Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #17

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

It’s the one-year anniversary – how’d we do?

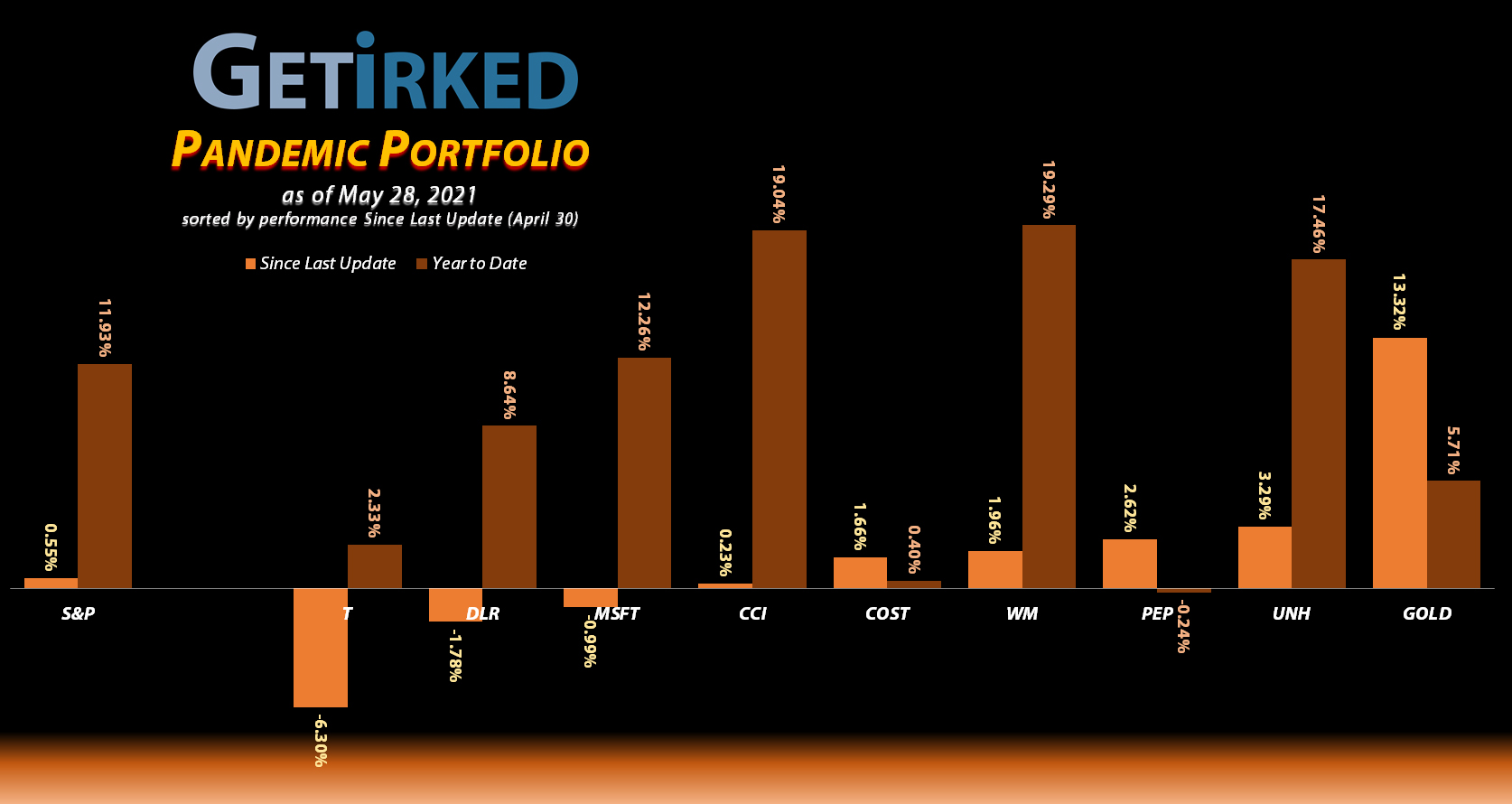

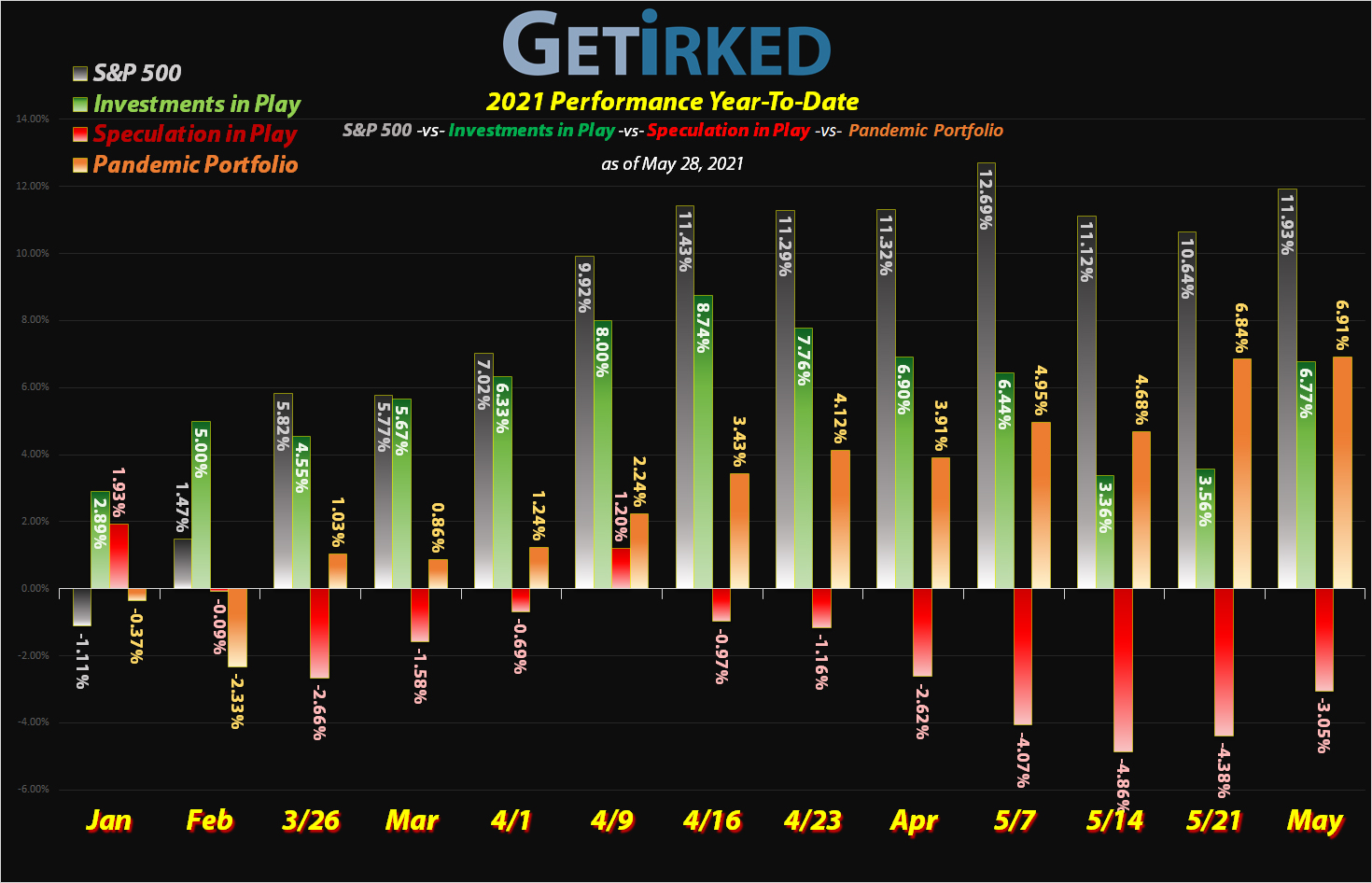

One year ago, I created the Pandemic Portfolio starting with buys in Costco (COST) and Digital Realty Trust (DLR) on May 12, 2020. A conservative portfolio targeting dividend-yielding stocks that could perform both in and out of a recession and a pandemic, this portfolio was one of my toughest since no one knew if we were going to test the market lows seen in March so I had to manage positions incredibly slowly, and, unfortunately, miss out on a lot of gains as the market rocketed higher and higher against all belief.

