Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #18

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Sometimes, it’s all about dividends and profits…

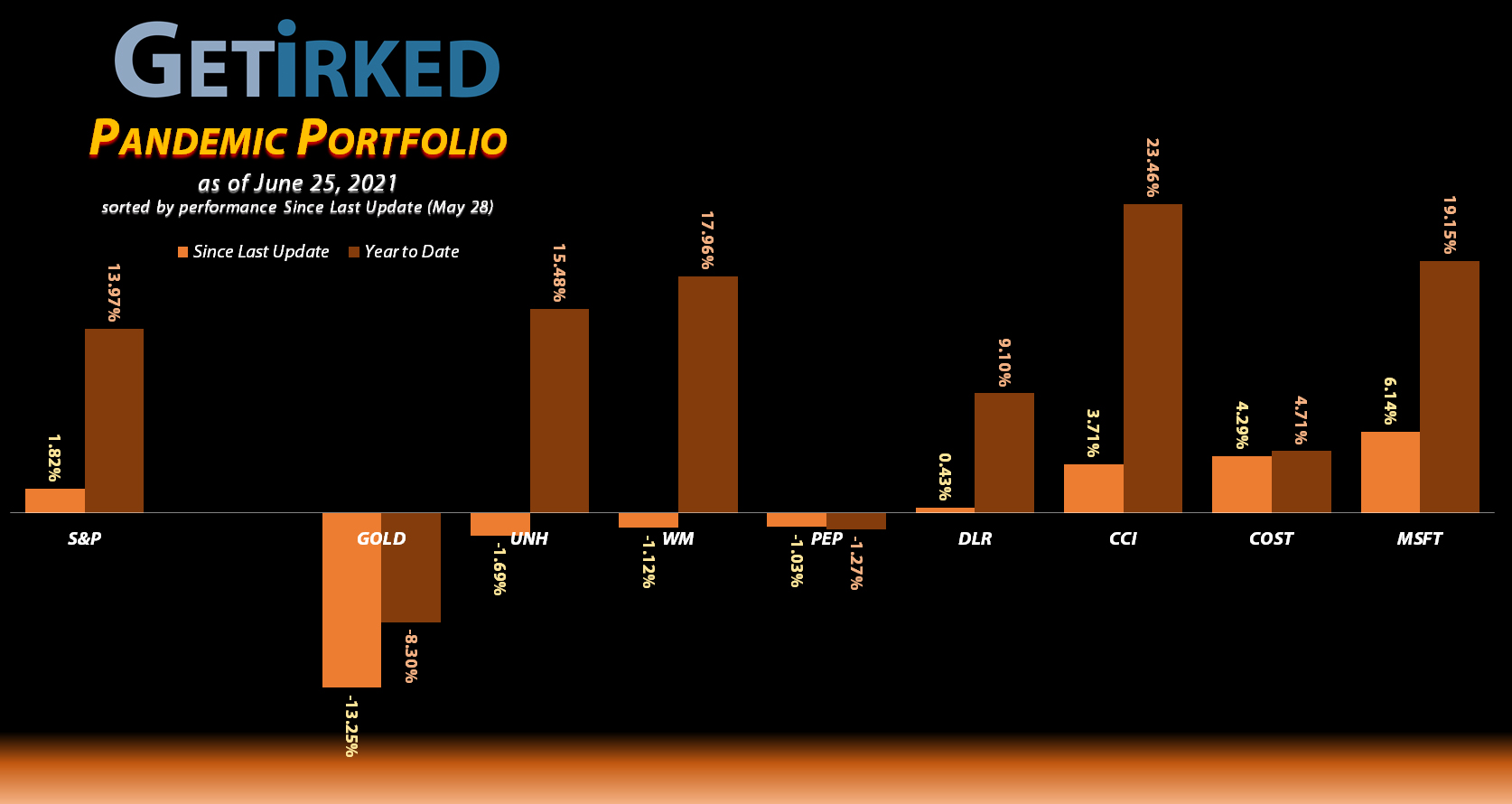

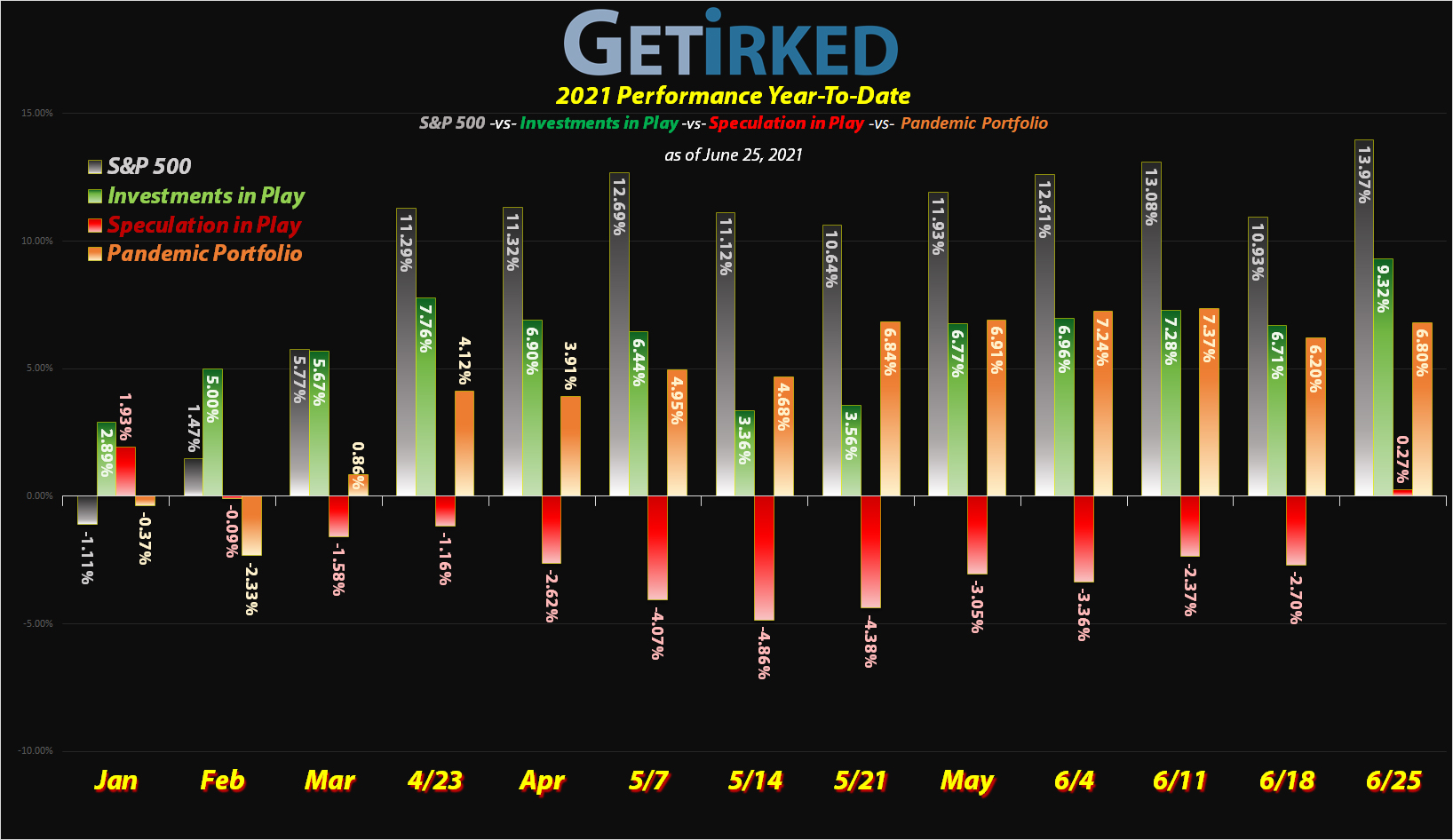

Over the past month, there hasn’t been a huge amount of action in the Pandemic Portfolio outside of profit-taking in Digital Realty Trust (DLR) and some dividend collection.

When the Federal Reserve acknowledged inflation, the price of gold tanked so hard that Barrick Gold (GOLD) flipped from a +6% profit over the past year to drop a whopping -12% and now sits at -6% for the past year. That’s how the yellow metal crumbles sometimes, I guess.

Let’s take a look at what happened in the portfolio’s positions and where I plan to go from here…

