Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #11

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Getting more aggressive in 2021

Since the last update, I’ve been able to pick up a few more shares in some positions, but given the ridiculous strength of the markets, it’s time to get more aggressive.

In this update, you can check out how I’ve substantially increased buying price targets for the Pandemic Portfolio’s positions in an effort to lock in more exposure to the markets in the new year.

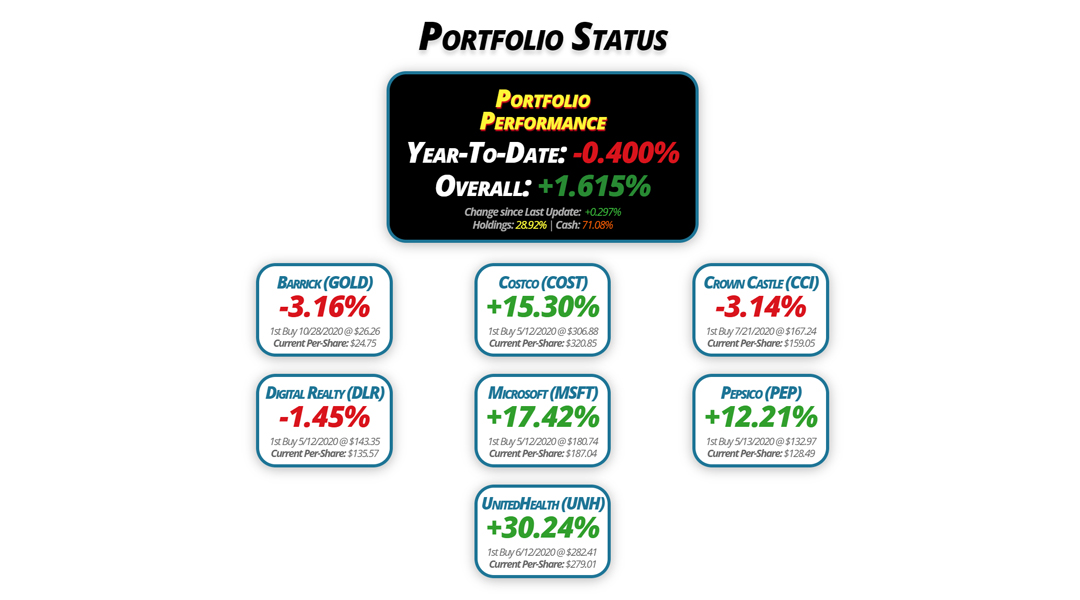

Portfolio Status

Portfolio

Performance

Year-To-Date: -0.400%

Overall: +1.615%

Change since Last Update: +0.297%

Holdings: 28.92% | Cash: 71.08%

Barrick (GOLD)

-3.16%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $24.75

Digital Realty (DLR)

-1.45%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $135.57

Costco (COST)

+15.30%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $320.85

Microsoft (MSFT)

+17.42%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $187.04

UnitedHealth (UNH)

+30.24%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $279.01

Crown Castle (CCI)

-3.14%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $159.05

Pepsico (PEP)

