Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #15

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

A month has passed…

So, a month has passed since the last update and I think that might be what I’ll do going forward with the Pandemic Portfolio – monthly updates. This way, the updates are much more… exciting? At the very least, more will have had a chance to happen.

For example, in the past month, I added to five of the eight positions, some of them having multiple buys. Additionally, the portfolio has regained some ground from where it was in February, both down Year-To-Date (YTD) but also down overall which was kind of a bummer.

With that, let’s get to it – the first of regular monthly updates!

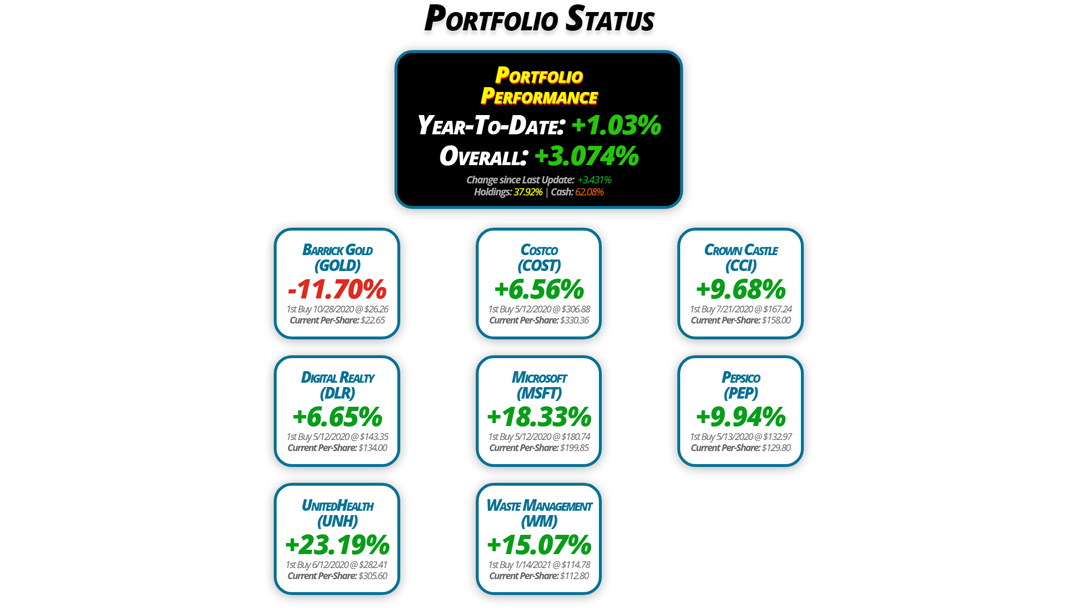

Portfolio Status

Portfolio

Performance

Year-To-Date: +1.03%

Overall: +3.074%

Change since Last Update: +3.431%

Holdings: 37.92% | Cash: 62.08%

Barrick Gold

(GOLD)

-11.70%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $22.65

Digital Realty

(DLR)

+6.65%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $134.00

UnitedHealth

(UNH)

+23.19%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $305.60

Costco

(COST)

+6.56%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $330.36

Microsoft

(MSFT)

+18.33%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $199.85

Waste Management

(WM)

+15.07%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $112.80

Crown Castle

(CCI)

+9.68%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $158.00

Pepsico

(PEP)

