June 14, 2019

Portfolio Allocation

Positions

%

Target Position Size

%

Desired Cash On-Hand

Current Position Performance

Boeing (BA)*

+530.05%

1st Buy 2/14/2012 @ $79.58

Current Per-Share Cost: $0.00*

Square (SQ)*

+519.78%

1st Buy 8/5/2016 @ $11.10

Current Per-Share Cost: $0.00*

Nvidia (NVDA)

+390.61%

1st Buy 9/6/2016 @ $63.10

Current Per-Share Cost: $29.48

Apple (AAPL)*

+382.78%

1st Buy 4/18/2013 @ $56.38

Current Per-Share Cost: $0.00*

Nike (NKE)*

+316.87%

1st Buy 2/14/2012 @ $26.71

Current Per-Share Cost: $0.00*

Disney (DIS)*

+280.83%

1st Buy 2/14/2012 @ $41.70

Current Per-Share Cost: $0.00*

Canopy Growth (CGC)

+121.99%

1st Buy 5/24/2018 @ $29.53

Current Per-Share Cost: $17.50

IDEXX Labs (IDXX)

120.77%

1st Buy 7/26/2017 @ $167.29

Current Per-Share Cost: $120.00

GW Pharma (GWPH)

+53.90%

1st Buy 7/25/2018 @ $142.28

Current Per-Share Cost: $111.03

Salesforce.com (CRM)

+24.91%

1st Buy 6/11/2018 @ $134.05

Current Per-Share Cost: $120.10

Amazon (AMZN)

+15.71%

1st Buy 2/6/2018 @ $1378.96

Current Per-Share Cost: $1,615.85

IBM (IBM)

+13.36%

1st Buy 11/6/2018 @ $120.87

Current Per-Share Cost: $119.23

Logitech (LOGI)

+12.55%

1st Buy 11/11/2016 @ $24.20

Current Per-Share Cost: $33.01

Citigroup (C)

+10.58%

1st Buy 10/26/2017 @ $74.06

Current Per-Share Cost: $61.02

JP Morgan (JPM)

+7.58%

1st Buy 10/26/2017 @ $102.30

Current Per-Share Cost: $101.47

Pfizer (PFE)

+6.99%

1st Buy 1/28/2019 @ $40.50

Current Per-Share Cost: $39.97

Take Two Inter (TTWO)

+2.35%

1st Buy 7/30/2018 @ $120.99

Current Per-Share Cost: $107.82

Dow (DOW)

+1.39%

1st Buy 5/3/2019 @ $53.18

Current Per-Share Cost: $50.45

Xilinx (XLNX)

-1.83%

1st Buy 5/13/2019 @ $111.57

Current Per-Share Cost: $107.39

3M (MMM)

-3.33%

1st Buy 5/1/2019 @ $188.97

Current Per-Share Cost: $172.42

Kohl’s (KSS)

-3.44%

1st Buy 6/3/2019 @ $50.45

Current Per-Share Cost: $49.47

* Indicates a position where the capital investment was sold.

Divide position’s current price by gains to calculate initial buy price

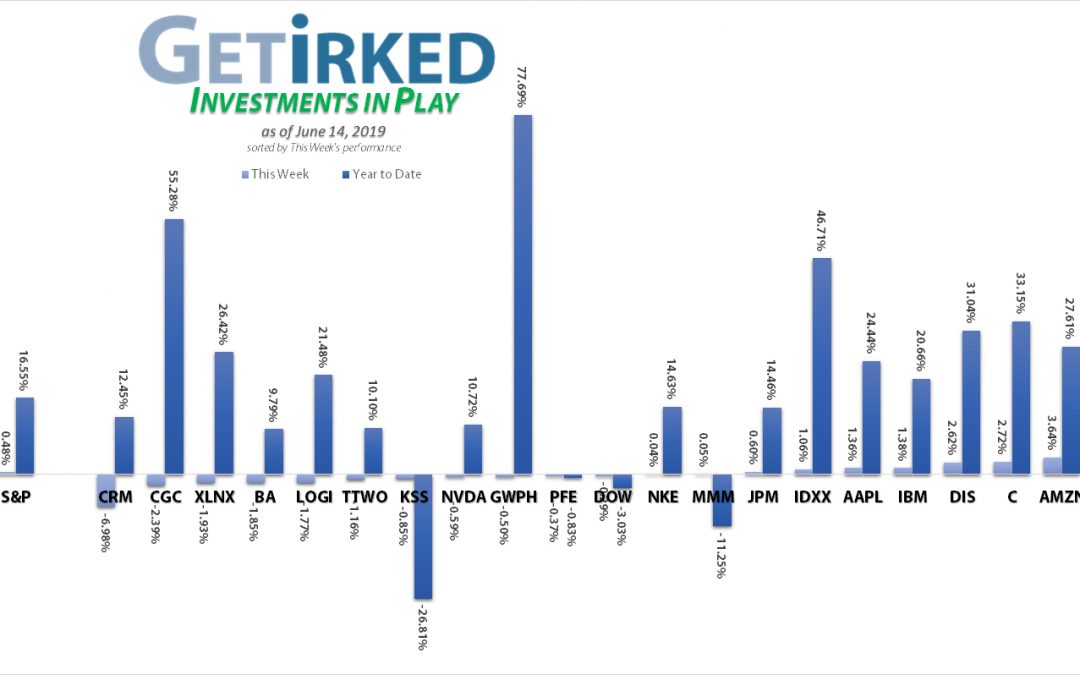

Highlights from the Week

Biggest Winner: Square (SQ)

Despite all the new hotness in the fintech space, Square (SQ) continues to be a market favorite, earning yet another Weekly Winner award with a +4.57% gain to round out a Year-To-Date gain of 32.33%. That Jack Dorsey knows what he’s doing!

Biggest Loser: Salesforce.com (CRM)

Salesforce.com disappointed investors by buying Tableau Software (DATA) this week for an all-stock transaction, losing -6.98% in a week. However, Co-CEO Marc Benioff has done this before when CRM acquired Mulesoft last year and rocketed to higher highs. While it’s unpleasant to experience a loss, we have faith this one’s headed higher.

This Week’s Moves

Kohl’s (KSS): Added to Position

When Kohl’s (KSS) tested support on Friday, we added to our position at $47.75, lowering our per-share cost to $49.47 from $50.45.

We decided to increase our allocation a little earlier than our initial plan when KSS started showing significantly more support at these levels, and we want to capitalize on the dividend which is 5.613% at $47.75.

Our next target is much lower at $39.88, a move Kohl’s has actually made in the past.

KSS closed the week at $47.77, basically a rounding error of +$0.02 from where we added on Friday.

Want Further Clarification?

As always, if you have questions about any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

You must be logged in to post a comment.