Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #12

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

One man’s trash…

As promised in the last update, I’ve gotten a lot more aggressive with the Pandemic Portfolio. In this update, I’ve added a new position to the portfolio, one that might seem surprising to some readers – Waste Management (WM). Believe it or not, in the stock market one man’s trash really is another man’s treasure.

In addition, I also bulk ordered some more Costco (COST) when the stock came under pressure to give me a deal I couldn’t resist.

Plus, I update all of my strategies and let you know what I think of where the positions will go from here.

Read on to find out…

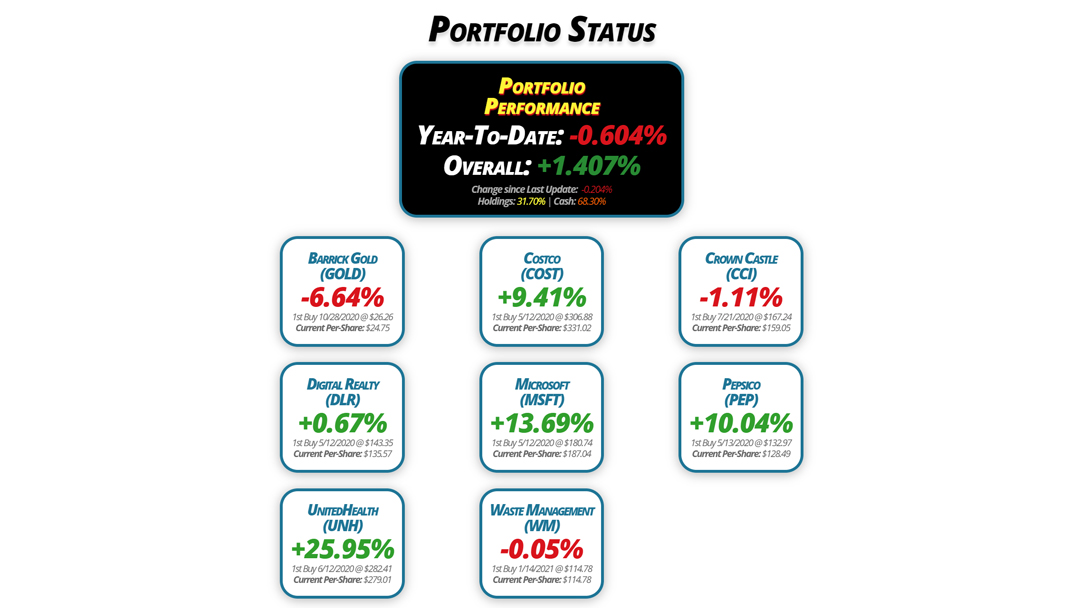

Portfolio Status

Portfolio

Performance

Year-To-Date: -0.604%

Overall: +1.407%

Change since Last Update: -0.204%

Holdings: 31.70% | Cash: 68.30%

Barrick Gold

(GOLD)

-6.64%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $24.75

Digital Realty

(DLR)

+0.67%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $135.57

UnitedHealth

(UNH)

+25.95%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $279.01

Costco

(COST)

+9.41%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $331.02

Microsoft

(MSFT)

+13.69%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $187.04

Waste Management

(WM)

-0.05%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $114.78

Crown Castle

(CCI)

-1.11%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $159.05

Pepsico

(PEP)