+9.94%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $129.80

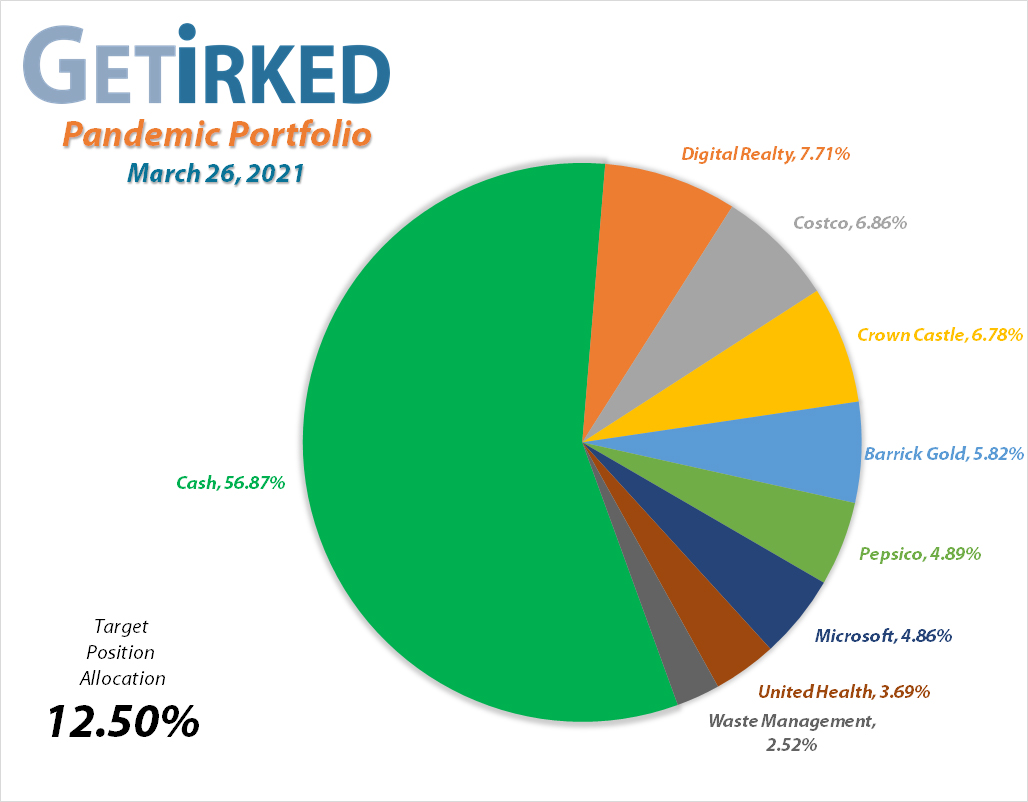

Portfolio Breakdown

Positions

%

Target Position Size

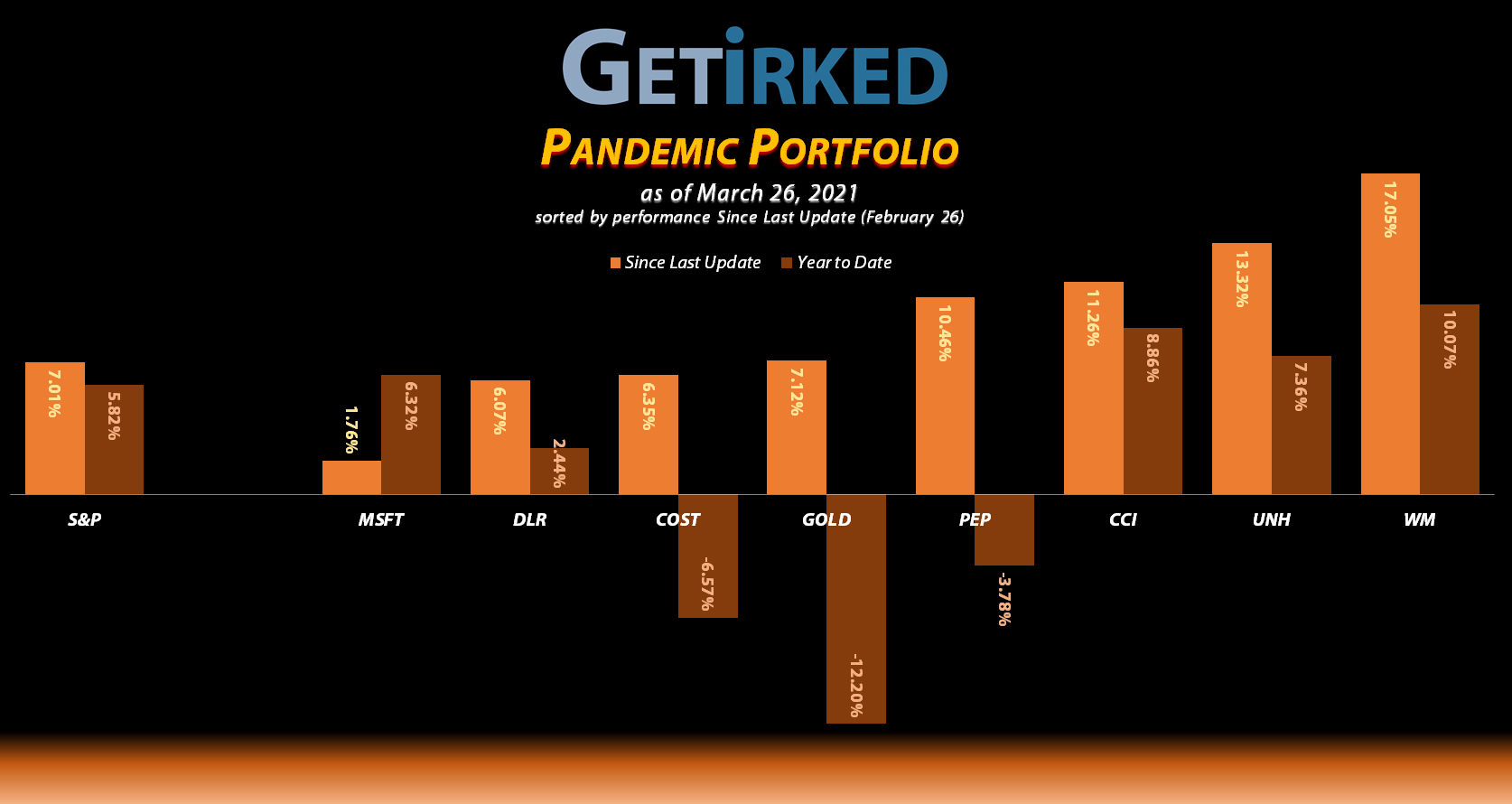

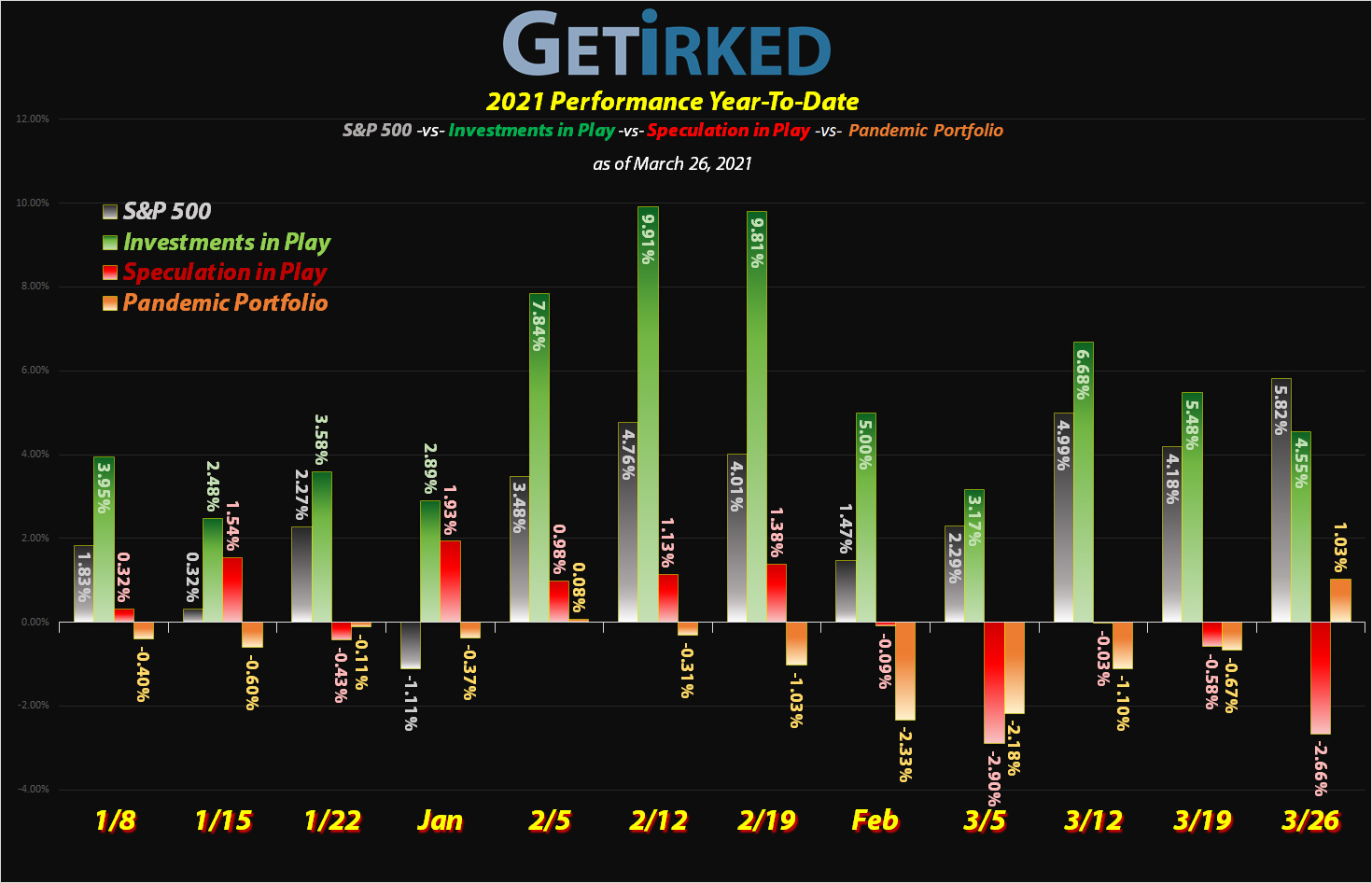

Click image for an enlarged version.

Click image for an enlarged version.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position

Current Price: $20.00

Per-Share Cost: $22.65 (-2.998% from last update)

Profit/Loss: -11.70%

Allocation: 5.821%* (+1.137% from last update)

Next Buy Target: $18.80

The selloff in precious metals that started in February continued into March, with Barrick Gold (GOLD) dropping below $19.00 once again on the March 1st, prompting me to once again add a bit to the position with an order that filled on Monday, March 1 at $18.90.

The buy lowered my per-share cost -1.171% from $23.35 to $22.95.

Why do I keep adding to GOLD despite the selling pressure?

While historically, increasing interest rates indicate a strong economy and wealthy individuals will move their money from gold – a hedge against dropping interest rates and a weak economy – and put it in bonds to take advantage of the interest (since holding physical gold and silver offers no yield).