Now, one year (and a week or two) later, the Pandemic Portfolio has seen an annual gain of +9.065%. While that’s paltry when compared with the S&P 500’s gain of +46.50% over the same time period, the Pandemic Portfolio has never been more than 50% invested. In other words, that +9.065% gain came with the vast majority of the portfolio in cash!

While I’ve been working on a less conservative approach, this update might not look like it as I am once again taking profits in a few positions in order to reduce their allocation size and/or per-share cost. Not to mention, I had to kill off a position when the story behind the investment changed dramatically!

At any rate, it’s been quite a year! Let’s take a look at what’s changed since the April update…

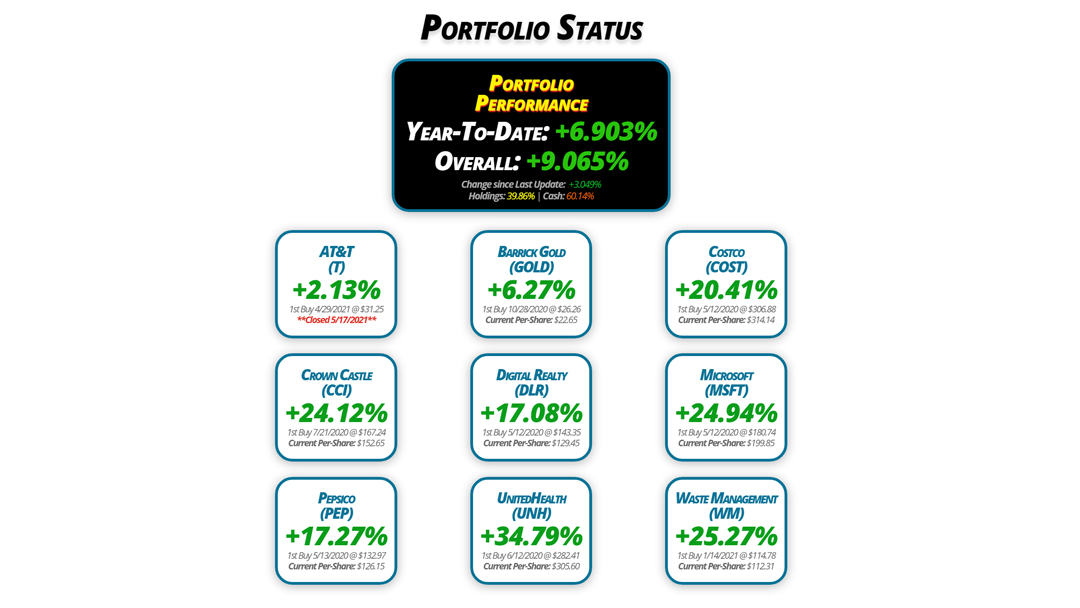

Portfolio Status

Portfolio

Performance

Year-To-Date: +6.903%

Overall: +9.065%

Change since Last Update: +3.049%

Holdings: 39.86% | Cash: 60.14%

AT&T

(T)

+2.13%

1st Buy 4/29/2021 @ $31.25

**Closed 5/17/2021**

Crown Castle

(CCI)

+24.12%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $152.65

Pepsico

(PEP)

+17.27%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $126.15

Barrick Gold

(GOLD)

+6.27%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $22.65

Digital Realty

(DLR)

+17.08%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $129.45

UnitedHealth

(UNH)

+34.79%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $305.60

Costco

(COST)

+20.41%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $314.14

Microsoft

(MSFT)

+24.94%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $199.85

Waste Management

(WM)