+12.21%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $128.49

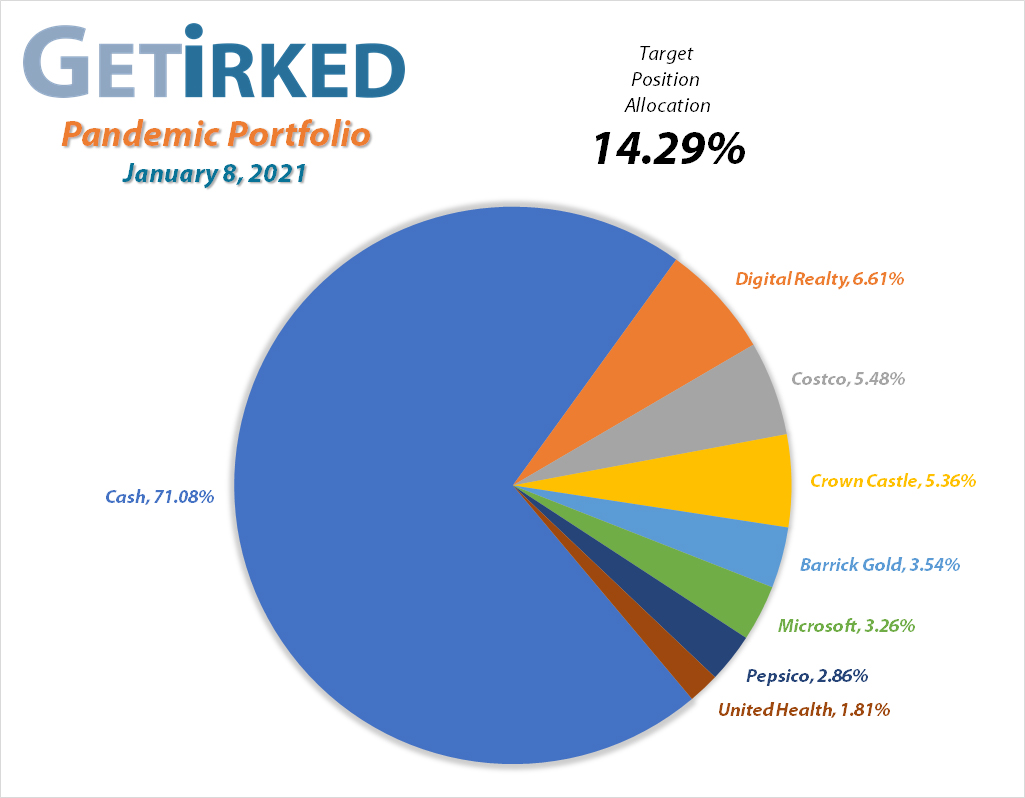

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

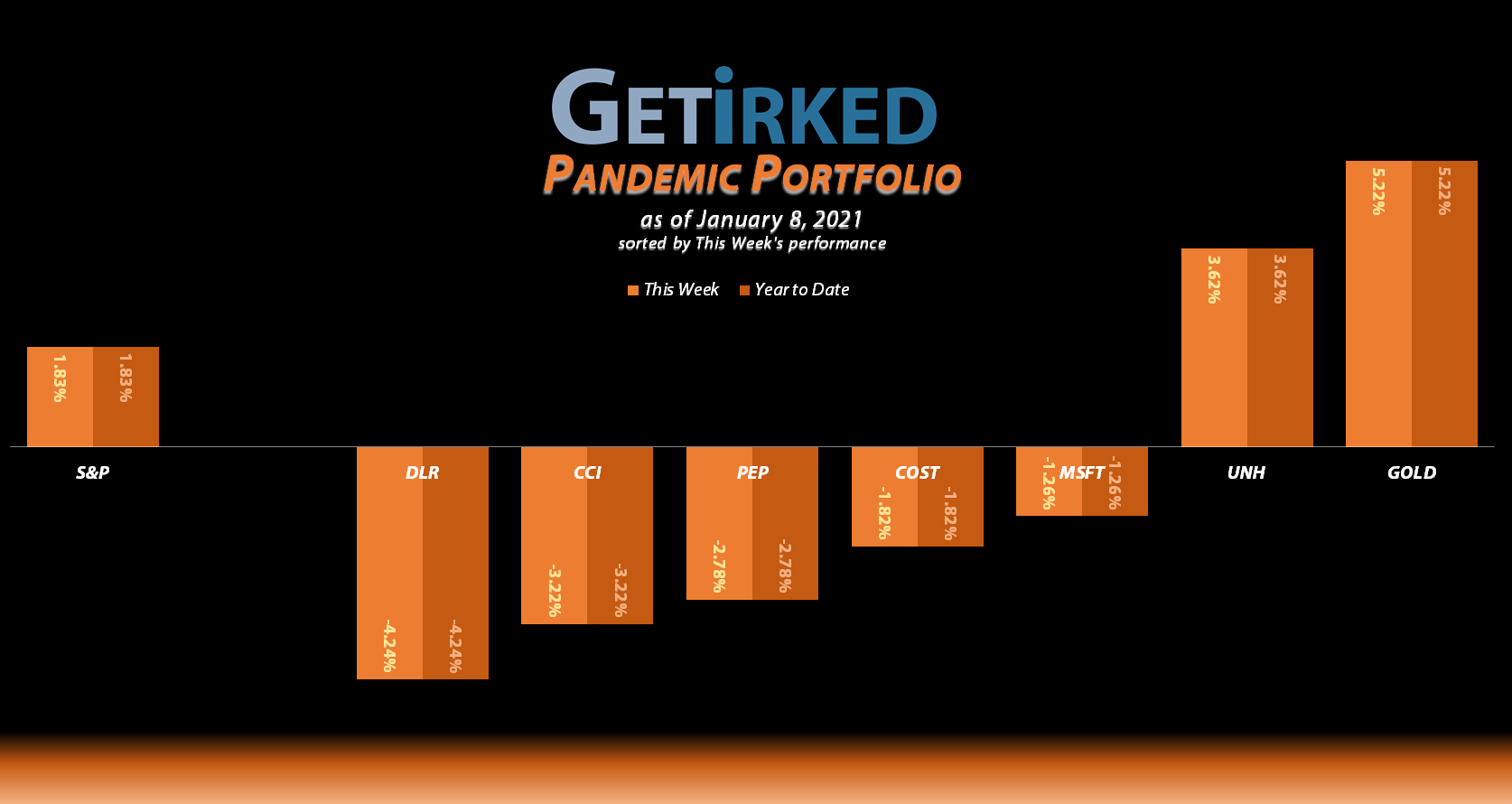

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position

Current Price: $23.97

Per-Share Cost: $24.75 (-1.040% from last update)