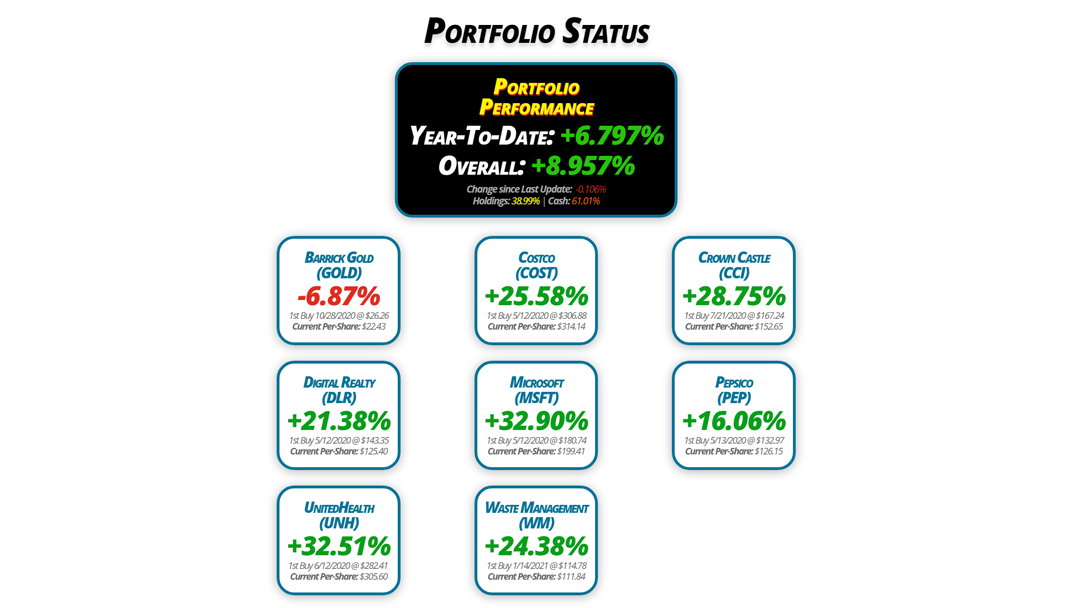

Portfolio Status

Portfolio

Performance

Year-To-Date: +6.797%

Overall: +8.957%

Change since Last Update: -0.106%

Holdings: 38.99% | Cash: 61.01%

Barrick Gold

(GOLD)

-6.87%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $22.43

Digital Realty

(DLR)

+21.38%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $125.40

UnitedHealth

(UNH)

+32.51%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $305.60

Costco

(COST)

+25.58%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $314.14

Microsoft

(MSFT)

+32.90%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $199.41

Waste Management

(WM)

+24.38%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $111.84

Crown Castle

(CCI)

+28.75%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $152.65

Pepsico

(PEP)

+16.06%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $126.15

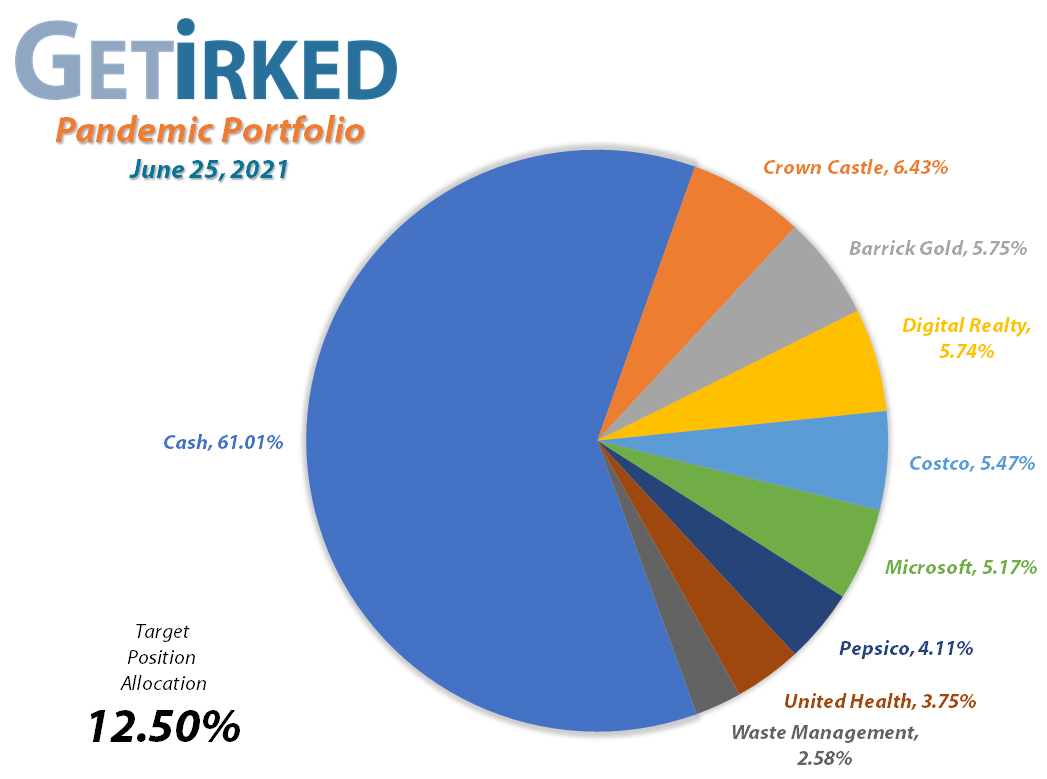

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Dividend Payout

Current Price: $20.89

Per-Share Cost: $22.43 (-0.971% since last update)

Profit/Loss: -6.87%

Allocation: 6.013%* (-0.261% since last update)

Next Buy Target: $20.70

Barrick Gold (GOLD) paid out its quarterly dividend of $0.23/shr on Wednesday, June 15, amounting to an annual yield of a beefy 4.098% as of its $22.45 closing price. Since Barrick isn’t headquartered in the United States, it isn’t eligible for Dividend Reinvestment Programs (DRiPs) through my brokerage.

