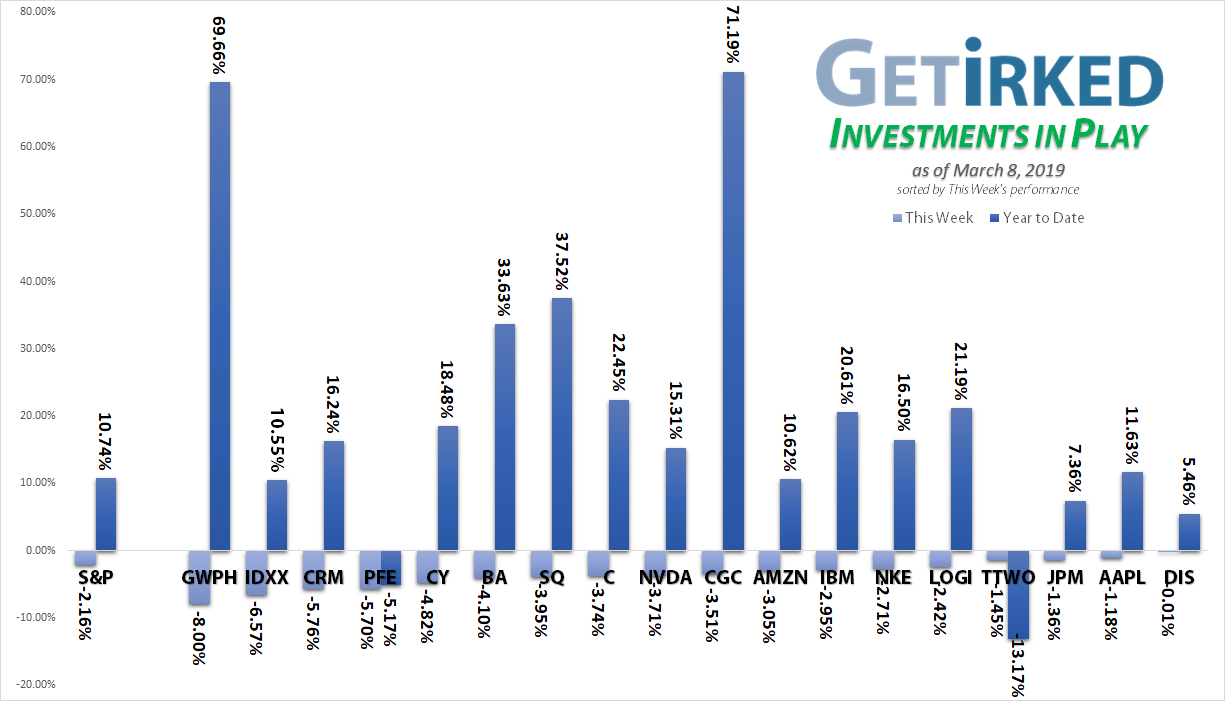

Highlights from the Week

Biggest Winner: Disney (DIS)

During market-wide sell-offs like we saw this week, there are no winners, just lesser losers. That logic makes Disney (DIS) our Biggest Winner this week, holding up remarkably well with just a -0.01% loss compared to the S&P 500’s -2.16% pullback. Announcements about the Mouse House’s new streaming service offering every movie Disney’s ever made led many analysts to predict that Netflix (NFLX) has a bigger competitor coming down the pike. When it comes to content creation, no one beats Disney.

Biggest Loser: GW Pharmaceuticals -and- Pfizer (PFE)

After rocketing 17%+ to nose-bleed territories last week, GW Pharma (GWPH) was due for a pullback this week, so it should have come as no surprise when the roaring cannabis pharmaceutical company pulled back 8.00% this week.

Pfeizer (PFE) may be the bigger loser, however as this week’s loss of -5.00%+ caused the stock to lose all of its annual gains. Even when compared to its biopharma brethren, PFE is not holding up well. Some might argue Take Two (TTWO) is in a similar situation, down more than 10% for the year, however the entire video game sector has been taking it on the chin lately thanks to Battle Royale First Person Shooter, Fortnite, and now Electronic Arts’ (EA) newest foray into the space – Apex Legends.

This Week’s Moves

Let’s Get Passive (Investing, that is)!

Although the market started to roll over this week, our high-flying stocks haven’t pulled back enough to make it to our target buying points so we actually made no moves in our individual-stock portfolios this week.

Instead, let’s take a look at the different ETFs we’ve been building in our long-term passive accounts!

(Click either chart to see an enlarged version)

Building ETF Portfolios

When investing in Exchange Traded Funds (ETFs), since each ETF is made up of an entire sector or market, the diversification offers a degree of safety not available in purchasing individual stocks – investors don’t have to worry about a specific company’s performance. However, not all ETFs are created equal.

Investors can vary the amount of exposure to a sector or space by selecting from a variety of different ETFs offered by Vanguard Funds (read more about our preferred provider in our post about Roboadvisers).

We recommend choosing percentage targets for each of your preferred sectors, while ensuring you have exposure to the entire market, the international market, downturn plays, and slow-growth protected plays.

