Click any chart for an enlarged version

Highlights from the Week

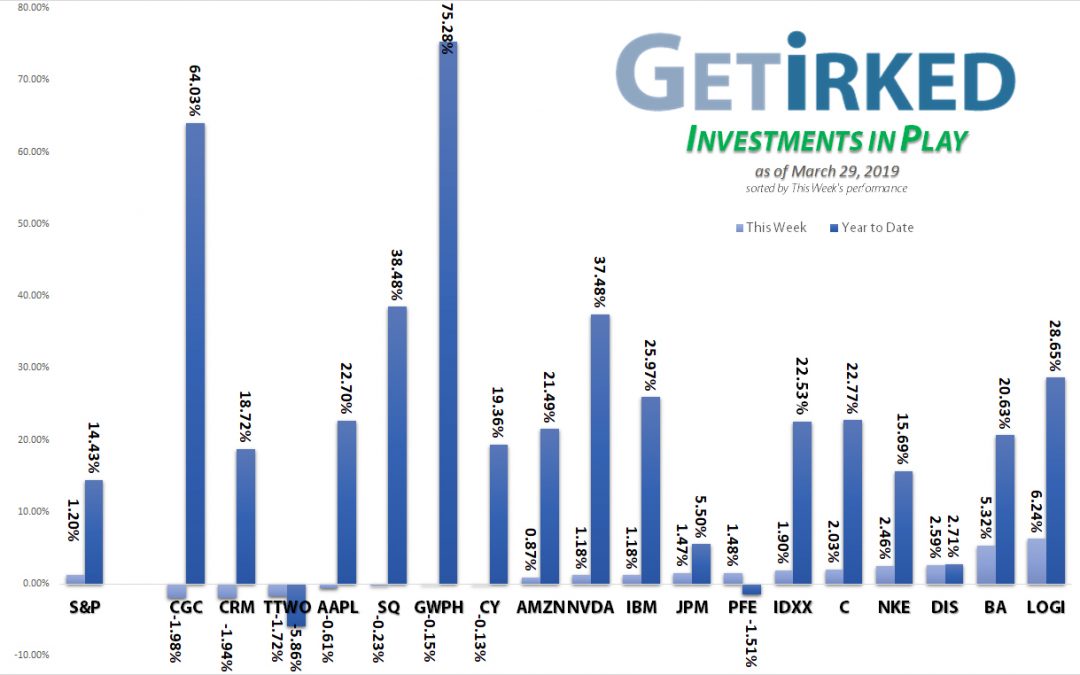

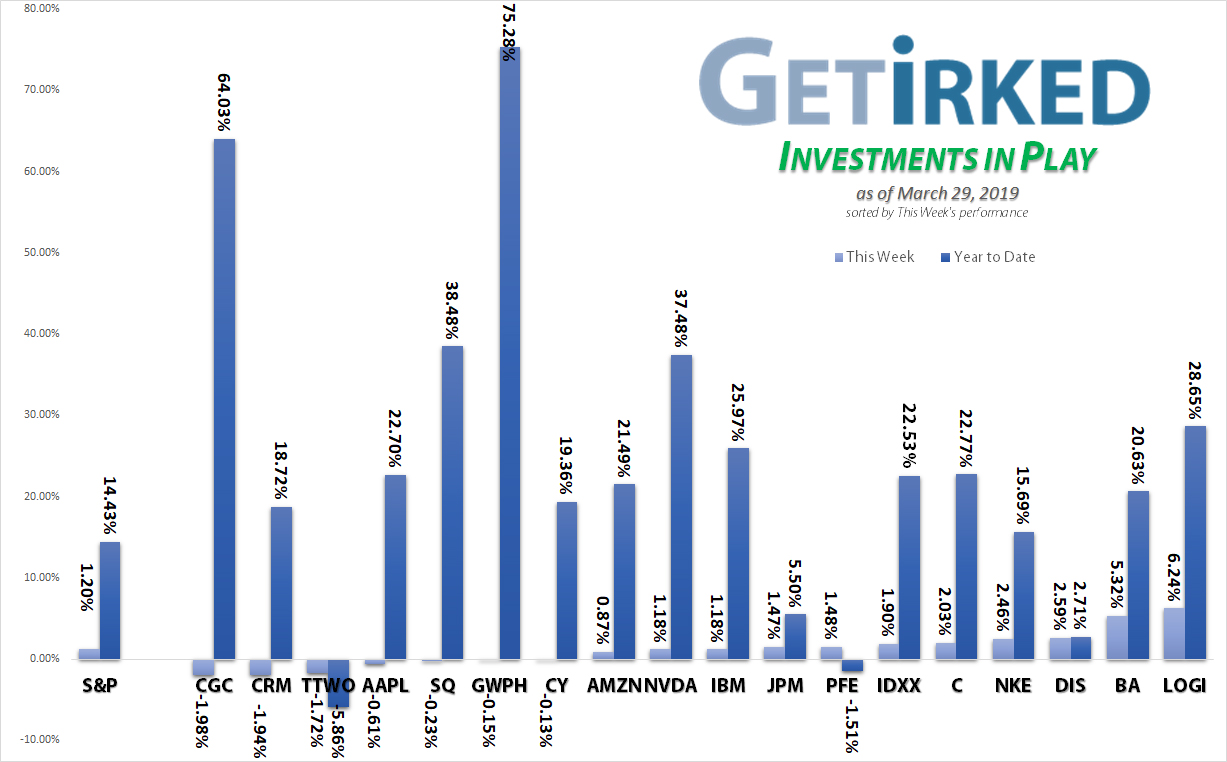

Biggest Winner: Logitech (LOGI)

Logitech (LOGI) has long been our favorite way to play the video game/e-sports sector due to the fact that it’s platform-agnostic: Logitech makes peripherals for Sony’s Playstation, Microsoft’s Xbox, Nintendo’s Switch, and, their main product category, for desktops and laptops (both Windows and OS/X).

Throw in a nearly 2% dividend (which no other video game company offers) and you’ve got an excellent long-term play on video games and e-sports. Oh, and did we mention Logitech popped 6.24% this week and is up nearly 30% Year-to-Date?

Biggest Loser: Canopy Growth Corp (CGC)

The cannabis sector got hit hard this week (likely due to institutional investors pulling money out to buy Lyft (LYFT) and the 200+ other IPOs coming to a market near you), but, that being said, a loss of less than 2% isn’t the end of the world for the biggest player in the sector, Canopy Growth (CGC).

Although Canopy was our biggest loser this week, CGC is the only consumer-focused cannabis play we recommend for long-term investors. If you want medical cannabis, GW Pharmaceuticals (GWPH) is the only way to fly.

This Week’s Moves

Boeing (BA)

Despite its 737-MAX woes, we dipped our toe back into Boeing at these levels, using a Trailing Stop (TS) order to replace 1/4 of the shares we sold at $429.72 at a price of $375.40, pocketing the 12.6% profits for use elsewhere while still having exposure to this high-flying airline manufacturer with a decent dividend (more than 2% even at these levels).

Boeing released a potential fix (hopefully) for the 737-MAX mid-week and ended the week higher at $381.42 with our position up +540.97%.

Citigroup (C)