+25.27%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $112.31

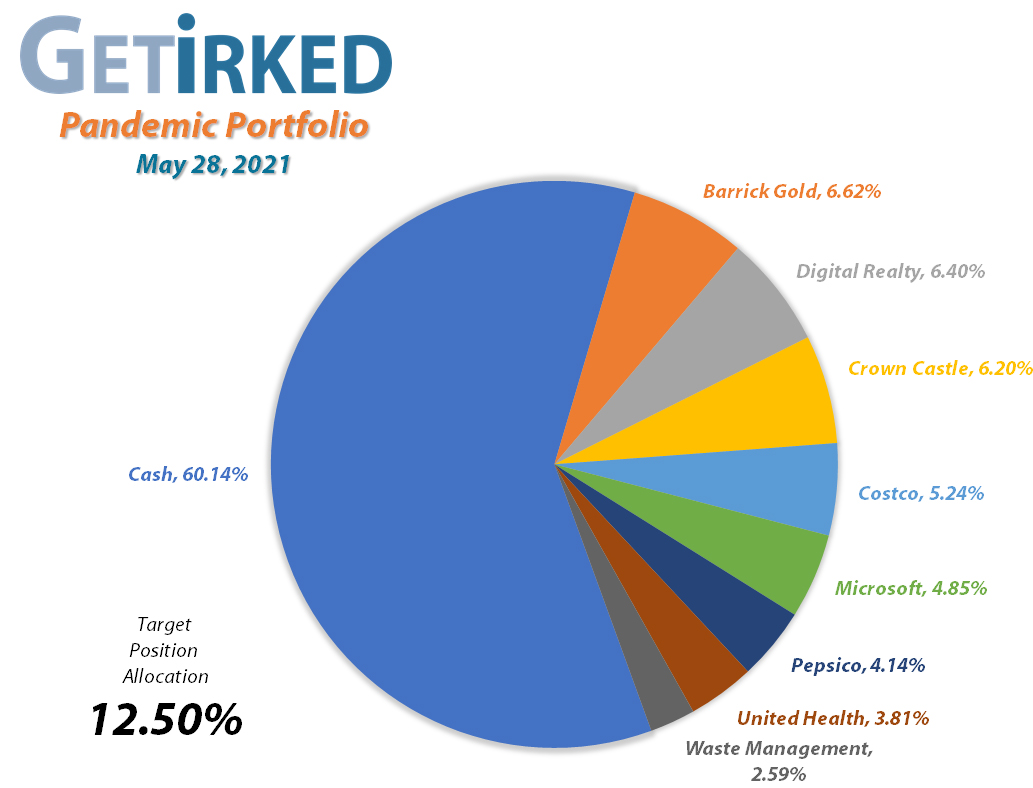

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

AT&T (T): *Closed Position: +2.128% Gain*

I know what some of my readers must be thinking: “Wait. Didn’t you just open a position in AT&T (T) in the last update??”

You are correct. However, this is an example of how when the facts change your investing thesis, you must change your mind.

On Monday, May 17, news broke that AT&T would sell its Time-Warner assets to Discovery Networks (DISCA), making AT&T a pure play on mobile and broadband services with a dividend which would be cut.

The sale invalidated my investment thesis for AT&T. I wanted AT&T specifically because of its exposure to streaming through Time-Warner. Without that exposure, AT&T is now a straight-up play on 5G, and that directly overlaps with this portfolio’s position in Crown Castle (CCI), the company that builds and rents out 5G cellular towers, which conflicts with diversification theory.

Additionally, AT&T is far from Best-in-Breed when it comes to the mobile providers (that honor goes to Verizon (VZ)), so in less than three short weeks, AT&T made its way out of the Pandemic Portfolio.

I originally purchased my position on April 29 for $31.25 and sold it on May 17 for $31.92, a total gain of +2.128% which makes for an annualized gain of +36.89% which isn’t too shabby considering my savings account pays 0.50% annually.

AT&T closed this update at $29.43, down -7.80% from where I sold it, showing that I am far from the only investor who did not like the change of plans.

Barrick Gold (GOLD): Strategy Update

Current Price: $24.07

Per-Share Cost: $22.65 (Unchanged since last update)

Profit/Loss: +6.27%

Allocation: 6.0131%* (+0.608% since last update)

Next Buy Target: $20.05

The yellow metal has seen quite the resurgence over the past month, resulting in Barrick Gold (GOLD) moving much higher. In fact, GOLD is now one of the biggest positions in the Pandemic Portfolio, and that’s just fine.