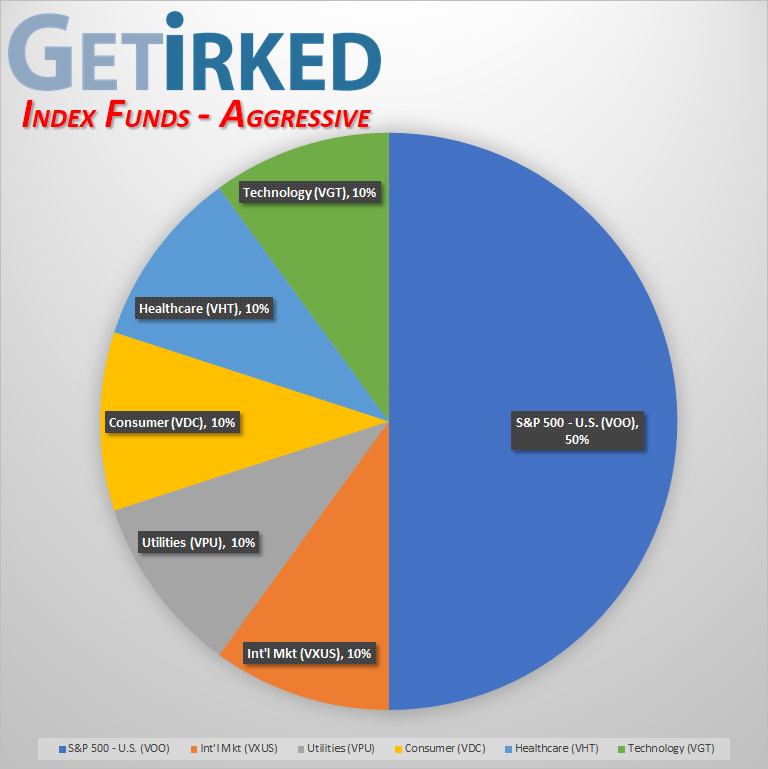

Get Irked holds two portfolios – a long-term investment portfolio (see the Aggressive Portfolio chart above) and a Roth IRA (see the Moderate Portfolio chart above).

Aggressive Portfolio

- S&P 500 (VOO) – 50% – For our more aggressive portfolio, we are using the S&P 500 ETF (VOO) instead of the total market (VTI) so we can more specifically target the faster-growing companies in that portfolio.

- International Markets (VXUS) – 10% – For broad exposure to the international markets where we can capitalize on global growth, we use VXUS, the International Stock Market ETF.

- Utilities (VPU) – 10% – The Utilities ETF takes the place of a bond issue as many analysts consider the Utilities sector a good alternative to bonds. Although the sector carries higher-risk than bonds, it also offers higher returns.

- Consumer Staples (VDC) – 10% – In addition to the Utilities ETF, we use the Consumer Staples (VDC) sector to protect our portfolio in downturns as professional investors will put money into Consumer Staples during market downturns as consumers won’t stop buying staples like shampoo or food, even in downturns.

- Targeted Sectors – Healthcare (VHT) and Technology (VGT) – 20% total – We believe that healthcare will continue to be a growth area as baby boomers retire and begin to age. We also believe that Technology will continue to be a growth sector as technological advances seem to affect the entire market. We put 10% into each sector.

Moderate Portfolio

- Total Market Index (VTI) – 50% – Instead of targeting just the S&P 500 as in our Aggressive Portfolio, we use the Total Stock Market Index (VTI) to capture all of the market.

- International Exposure – Total World – including U.S. – (VT) and Emerging Markets (VWO) – 30% – We broke up our international exposure in our Roth to capture Emerging Markets, a sector specifically targeting smaller countries just now growing into their global economy. Their long-term prospects could offer greater gains (but carry a bit of extra risk, which is why we’re only giving 10% exposure to VWO and 20% to VT).

- Energy (VDE) – 15% – We feel the Energy sector offers a lot of interesting future potential with the risk of renewables as well as the ever-changing oil and natural gas sectors. VDE captures all of these areas and became our choice.

- Total Bond Market (BND) – 5% – Although professional advisers recommend investors allocate 10% to the bond market, our long-term time horizon offers us the ability to take on more risk, so although we still feel exposure to the space is important, we lowered that amount to 5%.

Make your own portfolio!

Some of the biggest benefits to investing in ETFs are choosing your own portfolio and eliminating exposure to a single company’s risk.

You can select from the wide variety of ETFs on the market and elect to have more (or less) exposure to a certain area. To see all the ETF’s that Vanguard Funds offer, click here.

In Summary

Further Losses Ahead?

With the global economic slowdown in full swing and no positive trade deal news on the foreseeable horizon, we’re expecting the market to continue its sell-off next week. This isn’t bad news, however, as we have a lot of dry powder we’ve been wanting to put to work both in our self-managed portfolios as well as our Vanguard Funds.

Want Further Clarification?

As always, if you have questions any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!