost: $304.49 (-0.36% since last update)

Profit/Loss: +35.38%

Allocation: 3.767%* (+0.015% since last update)

Next Buy Target: $337.10

UnitedHealth (UNH) paid out its quarterly dividend of $1.45/shr on June 30 which worked out to be an annual yield of 1.456% at its $398.31 closing price.

After reinvesting the dividend through DRiP, my per-share cost dropped -0.36% from $305.60 to $304.49. From here, my next buy target for UNH is $337.10.

Waste Management (WM): Profit-Taking

Current Price: $148.26

Per-Share Cost: $101.00 (-9.69% since last update)

Profit/Loss: +46.79%

Allocation: 2.029%* (-0.546% since last update)

Next Buy Target: $130.85

Like many of the positions in this portfolio, Waste Management (WM) made an attempt at its all-time high mid-month, leading me to take profits with a sell order that filled on Thursday, July 15 at $144.74.

The order locked in +32.15% in gains on shares I bought on February 22, 2021 for $109.53 and lowered my per-share cost -9.69% from $111.84 to $101.00. My next buy target is $130.85 and I have no additional sell targets at this time.

As of this update, WM closed at $148.26, up +2.43% from where I sold.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.