+10.04%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $128.49

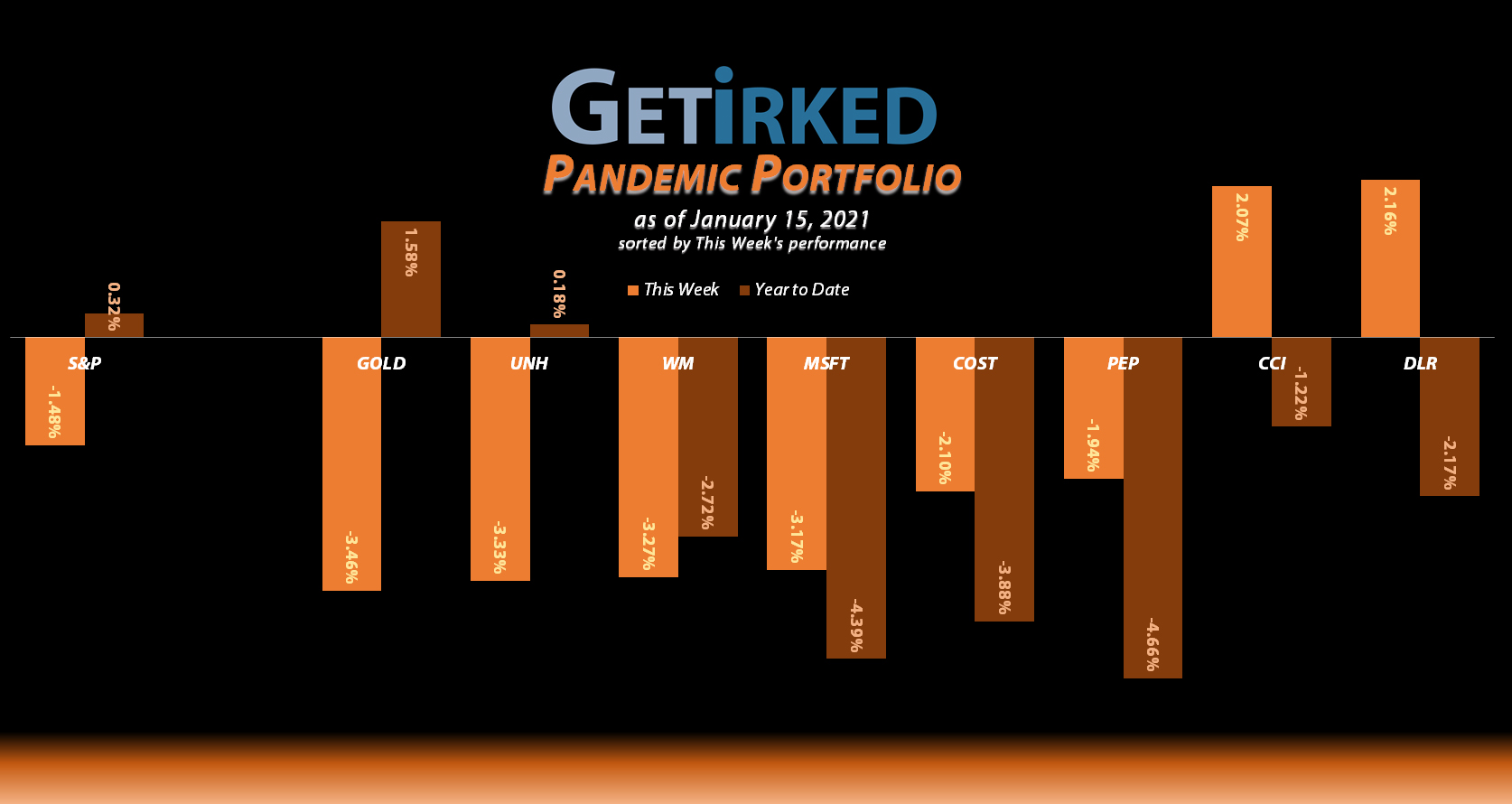

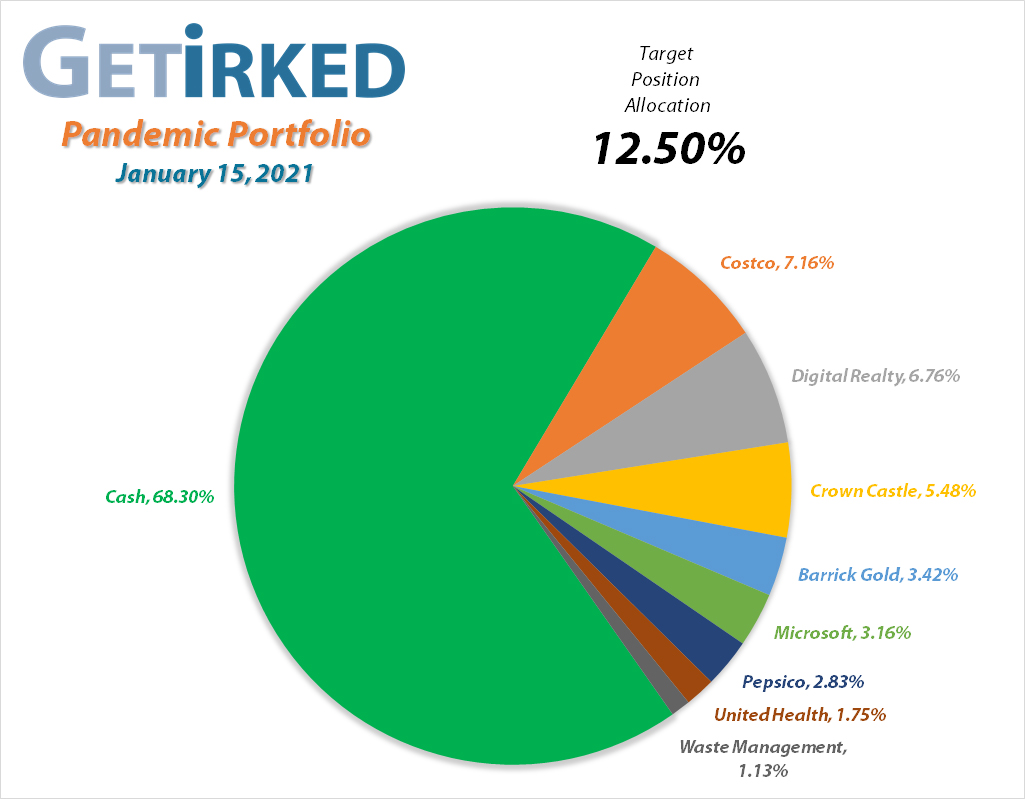

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $23.11

Per-Share Cost: $24.75 (Unchanged from last update)

Profit/Loss: -6.64%

Allocation: 3.418%* (-0.121% from last update)

Next Buy Target: $22.60

Not much has changed for Barrick Gold (GOLD) since the last update. Despite the endless money-printing, the yellow metal has come under a lot of selling pressure.