However, given the world is printing fiat currency like it’s going out of style and the long-term 25-year+ horizon of this portfolio, I truly believe that investing in gold through goldminers is an investment that will pay off as hyperinflation begins to be realized.

Barrick Gold paid out its dividend on March 15.

GOLD paid out its quarterly dividend $0.09 per share on March 15. While that might seem like a negligible amount, it adds up to an annual yield of 1.733% at its $20.77 closing price on the 15th, and that’s not bad at all since, as I said above, one of anti-goldbugs’ arguments against holding gold is that the metal offers no yield; but the miners do.

Unfortunately, my broker does not offer dividend reinvesting on GOLD since its headquarters is not in the U.S., however, taking the dividend as cash still ended up lowering my per-share cost -0.31% from $22.95 to $22.88 as it pulls the capital out of the position.

And time to add even more gold…

Mid-March, GOLD started a bounce, making it quite a bit over $20 where I decided to add a few more shares if it tried to retest $20, which it did on Tuesday, March 23 with an order filling at $20.16. This order lowered my per-share cost -1.01% from $22.88 to $22.65 and gave me an average buy price of $19.53 a share. My next buy target to add more will be if GOLD retests $18.80.

As of this update, GOLD closed at $20.00, up +2.41% from average buy.

Costco (COST): Strategy Update

Current Price: $352.02

Per-Share Cost: $330.36 (Unchanged from last update)

Profit/Loss: +6.56%

Allocation: 6.670%* (+0.187% from last update)

Next Buy Target: $308.50

Costco (COST) struggled a bit since our last update on February 26, dropping an additional -7.23% before finding a bottom at $307.00 and bouncing. It has been quite a bounce with COST trying to recover over its 200-day Moving Average (MA) just under $250 a share.

The bottom makes for my new price target of $308.50 where I’ll snag some should it retest its lows. If it doesn’t pull back, I’ll just sit pat with what I have.

Crown Castle (CCI): Added to Position

Current Price: $173.29

Per-Share Cost: $158.00 (-0.660% from last update)

Profit/Loss: +9.68%

Allocation: 6.785%* (+1.258% from last update)

Next Buy Target: $149.40

Crown Castle (CCI) came under pressure at the beginning of March, dipping down and filling my price target of $150.54 which filled on March 3. The buy lowered my per-share cost -0.660% from $159.05 to $158.00 and added even more of this 3.5%+ dividend-yielder.

