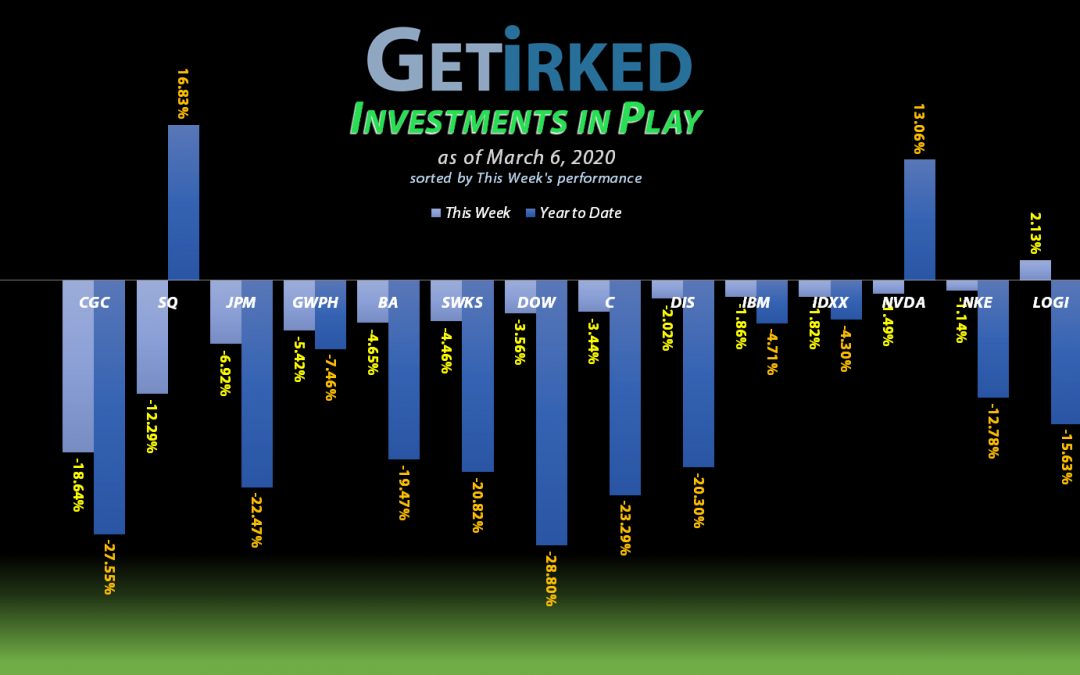

March 6, 2020

The Week’s Biggest Winner & Loser

Apple (AAPL)

Apple (AAPL) had an epic +5.73% from last week’s lows following analysts basically coming out and asking, “What in the name of all that’s holy is this stock doing in the $250s?!”

Between the millenials and Tim Cook’s seemingly Midas touch, Apple is definitely a stock to watch as it won this week’s Biggest Winner by a mile!

Canopy Growth (CGC)

A bad sector in a bad market at a bad time – there was just no helping Canopy Growth (CGC) this week as it lost a whopping -18.64% (especially bad in comparison with the S&P 500’s +0.61% week-over-week gain) after one bad news story after another.

Ouch! Definitely the winner of this week’s biggest loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+718.94%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$465.69)*

Apple (AAPL)

+472.72%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$113.27)*

Square (SQ)

+430.37%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$43.58)*

Nike (NKE)

+349.44%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$43.87)*

Disney (DIS)

+250.46%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $11.55**

Nvidia (NVDA)

+248.25%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$46.12)*

IBM (IBM)

+131.98%**

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $38.78**

IDEXX Lab (IDXX)

+113.84%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $116.86

Logitech (LOGI)

+22.46%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.49

JP Morgan (JPM)

+16.87%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $92.48

Citigroup (C)

+5.34%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $58.17

Skyworks (SWKS)

-9.26%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $105.47

Dow (DOW)

-15.89%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $46.33

Canopy (CGC)

-17.79%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $18.59

GW Pharm (GWPH)

-18.64%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $118.92

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

** For more accurate profit %, positions with extremely reduced per-share costs are calculated in the same manner as positions with sold capital investment.

This Week’s Moves

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corporation (CGC) lost support during the day on Tuesday following news that the company would be laying off 500 employees and closing greenhouses to reduce costs.

The stock dropped through my price target of $17.55 and triggered a trailing stop order I had which filled at $17.15.

Trailing stop orders are a type of contingency order which tell the broker that you’d like to take action a certain percentage or dollar amount from that point. In this case, I set a trailing stop that would trigger at $17.55 and fill when/if the stock bounced a certain amount.

Sometimes during volatile markets, this can result in very poor fill prices, however, in this case, my tight trailing stop allowed me to get filled at a -2.28% discount from my target price. The buy lowered my per-share cost -1.85% from $18.94 to $18.59.

While the announcement certainly isn’t good news, I believe in the long-term prospects for the company so I will continue to Buy in Stages. My next buy target for CGC is $14.22, near its all-time low.

CGC closed the week at $15.28, down -10.9% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

You must be logged in to post a comment.