Some pundits believe the drop in price is due to paper versions of gold and silver flooding the market pushed by a well-known financial institution who’s been busted for manipulating the price of metals in the past.

I don’t feel any need to name names, but it rhymes JP Blorgan Blase. My next price target to add more to GOLD is $22.60 (which is rapidly approaching).

Costco (COST): Added to Position

Current Price: $362.16

Per-Share Cost: $331.02 (+3.170% from last update)

Profit/Loss: +9.41%

Allocation: 7.157%* (+1.709% from last update)

Next Buy Target: $297.60

As promised in the first update for 2021, my plan for this year was to get more aggressive in this portfolio, and I did that in spades when I added to Costco (COST) at $361.62 when it retested this level on January 15.

The buy raises my per-share cost +3.170% from $320.85 to $331.02 but also increases my allocation in this recession-proof reseller for the long-term. However, I positively hate buying up my per-share cost in positions, so I’m going to slow it down. My next buy target is about -10% lower than my new per-share cost at $297.60.

COST closed the week at $362.16, up +0.15% from where I added Jan. 15.

Crown Castle (CCI): Strategy Update

Current Price: $157.29

Per-Share Cost: $159.05 (Unchanged from last update)

Profit/Loss: -1.11%

Allocation: 5.484%* (+0.908% from last update)

Next Buy Target: $149.60

Crown Castle (CCI) appeared to come under selling pressure over the past week, briefly dipping below the $150 mark before finding significant support and rocketing up to finish the week at $157.29. Accordingly, I’ve raised my buy price target for the stock to $149.60, slightly above its last dip.

Digital Realty Trust (DLR): Strategy Update

Current Price: $136.48

Per-Share Cost: $135.57 (Unchanged from last update)

Profit/Loss: +0.67%

Allocation: 6.645%* (+0.116% from last update)

Next Buy Target: $126.90

Digital Realty Trust (DLR) came under selling pressure for much of the week, but not enough to trigger my buy order before bouncing harder. My buy price target for the stock is $126.90.

Microsoft (MSFT): Strategy Update

Current Price: $212.65

Per-Share Cost: $187.04 (Unchanged from last update)

Profit/Loss: +13.69%

Allocation: 3.162%* (-0.091% from last update)

Next Buy Target: $204.90

Microsoft (MSFT) continues to show strength during any selloff, however, with persistent comments from hedge funds and institutional investors that growth tech stocks are out, I’m holding pat with a $204.90 buying price target before I add to my position.

Pepsico (PEP): Strategy Update

Current Price: $141.39

Per-Share Cost: $128.49 (Unchanged from last update)

Profit/Loss: +10.04%

Allocation: 2.885%* (-0.050% from last update)

Next Buy Target: $135.40

Pepsico (PEP) continues to hold up during these turbulent times, even while competitor Coca-Cola (KO) got knocked down a few pegs. All that being said, consumer product plays like this one are incredibly slow movers, so I’m patiently waiting for PEP to drop to $135.40, my buy price target, before I add any more to the position.

UnitedHealth (UNH): Strategy Update

Current Price: $351.40

Per-Share Cost: $279.01 (Unchanged from last update)

Profit/Loss: +25.95%

Allocation: 1.690%* (+0.064% from last update)

Next Buy Target: $335.90

UnitedHealth (UNH) continues to evade any of my attempts to add to the position, suddenly bouncing and rocketing higher. Despite that, this one’s a volatile monster, and I’m more than happy waiting for it to drop to its past point of support around $335.90 before getting excited to add to this position.

Waste Management (WM): *New Position*

Current Price: $114.72

Per-Share Cost: $114.78 (New position)

Profit/Loss: -0.05%

Allocation: 0.566%* (New position)

Next Buy Target: $110.70

I’ve been watching Waste Management (WM) for some time as a potential recovery play for the Pandemic Portfolio (more astute visitors may have noticed in the Stock Shopping List for months now). I opened the position with a small buy at $114.78 when the markets lost strength on Thursday, Jan. 14, 2021.

While a garbage processing company might seem like a strange play on the recovery, it isn’t. Waste Management (WM) sees business increase whenever the economy’s on the rise as new construction and infrastructure buildouts produce a shocking amount of trash and recycling.

In addition, Waste Management is developing renewable energy by harnessing the gases produced by rotting garbage and converting into usable sources of energy including potentially recreating natural gas.

Combine its astounding performance over the years, its growth potential, and its 2%+ dividend yield ($2.30 per share annually) at the price I opened the position, and you’ve got an excellent long-term holding for a return to normalcy and potential infrastructure bills.

WM closed Friday at $114.72, down -0.05% from where I added on Jan. 14.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.