Click any chart for an enlarged version

Highlights from the Week

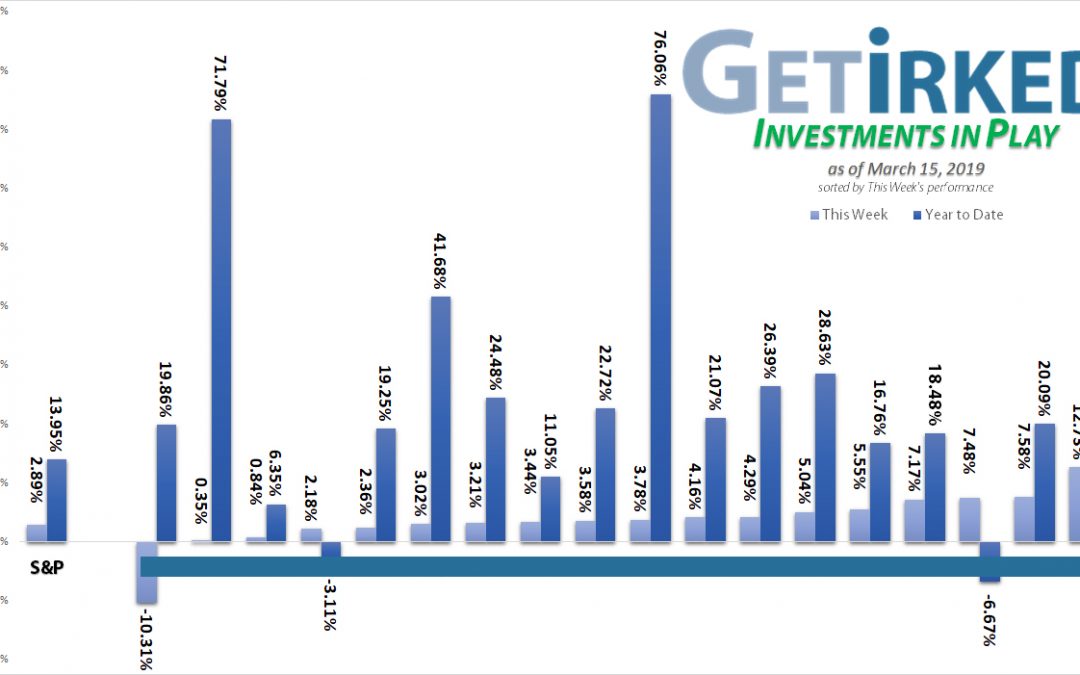

Biggest Winner: Nvidia (NVDA)

Nvidia came back from the dead this week, buying semiconductor/AI Mellanox for $6.9B, its largest acquisition ever. The Mellanox purchase was key for Nvidia for multiple reason – it offered Nvidia even more access to the AI space, however, almost more importantly, Nvidia bought Mellanox out from under Intel (INTC), one of Nvidia’s key competitors in the space. The purchase was well-received on the street, giving NVDA a weekly jump of +12.73%.

Biggest Loser: Boeing (BA)

Unless you were under a rock this week, you heard about the tragic crash of one of Boeing’s 737 MAX-8 planes resulting in the heart-wrenching loss of 157 lives. At this time, investigators still don’t know the cause of the crash, however given a similar crash less than six months ago in the identical aircraft, all 737 MAX-8 and MAX-9 planes – Boeing’s best-selling models – have been grounded globally until further notice. BA dropped -10.31% this week.

This Week’s Moves

Given the upward move overall in the market, there were once again no moves in Get Irked’s Investments in Play portfolio this week. We have taken all the profits we want and are simply waiting for a pullback in the markets to put the money to work.

Boring? Maybe. However, professional traders will tell you that the most dangerous time for a trader or an investor is when they start making irrational trades out of pure boredom.

Taking emotion out of the equation always leads to better results.

In Summary

This Week’s Lesson is Diversification

We know we’re repeating ourselves when we talk about the power of diversification, but that’s because diversification really is that important.

As you can see from our charts, Boeing (BA) makes up nearly 10% of our entire portfolio (including our cash position, BA is 5.78% as shown in the above chart). Despite a drop in BA stock of more than 10% just this week, our portfolio gained +2.27% over last week thanks to the diversified stocks from other sectors that make up this portfolio.

If you would like even more diversified protection, consider using sector-specific Exchange Traded Funds (ETFs). For example, Vanguard’s Industrials ETF (VIS) offers exposure to big-cap industrials like Boeing (BA) and Caterpillar (CAT) without company-specific risk. Despite Boeing’s death-drop, VIS gained +1.58% this week thanks to its diversification even being specifically targeted on industrials.

To learn more about Index Funds and sector-specific ETFs, read our feature on the topic: “How do you pick Exchange Traded Funds and Index Funds.“

Want Further Clarification?

As always, if you have questions any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!