With an allocation right around half of the portfolio target, I’m very comfortable with my position in GOLD and will wait for pullbacks below my per-share cost before adding more.

Costco (COST): Profit-Taking & Dividends

Current Price: $378.27

Per-Share Cost: $314.14 (-4.649% since last update)

Profit/Loss: +20.41%

Allocation: 5.244%* (-1.803% since last update)

Next Buy Target: $308.75

Like many of the other positions in the Pandemic Portfolio, Costco (COST) is currently trading in a wide range. Additionally, I overestimated Costco’s resilience, adding to my position at far too high a price only to have it drop below my both the new per-share cost and my original one (meaning I would have been better off just waiting).

Accordingly, when Costco took off toward its all-time highs, I decided it was time to limit its allocation and reduce my per-share cost by taking profits at $376.70 on Monday, May 3, 2021. The sale locked in a meager +4.17% in gains on shares I bought on January 15 at $361.62, but, more importantly, reduced my per-share cost -4.649% from $330.36 to $315.00.

On May 17, Costco paid out its quarterly dividend of $0.79/share (~0.82% annually) which lowered my per-share cost -0.27% further to $314.14.

Costco also has the dubious behavior of selling off when it reports good earnings. On May 27, COST reported decent earnings but warned about inflation risk which caused the stock to sell off nearly -2% the following day. Due to this sort of reaction, I’ve learned my lesson and won’t add to my position until it drops below my per-share cost. My next buy target for COST is $308.75, slightly above the low of its last big selloff a a few months ago.

COST closed this update at $378.27, up +0.417% from where I took profits.

Crown Castle (CCI): Strategy Update

Current Price: $189.47

Per-Share Cost: $152.65 (Unchanged since last update)

Profit/Loss: +24.12

Allocation: 6.196%* (-0.164% since last update)

Next Buy Target: $151.45

Crown Castle (CCI) has really come into its own in the past few months. Thanks to activist investors and a high-quality management team, CCI is recognized as the Best-in-Breed in the tower space, beating out competitors like American Tower (AMT).

While I would certainly love to add more CCI to my portfolio, I can wait until it comes below my per-share cost. If it never drops that low, I’ll reallocate the capital I would have used on CCI elsewhere. CCI is volatile enough that I don’t make a repeat of what I did with Costco by buying up my per-share cost.

Digital Realty Trust (DLR): Strategy Update

Current Price: $151.56

Per-Share Cost: $129.45 (Unchanged since last update)

Profit/Loss: +17.08%

Allocation: 6.400%* (-0.303% since last update)

Next Buy Target: $127.45

Digital Realty Trust (DLR) continues to stay within its trading range. While it’s currently near the high end of its range, I have no reason to suspect it will break out.

If it drops below $130, I will add more to my position, otherwise, I’m perfectly content sitting tight and collecting its juicy dividend each quarter until DLR makes a move that impresses me.

Microsoft (MSFT): Strategy Update

Current Price: $249.68

Per-Share Cost: $199.85 (Unchanged since last update)

Profit/Loss: +24.94%

Allocation: 4.852%* (-0.189% since last update)

Next Buy Target: $238.65

Despite the beat-down on tech stocks over the past month, Microsoft (MSFT) continues to be a stalwart, holding up well even during selloffs.

Microsoft has demonstrated incredible long-term strength, and I will definitely take the opportunity to increase my allocation if it pulls back, even though doing so means increasing my per-share cost in the position.

Microsoft’s consistent respect of support and moving averages means if I don’t buy up my per-share cost, I likely won’t have the opportunity to increase my allocation in this position.

Pepsico (PEP): Profit-Taking

Current Price: $147.94

Per-Share Cost: $126.15 (-2.209% since last update)

Profit/Loss: +17.27%

Allocation: 4.144%* (-0.690% since last update)

Next Buy Target: $128.60

Just like Costco (COST), Crown Castle (CCI), and Digital Realty Trust (DLR) above, Pepsico (PEP) has been trading in a range over the past year, bouncing between the upper-$120s to around $150, so I decided it was time to take some profits and lower my per-share cost on Monday, May 3 with a $146.41 sell order.