After bouncing significantly from its recent lows, my next price target is $149.40, slightly above the low of its recent drop.

As of this update, CCI is $173.29, up +15.11% from where I added.

Digital Realty Trust (DLR): Added to Position

Current Price: $142.91

Per-Share Cost: $134.00 (-0.438% from last update)

Profit/Loss: +6.65%

Allocation: 7.709%* (+0.867% from last update)

Next Buy Target: $127.35

Digital Realty Trust (DLR) broke down during the first week of March, crashing through $130 and triggering a small buy order I had in place at $128.06 on Tuesday, March 3. The order reduced my per-share cost by -0.438% from $134.59 to $134.00 and also increased my allocation of this long-term dividend payer with a yield of 3.5% at those prices.

Like Crown Castle (CCI) above, DLR saw a pretty significant bounce off its lows, so my next price target is slightly above its last selloff at $127.35.

As of this update, DLR is $142.91, up +11.596% from where I added.

Microsoft (MSFT): Added to Position

Current Price: $236.48

Per-Share Cost: $199.85 (+0.863% from last update)

Profit/Loss: +18.33%

Allocation: 4.682%* (+0.180% from last update)

Next Buy Target: $200.65

Dividend Reinvestment

Microsoft (MSFT) paid out its quarterly dividend of $0.56 a share (an annual yield of about 0.956% at its $234.32 closing price) on March 12, which, as always, I accepted as fractional shares rather than a cash payout by enrolling in my broker’s Dividend Reinvestment Program (DRiP).

The dividend lowered my per-share cost -0.181% from $198.50 to $198.14.

Added to Position

When Microsoft came under weakness mid-March, I decided to get off my duff and add a bit more to the position with an order that filled at $231.59 on Friday, March 19. The order raised my per-share cost +0.86% from $198.14 to $199.85, still keeping it below the key $200.00 psychological level. My next price target to add more to the position is $196.75.

As of this update, MSFT is $236.48, up +2.11% from where I added.

Pepsico (PEP): Added to Position

Current Price: $142.70

Per-Share Cost: $129.80 (-0.115% from last update)

Profit/Loss: +9.94%

Allocation: 4.892%* (+0.959% from last update)

Next Buy Target: $128.60

Consumer staples product companies like Pepsico (PEP) fell out of favor with investors at the beginning of March causing PEP to once again drop below $130 and trigger a buy order I had in placed which filled at $128.89 on Thursday, March 4.

The buy order only lowers my per-share cost -0.115% from $129.95 to $129.80, however, I had a relatively small allocation of PEP and wanted to increase it, particularly given its 3.3%+ yield at these levels.

From here, I’ll wait for PEP to once again retest its support under $130 to add more with a price target of $128.60.

As of this update, PEP is $142.70, up +10.71% from where I added.

UnitedHealth (UNH): Dividend Reinvestment

Current Price: $376.48

Per-Share Cost: $305.60 (-0.336% from last update)

Profit/Loss: +23.19%

Allocation: 3.302%* (+0.385% from last update)

Next Buy Target: $337.90

UnitedHealth (UNH) paid out its quarterly dividend on March 23 which I reinvested using my broker’s Dividend Reinvestment Program (DRiP), lowering my per-share cost -0.336% from $306.63 to $305.60.

At its current price in the $370s, UNH’s $5/share dividend works out to about 1.353%, not a bad yield on a stock with performance as good as UNH.

While I always hate buying up my cost basis, I plan to add some more to my position if UNH sees a pullback to the $330s again.

Waste Management (WM): Strategy Update

Current Price: $129.80

Per-Share Cost: $112.80 (Unchanged from last update)

Profit/Loss: +15.07%

Allocation: 2.226%* (+0.293% from last update)

Next Buy Target: $117.25

The economic reopening has been very, very good for Waste Management (WM) as it has rocketed more than +15% since its recent $109.11 low on February 23, slightly before the last update.

I was building my position in WM slowly, assuming that it would probably try to test $100, but, now, I see this as a very resilient stock. As I always say, I hate buying up my cost basis, however, if WM pulls back I’ll add some more at $117.25 and then add significantly more if breaks below $110 again.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.