Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #1

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

You may have noticed it’s been a few weeks since the kickoff episode of the Pandemic Portfolio. For long-term investment portfolios like this one, the activity level can often be… slow.

In other words, with stocks picked intentionally for the long-term, and even when we’re in volatile markets like we are now, a long-term portfolio may be one where all you do from week-to-week is check in on it.

With the Pandemic Portfolio, I will write updates, however, the updates will only come when something has happened, like this week.

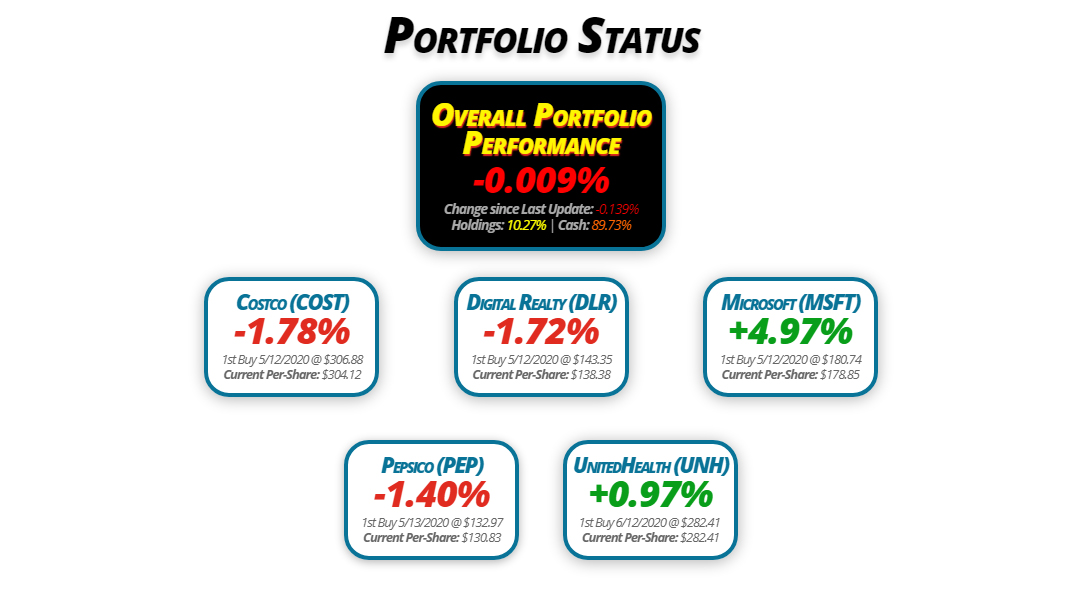

Portfolio Status

Overall Portfolio

Performance

-0.009%

Change since Last Update: -0.139%

Holdings: 10.27% | Cash: 89.73%

Costco (COST)

-1.78%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $304.12

Digital Realty (DLR)

-1.72%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $138.38

Microsoft (MSFT)

+4.97%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $178.85

Pepsico (PEP)

-1.40%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $130.83

UnitedHealth (UNH)