The sale locked in +13.593% in gains on shares I bought on March 4 for $128.89 and lowered my per-share cost -2.209% from $129.00 to $126.15. From here, my next buy target is $128.60 and I have no additional sell targets for the meantime.

While that buy target will increase my per-share cost, PEP has seen a great deal of support around that level, so I think it’s possible that PEP will never drop down to my new $126.15 per-share cost and I would definitely like to add to my position if it drops below $129 again.

PEP closed this update at $147.94, up +1.05% from where I took profits.

iShares Silver ETF (SILV): Writing Puts

If you’re a regular reader of my other portfolios, particularly Speculation in Play, you’ve noticed that I will use options trading from time-to-time for different positions.

In Speculation in Play, I often use SPY put spreads to protect against a potential marketwide downside move. In Investments in Play, I’ve used covered calls to collect yield on positions that I feel aren’t headed higher.

In the Pandemic Portfolio, I wanted to use a technique called writing puts to collect premium on a position I wouldn’t mind owning, the ETF that tracks the price of silver by iShares, SILV, in this case.

I believe that as we head into a potentially inflationary environment combined with the need of silver for industrial uses in Electric Vehicles and solar panels, that owning the silver ETF would provide a decent hedge and fit perfectly in a portfolio designed to succeed in good and bad economic times.

How does Writing Puts work?

When “writing puts,” I’m basically telling someone who owns 100 shares of SILV that I guarantee I will buy them at a set price if the underlying asset drops to that price or lower by a set date.

On May 18, I sold the 01/20/23 $25 long-dated puts for $3.74 (options are sold in lots of 100 contracts so the total amount I was paid was $374.35 after fees).

What this means is for each put contract I sold, I have to buy 100 shares of the SILV ETF if it drops below $25 anytime between May 18, 2021 and nearly two years away, January 20, 2023, the expiration date.

I used such a long expiration date because I really would like some silver exposure in the portfolio, so with SILV closing the day at $26.16, I wouldn’t mind buying it if it fell 4% to $25.00.

If SILV never drops to $25.00 before 1/20/2023, I keep all the premium. Alternatively, as SILV increases in value, the cost for me to buy back my puts drops, so I might buy back my puts and sell more if SILV starts on a runaway track higher.

If SILV drops to $25 and I have to buy the shares, the premium I collected means I’ll end up buying 100 shares for each put I sold at a net price of $21.26 each: 100 shares x $25 per share = $2,500 – $374.35 premium = $2,125.65 per 100 shares or $21.2565 per share. That would represent a discount of -18.74% from SILV’s $26.16 closing price when I first sold the puts – that’s substantial!

As of this update, SILV closed at $25.91, 3.51% away from my buy price.

UnitedHealth (UNH): Strategy Update

Current Price: $411.92

Per-Share Cost: $305.60 (Unchanged since last update)

Profit/Loss: +34.79%

Allocation: 3.813%* (+0.016% since last update)

Next Buy Target: $346.05

UnitedHealth (UNH) has performed incredibly well over the past month along with the rest of the healthcare industry. Accordingly, I’ve raised my price target to add more to this position, even though, like Microsoft, doing so will raise my per-share cost.

However, my price target is significantly below UNH’s current levels, so healthcare will have to see quite a selloff before I add more to my allocation.

Waste Management (WM): Strategy Update

Current Price: $140.68

Per-Share Cost: $112.31 (Unchanged since last update)

Profit/Loss: +25.27%

Allocation: 2.226%* (+0.365% since last update)

Next Buy Target: $137.90

Waste Management (WM) has held up incredibly well, proving itself as a recovery play as the economy reopens.

While I have no reason to expect a significant selloff, my allocation is so small in this position that I will definitely add more if it drops below $140, even though doing so means increasing my per-share cost.

Waste Management is a unique spin on playing both infrastructure and economic growth, so adding more even at higher prices, makes sense for the overall portfolio strategy for the Pandemic Portfolio.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.