Even still, taking the dividend as cash lowered my per-share -0.971% from $22.65 to $22.43. From here, my next buy target is $20.70.

Costco (COST): Strategy Update

Current Price: $394.51

Per-Share Cost: $314.14 (Unchanged since last update)

Profit/Loss: +25.58%

Allocation: 5.244%* (+0.231% since last update)

Next Buy Target: $315.60

Costco (COST) rallied to new all-time highs over the course of the past month as the government gets ready to send child-support stimulus checks to families throughout the United States (and where do you think they’ll probably spend those checks).

While I’ve definitely appreciated Costco’s performance, my next buy target of $315.60 is still much, much further away from its current levels as it surprised me with a lack of resilience not too long ago, dropping from similar levels to below $310 in a matter of weeks.

Crown Castle (CCI): Strategy Update

Current Price: $196.53

Per-Share Cost: $152.65 (Unchanged since last update)

Profit/Loss: +28.75%

Allocation: 6.196%* (+0.237% since last update)

Next Buy Target: $157.95

Crown Castle (CCI) has performed very well over the past year as the activist investors have made decisions which benefited everyone – the employees, the customers, and the shareholders.

While I do have a lot of faith in CCI for the long term, my buy target is much lower than the current levels at $157.95 since CCI is already the biggest position in my portfolio and doesn’t need much help unless its much cheaper.

Digital Realty Trust (DLR): Profit-Taking

Current Price: $152.51

Per-Share Cost: $125.40 (-3.129% since last update)

Profit/Loss: +21.38%

Allocation: 5.735%* (-0.665% since last update)

Next Buy Target: $132.35

Digital Realty Trust (DLR) saw quite the bull rally early in June, leading me to take profits on Thursday, June 10 when DLR became incredibly overbought with a sell order that filled at $162.72.

The sale lowered my per-share cost -3.129% from $129.45 to $125.40. From here, I have no plans to make any additional sales and my next buy target is $132.35, a point of significant support in previous selloffs.

As of this update, DLR closed at $152.51, down -6.27% from where I sold.

Microsoft (MSFT): Dividend Reinvestment

Current Price: $265.02

Per-Share Cost: $199.41 (-0.220% since last update)

Profit/Loss: +32.90%

Allocation: 5.166%* (+0.314% since last update)

Next Buy Target: $243.20

Microsoft paid out its quarterly dividend of $0.56/shr on Friday, June 11. Its $2.24/shr annually works out to a yield of 0.869% annually as of its Friday closing price of $257.89. As always, I have my portfolio set to automatically reinvest any eligible dividend, so the new shares lowered my per-share cost -0.220% from $199.85 to $199.41.

Pepsico (PEP): Strategy Update

Current Price: $146.45

Per-Share Cost: $126.15 (Unchanged since last update)

Profit/Loss: +16.06%

Allocation: 4.144%* (-0.039% since last update)

Next Buy Target: $132.20

Pepsico (PEP) came under selling pressure since the last update as investors rotated back out of value stocks and into growth stocks once more. Pepsico seems to very much be trading in a range from the high-$120s to the high-$140s, so I’ll patiently wait for it to pull back down to $132.20 once more before replacing shares I sold at higher levels in the last update.

UnitedHealth (UNH): Strategy Update

Current Price: $404.95

Per-Share Cost: $305.60 (Unchanged since last update)

Profit/Loss: +32.51%

Allocation: 3.752%* (-0.061% since last update)

Next Buy Target: $323.55

UnitedHealth (UNH) didn’t do much since the last update, remaining relatively flat for the past month. While it has performed very well over the course of the past year, I’m still keeping my low $323.55 price target as UnitedHealth and the healthcare sector, in general, has a tendency to sell off significantly when news works against it.

Waste Management (WM): Dividend Reinvestment

Current Price: $139.11

Per-Share Cost: $111.84 (-0.418% since last update)

Profit/Loss: +24.38%

Allocation: 2.575%* (+0.349% since last update)

Next Buy Target: $130.55

Waste Management (WM) paid out its quarterly dividend of $0.575/share on June 21, working out to an annual yield of 1.6579% at its $138.73 closing price. As always, I had the dividends reinvested which lowered my per-share cost -0.418% from $112.31 to $111.84.

From here, my price target to add more to the position is $130.75.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.