Although the banks continued to get hit on interest rate concerns, we used a Trailing Stop (TS) order to add to our Citigroup position when it dropped to lower levels at $61.30.

Although the financials aren’t performing well, we wanted to take advantage of Citigroup’s increased dividend yield at these levels of nearly 3%.

Citigroup closed the week higher at $62.22 with our position down -2.39%.

Cypress Semiconductor (CY)

During the market pullback, we couldn’t resist adding to one of our most successful investments, Cypress Semiconductor (CY).

Cypress is an incredibly underrated and relatively unknown company that makes many of the components going into cell phones and cars throughout the world. Cypress also offers a substantial dividend of nearly 3% – incredibly unusual for a technology company.

We added to our position using a trailing-stop (TS) order that filled at $14.95. CY closed the week slightly lower at $14.92 with our position up +593.72%.

Nike (NKE)

Although Nike’s small dividend of 1% isn’t much to write home about, NKE has shown incredible relative strength in the decreasing market, enticing us to add a little to our position at $83.75, down more than 5% from its recent high.

Nike closed the week slightly higher at $84.21 with our position up +318.08%.

In Summary

Who Knows Where The Market Goes?

Truthfully, the current market action has been some of the most challenging we’ve seen, as determining whether we’re headed higher or lower is anyone’s guess.

As we always recommend, develop a trading plan, regularly update your stock shopping list, and make sure you Buy in Stages for your long-term investments.

Capitalize on the potential upside by buying some of your favorite positions, but be sure to keep some funds on the sidelines in case the market ends up rolling over so you can buy more when your stocks are “on sale.”

Want Further Clarification?

As always, if you have questions any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!