Profit/Loss: -3.16%

Allocation: 3.539%* (+0.438% from last update)

Next Buy Target: $22.60

I added to my Barrick Gold (GOLD) position when it started to show weakness on Tuesday, December 22 with an order that filled at $22.46. The buy lowered my per-share cost -1.040% from $25.01 to $24.75. Thanks to the bounce, my next buy target for the stock is $22.60 to load up more.

As of writing, GOLD closed at $23.97, up +6.72% from where I added.

Costco (COST): Strategy Update

Current Price: $369.94

Per-Share Cost: $320.85 (Unchanged from last update)

Profit/Loss: +15.30%

Allocation: 5.448%* (+.028% from last update)

Next Buy Target: $345.90

Costco (COST) has been showing weakness since the start of 2021, however, its resolute nature combined with a desire to be more aggressive with the Pandemic Portfolio in 2021 motivated me to raise my price target to $345.90.

Crown Castle (CCI): Added to Position

Current Price: $154.06

Per-Share Cost: $159.05 (-1.38% from last update)

Profit/Loss: -3.14%

Allocation: 4.576%* (+0.786% from last update)

Next Buy Target: $141.40

Crown Castle (CCI) paid out its quarterly dividend ($5.32/share annually = $1.33/share quarterly) on December 31, 2020 which I reinvested using my broker’s Dividend Reinvestment Program (DRiP).

On January 6, CCI continued to fall under pressure with the rest of the market, triggering a buy order which filled at $152.38 on Wednesday.

The combination of the dividend and the purchase lowered my per-share cost by -1.38% from $161.28 to $159.05. From here, my next buy price target is $141.40, above a past point of support.

CCI closed the week at $154.06, up +1.10% from where I added Wednesday.

Digital Realty Trust (DLR): Strategy Update

Current Price: $133.60

Per-Share Cost: $135.57 (Unchanged from last update)

Profit/Loss: -1.45%

Allocation: 6.645%* (-0.039% from last update)

Next Buy Target: $128.40

Digital Realty Trust (DLR) continues to trade in a very strict range, finding support between $127-$128. Accordingly, I increased my buying price target to $128.40 in order to add more of this transition-to-the-cloud real estate play to the portfolio.

Microsoft (MSFT): Strategy Update

Current Price: $219.62

Per-Share Cost: $187.04 (Unchanged from last update)

Profit/Loss: +17.42%

Allocation: 3.253%* (+0.006% from last update)

Next Buy Target: $201.30

Microsoft (MSFT) continues to demonstrate undying strength under any selloff or selling pressure, motivating me to raise my buying price target to $201.30 in an attempt to add more of this high-flying position to the portfolio if we see a more significant selloff in the coming months as many analysts expect.

Pepsico (PEP): Dividend Reinvestment

Current Price: $144.18

Per-Share Cost: $128.49 (-0.711% from last update)

Profit/Loss: +11.41%

Allocation: 2.885%* (-0.043% from last update)

Next Buy Target: $134.90

Pepsico (PEP) paid out its quarterly dividend on Friday (January 8), $1.023 per share paid each quarter ($4.09 annually for a yield of 2.837%). The dividend reinvested into my position, lowering my per-share cost -0.711% from $129.41 to $128.49.

In addition, PEP saw quite the rally since my last update, inspiring me to raise my buying price target substantially to $134.90, above a past point of support for PEP. With its resilient prospects and bountiful dividend, PEP is definitely a stock I wouldn’t mind having more of in the portfolio.

UnitedHealth (UNH): Strategy Update

Current Price: $363.39

Per-Share Cost: $279.01 (Unchanged from last update)

Profit/Loss: +30.24%

Allocation: 1.690%* (+0.12% from last update)

Next Buy Target: $315.90

UnitedHealth (UNH) continues to be a stalwart in the portfolio, seeing renewed strength as Haven, the attempt by JP Morgan (JPM), Amazon (AMZN), and Berkshire-Hathaway (BRK.B) was quietly scuttled in the first week of 2021. In order to add more to the portfolio, I’ve substantially raised my buying price target to $315.90.

* Target allocation for each position in the portfolio is 14.29% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.