+0.97%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $282.41

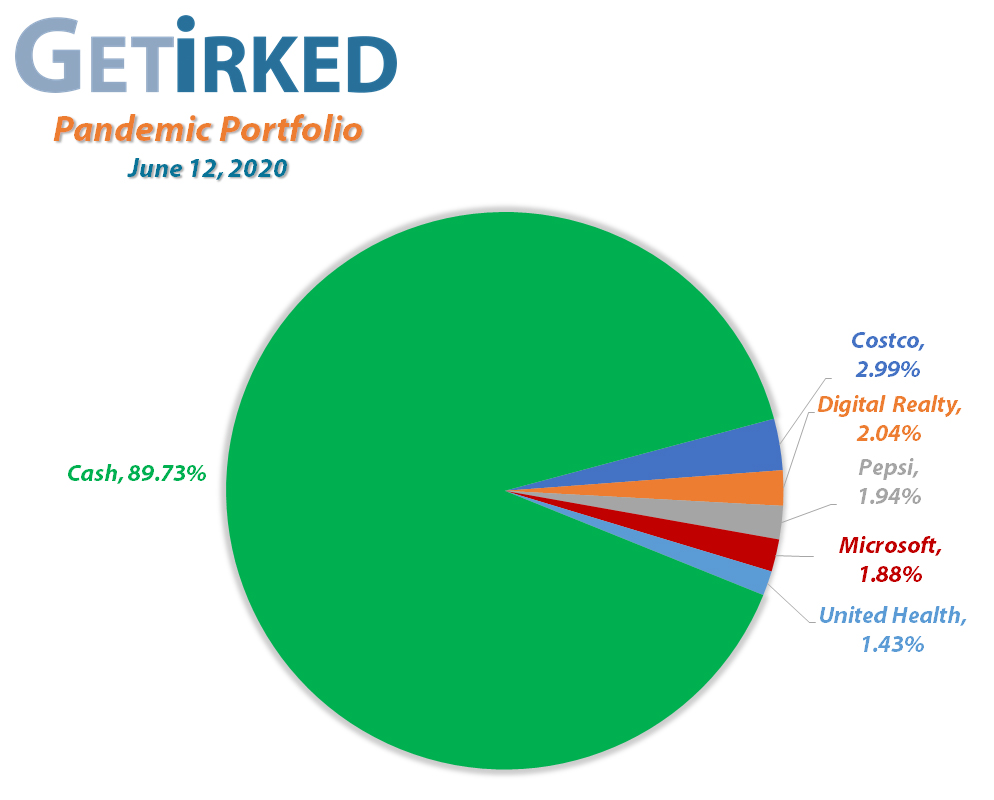

Portfolio Breakdown

Click image for an enlarged version.

Moves Since Last Update

Costco (COST): Added to Position

Current Price: $298.70

Per-Share Cost: $304.12 (reduced -0.90% from last time’s $306.88)

Profit/Loss: -1.78%

Allocation: 2.987%*

Next Buy Target: $289.60

Costco pulled back quite a bit during the selloff that came this week following news of increasing COVID-19 cases in reopened states, pulling back from $315.35 to test its 200-Day moving average around $300.50 during trading on Thursday.

Given its relative strength holding up during selloffs and Costco’s significant advantage during recessions and pandemics, I raised my price target and used a trailing stop order which filled at $301.36 on Friday.

Thursday’s buy order reduced my per-share cost marginally by -0.90% from $306.88 to $304.12.

COST closed the week at $298.70, down -0.88% from Friday’s buy price.

Digital Realty Trust (DLR): No Changes

Current Price: $136.00

Per-Share Cost: $138.38

Profit/Loss: -1.72%

Allocation: 2.040%*

Next Buy Target: $130.90

– No moves since last update –

Microsoft (MSFT): Dividend Reinvestment

Current Price: $187.74

Per-Share Cost: $178.85 (reduced -0.13% from last update)

Profit/Loss: +4.97%

Allocation: 1.935%*

Next Buy Target: $178.85

Microsoft (MSFT) paid out its quarterly dividend on Thursday (June 11), paying shareholders $0.51 per share of stock held (the annual yield is 1.09% at the current price). When using a broker’s Dividend Reinvestment Program (or DRiP), that dividend is paid out in shares (and fractional shares) of stock instead of cash, adding to a portfolio’s holding and compounding over time.

In the case of my very new Microsoft holding, the dividend lowered my per-share cost -0.13% from $179.09 to $178.85. Nothing significant, to be sure, but every little bit helps.

Pepsico (PEP): Added to Position

Current Price: $129.00

Per-Share Cost: $130.83 (reduced -1.09% from last update)

Profit/Loss: -1.40%

Allocation: 1.935%*

Next Buy Target: $125.40

Pepsico (PEP) sold off with the rest of the market as we headed into the end of the week, offering me the opportunity to add to my position when it crossed through my buy target, filling an order at $127.94 to add more during the test of the lows on Friday.

Friday’s buy lowered my per-share cost -1.09% from $132.27 to $130.83 with my next buy target for the stock at $125.40

PEP closed the week at $129.00, up +0.83% from where I added Friday.

UnitedHealth (UNH): Opened June 12 @ $282.41

Current Price: $285.15

Per-Share Cost: $282.41

Profit/Loss: +0.97%

Allocation: 1.426%*

Next Buy Target: $260.90

I’ve been wanting to open a position in UnitedHealth (UNH) ever since I narrowly missed buying at its low in May with a target price that was lower than its bottom. On Thursday, UNH once again stopped just below my target so I raised my price target in case the stock tested its lows which it did on Friday (and then some).

Despite providing huge growth opportunities, UnitedHealth is incredibly volatile along with the rest of the healthcare sector. In this case, UNH dropped -11.76% this week from its new $315.84 all-time high made Monday to $278.70 on Friday.

My buy order filled at $282.41 on Friday with my next buy targeting $260.90, slightly below UNH’s 200-Day Moving Average (MA).

UNH closed the week at $285.15, up +0.97% from my opening price.

* Target allocation for each position in the portfolio is 20% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.